Trades don’t always go as you expect…

You can have the best trading plan in the world and sometimes the stock won’t hit your target. Or it will hit your target, then quickly slam through your stop causing you to exit the trade…

Taking that stop can save you from big losses.

But it can also kick you out of a trade that ends up working.

So how can you avoid big losses and still take advantage of trades that work?

It all comes down to one simple concept…

Crucial Trading Rules

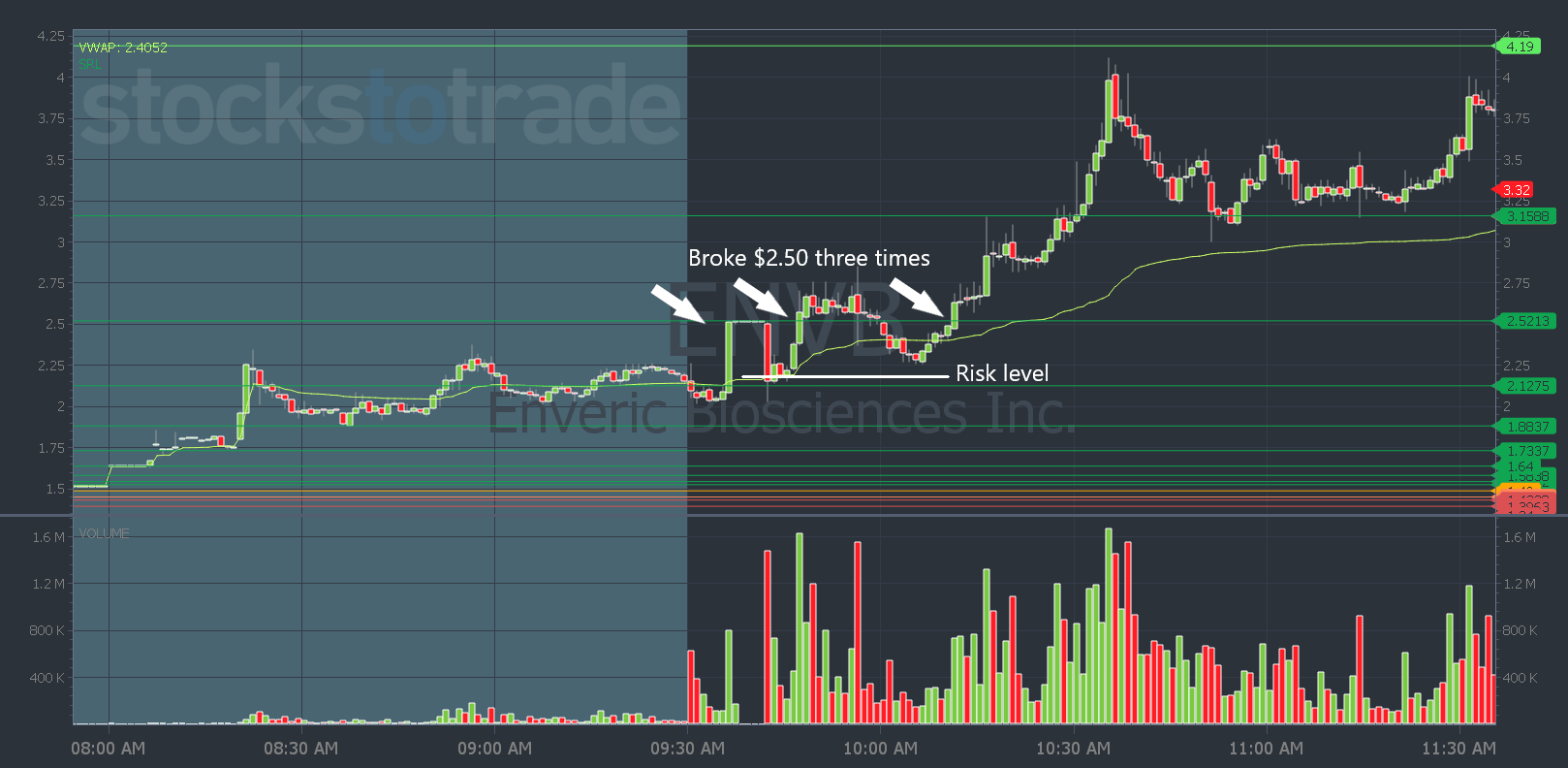

My plan for Enveric Biosciences, Inc. (NASDAQ: ENVB) yesterday ended up working out beautifully…

But it wasn’t a perfect trade where you enter a stock at your planned entry and the stock immediately spikes.

That’s not a realistic expectation for every trade.

There’s going to be consolidation. There are going to be times you get stopped out and take losses.

So what can you do?

Two rules can help you. Here’s how they could’ve worked in my number one trade plan yesterday…

Can These Two Rules Improve Your Trading?

My trade idea for ENVB included an entry at $2.50 with risk at $2.20.

But when ENVB first broke through $2.50 it immediately halted…

If you follow my rule for halts, you would’ve exited the trade as soon as the stock unhalted.

Or you would’ve been out when the stock hit the stop at $2.20.

So now you’re out of the trade … And both scenarios would have resulted in small losses.

Then, a few minutes later ENVB broke through $2.50 again … It consolidated and then dipped…

But this time it held it above the stop level of $2.20, went on to break $2.50 again and the trade idea worked — it hit the profit target of $3.10 and then some.

ENVB chart: 1-day, 1-minute candle — courtesy of StocksToTrade.com

Now maybe you’re frustrated that you exited. And maybe you can’t re-enter because you’re out of day trades.

Your brain might even be telling you, you should’ve ignored your stop and held it … Next time, just hold it…

But sticking to your stops is the one rule you can’t afford to break.

You have to take that small loss.

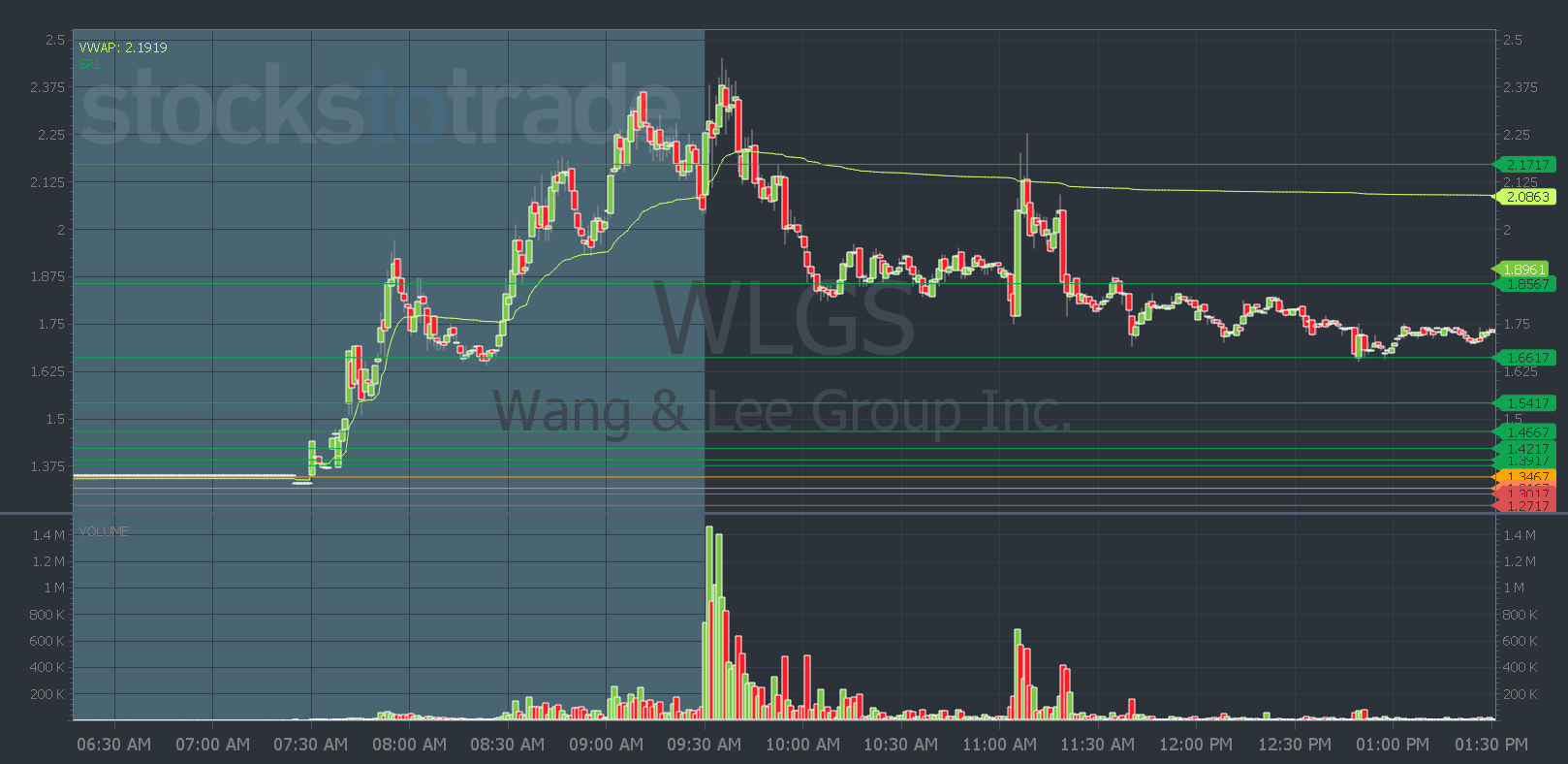

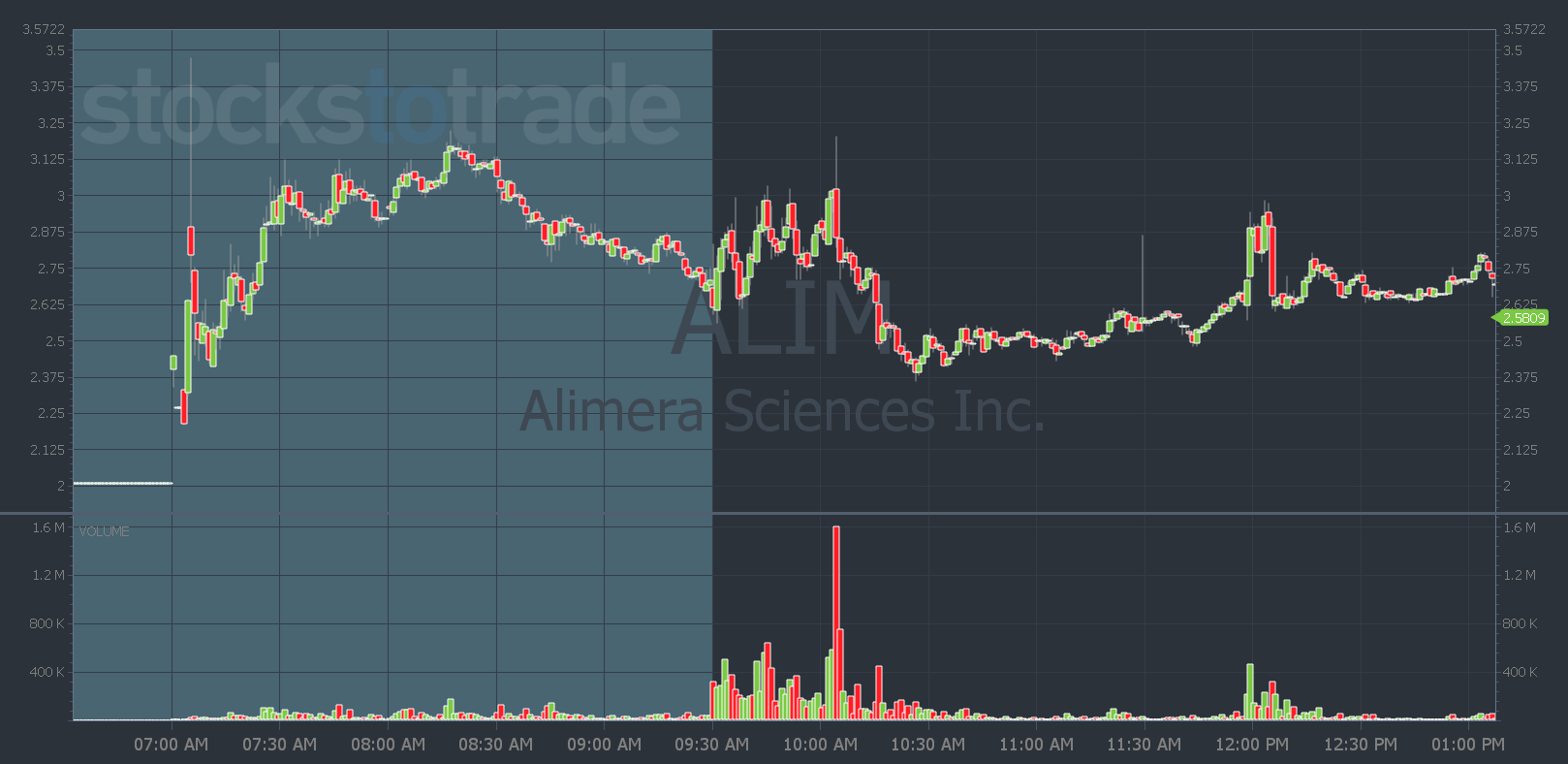

If you don’t, next time you could end up holding one of these other stocks that completely failed yesterday morning…

WLGS chart: 1-day, 1-minute candle — courtesy of StocksToTrade.com

ALIM chart: 1-day, 1-minute candle — courtesy of StocksToTrade.com

That’s why we have trading rules.

If you get in the habit of ignoring your stops, you’ll eventually take such big losses that you’ll blow up your account. Or you’ll be bag-holding losers and have no capital left to trade with.

So never ignore your stop. Build the discipline to stick to it.

There’s another rule you can follow that can help you avoid choppy moves and potential halts right near the open…

Wait until after 9:45 a.m. to enter a trade.

Waiting for post 9:45 a.m. is a trading rule that I usually impose on stocks that are chat pumps.

But I think every new trader should use it every day — for every trade.

It might mean you miss some trades that spike right at the open. But it can keep you out of the market chop at the open…

And that can prevent you from entering losing trades and save you a ton of frustration.

It also saves your day trades for those higher-odds setups when they do come around…

Get ready for the next potential opportunity and stay up to date on the market with my Market Update videos three times per week.

But if you want a full trading system and mentorship — attend one of our live webinars here.

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade