As a trader, it’s critical to limit your risk — and backtesting can be a powerful way to do it.

If you can lower your chances of losing — and increase your chances of winning — you can potentially position yourself for a long career in trading the stock market.

But what exactly is backtesting and why is it important?

Let’s answer that.

We’ll go over what backtesting is, how it works, and some tips so that you can test your own strategies … Read on for how you can become a smarter trader.

Table of Contents

- 1 What Is Backtesting?

- 2 How Does Backtesting Work?

- 3 The Importance of Backtesting

- 4 Backtesting Example

- 5 Backtesting Trading Strategies

- 6 Top Tips for Effective Backtesting

- 7 What Are the Best Backtesting Tools?

- 8 Automated Backtesting vs. Manual Backtesting

- 9 How to Manually Backtest Stocks

- 10 How to Avoid Backtesting Bias

- 11 Does Backtesting Work for Forex?

- 12 How Long Should You Backtest a Trading System?

- 13 Conclusion

What Is Backtesting?

Backtesting is a popular method used by many traders to develop and test trading strategies.

Let’s take a closer look …

What Does It Mean to Backtest a Trading Strategy?

Traders use testing to determine the viability of a trading strategy.

Instead of using real-time data for the tests — as traders would use with paper trading — backtesting reconstructs trades using historical data. It’s to see if a strategy would have worked in the past.

What Is Backtesting in Risk Management?

The whole purpose of testing is for traders to learn how they can limit their trading risks and work to maximize profits.

If done correctly, positive backtesting results can show that a particular strategy could work in the future … That can give you more confidence in a particular trading model.

But if the results aren’t positive … then you can either tweak the strategy or ditch it altogether.

How Does Backtesting Work?

Investors and traders use strategies to try to find the best opportunities.

Not only are backtesters looking for the overall potential profitability of a trading strategy … they’re also looking for how to better manage risk.

The great thing about backtesting is that it can be applied to any predictive strategy.

Testers basically take the trading model they’re interested in and compare their predicted results to what actually happened.

The Importance of Backtesting

No trader finds a stride right away in the market. It takes time to find what works. And this testing method can be an important step in developing and enhancing your trading strategy.

Any information that can help you gauge what works can potentially lead to more consistency. If you could do it without risking real money … even better, right?

Anyone can use backtesting to fine-tune a market strategy. But professional institutional traders and money managers use it the most. They have the access to expensive resources — such as software and expert analysts.

You can manually test for no cost, however. And it can be a great way to learn. More on that in a bit.

Backtesting Example

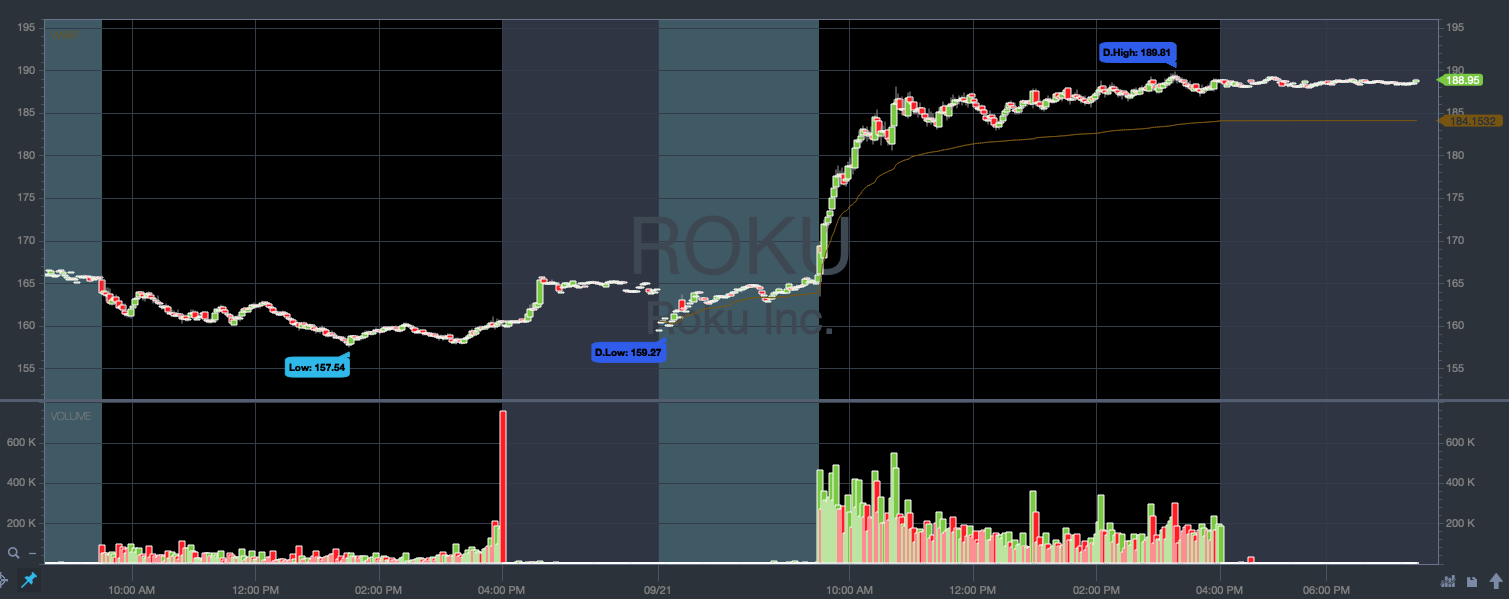

Let’s say you see Roku Inc. (NASDAQ: ROKU) breaking 52-week highs and staying above VWAP into the afternoon. Just as it did on September 21, 2020.

Now, you may want to test buying ROKU when it showed the same behavior in the past. You’d do that to see if it’s worthy of putting on your radar as a regular setup to watch for.

You can do this through backtesting software. There are plenty of options out there.

Once you plug in your specific criteria, you get statistical information on your setup and strategy. And you can then use that info to determine how the strategy might work out.

Backtesting Trading Strategies

There’s no shortage of statistical feedback from testing. So you have to be specific about your particular trading strategy and which statistics you think will be helpful for you.

Here are some of the most common statistics traders seek out:

- Averages — average gain and average loss, given in a percentage

- Net profit/loss

- Return — the percentage of return over a given time frame

- Volatility — this measures max percentages up and down

- Win/loss ratios

Top Tips for Effective Backtesting

Think you’re ready to dive into testing your strategy? Get super clear first. These tips can help you hone in…

#1) Start With a Specific and Measurable Idea

If you want to run a test … then you need to test something that’s measurable.

Ideas that are specific and measurable will enable testers to determine if the idea — in this case, a trading strategy — is true or not.

In other words, you need to know the exact parameters you want to evaluate. The more specific you are, the better the results should be.

#2) Make Sure Your Hypothesis Is Simple

There’s so much data available … You can find data to prove almost anything if you don’t focus on accuracy.

Be careful to not fool yourself. When it comes to trading and money, it’s really easy to come up with irrational ideas and justifications.

So be honest and keep it simple, stupid.

If the hypothesis or idea is too complicated, it could lead all kinds of funky conclusions … and that would throw off the results.

By keeping your hypothesis simple, you can get better results. That can help you tweak your strategy to be more effective for you.

#3) Identify Metrics and Indicators Before the Test

Although using a number of metrics and indicators in a test can improve the accuracy of results, adding them after the test begins can really skew things.

Take your time and prepare.

By identifying key metrics and indicators before the test, you can avoid bias. Remember, be honest about it, or there’s not much point in doing it.

#4) Factor in Different Market Conditions

Markets are always changing. 2020 is a great example of that. The volatility has been crazy this year. It might not be a great baseline for a test.

It’s smart to account for different market conditions if you want more useful results. Consider whether it’s a bull market, bear market, or a hot sector.

Testing trading strategies in a variety of market conditions can give you more robust results.

#5) Get the Right Tools

There are tons of tools to do testing. Choosing the right one depends on many factors … including what you’re trying to accomplish and what resources you have.

Prescribing particular tools for testing is beyond the scope of this article … So it’s important for you to do your research and choose the right tools for your needs, skill level, and budget.

What Are the Best Backtesting Tools?

The best tools will depend on your needs and goals. You need to find one that fits your available resources.

Again, the right tools will vary for different traders in different situations. That said, here are some types of tools to consider…

1) Market Data

At the very least, traders need historical market data. There are free market-data providers such as Yahoo Finance, Google Finance, and Qandl. There are also paid services from providers such as Bloomberg, Kinetick, and Algoseek.

2) Spreadsheets

For manual testing, you can use a spreadsheet app such as Excel or Google Sheets. This is one way you can gather data and create formulas for testing.

3) Charting Software

If you’re going to manually test, you’ll also need solid charting software. You want clean charts with historical stock data so you can test your hypothesis.

Not all charting software is equal, though. Some have more features that will help the research process go much smoother and faster.

StocksToTrade was built by actual traders and has beautiful charts that are among the easiest to read. Our platform has data that goes as far back as 20 years. Try it out with a two-week trial — it’s just $7!

4) Backtesting Software

There are many software options available for testing … They all have their own strengths and weaknesses.

These software options can be used for advanced charting, strategy backtesting, and trade simulation. Some even require some basic coding skills.

If you opt for this type of testing tool, make sure to do your research.

Automated Backtesting vs. Manual Backtesting

There are a couple of ways you can do your testing: automated or manual.

Automated is the most popular. To run your tests, you use software. It may require you to create a code script. If you know what you’re doing here, this can be a faster method.

Manual, on the other hand, requires you to study data and then place historic trades using historical data manually.

Although manual testing may take longer, there can be a big benefit.

You can consider factors that software can’t … such as the emotions that affect trading and differences in executions. It may be more timely, but the results may have some surprising nuance.

How to Manually Backtest Stocks

If you want to manually backtest a strategy, a good place to start is collecting your personal trade history with that strategy.

In Excel, you should enter the stock name, entry price, exit price, and any other information you think is relevant.

Take a look at the sample Excel sheet below…

After you aggregate the data, you need to perform a deep analysis and determine if the results agree with your hypothesis.

Tests may require much more data than this, but it’s a simple example of how anyone can start backtesting their own strategies.

The good thing about the manual method is that you learn by doing instead of relying on a system’s simulation.

Want more ideas on how to improve? Listen to our SteadTrade podcast. We talk all things trading and it’s full of great content to keep you inspired. You can catch episodes here. Don’t forget to subscribe so that you can get alerts on new episodes!

How to Avoid Backtesting Bias

Bias should be a real concern any time traders run a test. It’s easy to make mistakes that can affect the accuracy of the results.

If the test provides positive results but the test was flawed … you can get a false sense of confidence. And that can be dangerous in the markets and even negatively affect your account.

You need to make sure to test the strategy in different time periods with a variety of stocks. Stay objective. Don’t just pick your favorites or exclude anything that fits in the strategy.

It’s also important to avoid look-ahead bias. This can happen when you include future information that wasn’t available at the time of the testing period in the test.

Does Backtesting Work for Forex?

Backtesting is popular in the forex market and many forex traders consider it vital for success.

It can even work for other markets or assets such as options, OTC stocks, and crypto.

How Long Should You Backtest a Trading System?

You should continue backtesting as long as you use a particular strategy.

Let’s face it, even your top go-to trading strategies can stop working … even if it’s for a short amount of time.

As you trade, you develop new data. Smart traders continue to backtest in some form to make sure their strategy still works as they expect.

Conclusion

Now you know what backtesting is, why it’s important, and how you can start doing it for your own trading strategies.

Remember, one of the most important things for you to do as a trader is to limit your risks.

And you gotta be in it for the long haul.

If you backtest all your strategies, it can give you a chance to make key adjustments. That can help you stay in the game.

The trading journey can get lonely … But you don’t have to go it alone. Come join the SteadyTrade Team. You’ll be surrounded by like-minded traders learning the markets. We get together twice every trading day for webinars. And you can get mentorship to help you pursue your goal of becoming a smarter trader. Join us today!

Will you be backtesting your trading strategies? Leave a comment below!