Gold & silver stocks are popping up on a lot of traders’ watchlists…

It’s confirmed. Inflation is at its highest rate since 2008. So it’s no wonder smart traders and investors are looking for a safe haven for their capital.

What’s the original safe haven for times of market turmoil or high inflation? Precious metals — mainly gold and silver.

Even if you’re not worried about inflation, gold and silver stocks can offer great trading opportunities. We’re big fans of precious metal stocks inside the SteadyTrade Team community.

In this post, I’ll teach you all about the world of gold and silver stocks and well-planned approaches for how to trade them. Plus, I’ll share with you the 11 most exciting tickers on my gold and silver stock watchlist at the moment.

Let’s dive right in.

Table of Contents

- 1 What Are Gold & Silver Stocks?

- 2 Are Gold & Silver Stocks Still a Good Investment in 2023?

- 3 Top Gold & Silver Stocks to Watch

- 3.1 Ticker #1: Barrick Gold Corp. (NYSE

- 3.2 Ticker #2: Kinross Gold Corporation (NYSE

- 3.3 Ticker #3: Northern Dynasty Minerals Ltd. (AMEX: NAK)

- 3.4 Ticker #4: Yamana Gold Inc. (NYSE

- 3.5 Ticker #5: B2Gold Corp (AMEX: BTG)

- 3.6 Ticker #6: Newmont Corporation (NYSE

- 3.7 Ticker #7: New Gold Inc. (AMEX: NGD)

- 3.8 Ticker #8: AngloGold Ashanti Limited (NYSE

- 3.9 Ticker #9: Harmony Gold Mining Company Limited (NYSE

- 3.10 Ticker #10: Iamgold Corporation (NYSE

- 3.11 Ticker #11: Sandstorm Gold Ltd. (NYSE

- 4 How to Choose Gold & Silver Stocks to Trade

- 5 Gold & Silver Stocks as an Inflation Hedge

- 6 Frequently Asked Questions About Gold & Silver Stocks

- 7 Trade Gold & Silver Stocks With StocksToTrade

- 8 Gold & Silver Stocks: The Conclusion

What Are Gold & Silver Stocks?

Before we get into some of the most promising gold & silver stocks, let’s get up to speed on gold and silver. Why would these precious metals rally during times of high inflation?

For traders and investors, there are two main ways to view gold and silver — as precious metals or as a form of investment.

Let’s take a closer look…

Gold & Silver as Precious Metals

Gold and silver are both precious metals that have been highly valued by humans for thousands of years.

These shiny metals are most visibly used as forms of currencies, for jewelry, statues, and ornaments. For example, it’s common to see people wearing a ring or necklace made out of gold or silver.

But there are many lesser-known uses for both gold and silver. Many of these are in the industrial manufacturing process.

Many computers and electronic parts are made with small amounts of gold, due to the metal’s electrical conductivity properties.

Silver is commonly used in batteries, dentistry, and photography equipment, among other things. That’s due to both the metal’s strength and malleability.

Gold and silver are referred to as precious metals due to the fact there is only a finite of each substance in the world.

To obtain the metals, people mine deep into the earth all around the globe. But as time goes on, that becomes harder and harder to do.

Now, let’s examine why investors and traders all over the world may be interested in holding these metals and gold & silver stocks…

Gold & Silver as an Investment

Apart from their physical uses from art to industrial applications, gold and silver have been used as a store of value and investment for much of recorded history.

The first gold coins appeared around 650 BC. And now people still invest in precious metals.

Some investors buy gold or silver coins and keep them at home or in a safe location. More sophisticated investors can buy gold or silver bullion blocks and store them in high-security storage or safety deposit boxes at banks.

Buying and selling physical metals can be a huge hassle. Plus, there’s always the risk of someone stealing them. Thankfully, we can also invest in gold and silver without ever having to go near a single piece of gold or silver.

For one, Investors and traders can invest in or trade gold & silver stocks and ETFs.

Gold and silver stocks are diverse. The companies may be the firms that mine the metals out of the ground, companies that buy and sell the metals, or ETFs that simply mirror the current value of the metals.

Are Gold & Silver Stocks Still a Good Investment in 2023?

It seems like I hear a question like this every year.

Traders and investors always wonder whether gold & silver stocks have any promise and whether the price of each metal is headed up or down…

The prices of the metals are volatile over time. Gold was around $1,900 an ounce in 2011, $1,100 an ounce in 2016, and almost $1,800 an ounce in 2021. Silver has seen similar price swings over the years.

Does that mean you can only profit from gold & silver stocks in years where the underlying metal rises in price? Absolutely not.

The reality is that every single year, there will always be great opportunities in gold & silver stocks for traders or investors who know what they’re doing.

Let’s check out some of the most promising gold & silver tickers. Then, I’ll share with you some of the most clever tactics for trading these promising tickers…

Top Gold & Silver Stocks to Watch

With the gold and silver industries being such large, diverse, global industries, there are almost too many gold and silver stocks for a single trader to keep track of.

My tip? If you want to trade gold & silver stocks, keep a well-stocked watchlist.

Below are the top 11 tickers on my gold & silver stocks watchlist. Feel free to study them, learn their catalysts, and add them to your watchlist. Reminder: This is NO way a recommendation to buy.

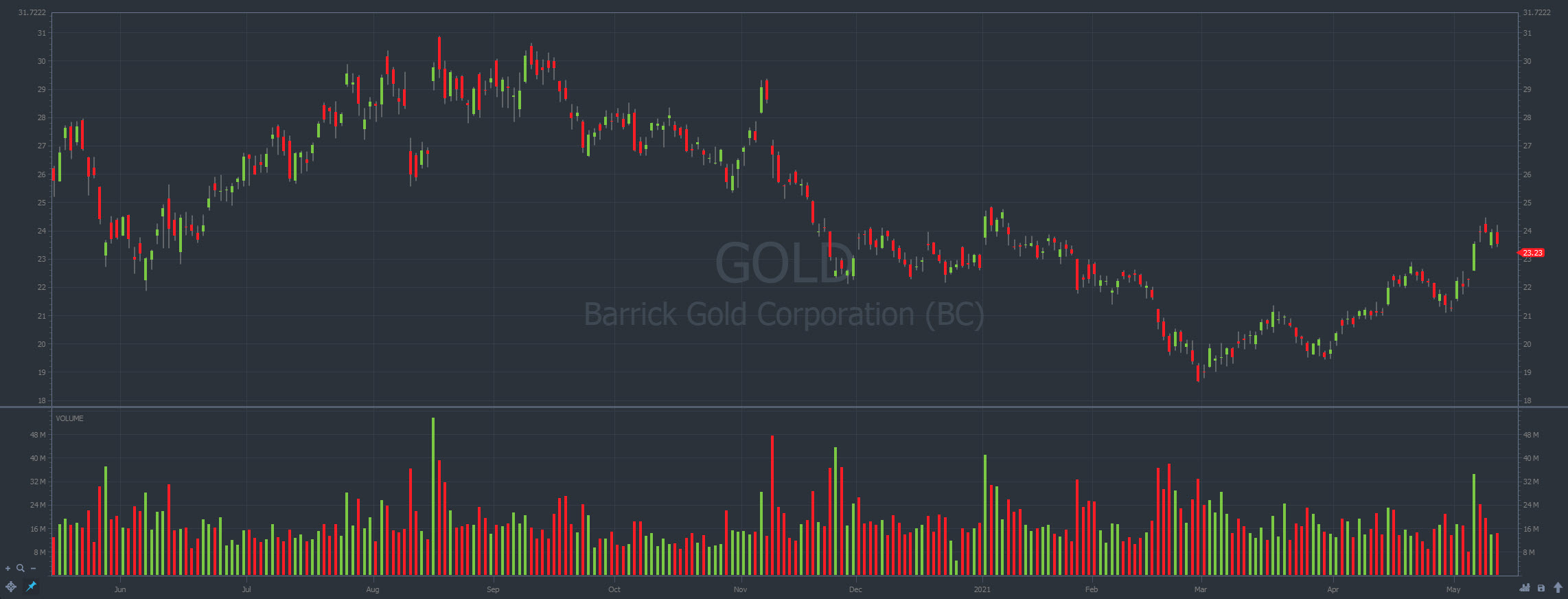

Ticker #1: Barrick Gold Corp. (NYSE: GOLD)

Market Cap: $41 billion

Float: 1.78 billion shares

Average Daily Volume: 18.33 million shares

Barrick Gold Corp. (NYSE: GOLD) daily chart (Source: StocksToTrade)

Barrick Gold Corp. (NYSE: GOLD) daily chart (Source: StocksToTrade)

Ticker #2: Kinross Gold Corporation (NYSE: KGC)

Market Cap: $9.38 billion

Float: 1.26 billion shares

Average Daily Volume: 13.22 million shares

Ticker #3: Northern Dynasty Minerals Ltd. (AMEX: NAK)

Market Cap: $266.66 million

Float: 446 million shares

Average Daily Volume: 6.18 million

Northern Dynasty Minerals Ltd. (AMEX: NAK) daily chart (Source: StocksToTrade)

Northern Dynasty Minerals Ltd. (AMEX: NAK) daily chart (Source: StocksToTrade)

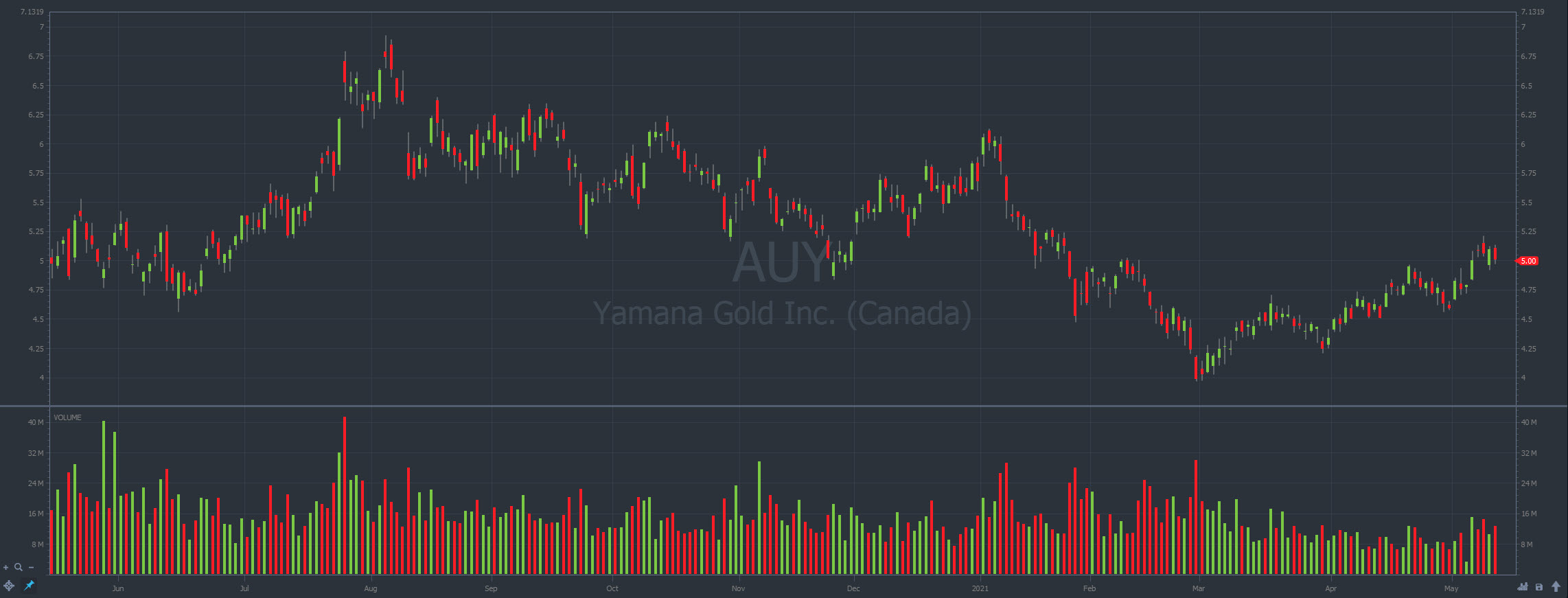

Ticker #4: Yamana Gold Inc. (NYSE: AUY)

Market Cap: $4.83 billion

Float: 961 million shares

Average Daily Volume: 10.26 million shares

Yamana Gold Inc. (NYSE: AUY) daily chart (Source: StocksToTrade)

Yamana Gold Inc. (NYSE: AUY) daily chart (Source: StocksToTrade)

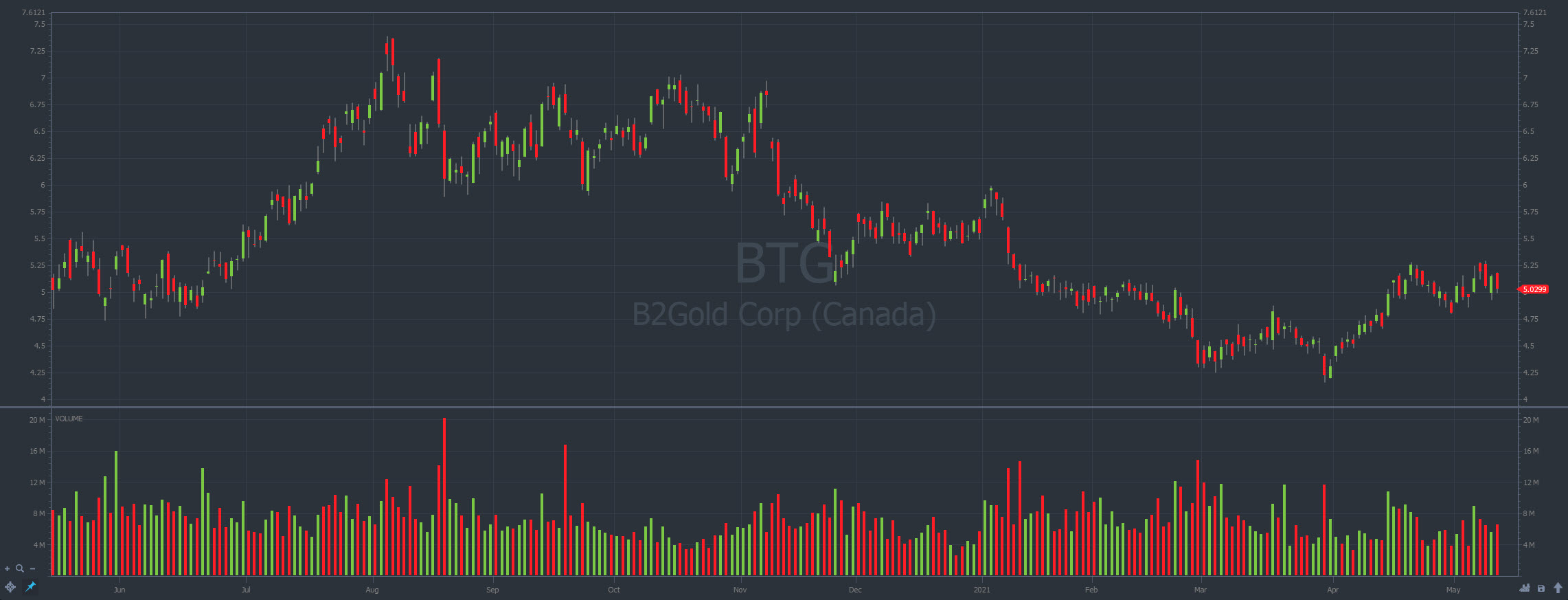

Ticker #5: B2Gold Corp (AMEX: BTG)

Market Cap: $5.29 billion

Float: 1.05 billion shares

Average Daily Volume: 6.08 million shares

B2Gold Corp (AMEX: BTG) daily chart (Source: StocksToTrade)

B2Gold Corp (AMEX: BTG) daily chart (Source: StocksToTrade)

Ticker #6: Newmont Corporation (NYSE: NEM)

Market Cap: $54.47 billion

Float: 706 million shares

Average Daily Volume: 6.75 million shares

Newmont Corporation (NYSE: NEM) daily chart (Source: StocksToTrade)

Newmont Corporation (NYSE: NEM) daily chart (Source: StocksToTrade)

Ticker #7: New Gold Inc. (AMEX: NGD)

Market Cap: $1.2 billion

Float: 680.7 million shares

Average Daily Volume: 5.17 million shares

New Gold Inc. (AMEX: NGD) daily chart (Source: StocksToTrade)

New Gold Inc. (AMEX: NGD) daily chart (Source: StocksToTrade)

Ticker #8: AngloGold Ashanti Limited (NYSE: AU)

Market Cap: $9.46 billion

Float: 417.12 million shares

Average Daily Volume: 3.04 million shares

AngloGold Ashanti Limited (NYSE: AU) daily chart (Source: StocksToTrade)

AngloGold Ashanti Limited (NYSE: AU) daily chart (Source: StocksToTrade)

Ticker #9: Harmony Gold Mining Company Limited (NYSE: HMY)

Market Cap: $2.91 billion

Float: 609 million shares

Average Daily Volume: 5.34 million shares

Harmony Gold Mining Company Limited (NYSE: HMY) daily chart (Source: StocksToTrade)

Harmony Gold Mining Company Limited (NYSE: HMY) daily chart (Source: StocksToTrade)

Ticker #10: Iamgold Corporation (NYSE: IAG)

Market Cap: $1.54 billion

Float: 476 million shares

Average Daily Volume: 4.59 million shares

Iamgold Corporation (NYSE: IAG) daily chart (Source: StocksToTrade)

Iamgold Corporation (NYSE: IAG) daily chart (Source: StocksToTrade)

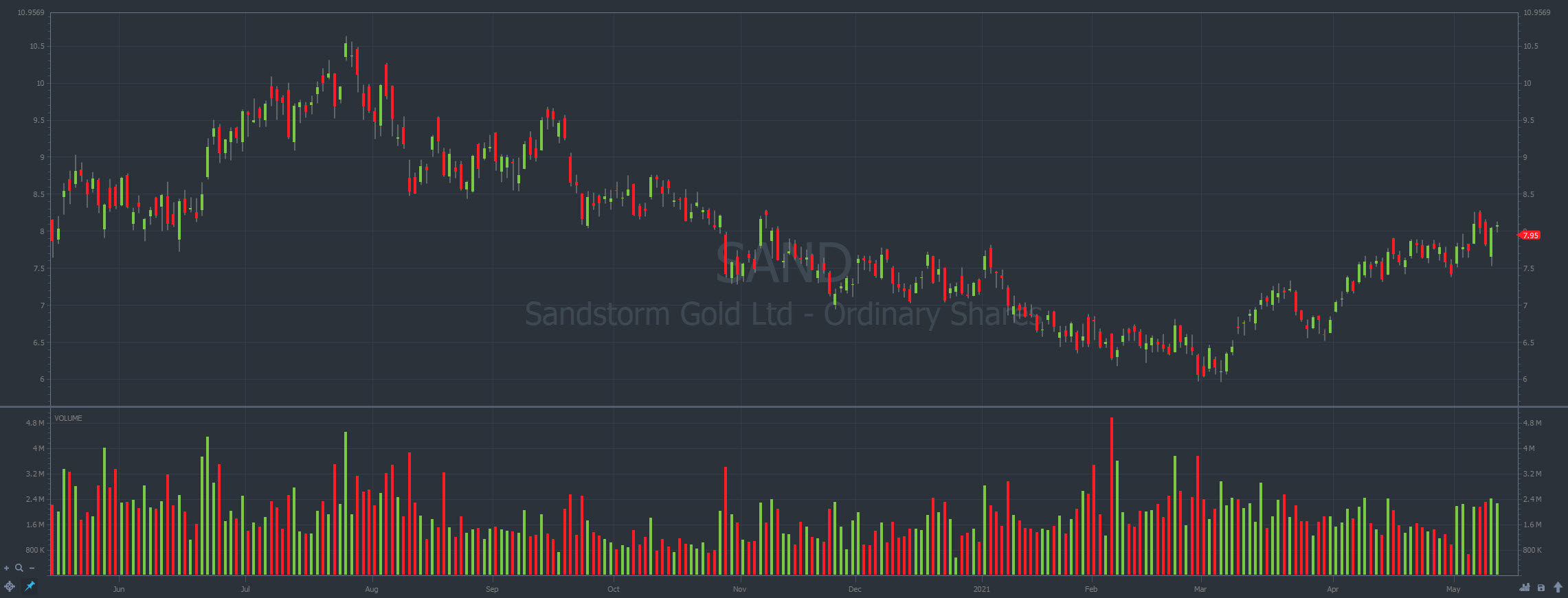

Ticker #11: Sandstorm Gold Ltd. (NYSE: SAND)

Market Cap: $1.55 billion

Float: 194 million shares

Average Daily Volume: 1.86 million shares

Sandstorm Gold Ltd. (NYSE: SAND) daily chart (Source: StocksToTrade)

Sandstorm Gold Ltd. (NYSE: SAND) daily chart (Source: StocksToTrade)

How to Choose Gold & Silver Stocks to Trade

If you want to maximize your success as a trader or investor in gold stocks, it’s not enough to just purchase some related shares.

Sure, the price of gold could boom, and the stock price will go up, but you’re relying a lot on the element of luck.

Instead, smart traders and investors use a bunch of tricks and tactics to find, take and manage the very best trading opportunities, in the very best tickers.

Here are a few straight to the point tips for choosing the right gold and silver stocks to trade:

Follow the Overall Price of Gold and Silver

Gold and silver stocks are often highly correlated with the underlying prices of gold and silver.

As a rule of thumb, if the price of gold or silver is in an uptrend, you should be more comfortable holding gold or silver stocks.

An easy way to follow the price of gold or silver is by viewing the chart of a gold or silver ETF.

Have a look at the SPDR Gold Shares ETF (NYSE: GLD) and the iShares Silver Trust (NYSE: SLV).

You can easily view these ETFs inside the StocksToTrade platform, just open the charting section and type in GLD or SLV. Don’t have StocksToTrade yet? Grab a 14-day trial for just $7 right here…

Pick Gold and Silver Stocks That Are in Uptrends

It shouldn’t be a surprise that the majority of traders find it easier to look for and plan trades for gold and silver stocks that move upward in price.

In market terms, we refer to stocks that move upward to be in uptrends.

You can quickly tell whether or not a stock is in an uptrend by looking at the stock chart. If the price is moving up and making price swings with higher highs and higher lows, it’s generally in an uptrend.

If you want to make things easy, before you purchase any gold or silver shares, bring up the chart and make sure that the stock is moving in the right direction.

Keep a Gold & Silver Stocks Watchlist

Even if you’re completely in love with a gold or silver stock, it’s a good idea to keep an eye on how other stocks in the precious metals industries are doing.

The easiest way to do this is by keeping a watchlist of anywhere from 10–30 of your favorite gold or silver tickers. Once you have your watchlist stocked up, check in on these stocks every week or so.

A watchlist is a list of tickers that share a certain theme. You can keep them in a spreadsheet or with pen and paper … But I think that can eat up a lot of time and be one heck of a chore.

Instead, try using StocksToTrade. It comes with unlimited watchlist capabilities. Check it out today. Get your 14-day trial of StocksToTrade for just $7 here.

Gold & Silver Stocks as an Inflation Hedge

The past year has seen interest rates across the globe drop to levels the world hasn’t seen in thousands of years.

At the same time, central banks have been printing money to stimulate economies. And judging by recent economic numbers, that’s starting to cause inflation.

Inflation is where more money is created and circulating in the economy. As a consequence, things such as food, housing, and living expenses become more expensive.

In times of high inflation, you generally want to hold fewer dollars and more assets that will rise in line with (or greater than) inflation. Investing in gold and silver has traditionally been seen as ways to retain wealth instead of watching inflation eat away at it.

Generally, the Federal Reserve aims for inflation of around 2% per year. Earlier this month, the markets were spooked when the Fed announced that inflation had hit 2.6% — the highest rate since 2008.

Could this news be the beginning of years of high inflation? It’s possible. But, it means that there will likely be heightened interest in precious metal stocks for the foreseeable future.

Frequently Asked Questions About Gold & Silver Stocks

If you’ve made it this far into the post, you’re probably excited about jumping in and trading some gold or silver stocks. But, maybe you have a few questions…

Below are my answers to some of the most commonly asked questions regarding gold and silver stocks.

Ready to learn more every day? Join me for my Pre-Market Prep sessions daily. It’s where I share my views from each upcoming trading day for no cost.

Here are the FAQs…

What Are the Best Gold Stocks to Buy?

This question is a bit like asking how long is a piece of string … There’s no right answer and it’s subjective. However, what you should look for in a gold stock are a few things, such as a price uptrend, big news catalyst, or even respectable fundamentals if you want a longer-term trade.

What Are the Best Silver Stocks to Buy?

Similar to gold stocks, finding the best silver stock to buy is all about looking for the basic criteria you find most good trading setups. This could be a stock in an uptrend that easily holds its support levels before moving higher. Or it could be a stock that announces major news, such as a successful discovery of a new silver deposit, which will draw in big volume. And it could be a well-managed company that owns several mines.

Is it Better to Buy Gold or Gold Stocks?

Deciding whether to focus more on gold or silver stocks has to do with timing the underlying price of each metal. If silver is booming but gold isn’t doing much, then focus on silver stocks, and vice versa. Remember to never fall in love with a single stock or sector. Instead, trade the hottest stocks in the hottest sectors with the cleanest trends — watch those charts!

Trade Gold & Silver Stocks With StocksToTrade

Gold & silver stocks can offer a huge amount of opportunity, especially if we’re entering a period of high inflation.

Successful trading involves more than just purchasing a stock and sitting on it, though.

You want to analyze your prospective stocks as best you can, then stay on top of all the related news and overall market trends.

You want to be aware of the price of gold and silver, the health of the overall stock market, and any major news stories related to your favorite stocks. That’s just the beginning…

Staying on top of all this can almost be a full-time job.

For me, I trade stocks in countless different industries. And I’m almost always on top of just about everything interesting happening in the markets.

How do I do it? It’s simple…

I use the StocksToTrade platform to keep on top of everything. StocksToTrade is a trading and analysis platform that was created by real-world traders to be the ultimate toolset for handling the modern stock market.

Inside the platform, you can view charts, watchlists, news feeds, trading algorithms, chat rooms, and so much more. If you want to streamline your trading so you can find and focus on the very best trading setups, then grab a 14-day trial of StocksToTrade for just $7 here…

Gold & Silver Stocks: The Conclusion

Gold and silver are the original stores of wealth that have been used throughout history to protect the value of people’s assets.

With this crazy economic environment — insanely low interest rates and money printing as far as the eye can see — you don’t need an economics Ph.D. to know inflation’s a real threat. So for many, it’s time to start looking for opportunities in gold & silver stocks.

The stocks I mentioned above will get you off to a solid start for building a watchlist of the most exciting gold and silver stocks.

If you’d like more direct, real-world advice about how I attack the market every day, consider joining me inside the SteadyTrade Team community. I strive to teach our community everything I know about the markets.

Some say bitcoin is the new digital gold. If you could own either $1,000 of bitcoin or $1,000 of gold, which would you pick? Tell me below!