After an ugly week last week, it was sure nice to see the markets gap up yesterday.

And penny stocks followed suit, with several morning gappers to pick and play from. Plus, we had all the runners from last week to keep on watch.

It’s exciting to see while you’re at the computer, right?

Finally, a ton of gappers to watch — and the market’s green!

But with so many choices, how do you know which stock to trade?

Do you chase them all at the open? Do you take multiple positions at a time?

Or do you pick one that looks good and still end up wasting your capital trading the wrong ticker?

It can be mentally exhausting.

That’s why today I’m sharing how you can control FOMO and spot the best potential trade of the day (chart examples included!)

This is how I stay chill as a cucumber — even on the craziest market days…

Get my number one pick and trade plan delivered to your inbox every morning here.

How to Spot the Best Trade of the Day

With all the gappers in premarket yesterday, a lot of traders got excited.

But my FOMO was low. Why?

It sounds counterintuitive, but on a day like yesterday when there are so many potential runners out there — I find it easy to wait.

Because it only takes one.

But a lot of traders struggle with FOMO. They want to nail every play and make bank, Bro…

So they bounce all over the place, chase entries in the wrong tickers, then end up with a loss and wasted capital.

Here’s what I prefer to do…

I wait until the afternoon — at least noon or later. (Get my afternoon trading tips here.)

Because when you let the charts play out, it makes it easier to spot the one lone survivor.

Just look at these chart examples from yesterday. They make it easy to see what I mean…

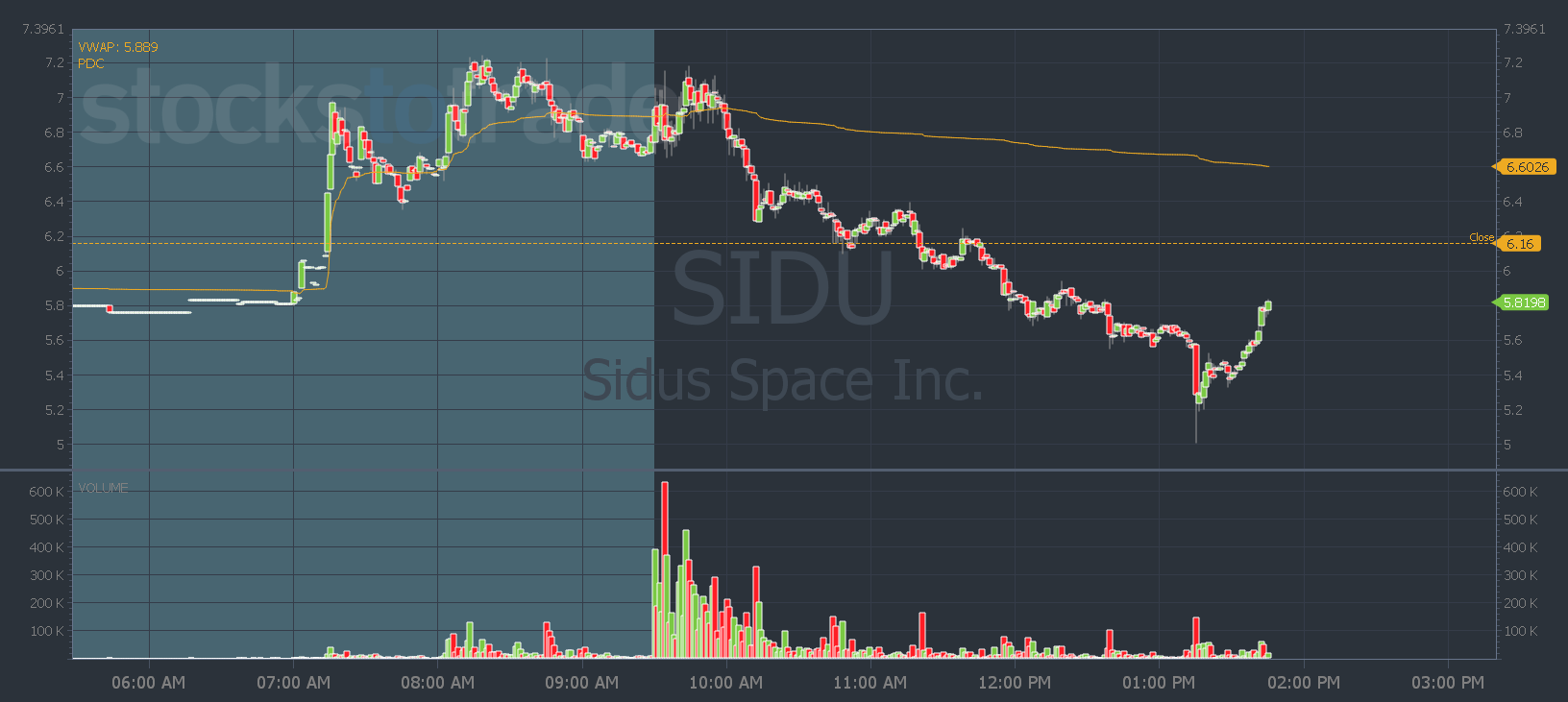

Yesterday the lone survivor wasn’t my number one watch, Sidus Space Inc. (NASDAQ: SIDU)…

