Lessons Learned: Mastering Greed Before You Lose

The trader has two key enemies: fear and greed, and when these two enemies start working together, you’re in for a wild ride and risk losing gains—or more. Mastering greed is vital for success.

Download the key points of this post as PDF.

STT lead trainer Tim Bohen will be the first to warn you against greed, fear and letting the two get together.

“Lot of traders get up big and give it all back—sometimes even turning winners into losers,” says Tim.

If you’re making $2 a share in a couple of hours, take it. If you don’t you’re just getting greedy and that’s where you can get into big trouble.

There were a couple of stocks over the past week where you could have made money quickly—and lost it just as quickly if you gave in to greed.

$HMNY is one. If you entered this trade on 29 September under $12 and then saw it climb to $14—which it did—you should have taken the over $2 per share win and called it a day. If you let greed overtake, then you lost half your gains on this play—for no reason.

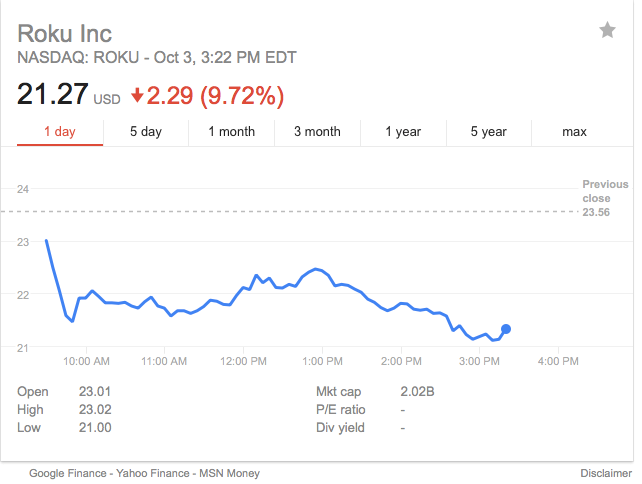

The ROKU IPO is another great example—and IPOs are always tricky, so all the more reason to make sure greed isn’t controlling your moves.

If you didn’t let up on this one after day 2 of the IPO, you lost all your gains, depending on when you entered. Shares traded up from their $14 IPO price, with a $16 opening price and hit as high as $30. But they closed at $23.50 on Monday night and since then, the pullback has been tough—down to $21 by close on Tuesday, with short-sellers scrambling to buy back shares.

What happens, then, is that those traders who didn’t take their wins when they should have are still holding on to the shares, thinking they’ve hit bottom now and will start climbing back up. But that’s not what’s happening, and this is where greed turns into fear and compounds into major losses for the trader.

Another great example comes from an investor-turned-trader, and now an STT Pro user. She recently detailed her story for us, and we thought we should share it with you all because there’s a major lesson learned here.

Another great example comes from an investor-turned-trader, and now an STT Pro user. She recently detailed her story for us, and we thought we should share it with you all because there’s a major lesson learned here.

She writes:

“Welcome to my life prior to STT Pro. I had invested some money and socked it away for retirement. I had been stashing away money in my company-sponsored 401K since my early twenties. Now, in my forties, I had decided to roll over my 401K into an IRA, and transferred my account—which was sitting comfortably in some boring mutual fund–to a brokerage firm to trade.

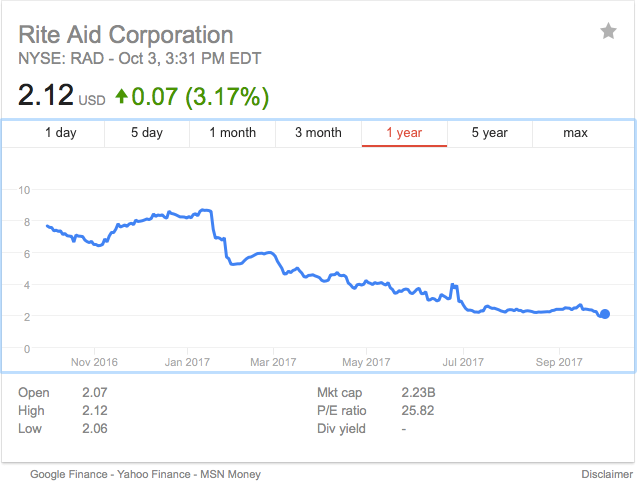

It was a sizeable amount—for me. I had roughly $70K to play with. I didn’t know much about the stock market—I did some research, and then took the plunge with a stock–$RAD. And this is where the scary ride begins. In no time, I was up. I was down. I was up again. I sold it, I bought it, I sold it again. In and out, in and out. I was up, I was down. I won some, I lost some, but luckily (and it was luck), I won more than I lost.

In a couple of years, I had gotten it up to $91K. Yay, me! Some of you fastidious traders may stick your nose up at my paltry sum amassed over a couple of years, but I was pleased, and except for one crazy day of multiple trades to save my skin after it lost $10K in a single day, I didn’t spend more than a couple hours per month managing it.

And this is where the story turns into something rather darker… I was up. There was a merger on the horizon. Walgreens, they said. Massive buyout, they said. An FTC ruling was the key to deal, and eventually it fell through. In retrospect (which is glaringly clear now), I ignored all the signs. I was up. I had received my gains, and should have ditched it a year ago.

I didn’t know anything about charts, so I ignored them. I only worked on what I thought was coming—a Walgreens buyout. But $RAD got even close to the share price Walgreens would have paid, prior to the merger falling through. But still, I thought, there were still a couple dollars more per share to be gained. I feared that I might lose out on that last couple of dollars per share –which would have made for a nice payout.

Well, $RAD tanked. My account plummeted more than $20K. I still held on, fearful to take my losses (somehow, by staying in, it seemed like I didn’t actually lose that money yet). Oh, but it went lower still. Still… I kept thinking… what if I get out and take my losses, and Walgreens announces the merger the next day? What if I miss out on that opportunity?

Finally, my account dropped to $30K, and I got exactly what I deserved. Not only had I been flying blind, but I did not get out when the getting was good—instead, I stayed in until it went bad, and then worse. And let’s be honest—if you don’t get out while it’s good… when will you get out? I didn’t really have a plan.

And then fear that I might miss out on what other traders might get on a buying stopped me from banking my $91K and going home. Instead, it’s just me and my $30K here, binge-eating ice cream in consolation.

Now I’m learning what I should have learned then, using STT Pro.”

This is a great lesson about greed and fear, and we hope you’ve all been paying attention. Hang out with STT lead trainer Tim Bohen and you’ll learn how to master your greed and keep it from fraternizing with fear and losing you money.

This is a great lesson about greed and fear, and we hope you’ve all been paying attention. Hang out with STT lead trainer Tim Bohen and you’ll learn how to master your greed and keep it from fraternizing with fear and losing you money.