A common question I get about trading is: “Can I trade without watching the screens all day?”

The answer is an absolute YES.

And now’s a great time to learn how to do it…

After all, it’s summer — you want to enjoy life while still taking advantage of some BIG penny stock runners…

One way to do this is with an order type you may be familiar with.

However, most traders don’t know they can use these orders to enter trades — not just exit them.

And using them is a great way to catch high of day breaks and breakouts.

So today I’ll break down how you can use this order type to catch upward momentum … While still being able to get out and enjoy your life, family, and vacation time…

So let’s get to it!

Watch your inbox this weekend … You don’t want to miss StocksToTrade’s killer fourth of July sale!

Try This Order Type to Catch Upward Momentum

When it comes to day trading volatile penny stocks, getting the right entry price is key.

So when there are too many runners to watch, I have appointments and errands to run, and can’t watch my screens, I like to use a stop-limit order.

You’re probably thinking stop-limit orders are how you exit a position when it goes against you. And you’re right…

But you can use stop-limit orders in multiple ways:

#1. To buy: Use the order to buy a stock if the price hits a certain level.

#2. To short sell: Use the order to short sell a stock if the price drops to a certain level.

#3. To stop out of a long position: Use the order to exit your long position if the price declines.

#4. To stop out of a short position: Use the order to exit your short position if the price rises.

Today I’m focusing on how you can use it to buy and enter a position.

In these cases, I like to call it a stop-trigger order — it just makes more sense when it’s triggering an order.

So let’s look at an example of how you can use this order type to enter trades, without having to waste your precious time tied to your computer…

Watch this video to discover four order types you must know and how to use them.

How Stop-Limit Orders Can Save You Time

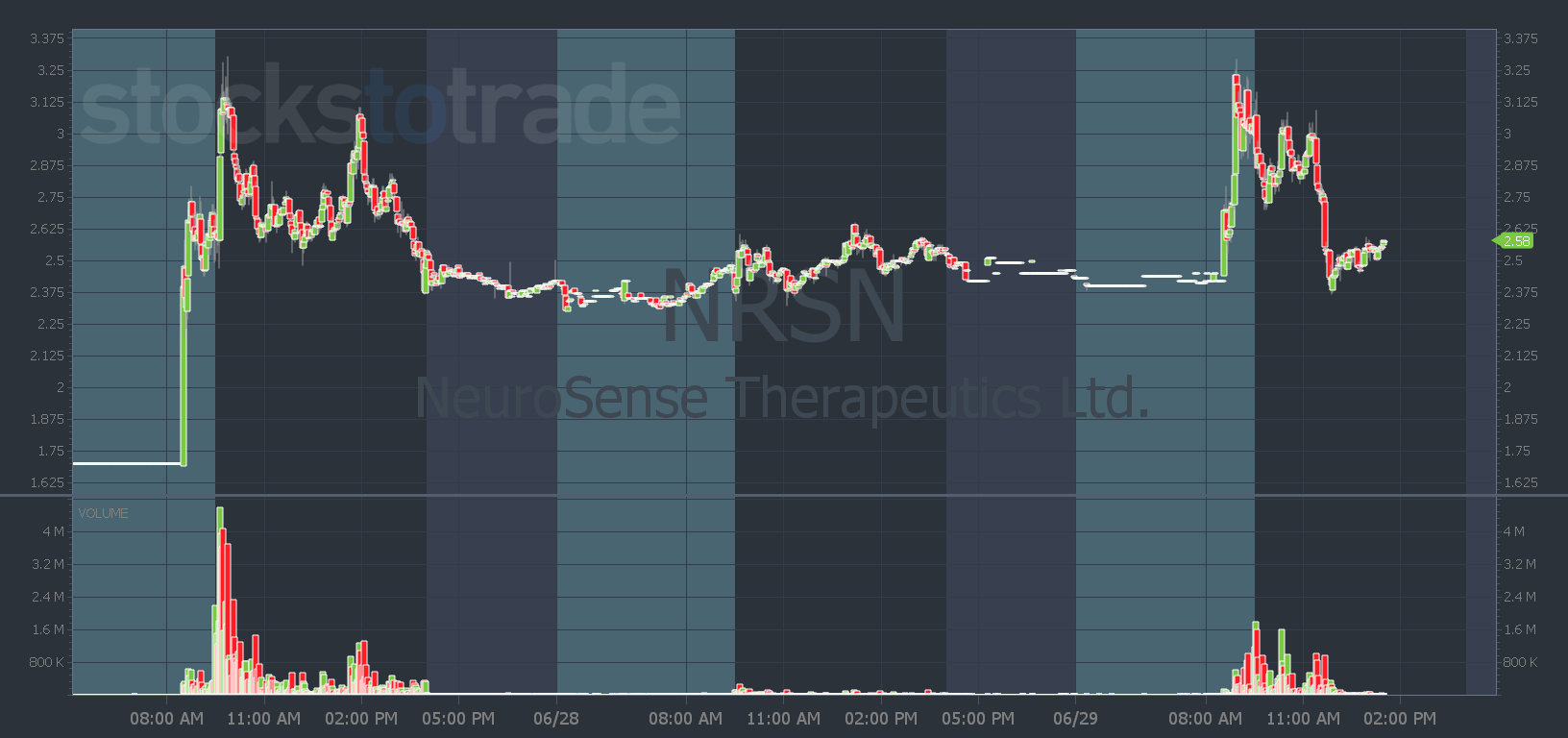

Yesterday in premarket, my number one watch was NeuroSense Therapeutics Ltd. (NASDAQ: NRSN).

It spiked in premarket and looked like it was set up for a textbook day-three surge…

But as you can see from the chart it eventually failed.

If you were waiting for the same move I was, you would’ve wasted hours of your day watching it. And that could’ve cost you other missed trading opportunities or some summer fun.

Who wants that?

Instead of watching NRSN, you could’ve set a stop-limit order and went about your day. Here’s how…

When you use a stop-limit order to enter a position, you’re basically giving your broker an if/ then statement. The order doesn’t happen until something else happens.

In my NRSN example, I wanted to see a break above $3.35 to confirm the day three surge pattern.

So I’d enter a stop (trigger) price of $3.25 and a limit buy price at $3.40 or even $3.50 (keeping key half-dollar levels in mind).

So I’m essentially telling my broker, if the price reaches $3.25, then enter my limit order to buy at $3.50.

If the stock hits $3.25, my broker enters my limit order. And if it reaches $3.50, my order is executed.

Using stop-limit orders is a great way to catch high of day breaks and multi-day breakouts without having to watch every tick.

But keep in mind that limit orders aren’t perfect…

There’s no guarantee your order will get executed if a stock moves too fast through the limit price.

And once you’re in a position, you’ll need to open your phone app or laptop and manage your position with a stop loss and/or limit order where you want to take profits.

Hope you’re all enjoying your summer. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade