If you’ve been paying attention to my Daily Market Briefing on Instagram, you’ve heard about cyclical stocks.

It’s rare that an economy will make for such clear winners and losers.

The last seven months have been a special case. The first month of the pandemic made people cut and run. We’ve been in recovery most of the time since.

In fact, a lot of us on the SteadyTrade Team have been cleaning up! This topsy-turvy market has given a lot of us our best months ever. Volatility can be a trader’s bread and butter, and the past few months have given us plenty.

If you’re looking for volatility, you should pay attention to cyclical stocks. These stocks have taken the same beating that the economy went through earlier this year.

Now with a market’s recovery, they could be poised for a rise.

Don’t know why volatility can be a good thing? I recommend that you check out my mentor Tim Sykes’ no-cost “Volatility Survival Guide.” Together, Sykes and I show you how to survive and thrive in a volatile market.

Now, let’s get to it!

Table of Contents

What Are Cyclical Stocks?

What the heck are cyclical stocks anyway?

A cyclical stock’s definition is that it follows the market’s movement. In a recession, it does poorly. In a bull market, it does well.

These stocks usually sell things that people buy in good times and not in bad times. When people are tightening their belts, cyclical stocks are the first to suffer.

Cyclical Consumer Stocks: Are They Different?

Besides government suppliers, every company is dependent on the economy. And even though the government can print its own money, it still relies on taxpayers.

Cyclical stocks are almost always consumer stocks. One major exception is the construction industry. Residential construction projects are bankrolled in advance. They also don’t depend on immediate turnover.

Construction stocks are dependent on the same macroeconomic shifts as other cyclical stocks. But they are somewhat downstream. Residential construction projects pick up steam as interest rates go down.

How Do You Know if a Stock Is Cyclical?

Consider this the acid test — if you were down to your last paycheck, would you buy the company’s product?

If we’re talking about a new car, the answer is probably no. If we’re talking about a tube of toothpaste or a utility bill, the answer is probably yes.

One is a discretionary product, which you can do without. Maybe you’re taking the bus while not giving Ford (NYSE: F) your hard-earned money. Or maybe you’re just staying at home like the rest of us.

If cyclical stocks are part of your trading strategy, this is a good time to learn the value of adapting. A stock’s health depends on many things. A big one is its relationship to the overall market.

Not all strategies work in all markets.

The Difference Between Cyclical vs. Non-Cyclical Stocks

Non-cyclical stocks are like that tube of toothpaste above. They’re often called defensive stocks.

These stocks perform relatively well in bear markets. They tend to underperform in bull markets. These companies sell necessities like consumer staples, utilities, and healthcare products.

And the stocks often provide steady dividends. They’re usually well-established companies with big market caps. These stocks are seen as stable enough to survive bad economic conditions.

Overall, these are stocks with little overall risk. That doesn’t necessarily mean that they’re the best for a turbulent economy. Unless you’re thinking of retiring soon.

Cyclical stocks can be traded in all economic conditions. Just make sure you know the risks … Risk management should always be part of your overall trading plan.

Examples of Cyclical Stocks

We’re in a weird, awesome market this year. Rarely do you find a bear market testing all-time highs within just a few months. Add in the stimulus money and pandemic uncertainty … Then add that it’s an election year! You’ll find some pretty unusual moves.

The most unusual moves have come from cyclical stocks. And if you’ve been paying attention, you know I love seeing this happen. One day we’re worried about a recession, the next day Tesla (NASDAQ: TSLA) is breaking out! It’s hard to get bored right now.

Top Cyclical Stocks List to Watch in 2020

You might have heard about these cyclical stock examples recently. They’re some of my favorite plays in general — and absolutely killing it this year.

When I target a cyclical stock, I don’t want to just see that it has volatility. I’m watching for a few things that tell me it has a future.

It might be yo-yoing a bit, but it should be part of a stable industry. And it should play a prominent role in that industry. Nothing hurts more than betting on an industry that ends up leaving your stock behind.

Tesla Inc. (NASDAQ: TSLA)

I love this stock. As far as cyclical stocks go, this seems like one of the best bets.

The traditional talking heads don’t know what to make of Tesla. One-year price targets range from $19 to $1,000. All the while, this stock has continued improving on its monster year.

It has a great amount of volume and volatility. I think a lot of people are turned off by Elon Musk’s showmanship. Not me. I think the man is brilliant. He’s going to send a rocket to Mars!

I think this stock could be the equivalent of what Apple (NASDAQ: AAPL) was 20 years ago. For now, it seems to be following the market’s upswing pretty well.

Microvision Inc. (NASDAQ: MVIS)

Microvision is one of those low-priced tech plays that always seem to come out of nowhere. That’s because no one knows exactly what it does.

It holds a bunch of patents around miniature projection and scanning. There was news earlier in the year that Microsoft could acquire it. This didn’t happen, but the company continues to hint at an outside acquisition.

That doesn’t really matter. Look at its steady march back up to its July levels. There could be a nice cup and handle pattern forming here.

Boxlight Corporation (NASDAQ: BOXL)

This had another unsupported July run-up, followed by a crash. But ignore July and look at its year.

This is both an e-education and remote learning play. Its fortunes have risen as people realized that the pandemic isn’t going away soon.

Boxlight provides online teacher training, which is sorely needed. Even when we can gather in one place, the connectivity that Boxlight supports is still a good thing.

GameStop Corp. (NYSE: GME)

GameStop is a company on the verge of a transformation.

When it was trading in the $2s in April, it seemed like it was part of the unlucky brick-and-mortar retail sector. But it’s since broken $10 after hooking up with an activist investor who wants the company to take on Amazon.

It’s rare that a company has the chance to cleanly change sectors. But it’s really important right now.

Brick-and-mortar retail isn’t just a cyclical industry. It’s also been one of the hardest hit by the pandemic. And it hasn’t seen the recovery of other cyclical sectors.

Which is good for a company that can adapt like GameStop.

Nokia (NYSE: NOK)

With Chinese 5G provider Huawei blocked from setting up networks in the U.S., there’s an opening for Nokia.

NOK has taken advantage. In October it reached the 100-contract mark with communications service providers. They’re in all of the 5G early adopter markets.

And NOK struck contracts with the top four U.S. service providers and the top three in both South Korea and Japan.

5G has some really exciting possibilities in store. It could change everything from heavy industries to home entertainment. With Nokia assuming a central position, there’s no telling where this stock might go.

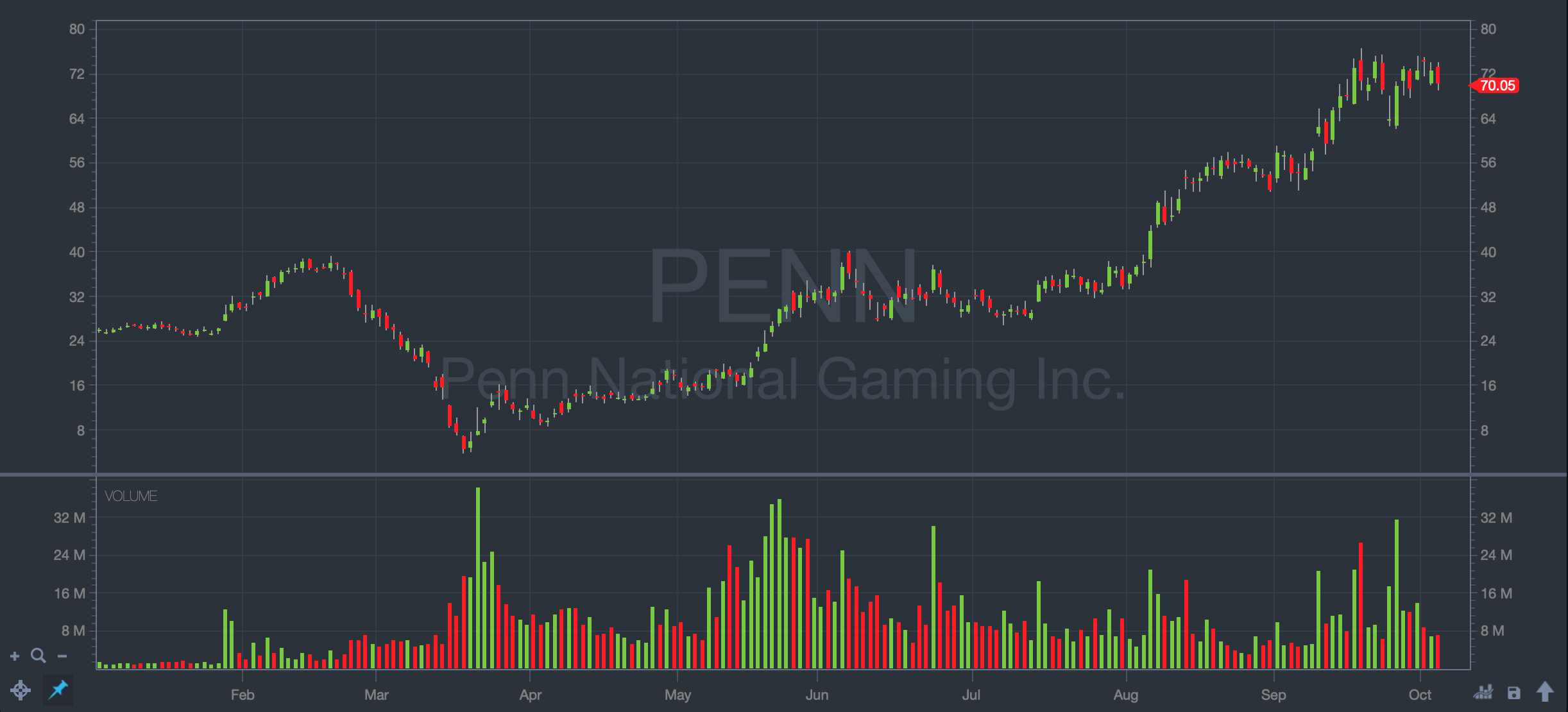

Penn National Gaming Inc. (NASDAQ: PENN)

This stock has rocketed up since March — it’s now trading at nearly 15 times its YTD low.

Not everyone’s a believer. In early October, Deutsche Bank called out Penn for being an overvalued “internet meme.” This is likely because of its most visible investor, Dave Portnoy.

I believe in Portnoy. His Barstool Sports credentials might be exactly what Penn needs to find even more growth.

Nautilus Inc. (NYSE: NLS)

One of the hardest-hit sectors during this pandemic has been in-person fitness. That’s bad for yoga teachers trying to teach over Zoom … but good for traders of at-home fitness. Spending the colder months under quarantine isn’t going to help you shed your ‘quarantine 15.’

I’m a big fan of Peloton Interactive Inc. (NASDAQ: PTON), which has been a good stock to watch this year as well. But sooner or later people who don’t want to spend $4,000 on a treadmill are gonna want to have that convenience too.

This is where Nautilus comes in. This stock should be a good play, along with the other things that come with in-home fitness.

What Are the Most Cyclical Sectors?

This year’s economy has been weird. Some of the most cyclical sectors were hit by the bear market AND pandemic conditions. Many haven’t recovered.

If you look at something like travel, that recovery is still a long way off. And retail has completely split down the middle. The brick-and-mortar style has had a bomb dropped in its lap. But online retailers have prospered.

Some of the following sectors have already recovered while others continue to suffer.

Airlines

In normal times, people spend on travel when they have money and stay at home when they don’t. Remember that?

This isn’t the case right now. According to the chairman of United Airlines, the U.S. airline industry will need to shrink by half to survive. Scary times.

Cars

This is an industry that’s actually been hot during the pandemic! The pandemic hasn’t killed rideshare companies like Uber (NYSE: UBER) and Lyft (NASDAQ: LYFT) … But it’s definitely slowed their momentum.

Add a massive dip in public transit and you have some interesting potential. But the real plays have been in the electric vehicles (EV) sector.

Restaurants

This is a group hit hard by the pandemic. But some of the best stocks in this sector have found new ways to cope.

Chain restaurants have used the opportunity to design processes that ease consumer fears. This has also increased their lead over solo operators.

I pointed this out in April. Delivery has been key to the restaurant industry’s survival. It’s even helped stocks in other sectors like Uber with Uber Eats.

Retail

The pandemic has been tough on mom-and-pop shops. But companies with an established online presence have done really well.

Everyone knows about Amazon, but check out Best Buy’s (NYSE: BBY) chart last few months. From a March low of $50, it’s more than doubled.

Technology

In most bear markets, tech stocks aren’t a necessity. It just shows you how weird conditions have been — tech stocks are now a consumer staple!

The EV sector has been burning hot. Tesla continues to be one of the most interesting plays on the market. Nearly every big tech stock under the sun is taking part in this gold rush.

How and When Should You Trade Cyclical Stocks?

Let me tell you something…

In all the time I’ve been trading, I don’t think I’ve ever seen a market like this. I mean, it’s been absolutely bonkers.

Like I’ve said before, I don’t think there’s ever been a better time to start trading.

The opportunity is here and now. But you’ve got to find it, and that means doing the work, every day.

And you can’t cheap out. Remember, you’re trading against other traders who want to make money as bad as you do. You need to have the same advantages as they do.

Or you could go for better, with powerful trader-designed software like StocksToTrade. It has everything you need in one platform. I’ve tried them all, and StocksToTrade’s stock screener is the absolute best. And a 14-day trial is only $7.

What a time to be a trader!

Conclusion

It really doesn’t matter whether or not a stock is cyclical for short-term trading. Unlike investors, you’re looking for patterns in the stock’s movement over a day.

You’re not thinking about where it might go in different market conditions.

But understanding this kind of stuff is essential if you want to make money trading. You know, unlike most traders out there. It’s one more piece of the market to learn about.

If you want to get good at anything, you need to see the whole field. It doesn’t matter if you’re not throwing the football to the guy near the sidelines, you still have to know what he’s doing.

And if you’re ready to step your game up, come join us in the SteadyTrade Team community. We dig into all things trading every day!

How does understanding cyclical stocks help you make sense of the market? Let me know in the comments!