If you want to outsmart your competition in trading—good luck!

Who wants to go against supercomputers, advanced quants, and the sharks on Wall Street?

Do you know some desks on Wall Street go a full quarter without incurring a day of losses?

That’s why it blows my mind when I see regular folks thinking they can beat Wall Street at their own game.

So why waste time digging through earnings reports, and dissecting earnings per share and revenues…?

Then sifting through analysts’ projections to decipher whether the company hit or missed expectations.

I prefer the keep-it-simple stupid method of trading…

There’s one thing I look for above all else that will tell me whether a stock’s an earnings winner or loser.

Here’s how you can tell, how I plan trades in earnings winners, and what’s coming up this week on the calendar…

I think this earnings season could be the shift we want to see in the market — get ready for all the opportunities NOW by joining the SteadyTrade Team!

Earnings Winners Vs. Earnings Losers

We had a massive week of earnings last week — some were good, and some were bad.

How can you tell whether a stock is an earnings winner or loser?

Price action is the ultimate arbiter of truth.

That means I don’t care so much about revenues and earnings per share. I care about the market’s reaction to the report.

A company could beat analysts’ revenue expectations, but the stock could still go down because the company has a poor outlook.

Or the company could announce missed revenue expectations but still go up because they’re restructuring the company.

A lot of things affect a stock’s reaction to earnings besides the numbers. So price action trumps all for me.

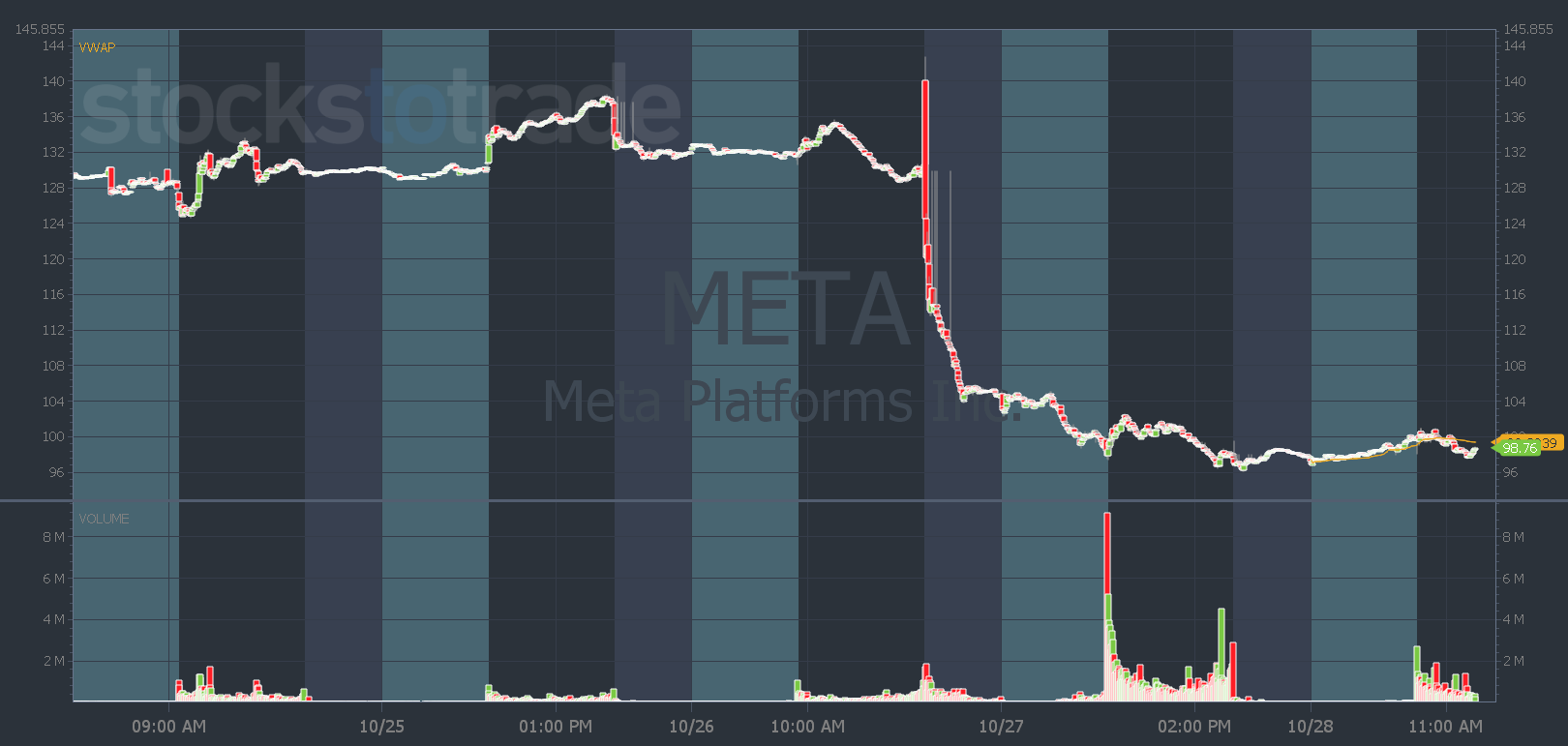

Look at Meta Platforms, Inc. (NASDAQ: META). It’s an earnings loser…

The company missed analysts’ earnings expectations.

But more importantly, CEO Mark Zuckerberg is betting big on the metaverse. And that means the company could lose money for years while it’s developed.

And look how the market reacted…

META chart: 5-day, 2-minute candle — courtesy of StocksToTrade.com

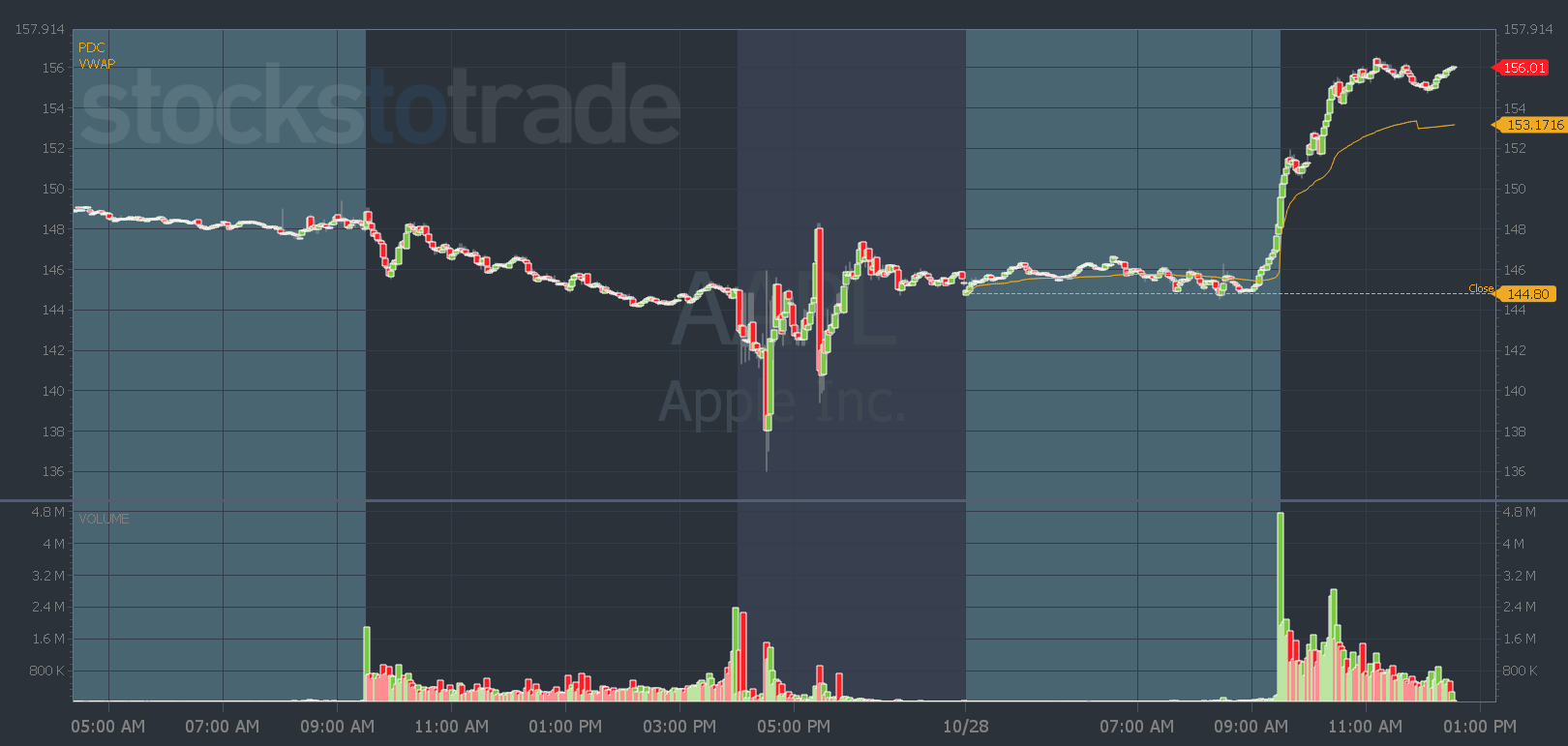

On the other hand, Apple Inc. (NASDAQ: AAPL) is an earnings winner…

The company beat analysts’ revenue and EPS expectations.

It had some choppy trading action after hours when the news was announced. But when regular market hours opened, the reaction was clear…

AAPL chart: 2-day, 2-minute candle — courtesy of StocksToTrade.com

How I Make Trading Plans

When I make trade plans for large-cap earning plays, I think of them more as swing trade opportunities. But you can day trade them too if you have smaller gain expectations.

I form a thesis based on my 15 years of experience. And I look at the range the stock has traded with high volume. Look at the AAPL chart above for example…

If it can trade almost $10 per share in one day on high volume, then can it trade $10 per share in a few days? Probably.

Then I wait for the right pattern to get an entry with a clear risk level. I could enter a red-to-green move with risk on VWAP or low of the day.

Or wait for more consolidation, then enter on a breakout risking the low after earnings. And look to take profits near resistance on the daily chart, in the $165 range.

Upcoming Earnings to Watch

Most of the big tech earnings are behind us, but there are still some big earnings to look forward to this week…

Pfizer Inc. (NYSE: PFE) reports earnings tomorrow and Moderna, Inc. (NASDAQ: MRNA) reports earnings in premarket on November 3.

And while there aren’t many low-price tech stocks we can trade in sympathy to big earnings — there are biotech penny stocks that could jump in sympathy to the large biotech names.

But like any trade, we wait for a reaction. We don’t anticipate.

I’m excited about winter and the next year. It was a choppy and slow start to last week. But I’m excited, things felt different on Friday. Like there was a momentum shift in the markets.

So now’s the time to study and get ready for what the market has in store. I can see it ripping back in full force like in 2020.

If you want to prepare for all the action — start studying in the SteadyTrade Team now!

Have a great money Monday, everyone. See you all back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade