It pays to read the Daily Accelerator religiously…

For example, if you read yesterday’s post, you would have been primed to take advantage of this week’s best trading opportunities.

Market themes can change quickly, and right now the one I see working the best is ignoring the morning action and focusing on afternoon setups.

For instance, traders yesterday were all fired up about two large pre-market spikers…

However, If you bought either of those stocks before 9:45 a.m., you could’ve gotten wrecked…

I’ll show you why…

Focus On High Probability Setups

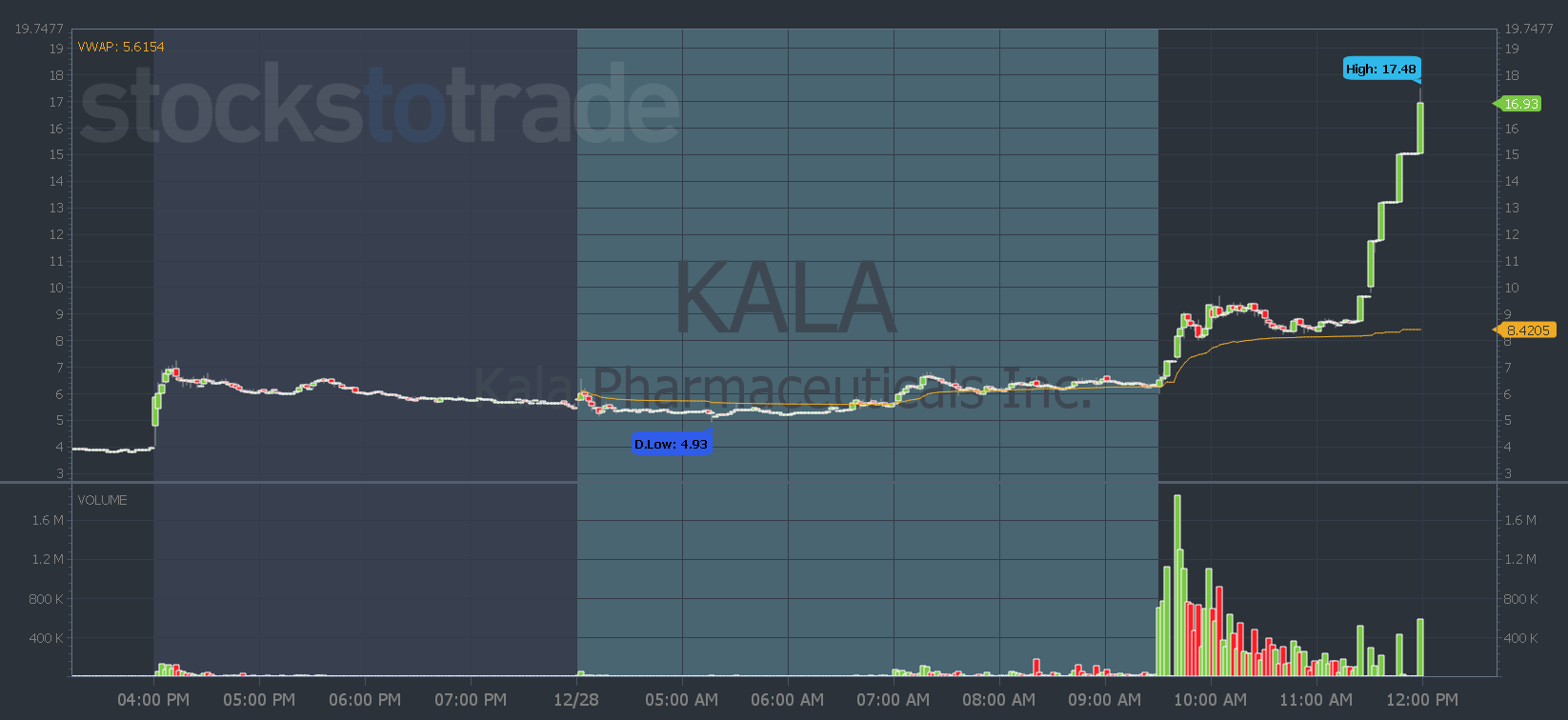

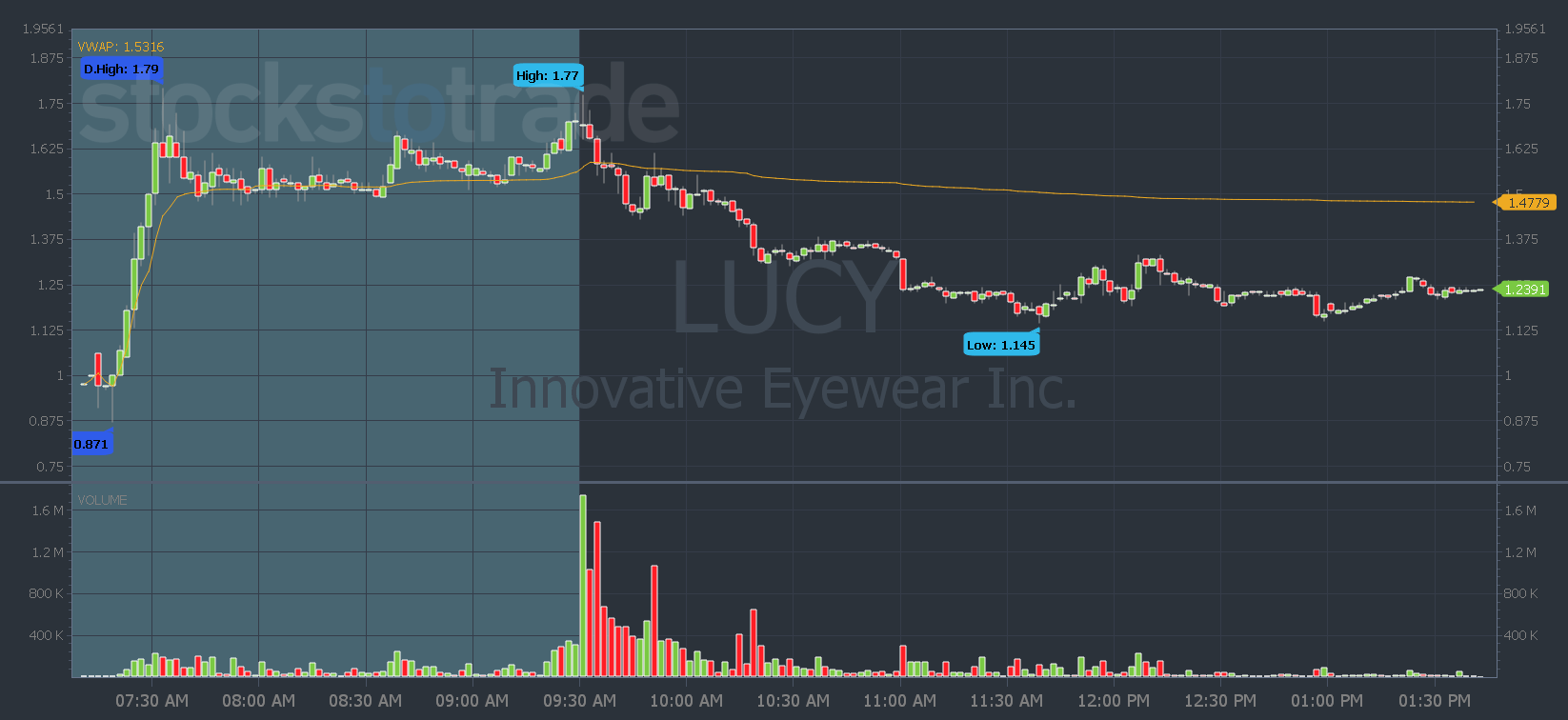

It wasn’t impossible for Kala Pharmaceuticals, Inc. (NASDAQ: KALA) and Innovative Eyewear, Inc. (NASDAQ: LUCY) to go on big runs … They were both chat pumps, they were both on Oracle, and both were my number one watches.

But what were the odds of a premarket and morning run?

We haven’t seen these premarket runners follow through…

… The chat guy is ice-cold lately — his pumps spike like 2 cents…

And KALA’s press release timing wasn’t ideal … The Breaking News Chat team alerted it when it dropped in after hours on Tuesday. I prefer a morning PR.

And what I teach traders to do in the SteadyTrade Team — and what consistently profitable traders do — is locate an edge or high-probability setup and exploit it.

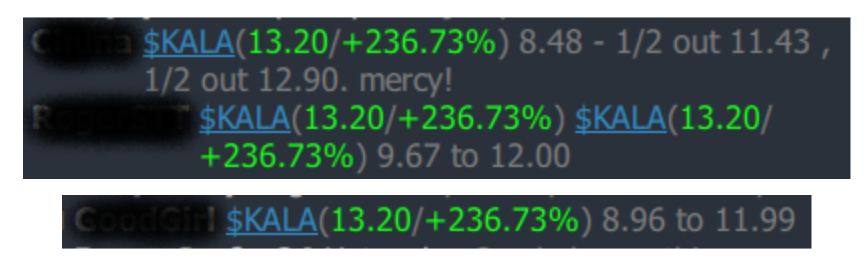

So even though plenty of SteadyTrade Team members still jumped in when KALA went nuts in the morning…

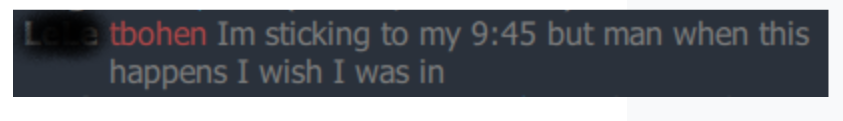

And some traders were left out with FOMO…

I stand by my word that it’s not a high-probability setup.

… And my lessons still paid off…

You could’ve sat out of the morning move (that in my opinion was less predictable) and you could’ve caught the afternoon move which turned out to be even bigger than the morning!

And traders who waited for the higher probability afternoon trade were rewarded with big moves that made the morning trades look like scalps…

In the morning KALA could’ve easily done what LUCY did. But following my rules kept traders safe from getting caught in that move…

And how did we know a KALA afternoon move would be more predictable than the morning spike?

First, that’s what’s working in the market.

Second, KALA gave hints it could have a bigger move in mid to late day…

After its morning spike, it trended sideways and dipped…

But it held above VWAP. That means the short sellers hadn’t taken control yet. And most longs were still likely up on their position with no reason to sell.

So when KALA broke the high of the day, it triggered short sellers’ risk levels.

Then after every halt, they were outbidding each other to buy and get out.

That’s the type of price action and strength you want to see in morning spikers. Because those can lead to even bigger squeezes in the afternoon if it breaks over the high of the day.

I feel like I’m taking crazy pills because it’s the same repeating pattern!

Study it and master it.

And get all StocksToTrade’s tools that find these big runners and alert you to the news that moves them.

Right now you can sign up here to get one of Oracle’s top daily picks delivered to you every day — for FREE.

Once you sign up, you’ll also get a special invite to our live webinars where you can see all our powerful tools at work so you can spot and trade these big gainers for yourself!

Have a great day everyone! See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade

P.S. You have two days to get Pre-Market Prep for our lowest price. In the New Year, it goes exclusive! Lock in your subscription now!