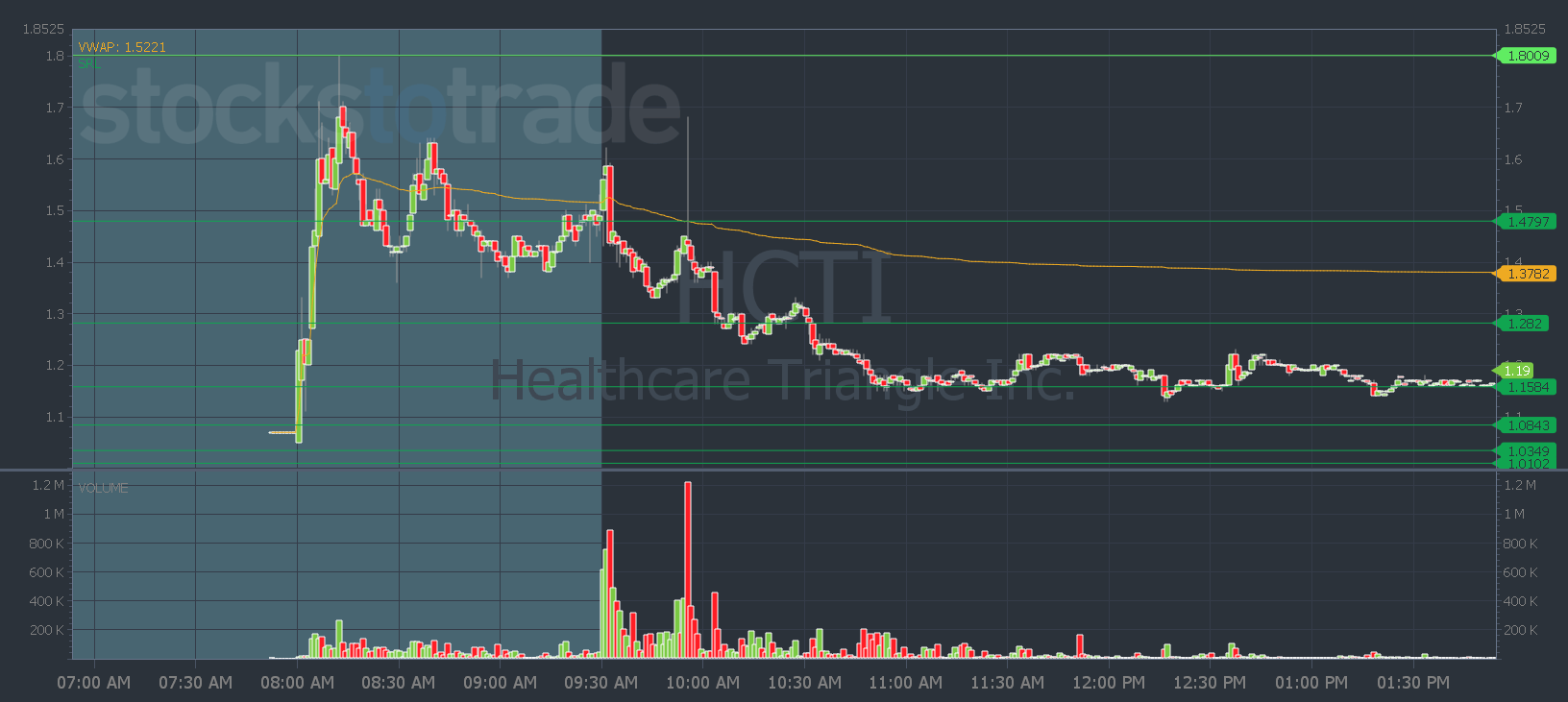

And it wasn’t day one spiker Healthcare Triangle, Inc. (NASDAQ: HCTI)…

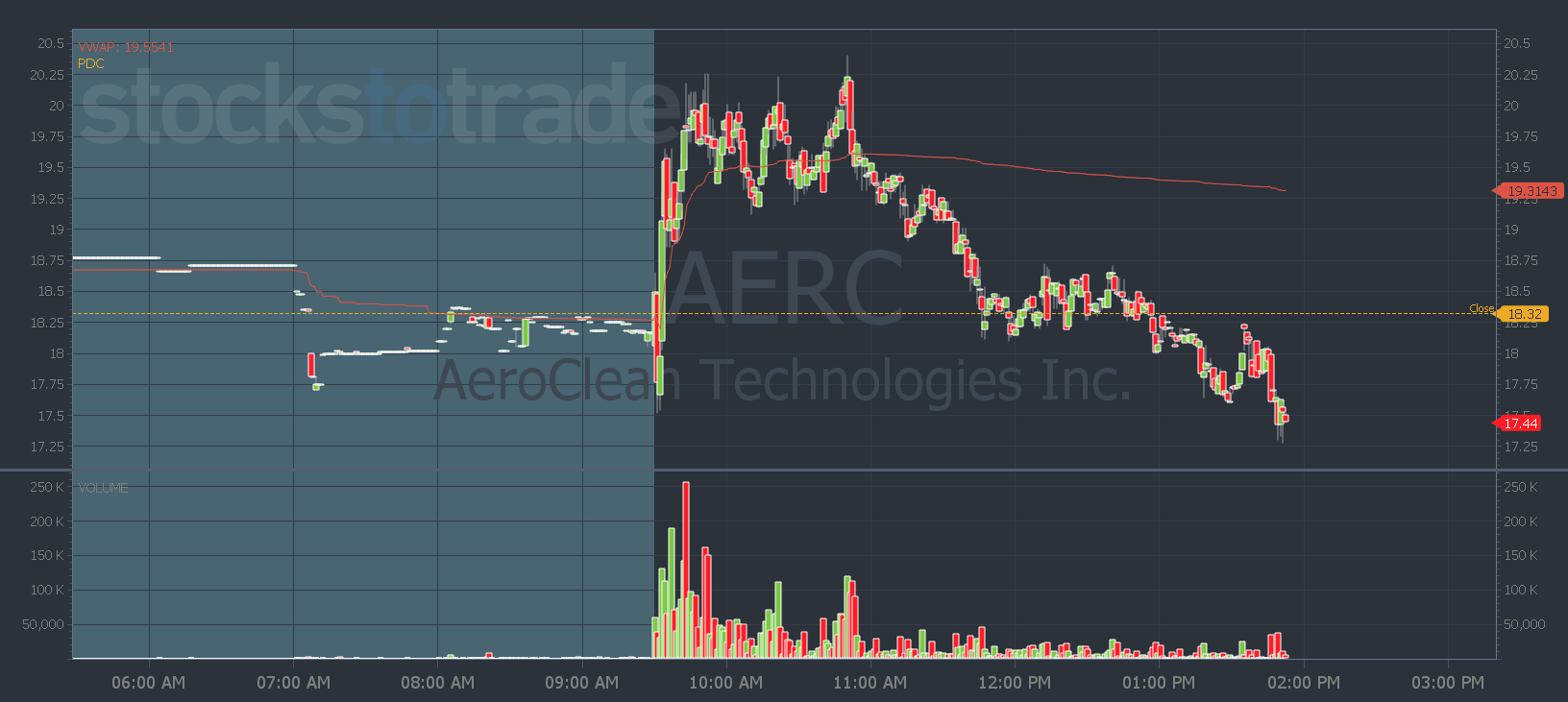

It wasn’t even our favorite recent multi-day runner AeroClean Technologies, Inc. (NASDAQ: AERC)…

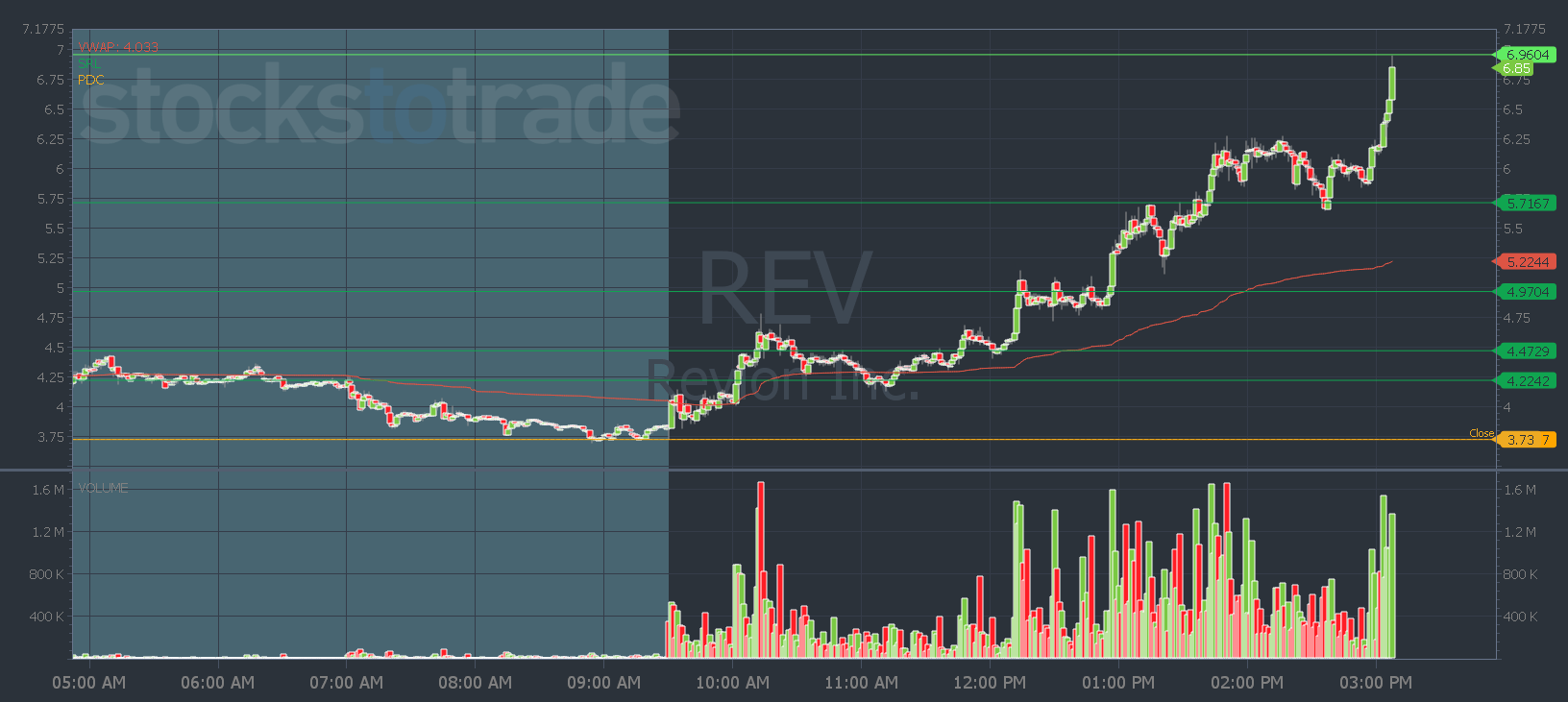

It was bankruptcy play and multi-day squeezer, Revlon, Inc. (NYSE: REV).

REV broke the high of the day after 9:45 a.m. And while that trade would’ve been decent if you took profits into resistance near Friday’s high — the better play was to wait.

Because after the morning high of day break, REV pulled back. It dipped below VWAP to lure in more shorts…

Then it slowly worked its way back up and broke out to new daily highs again after noon. And that $4.75 level was also Friday’s high.

That’s exactly the move I said to look for in Pre-Market Prep…

So what’s the lesson here?

We’re entering summer trading. And there’s an old adage in the market, sell in May and go away. So I don’t think there’s an edge in trading before 9:45 a.m. in the summer.

We’re also still in a bear market.

That means traders should adjust their expectations for every trade. Take profits into spikes and don’t get greedy.

If a stock sets up for another leg higher, you can always get back in.

There’s no need to be aggressive. Even on green market days…

Yesterday was an easy day for me to resist FOMO and stay patient. Because it only takes one good trade per day to grow your account.

But one mistake can take your account from $5,000 to $352 real quick. Right now is a good time to focus on developing good habits and staying conservative.

If you want to see how I help new traders find setups that can help them grow their accounts — join the SteadyTrade Team.

Stay steady and I’ll see you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade