On Monday, I was fired up … We had some crazy runners and SteadyTrade Team members nailed some big moves!

I even took a live trade of my own in my afternoon webinar…

How did it turn out? Read on to find out…

See why I traded Pliant Therapeutics, Inc. (NASDAQ: PLRX), what my plan was, and what mistakes I made.

There are lessons for every trader below!

Stay tuned for some BIG SteadyTrade Team news coming this week!

Lessons From My Live PLRX Trade

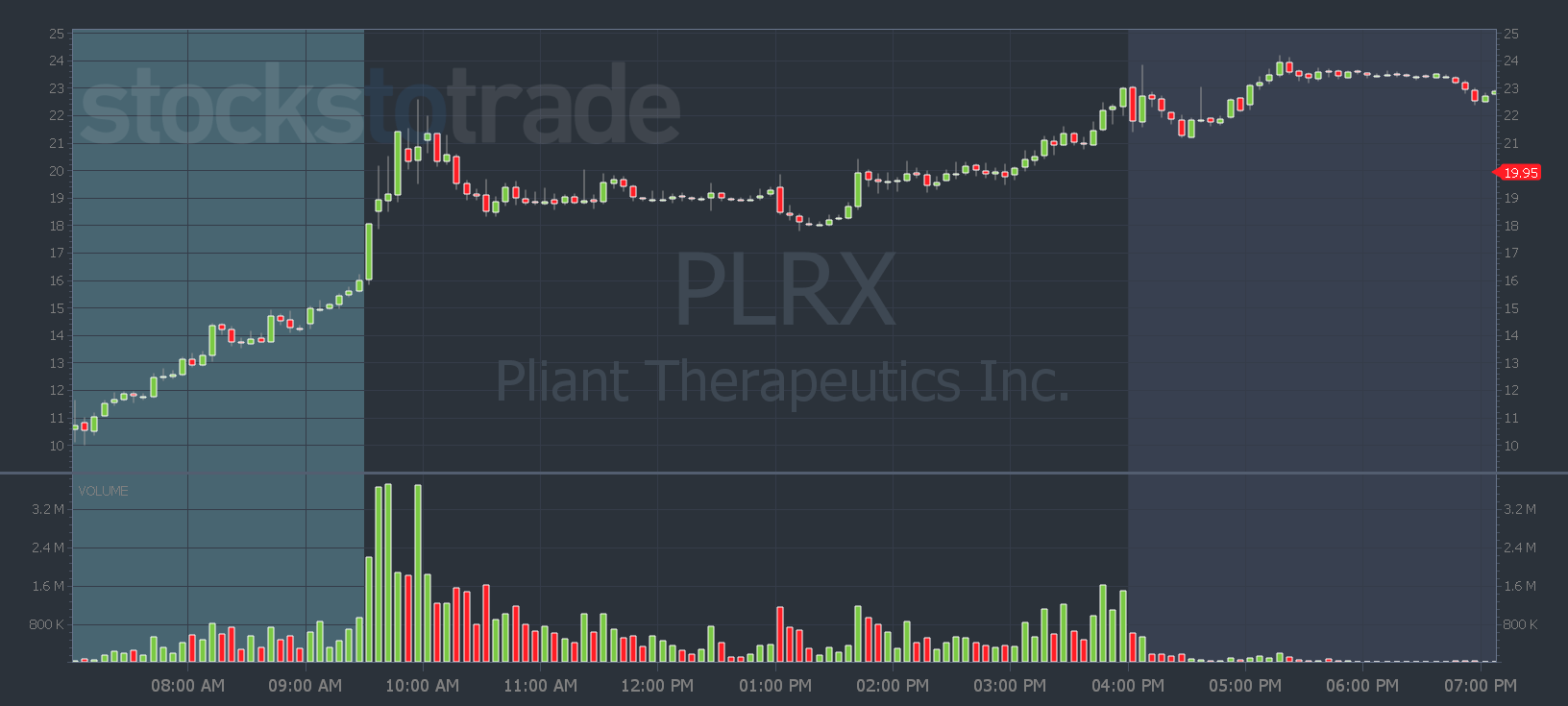

At the beginning of my Monday afternoon SteadyTrade Team webinar I had a stop trigger order set for PLRX at $22.01. (If you don’t know what a stop trigger order is, I wrote about them here.)

Why did I like that entry and the stock?

I was waiting for a high of day break. And PLRX checked a lot of boxes…

- Chat pump survivor.

- Had news.

- “Hottest” stock out there (beside KSPN).

- Low float.

- 4X float rotation.

- Favorite chart pattern (VWAP hold).

- Idiots on Twitter trying to guess tops.

- The daily chart was close to a 52-week high. (Besides one day.)

I used the $20 level as my risk, and my goal was a move to the mid to high $20s. So I was risking $2 per share on a stock that checked eight boxes.

But the number one thing I liked about PLRX was that it was full of short-sellers.

I mean, look at that move at 1 p.m…

Imagine how many short sellers got sucked into that dip.

PLRX was also a chat pump survivor. That’s why I liked it even more going into the afternoon. Because it was holding up and grinding higher…

To me, that means shorts are stuck.

My Entry

About midway through my webinar, my order executed. And about two minutes later I shared my thoughts on the price action…

I said the price action is concerning. I thought if it broke the high of the day it would spike FAST. Instead, PLRX chopped around. It wasn’t the reaction I expected…

I expected a violent move to the upside and that it’d hit $25 in a few minutes. I didn’t think it’d still be trading around $22, 15 minutes after my entry.

But I stuck to my plan…

And I continued to answer SteadyTrade Team members’ questions.

I end my afternoon webinars at the market close. That’s when PLRX finally started to speed up. It was looking good as I shut down the webinar…

What Happened Next?

It was Money Monday so I also gave a strategy session webinar at 6 p.m. Eastern. That’s when I updated the team on how my trade played out…

Right after the market closed, PLRX did what most of these sketchy companies do…

They dropped an offering.

I had to exit my trade. I didn’t panic — but I had to get out.

And I ended up losing about 22 cents per share — a little over $200.

By the time I was in my strategy session webinar, PLRX was back up to $23 and I would’ve been green on my trade…

But when news like that drops, you can’t hold through it and see what happens.

Hope isn’t a strategy.

And my evening webinar gave me the chance to reflect on my trade. Here’s what I learned…

Two Lessons From My Live Trade

This is a good lesson on the importance of journaling and reviewing your trades…

Anyone could say, oh man, they dropped an offering, that’s bad luck. No — that’s the easy way out.

As I looked back on my trade and asked myself what went wrong, I realized a few things…

First, I was a little late for the move. (It was 3:50 p.m. and I was busy all afternoon when SteadyTrade Team members were crushing it.)

But my two biggest mistakes were these:

- I recognized the price action wasn’t what I expected, but I chose to ignore it.

- I got caught up in the moment.

I said multiple times when I was in my trade that I didn’t like the price action. It wasn’t spiking like I thought it should.

Why did I ignore it?

I got emotional. I was live trading and got caught up in the excitement — I was fired up that so many SteadyTrade Team members were in PLRX before I was. Some members nailed multiple dollar per share moves…

They recognized the bread and butter pattern and they capitalized.

And that makes me proud.

Because at the end of the day, I’m here for YOU — not for myself. So I’m not bummed about my small loss. My trading comes last…

I want to see others succeed. That’s why I give so many webinars and resources to get you started. So that you can learn to spot these trades without me.

If you’re ready to join the Team — check it out here. And stay tuned this week for some BIG news you don’t want to miss!

Have a great day everyone. Remember to always review and journal your trades!

I’ll see you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade