Right now, we’re dealing with a global pandemic, a $2 trillion stimulus, a bear market, and record unemployment … Why not add an oil crash to the mix?

This week, oil futures went negative for the first time in history. Just another line item in an action-packed year of “didn’t see that coming” events. It’s all creating massive stock market volatility.

So what happened? In short, an unfortunate series of events led to a massive oversupply of oil. That caused a huge disparity in supply and demand, which tanked prices.

What does it all mean — and how does it affect you as a trader?

In this post, I’ll lay out the details of the oil crash … Read on to learn what led to the crash, plus some important strategy tips for all traders trading through this INSANE market.

Table of Contents

The Oil Crash: What Happened?

The coronavirus is the main catalyst behind most of the crazy stock market movement lately. The oil crash is no exception.

A lot of it’s about supply and demand. So many things in life are ruled by supply and demand — the coronavirus shifted that relationship for many things. Just think about things like hand sanitizer and masks now as compared to this time last year.

Oil is ruled by supply and demand.

Demand for oil and low supply can create a massive uptrend. Like in 2008, when crude oil hit record highs of over $145 per barrel.

On the flip side, an oversupply of oil and too little demand can create a depressing downtrend. We saw it in 2015 when prices fell to below $37 per barrel. Yeah, we thought that was bad.

On April 20, prices actually went negative — some traders were actually paying buyers to take the oil.

The coronavirus is a huge contributor to this shift in supply and demand. One big reason is the travel halt.

With stay-at-home orders in place, most people aren’t driving their cars to commute to work or for road trips. If they’re driving at all, most people are just making grocery runs, picking up supplies, or checking on relatives.

The demand for gas has hit record lows.

Flying is down, too. It’s basically tumbleweeds on the tarmac. TSA checkpoints are logging a fraction of the number of travelers from this time last year. With most flights grounded, planes aren’t using much fuel. Usage is down about 70% compared to this time last year. It could remain down for the foreseeable future.

These factors alone are enough to have a huge impact on oil prices … But there’s more!

Oil Price Wars

Oil Price Wars

Also contributing to the supply-and-demand disparity? Price wars.

Earlier in 2020, OPEC (short for Organization of the Petroleum Exporting Countries) — and several other countries — made an agreement to make production cuts. The goal? Bolster oil prices around the world.

But not everyone wanted to play nice. Russia actually started to increase production. Saudi Arabia lowered prices in response. A price war began.

Meanwhile, over here in the U.S., we were experiencing record oil production in early 2020.

You see what’s happening, right? Disagreements, discord, record production … and then the pandemic hit, erasing demand.

The result? Our barrels runneth over … or they will soon. In the near future, tanks will be at capacity. Leading to the…

Oil Crash

Crude oil mainly trades through West Texas Intermediate Crude and Brent Crude, which come from the U.S. Permian Basin and the North Atlantic, respectively.

Recently, the May contract for WTI crude went negative … for the first time in history.

Here you have traders who have contracts for May. Suddenly, there’s a situation where barrels upon barrels of oil are coming and there’s nowhere to put them. Let the panic selling begin and bring on the crash!

Long-Term Effects

You might be thinking, “What’s the big deal? It’s awesome to have super-low gas prices!”

Sure, that’s nice … for now. But the short-term gain could give way to long-term pain.

For one, there could be bankruptcies. This could have huge ripple effects. Our economy relies heavily on the ability to get things from place to place — and that requires oil. It could have an effect on all sorts of industries and businesses.

Check out this episode of the SteadyTrade podcast where we discuss the macro effect of the coronavirus. Big picture: we’ll now have to think about the oil crash too.

Trading the Oil Crash

Why does knowing about the oil crash matter?

By taking the time to understand the oil crash, you’ve got a stronger knowledge base. That can help you make better and more educated trading decisions.

With this knowledge in mind, here are some things to keep in mind if you want to trade the oil crash…

Remember the Current Market Volatility

You’ve gotta remember that we’re in a crazy volatile market. Adding the oil crash to the situation won’t lessen the volatility. It’s important to adjust your mindset and approach. You need to be realistic and stay safe in the current market.

If you’re not sure where to get started, good news — I just collaborated with one of my earliest trading mentors and friend Tim Sykes on his NO-COST two-hour guide, “The Volatility Survival Guide.”

Every trader is trying to adjust to the insane volatility right now. This guide can help. And it can help you better prepare for future volatility.

In the guide, Sykes offers a fast education on the most important things you should know about trading in volatile markets. I do a segment in the video too. I specifically talk about some of the ways that you can find opportunities using the StocksToTrade platform.

The key thing to remember is that the market is NOT rational right now. There are opportunities, but you need to adapt your strategy and be realistic.

Understand the Risks of Trading Oil

Most traders who trade oil do so through ETFs. ETF is short for exchange-traded fund. It’s basically a bunch of different securities rolled into one fund.

That might sound like a mutual fund, but there’s a key difference. With an ETF, you can trade it on an exchange. ETFs have tickers.

With oil ETFs, you’ll usually get a mix of stocks offered by oil companies, futures and derivative contracts, and oil-related indexes.

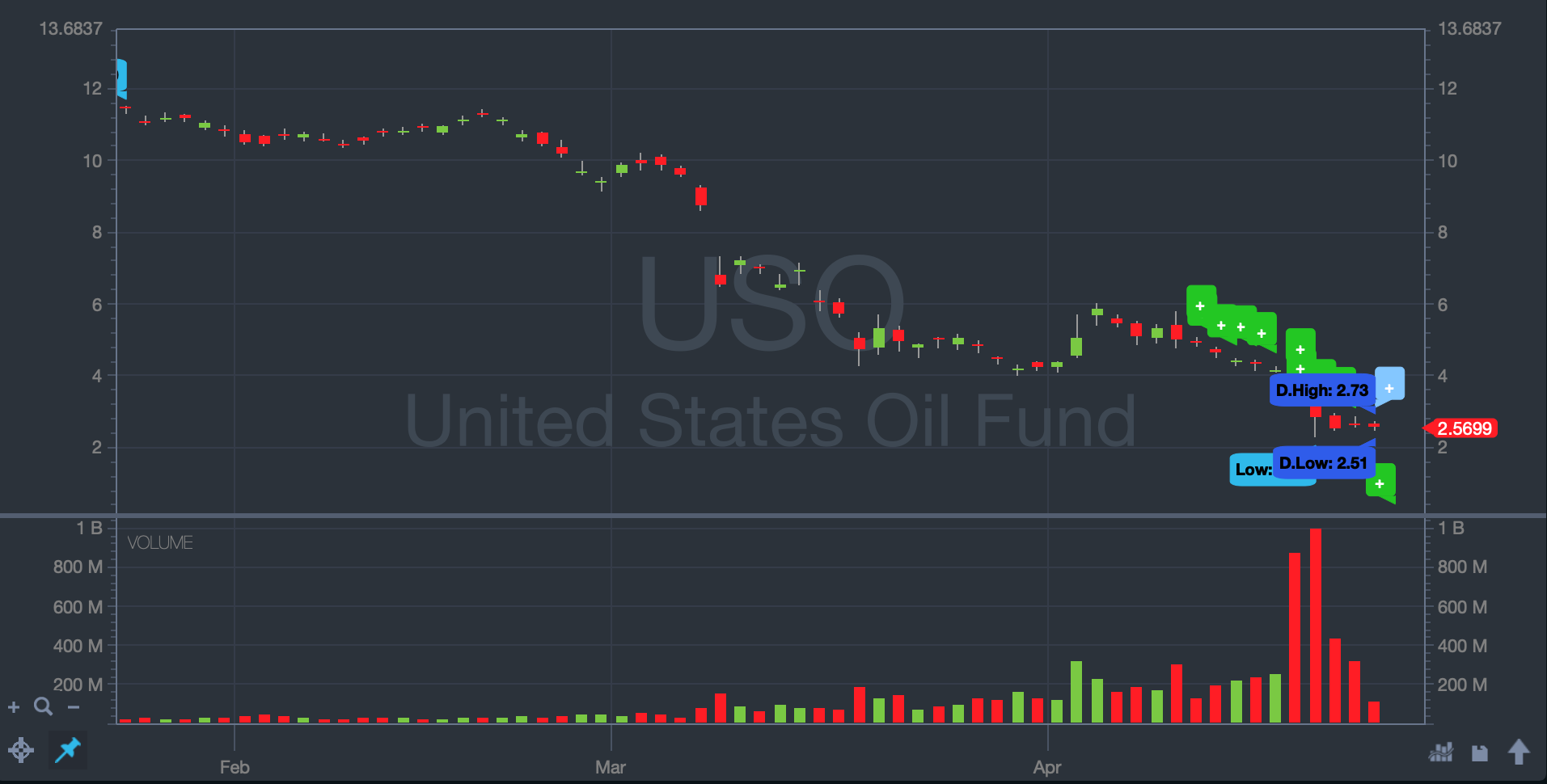

Tempted to buy low? Heed my warning: be VERY careful. While there’s been some lift in the past few days, there’s no way of knowing what will happen. Just look at the three-month chart:

United States Oil Fund (NYSE: USO) 3-month chart (Source: StocksToTrade)

I make the coach analogy a lot, and it’s appropriate here…

I can give you tips on how to approach the markets … But ultimately I’m your guide — not your boss.

I know it can be tempting to trade oil right now. But there’s so much unknown. So I beg you: do NOT stay in any of these oil ETFs overnight.

You could blow up — long OR short.

I like to focus on good risk/reward setups. The choice is yours. But in my opinion, there’s a lot of other trades right now with a much more desirable risk/reward.

Approach Green Energy With Caution

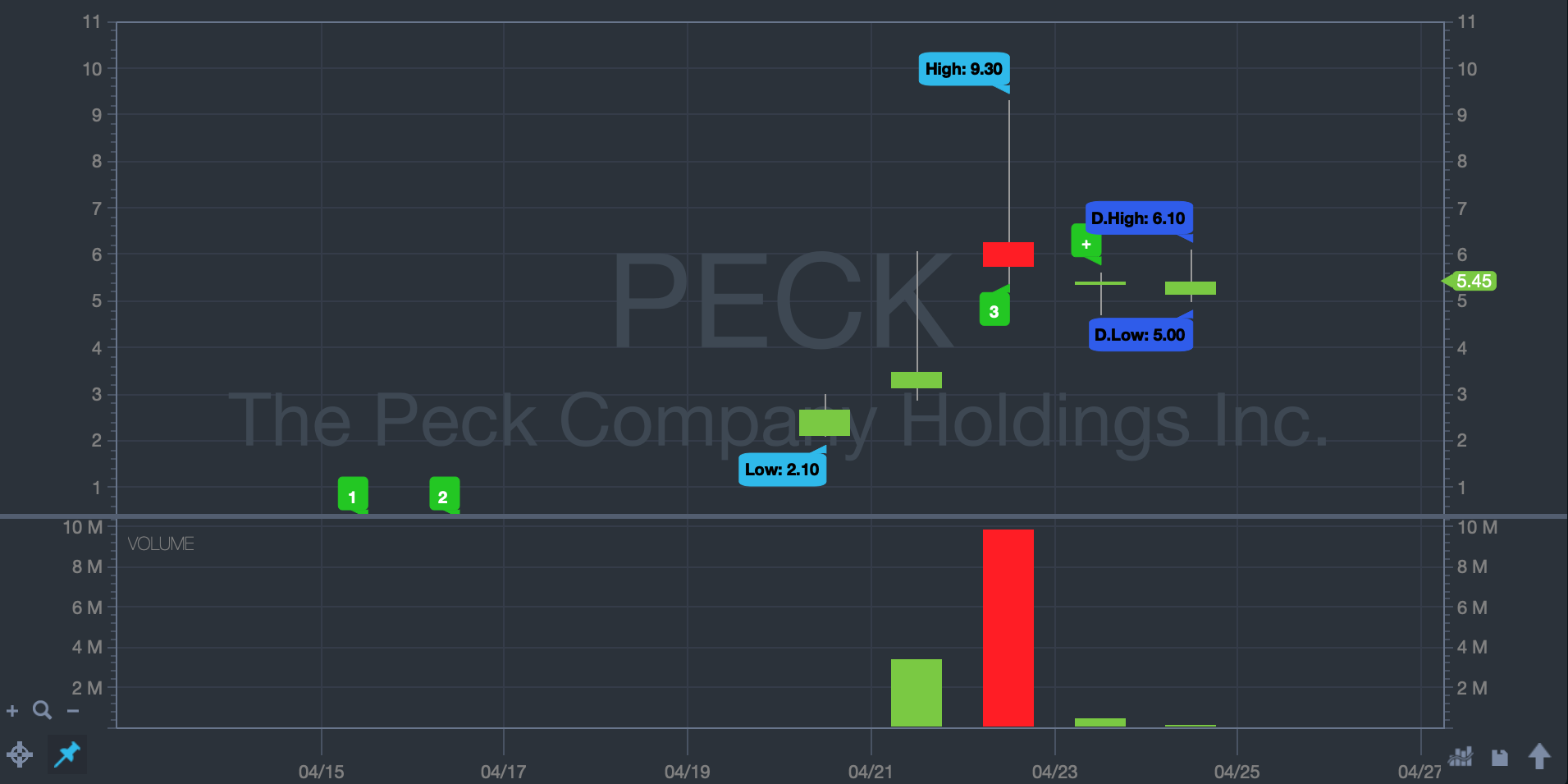

The other day in my StocksToTrade Pro webinar, an STT Pro member brought up a potential stock to trade: Peck Company Holdings, Inc. (NASDAQ: PECK). This is a solar company that had some good news, and the chart was pretty compelling:

My problem with it? Solar hasn’t been very hot lately. I’m not saying this as a judgment — I’m a big green-energy guy. But lately, solar stocks haven’t been big movers.

Plus, oil is REALLY cheap right now … That’s not very bullish for green-energy plays.

Here’s my line of thinking as we go into earnings season with oil prices bottoming out … There’s just too much going on to focus on sectors that aren’t hot. So for right now, a solar stock in the age of the oil crash just isn’t that interesting to me.

But does that mean it’s a bad idea to trade? Not necessarily. I mean, this stock did go from the $2s to the $9s. Ask yourself if it fits your setup and whether you’ve got a solid trading plan before you make a move.

Consider Sympathy Plays

A smart trader thinks about the ripple effects of big catalysts. So what are some potential sympathy plays for oil?

Well, how about the stocks that could benefit from the fact that everyone’s scrambling to find a place to put all that excess oil? Right now, oil is being stored on ships. That could explain why some shipping stocks experienced surges this week.

