At-home plays make up one of the hottest sectors right now … so which ones deserve a spot on your watchlist?

Think back to a year ago. Could you have predicted such a huge demand for businesses that help people stay at home as much as possible?

Probably not … but that’s 2020 for ya. The global pandemic rages on and continues to change the world as we know it.

If you’re a trader, this market is such a great learning opportunity. Every day seems to have a new great trading setup.

I always talk about how bad news can mean great things for the stock market … Boy, is that playing out right now. This is probably the best trading market any of us has ever seen.

Just goes to show … even when the world feels like it’s being destroyed, there’s always opportunity for savvy investors who know what to look for. That’s why it’s so important to be prepared.

Today we’ll look at the top at-home plays to watch.

Let’s go!

Table of Contents

What Are At-Home Stocks?

What Are At-Home Stocks?

Like I said … the world is changing before our very eyes.

The pandemic is forcing people to stay socially distanced and at home. It’s sparked a whole new industry … If you’ve got a solution to help people adjust, you may just have a great idea for a business in 2020!

At-home stocks are basically stocks of companies that make it more convenient for people to live and work from home. It’s basically adapting to the ‘new normal.’

Let’s take a look at the top six on my radar. Keep in mind that these are stocks to watch, not trade recommendations. Use this list as inspiration to build your own watchlist.

Top 6 At-Home Stocks

Peloton Interactive Inc. (NASDAQ: PTON)

If you follow me, you probably already know this stock is a favorite of mine.

I talked about it on the SteadyTrade podcast — check that out here. It became a great example of how traders need to manage their emotions if they want any chance of finding consistency.

This is a good example of the outrage culture … People get offended about everything!

Remember this Peloton commercial?

People were upset by the storyline of a husband who bought his wife a Peloton bike for Christmas. It got to the point where the actor who played the husband was accused of being sexist. Come on, people.

The thing is … I think people who participate in this kind of outrage are only hurting themselves. They’re making it near impossible to remain objective. If you wanna make smart decisions, you can’t let your emotions dictate everything.

As a trader, it’s your job to look at what’s actually happening and react to reality.

I knew PTON’s fundamentals were stellar… and I love the business model. The company has high margins for bike sales and gets monthly income from subscription fees.

When the outrage caused the stock price to go down, I knew it didn’t make sense … I saw a good opportunity to buy it at a discount.

Let’s put it in perspective: the bike is about $3,000. If you spent that amount of money on PTON stock last Christmas instead of a bike, those shares would be worth more than $19,000 as of this writing.

PTON has cool technology and a great business model. It’s a strong at-home stock and I’ll continue watching it.

Zoom Video Communications, Inc. (NASDAQ: ZM)

Who would’ve thought that virtual meetings would become a regular part of our daily lives? And not just for business meetings, either.

You know a company’s doing well when their name is so well known, it’s used to describe the product in general. Think Pampers and Kleenex.

Now people refer to virtual meetings as Zoom calls. They’re finding creative ways to connect with friends and family … including holding virtual birthday parties and even proms.

I think one of the smartest things the company did was to offer its services to K-12 schools for free and remove the 40-minute time limit.

Now Zoom has become a household name. And schools will probably continue to use it after the lockdown is over.

I remember being able to buy this stock in the $60s last year … now it’s over $560.

Zoom had a huge breakout last week and continues to forge on strong. I mean, take a look at that beautiful chart!

Nautilus Inc. (NYSE: NLS)

NLS is another home-fitness play.

Even with gyms opening up, many people are leary of working out around other sweaty people. Do you really wanna workout with someone coughing next to you … Or would you rather workout in the safety of your own home?

A LOT of people are choosing the latter.

If you have a smaller account, PTON may be out of your reach already. NLS could be a way to take part in at-home-fitness plays.

At the beginning of the year, NLS was just a penny stock. Even with its sky-rocketing growth during the pandemic, it’s still a sub-$30 play as of this writing.

It’s continuing to rise and approaching a possible breakout over all-time highs.

Keep an eye on NLS.

Chewy Inc. (NYSE: CHWY)

Chewy is PetSmart’s online pet store and a fairly recent IPO from last year.

Pets are an important part of people’s families … So you know people need a way to take care of their pets in this new environment.

In March, CHWY was in the low $20s, but it’s made a run to all-time highs — passing $70. It’s had a good-sized dip since then. Now it’s setting up for a possible breakout past that previous high. If there’s relevant news, it could keep going.

Want to know how top traders get breaking news fast? Check out our brand-new Breaking News Chat feature. Two skilled stock market pros help you find the news with the most potential to move stocks. Start your 14-day trial today!

Amazon.com Inc. (NASDAQ: AMZN)

When Jeff Bezos started Amazon.com, people thought it was a stupid idea.

Who would buy books online? And why would he quit a comfortable Wall Street job to build it?

You know what happened next. AMZN ended up becoming one of the internet’s biggest success stories.

You can buy almost anything on Amazon now. It’s become an important marketplace in the pandemic … forever changing our buying habits.

The low that AMZN hit in March was a huge discount price … and has gone up almost $2,000 per share since then!

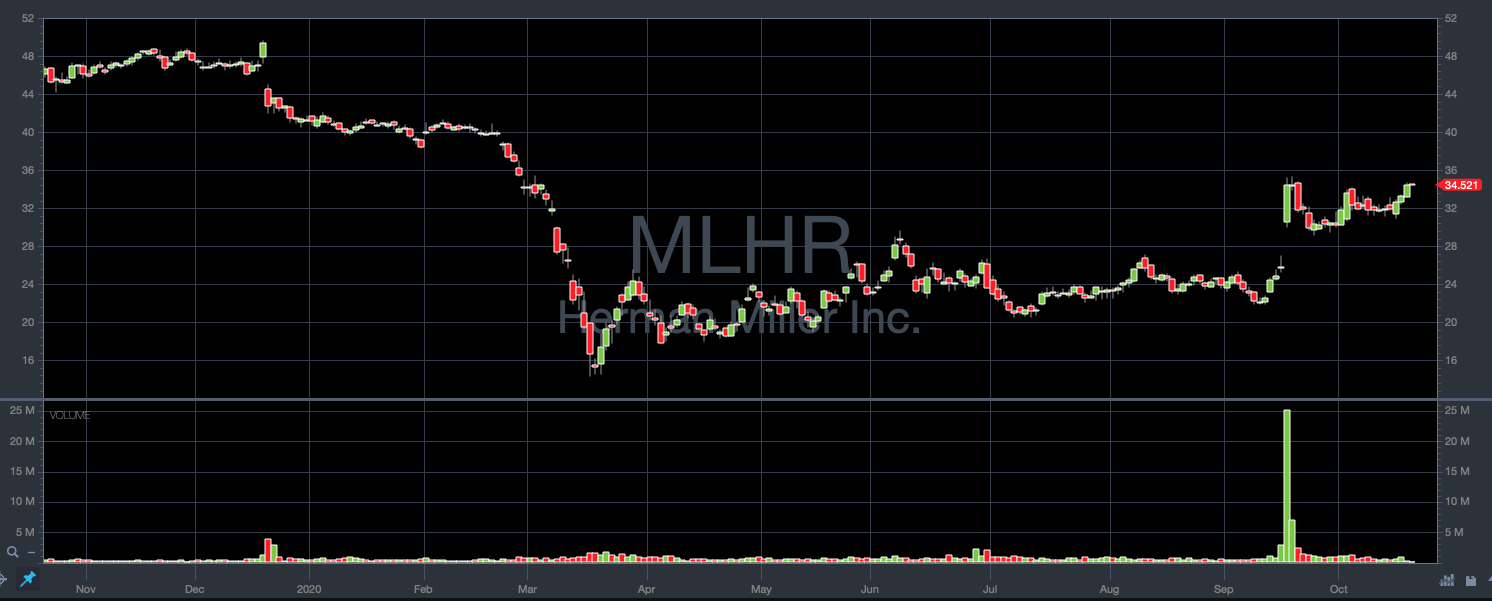

Herman Miller Inc. (NASDAQ: MLHR)

With so much of the country working from home now, people are upgrading their home offices.

Herman Miller is one of the greatest mid-century modern companies ever, and I think they make the dopest office furniture out there!

I also love that it’s a Michigan company.

MLHR crashed at the beginning of the lockdown but has been climbing up steadily since March.

As remote work continues, more people will likely be upgrading their offices. I’m watching it for a potential at-home play.

Why Should You Trade At-Home Stocks?

An important part of trading is finding hot stocks that have the potential to really move. Nothing is moving as much as at-home stocks in this market.

You also want to find stocks with a strong long-term trend. Trade with the trend to help you limit your risks.

The demand for the products and services these companies provide show no signs of fading, so the trends are likely to continue.

How Should You Trade At-Home Stocks?

It’s just like trading other stocks. You need a computer, Wi-Fi, and an online brokerage account to get started.

There are tons of different brokerage options, so do your research. Here’s a great post to guide you.

You also need great charting software. Take your game to the next level and try StocksToTrade. Not only does it have amazing charts … It has tons of tools and features to help you find stocks to trade. You can try it out for yourself — a 14-day trial is just $7.

When Should You Trade At-Home Stocks?

When Should You Trade At-Home Stocks?

At-home stocks are hot right now. So now’s a great time to add them to your watchlist.

But don’t trade a stock unless it fits your setups and account size … And always create a thorough trading plan.

If you’d like help, join me in the SteadyTrade Team. Every day I give examples of setups I look for and even create trading plans. Members get access to mentorship, webinars, chat, and trading education. I’d love to have you in the community!

How Do You Find At-Home Stocks?

This particular sector has risen out of the need created by the pandemic. True, these companies existed before … but the current environment has caused them to surge.

Pay attention to companies making things more convenient for everyone being home more.

Also, look for big stock movers. If you see a stock making big moves, do your research and see if it’s a play that suits your strategies.

Common Questions About At-Home Stocks

Here are a few common questions I get about this particular sector…

Are At-Home Stocks Just a Phase?

In my opinion, no. I think 10 years from now when they’re studying the effects of the pandemic on society, they’ll be able to tie a lot of our lifestyles to it.

Companies that never planned for employees working remotely are now seeing how productive and efficient it can be. Many business leaders are discussing the possibilities of keeping at least a portion of their workforce remote.

A lot of people have left the city with no plans on moving back.

Even when society opens up fully, how long will it take for people to feel comfortable traveling and attending large gatherings again? My guess is it’ll take a while.

And as far as shopping? After seeing how easy it is to have items delivered … our shopping habits have likely changed forever.

Can You Make Money Trading At-Home Stocks?

These stocks are some of the strongest stocks in the whole stock market right now, but you gotta have a smart trading strategy.

Look for patterns, create a good trading plan, and stick to it when you’re on the hunt for any opportunity.

StocksToTrade

If you’re going to trade this — or any — market, it’s important to have the right tools. That includes good charting software. Not all charting software is equal, though. Some have more features that can help your research process go much smoother and faster.

The platform was built by actual traders and has beautiful charts that are among the easiest to read. It even has data going back 20 years. If you haven’t given StocksToTrade a try, here’s a special just for you. Try it now with our 14-day trial for $7!

Conclusion

Conclusion

That’s a wrap on my list of the top six at-home stocks to watch.

This is a crazy time in history, and it’s created a lot of challenges. A lot of innovative companies are working to help people overcome those challenges … and making a lot of money in the process.

As a trader, you don’t have to create a product or start a company to make money. If you’re skilled and savvy, you can simply find those companies and learn to ride the momentum of their stock moves.

Do the work and build your trading skills so you can trade smart!

Are there any stay-at-home stocks you’re watching that I didn’t mention? I’d love to hear about them. Comment below!