Oscillators are pivotal tools in technical analysis, providing traders and analysts with crucial insights into market momentum and potential reversal points. These tools are fundamental in identifying overbought or oversold conditions, helping to predict shifts in market dynamics before they occur. Understanding how to effectively use oscillators can significantly enhance your trading strategy, giving you an edge in the fast-paced trading environment.

Read this article to master the art of using oscillators in trading, enhancing your technical analysis skills and adapting strategies to varying market conditions.

I’ll answer the following questions:

- What are oscillators in trading?

- How do oscillators serve as tools in technical analysis?

- What are some practical uses of oscillators in daily trading?

- How do different types of oscillators, like RSI and MACD, function?

- What is the difference between bounded and centered oscillators?

- What are the benefits and drawbacks of using stochastic oscillators and others?

- How can traders employ oscillators in swing trading and long-term investments?

- How does market volatility affect oscillator analysis?

Let’s get to the content!

What Are Oscillators?

Oscillators are technical indicators that oscillate between two levels on a chart, primarily used to gauge market momentum and potential price reversals. They are invaluable in markets that do not display a clear trend, offering insights based on the speed and changes of price movements.

Basic Principles of Oscillators

The fundamental principle behind oscillators is their ability to show when an asset is overbought or oversold. In my trading experience, these indicators signal the exhaustion of a price move and the potential for a market reversal. This makes them essential for planning entry and exit points, minimizing risks, and maximizing potential returns.

Importance in Technical Analysis

Oscillators enrich technical analysis by providing a layer of confirmation beyond what is visible through price action alone. They help clarify the strength of trends and predict their continuity. The ability to read oscillator readings in conjunction with other technical tools has been instrumental in refining my trading decisions, particularly in ambiguous market conditions.

Oscillator Trading in Practice

In practice, trading with oscillators involves looking for divergence or convergence with price action, which signals upcoming reversals or continuations of trends. Utilizing oscillators effectively requires understanding their mechanics and how they relate to current market conditions—skills that I’ve developed through persistent trading and continuous learning.

You’ll need a good trading platform…

StocksToTrade has the trading indicators, dynamic charts, and stock screening capabilities that traders like me look for in a platform. It also has a selection of add-on alerts services, so you can stay ahead of the curve.

Grab your 14-day StocksToTrade trial today — it’s only $7!

Oscillator Analysis

Analyzing market trends through oscillators involves more than just spotting peaks and troughs. It requires interpreting what these movements signify about market sentiment and momentum. This analysis can uncover trading opportunities before they are apparent through price movements alone, providing a strategic advantage.

Future of Oscillator Trading

The future of oscillator trading looks robust as advances in trading technology and data analytics continue to evolve. These tools are becoming more sophisticated, offering deeper insights and more precise signals. As we move forward, I anticipate these indicators will become even more integral to successful trading strategies, especially as markets become more volatile and competitive.

What Have You Been Missing When Trading Oscillators?

When trading with oscillators, many traders overlook the critical insights these tools can provide beyond mere overbought or oversold signals. Oscillators can decipher the market’s rhythm and momentum, crucial for pinpointing optimal entry and exit points. For instance, understanding the intricacies of how oscillators like the RSI or MACD relate to price action and volume can reveal powerful buying opportunities or warn of impending reversals.

My experience has shown that integrating oscillators with other indicators like trend lines and Bollinger Bands enhances their efficacy, providing a more robust framework for making trading decisions that are informed by a comprehensive market view.

Mechanics of an Oscillator

The mechanics of an oscillator involve a formula that calculates the moving relationship between various price points, such as highs, lows, and closing prices within a set period. This calculation produces a value that moves within a defined range, providing visual cues about the market’s current state. Mastery of these mechanics, through both study and application, has allowed me to anticipate market moves with greater accuracy.

Divergence and Convergence in Oscillators

Divergence occurs when the direction of an oscillator deviates from the current price trend, suggesting that a reversal might be imminent. Convergence, on the other hand, reinforces the existing price trend, indicating its likely continuation. Understanding these concepts has sharpened my trading by highlighting potential reversals or continuations at critical junctures.

Oscillators in Different Market Conditions

Oscillators reveal their true value when adapted to varying market conditions. Whether in a bullish, bearish, or sideways market, these tools can provide insights that are not readily apparent through price action alone. My approach adapts the use of specific oscillators depending on market volatility and trading objectives, optimizing their effectiveness across different trading environments.

Types of Oscillators and Their Uses

Oscillators serve varied roles in financial markets, from stocks and commodities to derivatives and Forex. These tools are indispensable for investors looking to capitalize on short-term price movements and for day traders who need to make quick decisions based on real-time data.

For example, while the RSI and Stochastic focus on price momentum and potential reversal zones, Bollinger Bands help identify the volatility and relative price levels of an asset. Each oscillator comes with its methodology and application area, enhancing trading strategies by providing additional data layers that reflect the asset’s current market conditions.

Some oscillators are also momentum indicators, a category of technical analysis tools that measure the rate at which the price of an asset changes. These indicators are vital for identifying the strength of a trend and spotting potential reversals through divergences from price movements. They are particularly useful in volatile markets, allowing traders to gauge whether a movement has enough support to continue or if it is losing strength. To fully leverage momentum indicators in your trading strategies, check out our article on how to effectively use momentum indicators.

Common Oscillators

The most widely used oscillators in trading include the Relative Strength Index (RSI), Stochastic Oscillator, MACD, and Bollinger Bands. Each of these has been instrumental in my trading arsenal, offering unique perspectives on market conditions.

The RSI, for example, measures the speed and change of price movements, providing insights into the strength of a trend. Bollinger Bands, which incorporate moving averages and standard deviations, help define the upper and lower price levels that form potential support and resistance areas. These tools, when used correctly, can significantly enhance the analysis of price movements and momentum, guiding traders towards more informed decisions.

Relative Strength Index (RSI)

The RSI is a momentum indicator that measures the speed and change of price movements, typically on a scale of 0 to 100. It is particularly useful for identifying overbought or oversold conditions, making it a staple in my trading toolkit for assessing potential reversal points.

Stochastic Oscillator

This momentum indicator compares a particular closing price of an asset to a range of its prices over a certain period. Its sensitivity to market movements makes it ideal for generating signals for potential entry and exit points, which have been crucial in my short-term trading strategies.

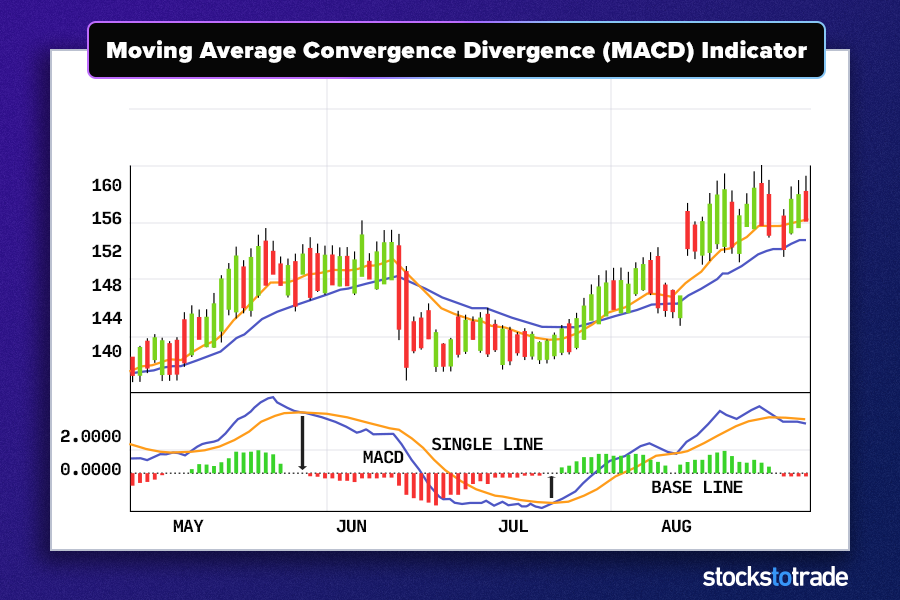

Moving Average Convergence Divergence (MACD)

MACD is used to spot changes in the strength, direction, momentum, and duration of a trend in a stock’s price. It’s a more comprehensive tool that combines several elements to provide a rounded view of market dynamics. I’ve found MACD invaluable for confirming trends and potential reversals, enhancing its utility in my trading decisions.

The MACD utilizes moving averages to determine momentum by showing the relationship between two moving averages of a security’s price. It’s calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. The result of this calculation helps highlight changes in the strength, direction, momentum, and duration of a stock’s price trend. To effectively use MACD in your day trading strategy, especially in volatile markets, a deep understanding of moving averages is essential. Learn more about this crucial indicator in our detailed guide on moving averages for day trading.

Commodity Channel Index (CCI)

CCI helps identify new trends or warn of extreme conditions. It’s versatile enough to be incorporated into various trading strategies, providing valuable insights into price levels relative to their average.

Awesome Oscillator (AO)

The AO is an indicator used to measure market momentum. It captures the essence of market dynamics by assessing the recent market momentum compared to the momentum over a broader period. Its simplicity and effectiveness in confirming trends or signaling the end of a trend have made it a preferred choice in my trading scenarios.

Bounded vs. Centered Oscillators

Bounded oscillators such as the RSI are confined within a range, typically 0-100, offering clear indicators when a stock is considered overbought or oversold. Centered oscillators, like the MACD, oscillate around a central zero line, indicating bullish or bearish momentum based on their direction above or below this line. The distinction between these two types can profoundly impact trading strategies, as the interpretation of their signals varies significantly. Understanding these differences has been crucial in applying the appropriate oscillator to the right market scenario, ensuring that my trading decisions are backed by reliable and relevant data.

Benefits and Drawbacks of Each Oscillator Type

Bounded oscillators, such as RSI, have fixed ranges typically bound between 0 and 100, making them ideal for identifying overbought or oversold conditions. On the other hand, centered oscillators like the MACD oscillate around a central point or zero line, which can signify trend reversals or continuations based on their direction of crossing. Understanding these differences and their practical applications has enhanced my ability to choose the right oscillator based on the specific trading scenario and market condition.

Oscillator Trading Strategies

Effective oscillator trading strategies often combine multiple technical indicators to validate signals and enhance trade accuracy. Swing trading with oscillators involves identifying the momentum behind market moves and using oscillators to confirm when the trend is likely to continue or reverse. This method has proven effective across various markets, providing a reliable basis for making entry and exit decisions. Another strategy involves using oscillators for algorithmic trading, where trading models automatically adjust to oscillator readings, optimizing trade timing and execution.

Swing Trading with Oscillators

Swing trading involves capitalizing on price swings within a relatively short timeframe, and using oscillators can help identify the best times to enter and exit trades. This strategy has benefited from my use of RSI and MACD to pinpoint market extremes and potential reversals, aiding in decision-making for entry and exit points.

Long-Term Investment Strategies Using Oscillators

For long-term investment strategies, oscillators can provide insights into market conditions that inform buy-and-hold decisions. Strategies such as using the Stochastic oscillator to identify long-term trends have enabled me to optimize the timing of entries and exits, enhancing overall investment returns.

Algorithmic Models and Oscillator Trading

Integrating oscillators into algorithmic trading models can automate the process of identifying trading signals based on specific oscillator readings. My experience with developing and testing these models has shown that they can significantly increase the efficiency and accuracy of trades, especially when combined with other technical indicators and data inputs.

Advantages and Limitations of Oscillators

Oscillators offer numerous advantages, including their ability to provide timely signals for reversals and continuations in market trends. However, they also come with limitations, such as the potential for producing false signals during periods of price consolidation or when the market is not trending. My trading approach has always emphasized the importance of using oscillators in conjunction with other analysis tools to mitigate these risks, ensuring that every trading decision is well-rounded and thoroughly vetted.

Benefits of Using Oscillator Indicators

Oscillators provide a clear framework for understanding market dynamics, offering traders valuable insights into potential price movements. The ability to identify overbought or oversold conditions or confirm other technical signals makes them an indispensable part of the trader’s toolkit.

Challenges and Cautions When Using Oscillators

While oscillators are powerful tools, they come with their limitations and must be used judiciously. One common challenge is the potential for false signals, particularly in highly volatile markets where price movements can be erratic. Therefore, it’s crucial to use oscillators in conjunction with other forms of analysis and trading signals to validate their readings.

Impact of Market Volatility on Oscillator Analysis

Market volatility can significantly impact the effectiveness of oscillators. High volatility may lead to more frequent signal fluctuations, which can increase the risk of misinterpreting market movements. My approach has been to adjust oscillator parameters or combine multiple indicators to mitigate these effects, striving for a balanced view that accounts for current market conditions.

Oscillator Signals and Their Interpretations

Interpreting oscillator signals correctly is fundamental to successful trading. Positive and negative divergences in indicators like the RSI or MACD can signal upcoming reversals, while overbought and oversold conditions suggest temporary extremes in price movements. Additionally, centerline crossovers in the MACD provide insights into the momentum behind price changes. By understanding these signals in the context of broader market conditions and oscillator behavior, traders can significantly enhance their ability to make informed trading decisions, leveraging these tools to maximize returns while managing risk effectively.

Positive and Negative Divergences

Divergences—where the price trend and the oscillator move in opposite directions—can be strong indicators of potential market reversals. Positive divergences (where the oscillator indicates an upward trend while the price is still declining) suggest bullish reversals, whereas negative divergences indicate bearish reversals. Recognizing these patterns has been key to exploiting potential trend reversals before they become apparent in the price action alone.

Overbought and Oversold Extremes

Oscillators like the RSI and Stochastic can indicate when an asset has reached overbought or oversold conditions. These signals are crucial for predicting short-term reversals and are particularly useful in range-bound markets. My strategy often involves looking for these extremes as signals to prepare for a potential counter-move in the market.

Centerline Crossovers

Centerline crossovers, often observed with MACD and other centered oscillators, can signal a shift in momentum and are used to confirm trend changes. A crossover above the centerline indicates bullish momentum, while a crossover below suggests bearish momentum. These signals have formed a core part of my trading strategy, providing timely alerts to changes in market sentiment.

Key Takeaways

- Oscillators are essential tools for any trader’s arsenal, providing deep insights into market momentum and potential reversal points.

- Effective use of oscillators requires an understanding of their mechanics and the ability to integrate them with other technical analysis tools.

- While powerful, oscillators should be used with caution, especially in volatile markets where they may produce false signals.

There are a ton of ways to build day trading careers… But all of them start with the basics.

Before you even think about becoming profitable, you’ll need to build a solid foundation. That’s what I help my students do every day — scanning the market, outlining trading plans, and answering any questions that come up.

You can check out the NO-COST webinar here for a closer look at how profitable traders go about preparing for the trading day!

What trading indicators do you use? Write “I won’t trade without a plan” in the comments if you’re ready to trade the right way!

Frequently Asked Questions

How Do Oscillators Help Traders Make Decisions?

Oscillators help traders by providing actionable signals about market conditions, particularly potential overbought or oversold states. This information is crucial for making informed decisions about when to enter or exit trades.

Are Oscillators Reliable for Generating Trading Signals?

Yes, when used correctly and in conjunction with other indicators, oscillators can be highly reliable for generating trading signals. However, traders should be aware of their limitations and the potential for false signals, especially in volatile or irregular market conditions.

What Are the Limitations of Using Oscillators?

The main limitations of using oscillators arise from their tendency to provide false signals during periods of strong directional trends or significant price shocks. Additionally, oscillators are inherently reactive rather than predictive, meaning they can lag behind real-time price changes.

How Do Oscillators Like the RSI Indicator and EMA Help in Trading?

Oscillators such as the RSI indicator and EMA (Exponential Moving Average) are critical momentum indicators used in trading to identify potential buying opportunities. The RSI helps gauge the speed and change of price movements, indicating overbought or oversold conditions, while the EMA provides a smoothed average of price movements over a period, highlighting trends. Traders use these tools to determine optimal entry and exit points, aligning their trading strategies with the observed asset prices and values, ensuring they capitalize on market movements effectively.

What Role Do Waveform and Frequency Play in Oscillators Trading?

In oscillators trading, understanding the concepts of waveform, frequency, and amplitude is essential for tracking market cycles and phases. These elements help traders analyze the periodic fluctuations in asset prices, enabling them to synchronize their trades with market rhythms. By examining how these waves interact—whether through sine or square waveforms—traders can better predict cycle peaks and troughs, potentially identifying key pivot points for making trades.

How Can Traders Leverage Articles and Community Knowledge for Better Strategy?

Leveraging articles and community forums can significantly enhance a trader’s understanding of oscillators trading. Through detailed articles, traders can gain an introduction to various oscillators and learn from examples and case studies. Additionally, engaging with a trading community on platforms like Instagram allows traders to share insights, discuss strategies, and review common practices, helping them refine their approaches based on collective knowledge and results.

What Is the Importance of Broker Reviews and Security in Trading?

Broker reviews and ensuring robust security are paramount for traders using oscillators. Reviews can guide traders in choosing brokers that offer reliable resources, adequate support, and appropriate trading limits, which are crucial for managing risks associated with high-frequency trading. Moreover, ensuring that a broker upholds high security standards protects traders from potential cyber threats and fraud, safeguarding their profits and trading positions.

How Do Brokers Affect a Trader’s Strategy in Oscillators Trading?

Understanding a broker’s duty and a trader’s rights can significantly impact strategy effectiveness in oscillators trading. A broker’s duty includes providing accurate tracking of orders and positions and offering resources that assist in synchronization and modulation of trades according to market dynamics. A trader’s rights involve access to transparent information and the ability to contest discrepancies in order execution or results, ensuring fair trading practices and the ability to defend one’s financial interests.

How Can Traders Identify Top Buying Opportunities in the Market?

Identifying top buying opportunities in the market involves understanding the interplay of various indicators and the current state of asset prices. Traders should keep in mind the number of factors affecting the market, including economic data, company earnings reports, and geopolitical events, which can provide critical insights into potential investment opportunities. By comparing these factors across different cases and considering the experiences of others, traders can better position themselves to act when the market reaches a bottom point or when a particularly favorable setup occurs.

What Role Does Company Reputation and Market Position Play in Trading Decisions?

The reputation and name of a company, along with its position in the world market, are crucial considerations for traders looking to maximize their profits. A well-regarded company at the top of its industry might represent a safer buying opportunity, while companies at the bottom might be viewed as riskier unless there is clear potential for a turnaround. Traders must factor in these aspects, along with a lot of contextual data and historical performance, to make informed trading decisions that align with their strategic goals and risk tolerance.