This time of year can offer some of the best trade opportunities, whether you swing trade or day trade. (I’ll show you an example shortly)…

And it’s great whether you like ‘real’ stocks or penny stocks…

The best part is, this exciting time comes around four times per year.

It’s earnings season, baby!

But these aren’t gimme trades…

There are two things you must look for before jumping in.

I’ll break them all down for you today and give you an example of how it all comes together to create better odds trades…

The News That Could Create Powerful Moves

We’re getting deeper into one of my favorite times to trade…

And I’m looking forward to some big tech names due to announce earnings this week and next.

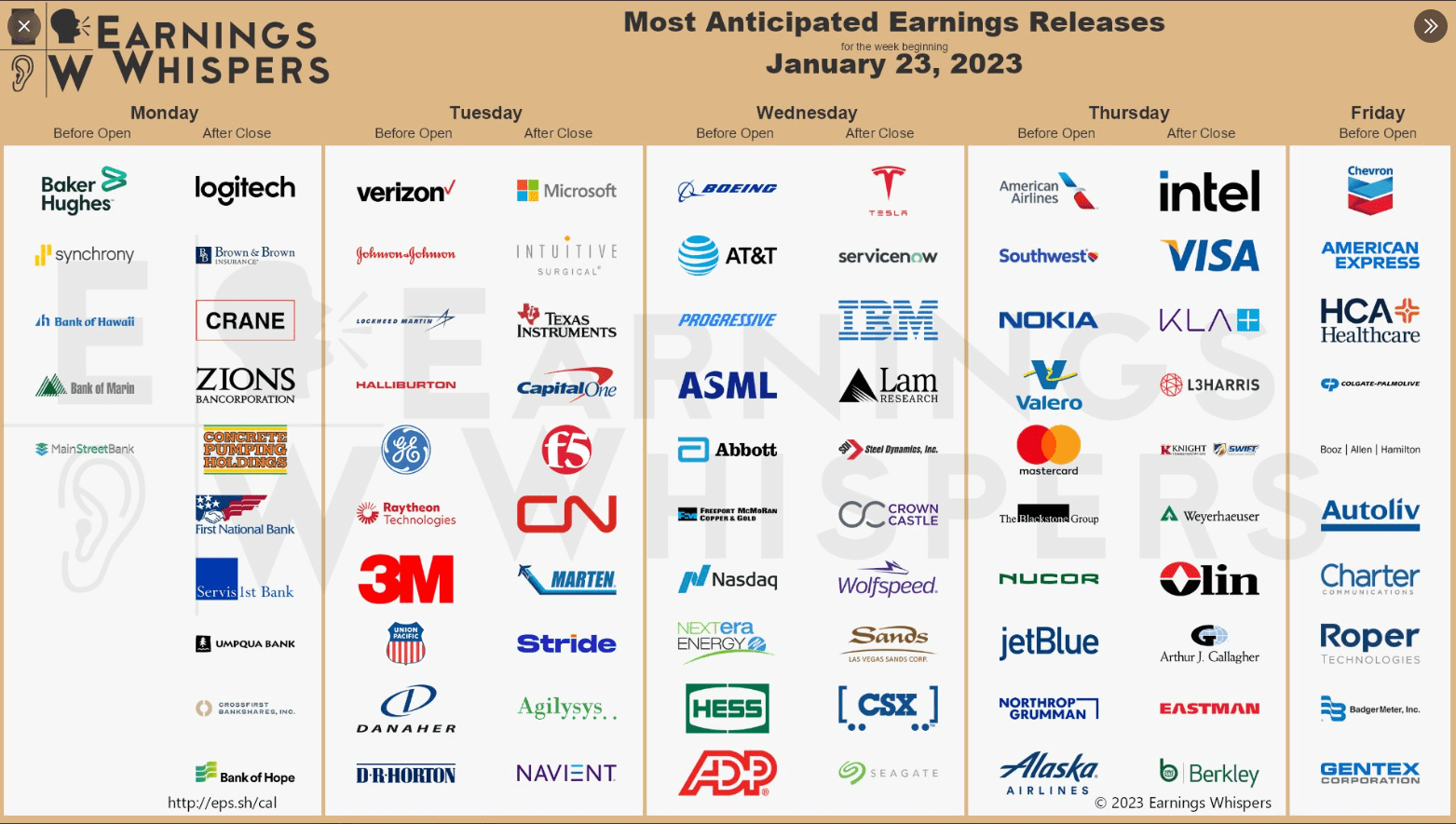

Here’s what’s coming out this week according to Earnings Whispers…

These are all ‘real’ companies, so they could offer great opportunities for swing traders and part-time traders.

Just look at this example…

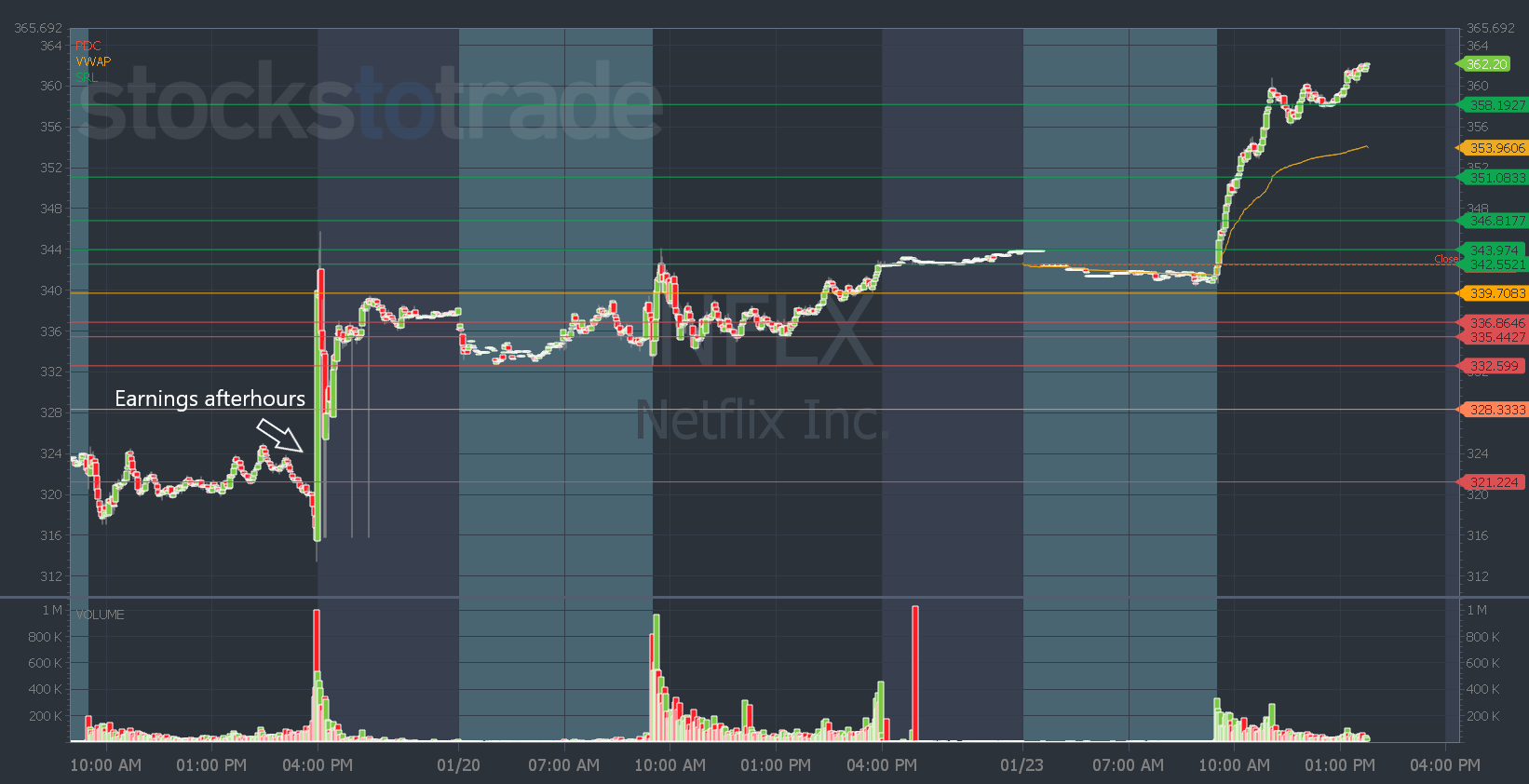

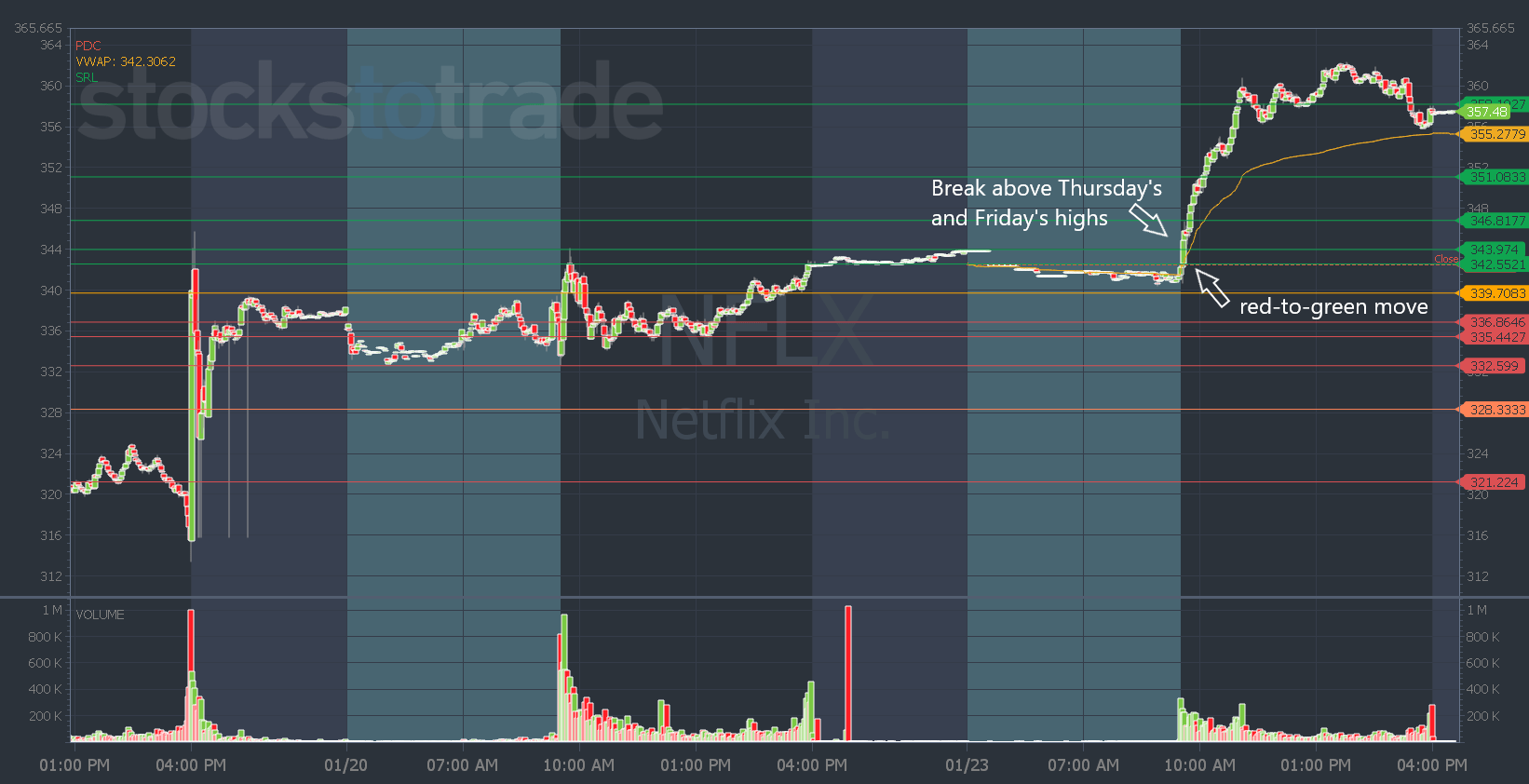

Netflix, Inc. (NASDAQ: NFLX) had a huge gain after earnings…

How can you capture a piece of these opportunities?

And can day traders still capitalize on these moves too?

Let’s dig in…

How to Trade Earnings Winners

Trading earnings winners is a fantastic strategy for swing traders or day traders. But before you dig through reports and look for a stock with good earnings to buy…

The first thing you want to look at is the chart.

That will show you whether it’s an earnings winner. It doesn’t have to do with reading the earnings reports and digging through numbers or financials.

An earnings winner is a stock that’s reacting positively to earnings. That means it’s climbing higher after the news and breaking resistance levels, ideally with high volume

The challenge with earnings is that the news is released in either premarket or after hours…

So it can be tough to plan a trade around key levels. And there are more risks since these are usually more illiquid times to trade.

The crucial part of trading earnings winners is to treat the trades like any other trade — you need to combine the news and reaction with a pattern and trading plan.

Look at NFLX as an example…

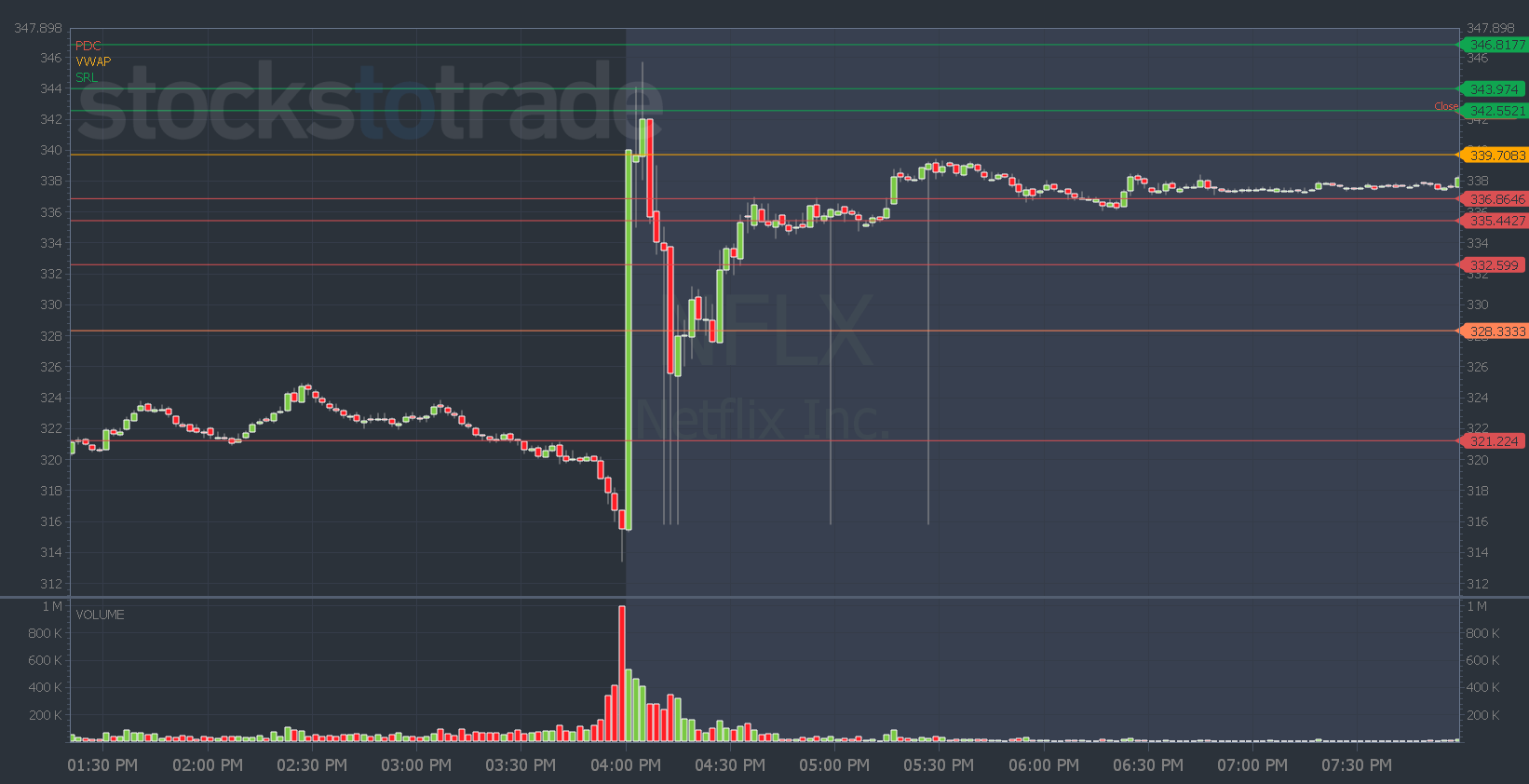

The company announced earnings after the close last Thursday. And it had a big move to the upside. But it had volatile swings before eventually evening out near the top of its move.

It didn’t really offer an excellent risk-to-reward trade, especially since it was after hours…

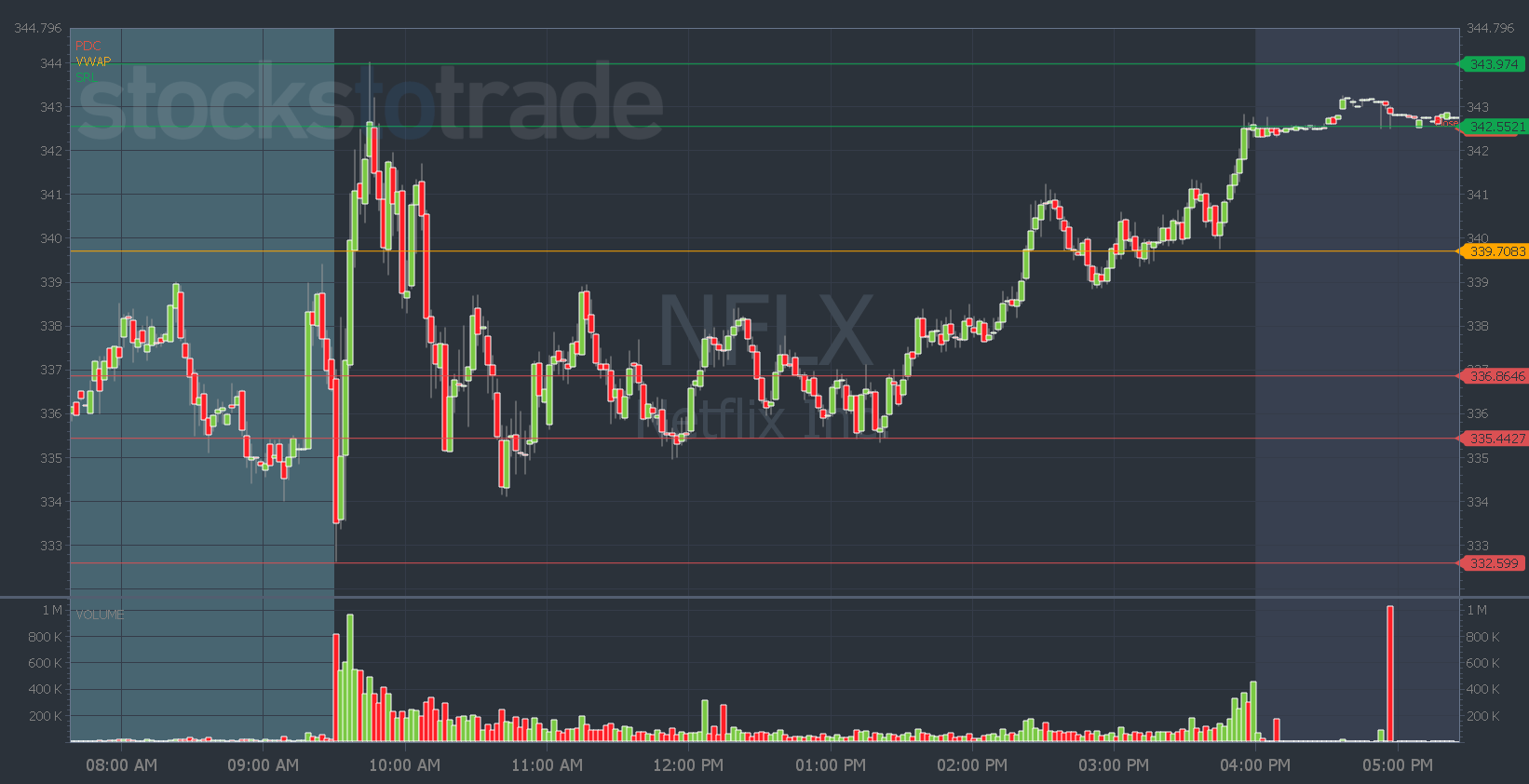

Then the next day, the stock consolidated and chopped around after its big gap up. So there was no trade there either…

But yesterday it made a monster red-to-green move. It also made a similar move to a day three surge pattern when it broke above the after-hours high from Thursday and Friday’s high.

Taking the red-to-green entry could’ve returned up to $20 per share gains.

That’s pretty incredible for a 160 billion market cap stock to make that kind of move in a day.

So whether you want to swing or day trade earnings winners, remember what’s most important…

We don’t care about the actual numbers or earnings. We care about the reaction to the earnings.

And you must combine the news catalyst with a pattern to give yourself the best odds in your trade.

Stay up to date on all the potential earnings plays I’m watching — get my market updates three days a week as part of my StocksToTrade Advisory.

Have a great day everyone! See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade