Howdy, gang! Welcome to the latest edition of Bohen’s Take! Ready for awesome setups for part-time traders and keys to understanding what’s hot in small stocks?

In this week’s post, you’ll learn about how I’ve been burning the candle at both ends, working my butt off to create ultra-specific, bite-size trading education content.

You’ll also learn about three absolute killer trade setups that were on the Weekly Watchlist and ideal for traders who hold down day jobs…

And I’ll show you a clever little StocksToTrade feature that can quickly alert you to exciting movements in the smaller stocks.

We’ve got a lot to get through — let’s dive in!

Table of Contents

What’s the Haps

So, what have I been up to? It’s mainly been work, work, work, and more work…

The markets have been pretty volatile. Great trade setups are coming hard and fast, but I’ve also been working like a madman to improve the StocksToTrade Pro educational features.

If you’re a current or former STT Pro member, you probably know that I do a ton of live webinars…

Seriously, most days it’s two live webinars, sometimes it’s three … And all of them are live and archived. At this point, it’s over 1,500 total webinars in the past three years.

Now, live webinars are awesome and can be a great way to learn. But due to the Q&A with webinar viewers, I find that some of my lessons can jump around a lot.

Think about it… There are so many moving parts that I focus on in a live webinar: charts, fundamentals, news, stock floats … the list goes on…

That’s why I’ve been working on a feature that I’m calling offline webinars for the STT Pro community. These offline webinars are very brief and concise lessons, lasting 5–15 minutes each.

I do them without a chat (which can be great but also distracting), so they’re very direct and to the point. And I’m creating them for a ton of topics, like “What Is an Earnings Winner” and “What Is Float Rotation” — all kinds of niche topics that our members and traders want to learn more about.

The idea is that when I’ve built an entire library of videos, at any time, our members will be able to go directly to one of these lessons and learn useful trading knowledge in minimal time.

I’m proud of what we’ve built with StocksToTrade Pro. I truly believe it’s one of the greatest opportunities to learn stock trading out there today … and I’m busy improving it!

You too can have access to all the live discussions, webinars and trader chat. Sign up for StocksToTrade Pro now — traders of all levels are invited.

The Setup(s) of the Week

Often I share just a single favorite setup for each Bohen’s Take post, but this week I’m sharing three.

The reason is that all three setups share a lot in common.

They are:

- Enphase Energy Inc (Nasdaq: ENPH)

- Builders FirstSource Inc (Nasdaq: BLDR)

- Ballard Power Systems Inc (Nasdaq: BLDP)

All three of these stocks were on the Weekly Watchlist that we send to our subscribers. It’s completely free of cost. Click here to sign up if you’re not on our list yet.

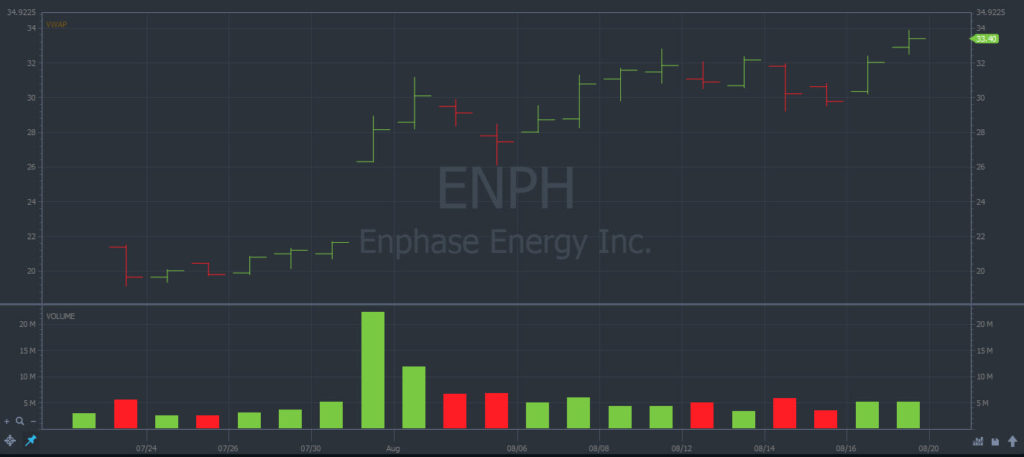

Enphase Energy Inc (NASDAQ: ENPH) daily chart — post-earnings spike (Source: StocksToTrade)

These stocks were also all earnings winners, breaking out to 52-week highs. And they were absolutely phenomenal swing trade setups for part-time traders or traders with day jobs or other responsibilities. Traders could’ve sat on these for days as they grinded up after earnings.

Many people looking to get started trading still have jobs, family, or other obligations … but some of the wildest day trading opportunities involve buying some insane one-cent stocks that spike and drop in the blink of an eye. It’s really not the most workable situation for someone who can’t be in front of the screens all day.

That’s why some high-priced stocks earnings winners can be potentially stellar opportunities — they can sometimes run for days or weeks. I’ll dive more into the finer details of the setup later in this post when I get the question of the week.

StocksToTrade Feature of the Week

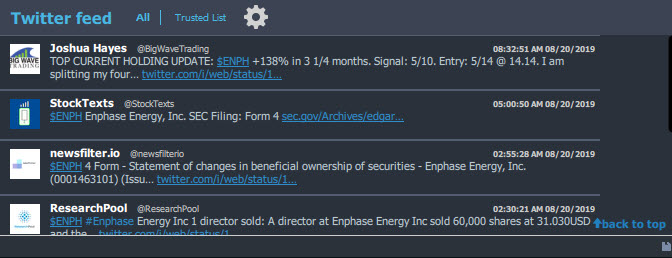

You might know that the social media platform Twitter is used pretty actively by many traders and investors.

All kinds of people — from amateurs to big-name professionals — are on Twitter. They discuss stocks, company rumors, stock insights, and more. It’s one place you can definitely find some great info on hot stocks.

That’s why, at StocksToTrade, we built a Twitter scan feature right into the platform.

This is a really cool feature that I use all the time. It allows me to screen for specific tickers, rather than just look at a random bunch of tweets.

When I’m in a really volatile stock and laser-focused, I really don’t care what someone’s saying about Apple or Microsoft. At that moment, all I really want to know is any chatter related to the volatile stock I’m in or about to be in…

The StocksToTrade Twitter scanner provides exactly that. And it doesn’t end there…

You can also use the Twitter scanner to filter for tweets about stocks that meet your specific criteria.

FOR EXAMPLE, let’s say I’m looking for a trade … I want to find a stock that’s priced between $1–$2, has traded a million shares that day, is up 10% in the session, and has a news catalyst…

I can have the STT scanner show me tweets that are related to only the stocks that meet that criteria. It’s a pretty quick way to get focused on what’s hot — and what meets YOUR criteria — at that moment.

So, that’s the feature of the week. There’s an absolute ton of other features, including amazing charting, scanning, watch-lists, and more. Check out the StocksToTrade platform with a 14-day trial for just $7 today!

The Question of the Week

I’m paraphrasing, but here’s a question traders have asked me a few times recently:

“What is an earnings winner and why should I care as a new or intermediate trader?”

Let me start by saying that the term ‘earnings winner’ is possibly one of the most confusing pieces of jargon in all of day trading.

Many traders see a stock spiking after the company releases bad earnings, but they see someone like Tim Sykes or me referring to it as an earnings winner. It can be confusing.

First, know that as traders, when the market is moving, we don’t have a lot of time to use complex terms. So let’s break this one down.

Earnings winners are technically stocks that spike on unusually high volume, either immediately or within a day or two of releasing earnings…

The earnings don’t necessarily need to be impressive. In fact, a lot of the time, especially in low-priced stocks, everyone expects the company to lose money. That’s especially true in home-run type businesses, such as biotech stocks.

A stock that spikes post-earnings also has a lot to do with perception and market expectations. For example, if the market expects a company to lose $10 million and they only lose $1 million, that stock could easily spike hard.

So, why should you care about these earnings winners as a beginner or intermediate trader?

Well, you might recall an old saying: “Make hay while the sun shines …” In the stock market, earnings season is generally when the sun shines. You can often get some pretty wild price action when companies report earnings.

Earnings season comes about four times a year and runs for about six weeks at a time. That’s 24 weeks — almost half the year.

I tell so many traders, especially if they’re new, to focus on looking for trades in earnings season.

When it’s not earnings season, focus on school, your job, family, or a side hustle. That can be one way to jump into the markets when you’re short on time.

In fact, scroll up to look at this week’s setups. They’re all earnings winners. The traders who got involved could’ve stayed in them for days. That can be perfect if you’ve got to focus on something besides the markets all day.

Conclusion

That’s all for this one, folks…

I hope you’re as excited as I am about the bite-size educational webinars I’m creating. The goal: to help full- and part-time traders of all skill levels get up to speed on niche topics as quickly as possible.

Join StocksToTrade Pro if you want to check them out.

We also had a grab bag of setups with three great earnings winners in this post. I’m very proud of the fact that we alerted subscribers to these stocks in our Weekly Watchlist.

And be sure to check out the Twitter scanner on StocksToTrade. There’s a ton of great information and ways to find stocks on Twitter…

… but if you can filter all that information that’s related to your favorite stocks into one focused feed? Think of how that can help you in your trading day. And that’s why StocksToTrade has a built-in Twitter scanner.

Not on the StocksToTrade platform yet? See how it can help you in your trading day. A 14-day trial of StocksToTrade is just $7. Start your trial today!

Are you one of the many part-time traders with a day job or side hustle? What’s your daily routine like? How do you fit trading in? Share your tips and tricks in the comment below!