Yep, today we’re talking pot and how to trade marijuana stocks.

It’s hailed as one of the most exciting industries over the coming decade. The sector is teeming with highly volatile stocks that can offer some potentially amazing trade setups.

This is an industry that’s already booming. But it may be primed to explode even more in the coming years. There’s already a ton of listed stocks, with new ones launching IPOs all the time.

In this post, you’ll find out all about trading pot stocks…

We’ll also show you a list of some of the most interesting weed and CBD stocks to watch.

Let’s dive right in…

Table of Contents

- 1 What Are Marijuana Stocks?

- 2 Types of Marijuana Stocks

- 3 Tips and Tricks for Trading Marijuana Stocks

- 4 Should You Buy Marijuana Stocks?

- 5 Trends Influencing Marijuana Stocks

- 6 6 Marijuana and CBD Stocks to Watch

- 7 How StocksToTrade Can Help You Trade Marijuana Stocks

- 8 Conclusion

What Are Marijuana Stocks?

This may seem silly, but first, let’s clear up what exactly a marijuana stock is.

Marijuana stocks are the stocks of companies that are involved in the rapidly evolving marijuana industry. Some companies solely focus on marijuana — growing it, selling it, or researching it. It’s easy to think of these companies as pot stocks.

But there are also other stocks that aren’t as obviously involved with weed but can still be considered pot stocks. For example, they may be a warehousing and distribution company that services firms in the marijuana industry.

Other companies may be involved in the production and development of things like CBD oil and may be considered CBD stocks, which still fall under the broad umbrella of marijuana stocks.

As a rule of thumb, if a company derives more than a third of its revenue from marijuana-related activities, you could probably consider it a pot stock and keep it on a pot-stock watchlist.

Why Are Marijuana Stocks so Exciting?

Here’s another logical question to ask: There are all kinds of hot sectors to trade at the moment … why weed stocks?

Consider something … This is a well-known drug that’s slowly being legalized in states. The demand is already huge. And it’s not just being legalized or decriminalized in the U.S. Canada’s already made pot legal on a national level. There’s a lot of speculation that legalization could spread through much of the world.

Many analysts and investors believe that weed will become a major industry in the next decade. Some analysts even believe the industry might surpass the massive soda industry. That’s monumental if true!

It’s that kind of wild potential that’s causing companies to pop up left and right, trying to stake a claim and profit from the growing industry.

And thankfully for traders, many of those companies trade on stock exchanges. If you’re prepared, there can potentially be exciting trading opportunities here.

Read on to find out what kind of pot stocks are available to trade and learn what to look for when trading them…

Types of Marijuana Stocks

Clearly, there’s a lot of buzz about the plentiful trading opportunities that can be found in weed stocks. Now let’s get into specifics.

Cannabis Growers

These stocks are arguably the most basic type of marijuana company.

Cannabis growers are effectively cannabis farmers. They often own or lease large plots of land where they install facilities to cultivate the plant. These facilities are often somewhat high-tech, using indoor growing techniques and greenhouses to create a competitive product.

Cannabis Biotechs

A lot of research goes into modifying marijuana and its related products, looking for innovative ways to treat illnesses and ailments such as epilepsy, anxiety, and cancer.

Cannabis-focused biotech firms are often behind this research.

As with many biotechs, those with a cannabis focus often require a lot of investor cash while researching and testing products through various phases. Producing something with mass-market appeal can be hard. There can be a lot of disappointment in this process.

On the flip side, when a company successfully makes it through testing, the hype can be huge. That can cause major moves in the stock price and offer exciting trading opportunities.

Industry Support Providers

The marijuana industry doesn’t just include the companies that grow or research the drug.

The industry is complex enough to have all kinds of firms that service the industry.

Some companies help produce the hydroponic systems used in growing the products. And there are also companies involved in logistics, warehousing, or even leasing land to pot companies.

It can be smart to check out these related and less obvious companies. It’s one way to play sympathy moves as prices fluctuate in related stocks.

How to Trade Marijuana Stocks

Trading marijuana stocks is about as easy as trading any other industry…

The big difference is that since it’s a new, growing industry, it’s important to keep on top of industry trends, company news, and news related to legalization.

Apart from that, analyzing the company fundamentals are like any other stock. Reading the stock chart and looking for patterns also require the exact same process as other stocks.

All you need is a trading and analysis platform to analyze all the best pot stock tickers. StocksToTrade can help you with that. Grab a 7-day trial for just $14 today.

How to Buy Marijuana Stocks Online

If you want to get involved in the hot weed stock sector, the good news is it can be super easy. You don’t even need to leave your house.

First, you’ll need to open a brokerage account with an online stockbroker. This post can help you select the best broker for your needs.

Then, you’ll need some capital to buy your first pot stock. This can be as little as $500 or $1,000.

Next, you need to locate a pot stock that shows some promise, determine the right level you’d like to buy at, and where to place your stop-loss order.

All that’s left to do is place your orders and wait until they execute. After that, you officially own your first pot stock.

Tips and Tricks for Trading Marijuana Stocks

The weed industry is hot right now — no doubt about it. But even if you’re involved in a hot sector, you still need to master a number of skills and techniques to find, analyze, and trade solid setups.

Read on for a few simple-but-powerful trading tips that can help you on the path for trading pot stocks.

Watch for News Catalysts

Question: When you look at the biggest percentage movers for the stock market on any given day, what’s one thing they almost always have in common?

Answer: News catalysts.

News catalysts are exciting news stories, rumors, or buzz that excite traders or investors to pile into or out of a stock. That can create price waves in the process.

If you want to catch these moves, you need to keep an eye on the latest news catalysts. You could comb through countless news sites and online forums while keeping an eye on Twitter…

Or you can put modern technology to smart use in the form of a news scanner. The StocksToTrade news scanner can help you with the bulk of the work. Just put in the tickers of your favorite stocks, and the scanner will alert you anytime there’s a hot news story or social media mention for any of those stocks.

Look at the Stock Charts

I’ve said it before, and I’ll say it again: No matter how excited you are about a stock, and no matter how exciting the company’s story is, look at the chart before making trading decisions.

If you can read a stock chart, you can learn a lot about the stock, such as:

- Where to intelligently enter a trade.

- A good place to put your stop-loss.

- Whether it’s in an uptrend, downtrend, or trading range.

- How excited (or indifferent) the market is about it.

- Key levels where the market’s shown excitement before.

There’s a big reason that when you see a successful trader’s trading desk, you almost always see charts on their screens. Get really comfortable reading stock charts.

To get you started, here are a few charts of some major pot stocks:

Cronos Stock Chart

Canopy Growth Stock Chart

Tilray Stock Chart

Aurora Cannabis Stock Chart

Aphria Stock Chart

CannTrust Stock Chart

Innovative Industrial Properties Stock Chart

Use a Stock Scanner

A big part of successful trading is finding trade setups that meet your criteria. Sounds simple, right?

Here’s the problem: For pot stocks alone, there are already hundreds of tickers to keep track of, and that list is growing. Tracking every one each day could take hours and be exhausting…

But it doesn’t have to be that way. Thanks to modern technology, you can use a stock scanner to quickly scan through a huge number of stocks, looking for your exact trading criteria.

With the StocksToTrade stock scanner, you put in the criteria you’re looking for: a chart pattern, a fundamental ratio, or a combination of factors.

Then, it’s just a few clicks and the scanner will search for all the stocks that show exactly what you’re looking for, allowing you to focus on the stocks that best fit your criteria.

See how quick and easy scanning for stocks can be — get your 14-day trial for StocksToTrade for just $7!

Look to Trade Both Long and Short

This applies more to active traders and not so much to investors…

To be long a stock means to hold the stock and (hopefully) profit as the price goes up. To be short a stock means to borrow the stock, sell it, and buy it back later to hopefully profit from declining price.

Over the next few years, the marijuana industry might really boom. But in terms of stocks, there will be winners and losers. Sometimes, it can easier to find a stock that’s collapsing in price than finding an uptrending stock.

Either way, it never hurts to beef up on your trading education to grant yourself the ability to go long or short based on your analysis. Short selling can definitely be complicated, so be sure to do your research and study up on this strategy before you dive in.

Should You Buy Marijuana Stocks?

If you’re looking to hold a stock as a longer-term investment, you may be wondering if you should focus on pot stocks, since the sector shows so much promise.

My best advice is to trade in a few sectors, depending on which stocks display the best price action and chart patterns.

As a trader, you don’t want to get married to a stock, or a sector. Instead, make your money in a hot area of the market, then follow the hype to the next hot area.

Trends Influencing Marijuana Stocks

There’s currently a lot happening in the weed industry.

For example, with America’s legalization of hemp, a strain of the marijuana plant with industrial uses, many weed companies are looking to grow the plant in the U.S.

There’s also the ongoing push of weed companies looking to grab market share from alcohol producers.

Many retailers of CBD oil products are looking for clearer guidance from government bodies before they fully commit to selling the product.

Importantly, there are no major roadblocks or dangers for pot stocks in the foreseeable future, so the industry continues to show promise.

6 Marijuana and CBD Stocks to Watch

By now, you might be excited to dive right in and start looking for a few exciting pot-stock trade setups.

There are a lot of marijuana stocks to invest in and even more that you can actively trade … Some are heading up in price and some are heading down. Here’s a list of ten interesting pot stocks to check out.

Aurora Cannabis (NYSE: ACB)

Aurora Cannabis is a company based in Edmonton, Canada that mainly grows and distributes cannabis.

It’s a major producer in the industry, operating eight different production facilities with the stated capacity to produce over 500,000 kilograms of cannabis per year.

The ACB stock trades on the NYSE and has a strong management team that’s taken steps to acquire other marijuana firms over the past few years.

Tilray (NASDAQ: TLRY)

If you’re experienced in the markets or even just watch financial news, you’re probably familiar with Tilray.

The Tilray stock was the very first of the pot stocks to IPO on a major U.S. exchange, and the stock price has had quite a while ride since that listing.

The company itself is based out of Toronto, Canada. It’s involved in operations in various countries including Germany, Australia, and Portugal.

GW Pharmaceuticals (NASDAQ: GWPH)

GW Pharmaceuticals is a cannabis biotech stock based in the U.K.

This company is involved in the research, development, and testing of a number of cannabis products for mainly medical uses.

The firm has a long history of success related to cannabis products. Just last year, the company had its epilepsy treatment product approved for the market.

Cronos Group Inc. (NASDAQ: CRON)

Cronos Group is a diversified cannabis company based out of Toronto, Canada.

The company primarily invests in pot companies involved in the medical marijuana industry, making it somewhat of a diversified investment company.

The company hasn’t been too profitable historically, and we can see that reflected in the chart with a consistent downtrend throughout 2019.

Keep this one on your radar, and watch for an eventual change in trend.

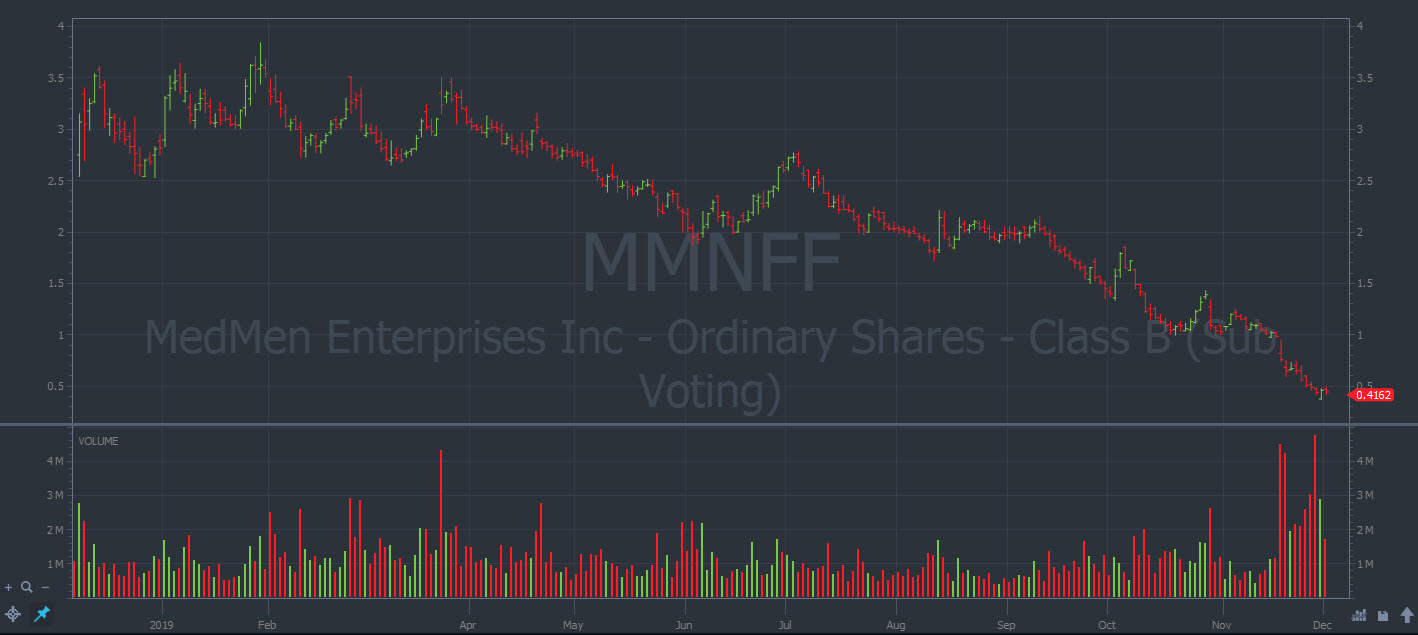

MadMen Enterprises Inc (OTCQX: MMNFF)

MadMen Enterprises is a marijuana cultivation and retail company based out of Culver City, California.

The company operates 32 marijuana dispensaries across Arizona, California, Illinois, Nevada, New York, and Florida. They’re possibly the best-known marijuana retailer in the country.

As of this writing, the company has some financial troubles, and that’s shown in the clear downtrend on the stock chart.

This is possibly a stock that’s better to short sell, or at least wait until there’s a change in trend direction before diving into this one.

GreenGro Technologies (OTCPK: GRNH)

GreenGro Technologies is an agricultural technology company based out of Anaheim, California.

The company develops green technology to help grow cannabis on both indoor and outdoor plantations.

This company is tiny and a true penny stock. Put it on a watchlist and look out for news catalysts — you may be able to catch a sudden move.

How StocksToTrade Can Help You Trade Marijuana Stocks

Trading pot stocks can be very exciting and potentially lucrative. But at the end of the day, there’s a lot you need to stay on top of.

Things like finding the solid chart setups, keeping up with the latest news and hottest stocks, updating your stop-loss levels, determining your profit targets, and so much more…

Back in the early days of the internet, I’d sit at my desk and try to find and trade the best setups. And that would mean clicking between several clunky websites and software programs. Sometimes my computer would freeze under the weight of everything I had running. It was a total headache.

To make matters worse, I was paying a whole bunch of subscription fees for each of those websites and services. And I wasn’t fully using most of them…

Thankfully, those days are over.

Now, you can get all the charts, scanners, news feeds, watchlists, and more in one program, for just one monthly fee with StocksToTrade.

StocksToTrade is the trading and analysis platform used by many of the world’s best stock traders. Check out how efficient we can help make your trading day with a 14-day trial for just $7 now!

Conclusion

By now, you likely have a better understanding of why many traders are nuts for weed stocks.

When you first start reading about cannabis stocks, you’ll likely encounter a lot of boring scientific terms. I’ve been there, so I tried to make explaining the various types of pot stocks light and easy.

This sector is producing a lot of exciting price moves and is pretty ripe for an active trader or investor. In my opinion, several of the biggest percentage movers in the next two to three years will be in this sector.

I’ve gotta remind you, though: Trading pot stocks well requires that you know what you’re doing, that you have a trading plan, and that you can make sound trading decisions. Always remember that trading is RISKY.

The tips I listed in this post can help set you on the right path, but if you’d like more support, join me in daily webinars and our live chat room at StocksToTrade Pro.

Follow along with the above tips, load up your trading platforms, and pull up those charts.

If you don’t have a trading platform set up, grab your 14-day trial of StocksToTrade for just $7 and get to work today!

Traders: How are you following this growing sector? Share your kind canniness on pot stocks … Leave a comment below!