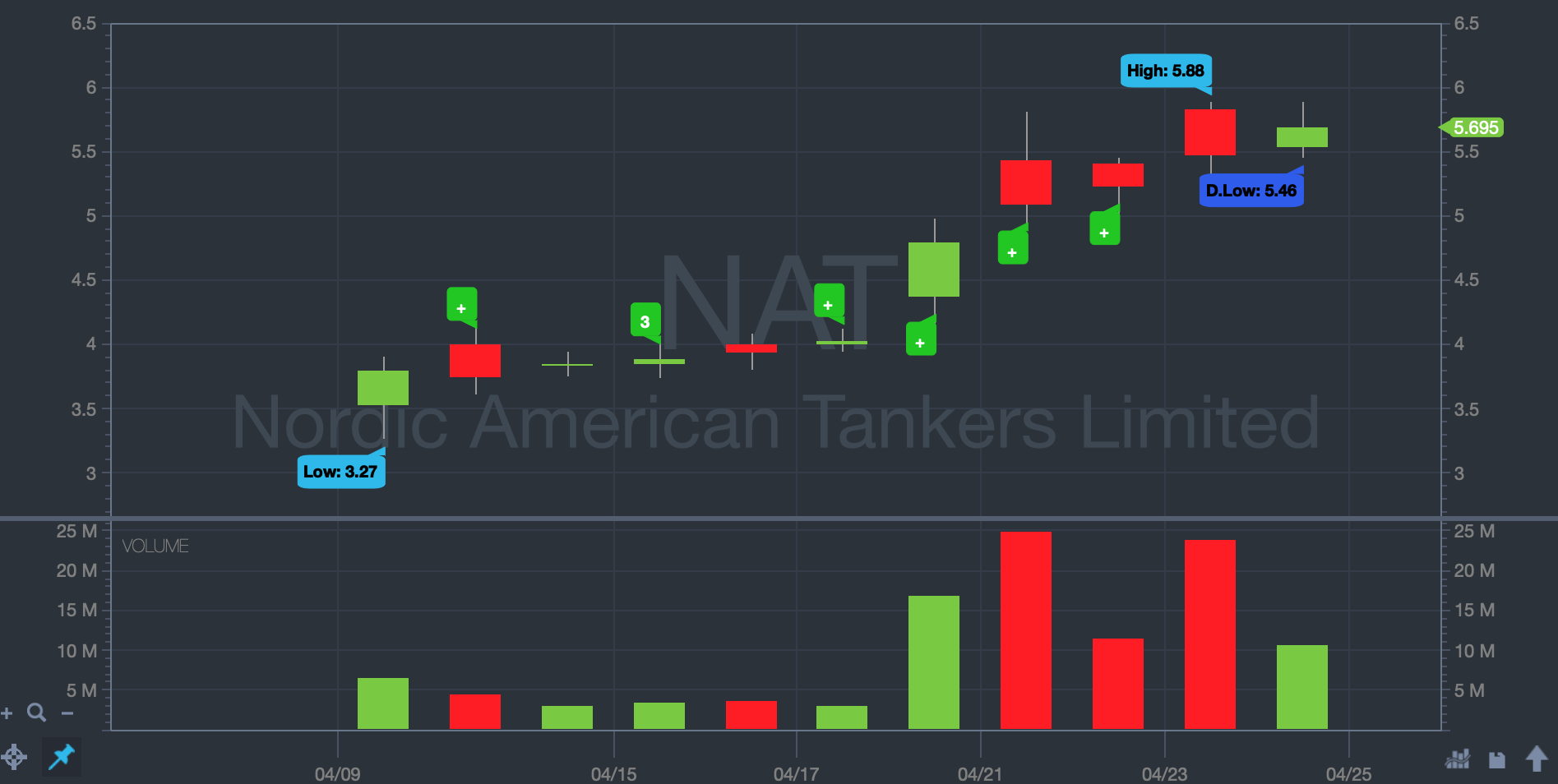

For instance, consider Nordic American Tanker, Ltd. (NYSE: NAT). This was a stock some STT Pro members pointed out the other day. When you look at the chart, there’s a clear uptrend that picked up steam right around the time of the crash:

Supply and demand is working in the opposite direction for tankers. They have space, and now that’s in demand for oil. Storage prices are going up, meaning tankers could be on the receiving end of a pretty big windfall.

StocksToTrade for Oil Crash Plays

Wanna keep up with the most current price action on oil plays, coronavirus plays, and their sympathy plays? StocksToTrade makes it easy to find the stocks in play right now and build a strong watchlist.

Sign up for my FREE weekly watchlist here.

Here’s what you can expect:

- Advanced scanning tools. Who has time to spend hours analyzing potential stocks to trade? STT makes it easy to scan for stocks, with amazing software to help you filter the thousands of stocks out there down to the ones that fit your criteria.

- Paper trading. Especially during times of volatility, you might want to test out a strategy with paper trading before going live. STT’s paper trading program lets you do that easily.

- The power of technology. Oracle is StocksToTrade’s alert system … It can help you find great trades faster.

Give STT a try today with our 14-day trial for just $7!

Give STT a try today with our 14-day trial for just $7!

Go STT Pro

The StocksToTrade Pro community is incredible.

I’ve mentioned some of the conversations and trading ideas brought up by STT Pro members in this post. That’s all thanks to the StocksToTrade Pro community. Join us and get access to amazing trading resources like daily webinars, chat, and cutting-edge tips.

This is a great way to get ideas for trades, learn the market ropes, and so much more. Sign up today!

The Final Word on Trading the Oil Crash

It’s been a crazy year so far. This oil crash isn’t doing anything to calm down the market volatility we’ve been experiencing.

A massive catalyst like this can create potential trading opportunities … But it’s super important to be extremely vigilant in this uncharted territory. We’ve never experienced anything like this before, so there isn’t much historical data to inform your trading.

The bottom line? If you want to trade the oil crash, be sure to do your research, have a strong trading plan, and be cautious — better safe than sorry!

What do you think about the oil crash? Are you trading through it? Share your experience below!