The market continues to chop around…

The Dow plummets for days and then rallies 600 points out of the blue…

You need nerves of steel to hold through so much volatility…

But as day traders, we don’t have to deal with that stress.

We don’t hold positions overnight and hope for the trading Gods to bless us…

Instead, we try to find winning repeatable patterns and then take our shot.

And while the market is volatile, we’re only in a trade for a short period, taking fast profits or cutting losses quickly.

By the closing bell, our trading account looks like a checking account—ALL cash and no stress.

It gives us an edge over mainstream investors because each day is fresh.

We’re ready to attack the day and not worried about how much our portfolio is down when the market is tanking.

Now, you’re probably wondering…what does a winning repeatable pattern look like?

Good question.

You’re about to find out…

Wait, Wait, Wait … And Wait Some More…

90% of trading is waiting for your perfect setup to show itself so you can plan and execute a successful trade.

It’s not about watching a bunch of tickers and clicking a ton of buttons…

Pick your best potential setup, then stalk it like a hunter waiting for your perfect shot.

That might be a morning dip and rip on a day one runner. Or maybe you’re like me and like to wait for multi-day runners to set up, and stocks that hang around.

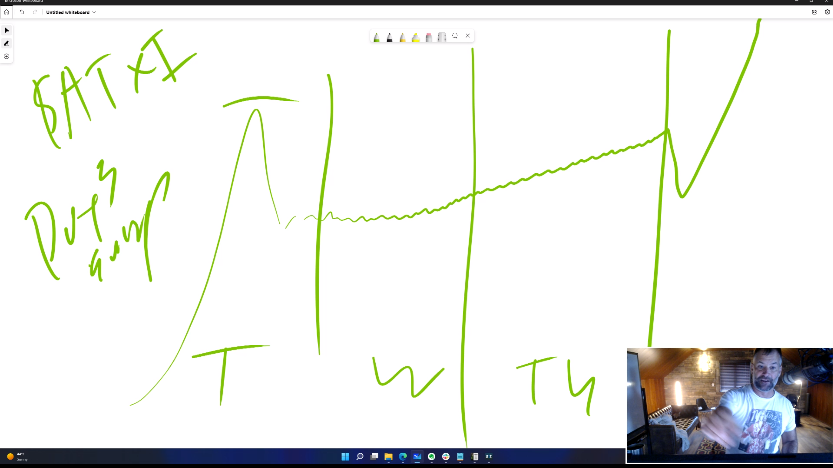

Avenue Therapeutics, Inc. (NASDAQ: ATXI) is one of those stocks…

It was a nice gainer on Tuesday and yesterday it hung around…

But we don’t buy on day one and hold and hope…

Remember, we want to get in and out of trades fast, taking advantage of the biggest and best moves.

So here’s what I’m looking for this week…

Why The Day Three Surge Isn’t An Exact Science

Yesterday in the morning SteadyTrade Team webinar, I said that trading a red-to-green move in ATXI was aggressive.

Then I broke down what I prefer to see…

Wednesdays are typically a slow day for stocks, plus, it was day two of ATXI’s move … So I wanted to see it grind around sideways yesterday … and maybe even today…

Then I want to see it dip on Friday morning and break above Tuesday’s high.

So I’m basically watching for a day three surge. But the move doesn’t have to happen specifically on day three…

It can happen on day four or five. The day three surge is the pattern and price action we’re looking for. It’s not about what day the move happens.

What we want to see is a stock that has a huge day one run. Then for it to hang around on day two or three. And the next day, I want it to dip near the open and reverse to the upside for an explosion through the day one high!

The goal of trading this pattern is to take advantage of short sellers who haven’t covered yet.

And that’s the exact move I’ll be looking for in ATXI today or tomorrow.

As we head into the end of the week I think we could see an explosive move if ATXI breaks above $11.

Keep it on your watchlist for that move. And as always, if it dies, it dies.

I break down trade ideas and plans like this twice daily for SteadyTrade Team members. And it’s all done live in real time.

Get 1% better with our community today!

See you on the inside.

Tim Bohen

Lead Trainer, StocksToTrade