Did you open my Sunday email and click through to see the full watchlist?

If you didn’t, you missed a beautiful setup…

I pretty much gift-wrapped this trade and delivered it to you with a bow…

In fact, if you caught the move, you could’ve made $400 with only a 100 share position — those are meaningful gains for a small account.

If you missed it, read on to see how this repeating pattern played out so you can be ready for the next one…

And next time, read my full watchlist!

The Power Of The Weak Open Red-to-Green Move

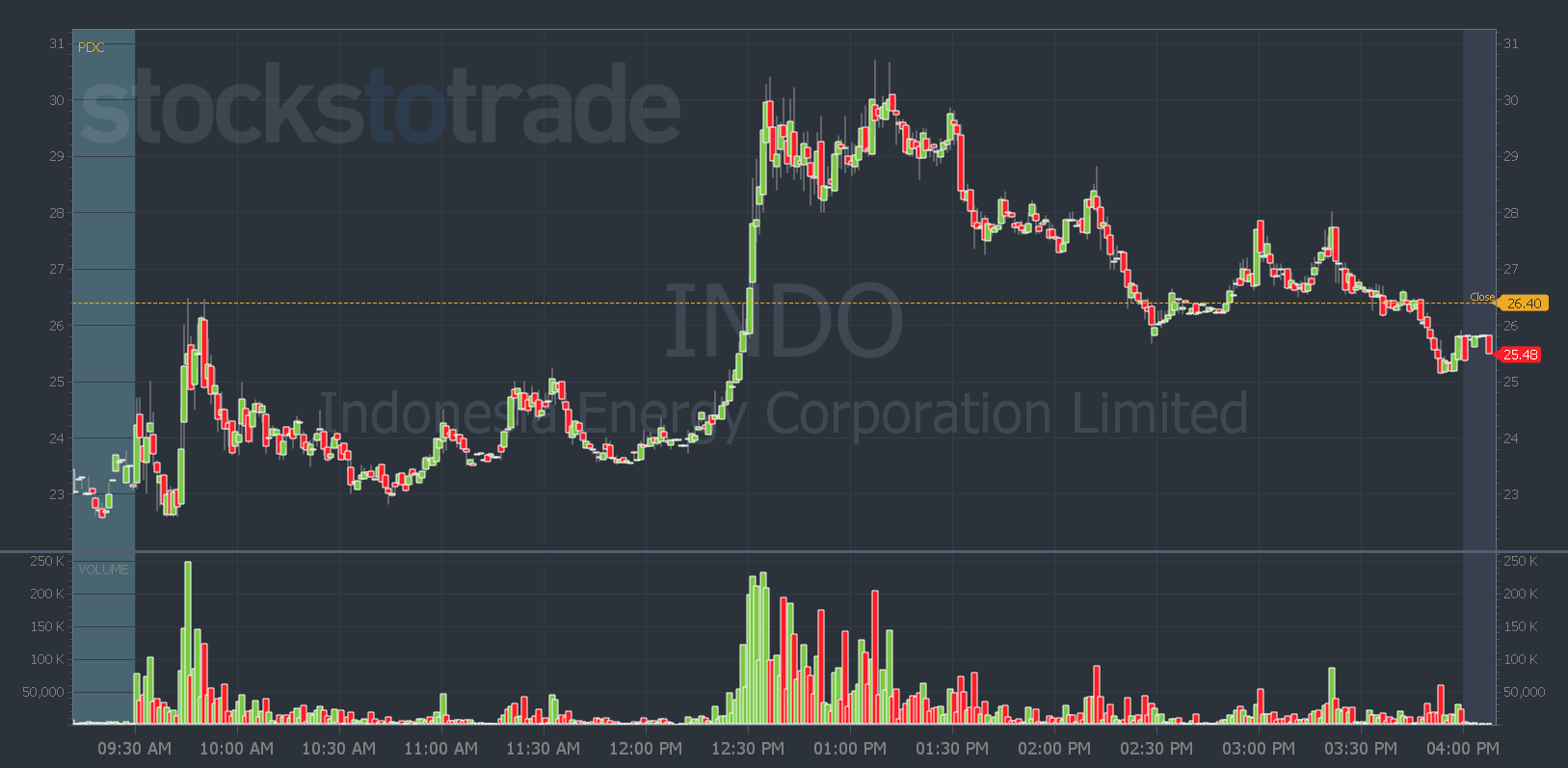

Yesterday, Indonesia Energy Corporation Limited (AMEX: INDO) opened weak just like I wanted … It traded below Thursday’s closing price in premarket. And at the open, it spiked to the red-to-green level and was rejected…

I love to see that move because it lures in more short sellers.

And as the stock traded sideways throughout the morning, shorts had no reason to exit. They probably even added to their positions when the stock popped through VWAP to the $25 level…

But when the stock broke through that $25 level, shorts got nervous…

High volume came in and shorts rushed to buy to cover. And when the stock broke the high of the day — which was also the red-to-green level — we got an explosive move…

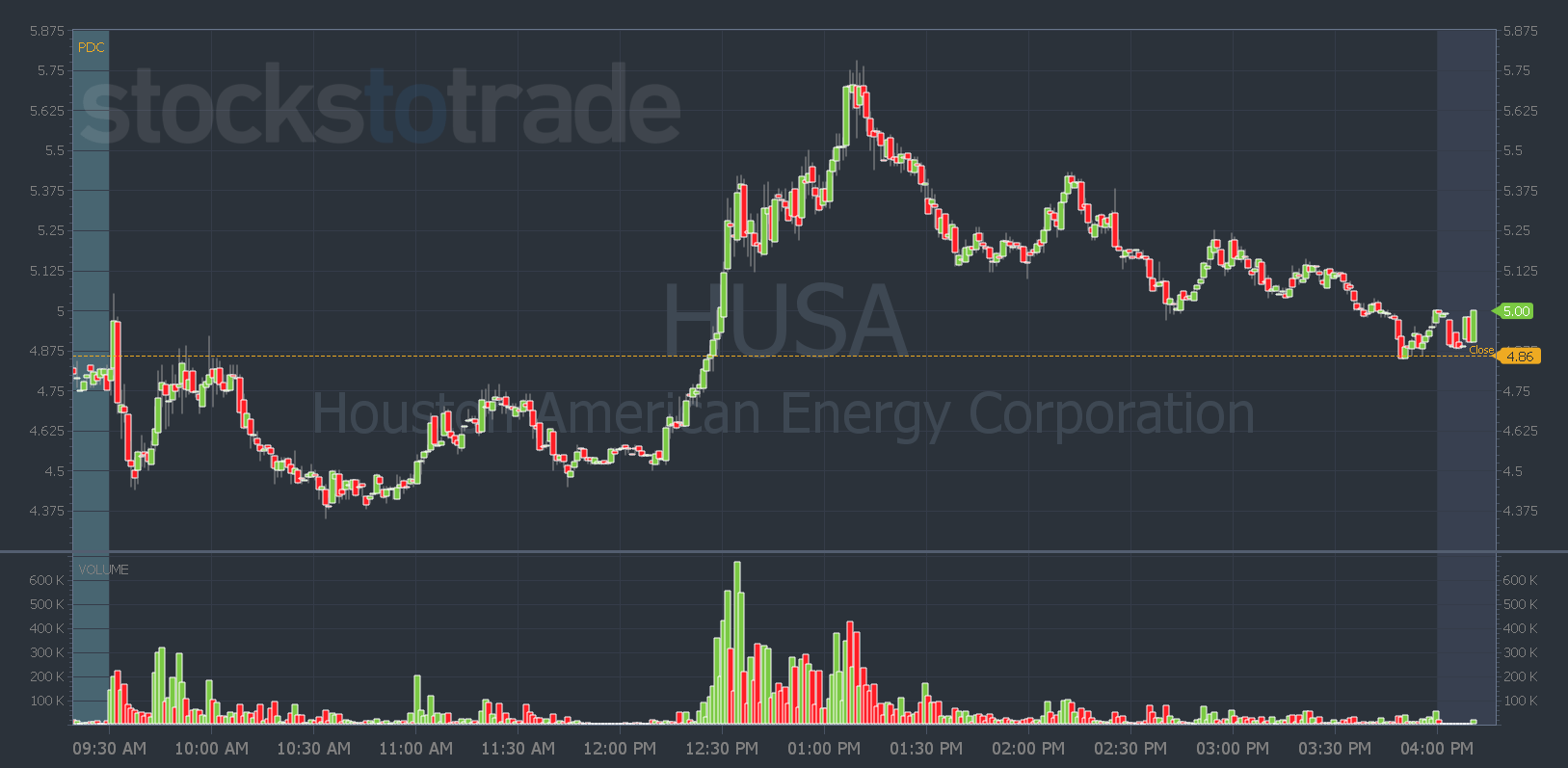

Other oil and gas stocks had similar moves — check out Houston American Energy Corp.’s (AMEX: HUSA) red-to-green move…

What makes the red-to-green move so powerful?

Short sellers.

And when you let the chart develop into the afternoon, short-sellers have more time to enter positions.

It also means you don’t have to trade the choppiness and volatility at the open. Or chase early spikes…

Even with years of experience, I still have to remind myself to avoid FOMO and wait until the afternoon. I even sang a beautiful song about it to SteadyTrade Team members in my morning webinar. (Maybe I’ll release an audio NFT one day soon…)

The point is, do whatever you gotta do to fend off FOMO and wait for your best setups.

That might mean singing yourself a song, or simply avoiding the market open completely and only trading in the afternoon…

If you want to learn how to spot the best potential afternoon trades AND get alerted when I’m watching one of my favorite patterns…

Have a great day everyone. See you back here tomorrow!

Tim Bohen

Lead Trainer, StocksToTrade