Did ya miss the hot morning play? There could be potential afternoon trading opportunities…

And even if you weren’t feeling solid about your watchlist at the market open, don’t worry. There’s usually a second wave of momentum in the afternoon.

And I’ve got the perfect pattern and two afternoon scans to help you find the hottest plays.

As SteadyTrade Team members, my Instagram followers, and probably even my neighbors know, I don’t trust stocks blindly.

No matter how great a stock might look, I still like it to prove itself. For me, that means being patient. Or as I said in a SteadyTrade Team webinar the other day, “real trading is sitting here, waiting for your setup.”

Side note: interested in my webinars? Check out this FREE webinar I did with Tim Sykes recently…

I’m not scared to wait for the right plays. I usually don’t trade right at the market open.

My ‘9:45 rule’ has become the stuff of legends in the trading community. I like to let the excitement settle down a bit before I execute. It’s how I can have a more accurate picture of what’s going on with a stock. More often than not, this rule works for me.

And if it doesn’t work out at 9:45 a.m., there’s always afternoon trading. Often, around 2 p.m. Eastern, early spikers get a second wind. And I like to be ready to take advantage of it.

Confused about afternoon plays and how to find them? Here, I’ll go through the basics of one of my favorite afternoon patterns and how I find potential trades using two of my favorite scans: the 52-week break scan and the VWAP break scan.

Table of Contents

Why Wait for Afternoon Trading?

As many of you know, one of my all-time favorite patterns is the dip and rip, which is primarily what I call a ‘9:45 a.m. or later’ (Eastern) play. Learn more about it here:

With this pattern, you have a stock that looks good … but it pulls back at the open before resuming a spike. By buying on the dip, you can take advantage of that ascent.

But sometimes the dip and rip play just isn’t there … or you’re just not sure.

The summer of 2020 has been exceptionally crazy and volatile. None of that ‘sell in May and go away’ business this year.

But finally, in August, we’ve started to see some slightly quieter days.

One side effect? You might not see as many distinctly watchlist-worthy stocks every single morning.

When you’re not seeing as many potential trades in the early hours, it doesn’t mean there are no opportunities. It means you want to be prepared for potential action in the afternoon.

Lucky for you, I’ve got a go-to pattern to share that’s perfect for afternoon trading — around 2 p.m. Eastern or so.

But watch out, the title is a mouthful…

The Late-Day, VWAP-Hold, HOD-Break With News at or Around 52-Week Highs

Yeah, I told you it was a lot.

I can accept that ‘Late-Day, VWAP-Hold, HOD-Break With News at or Around 52-Week Highs’ lacks the swagger of ‘dip and rip.’ Hey, I’m open to suggestions. You can suggest a different title — leave a comment below if you’ve got an idea!

But as clunky as the name may be, it does a pretty good job of describing precisely what you look for.

This pattern is sorta like an alternate-universe version of the dip and rip.

It’s a stock that’s up big on the day … but maybe the market’s a little mixed, or you’re just feeling cautious. You’re not sure if you’re feeling it. Hey, intuition matters — don’t discount yours.

If you’re not sure you’re feeling it, it’s totally fine to be cautious. Instead of getting in early, it can be smart to wait for the potential late-day break. Waiting gives the stock a chance to prove itself, and you know I love that…

It’s also a pretty easily identifiable pattern that’s easy to act on — or not. One of the nice things about this pattern is that if that late-day break doesn’t come, you can forget about it and just move on.

How This Afternoon Trading Pattern Works

How This Afternoon Trading Pattern Works

Here’s what to look for with this pattern…

Hot Sector, 52-Week Highs

With this pattern, your dream ticker will be in a hot sector with actual news. It should be hover at or around 52-week highs for best results.

Early Spike

Even though you won’t be trading until the afternoon, you want to see an early spike — that’s a clue that the stock could have a late-day break.

Through early and midday, you’re just kind of keeping an eye on the stock … but not taking action.

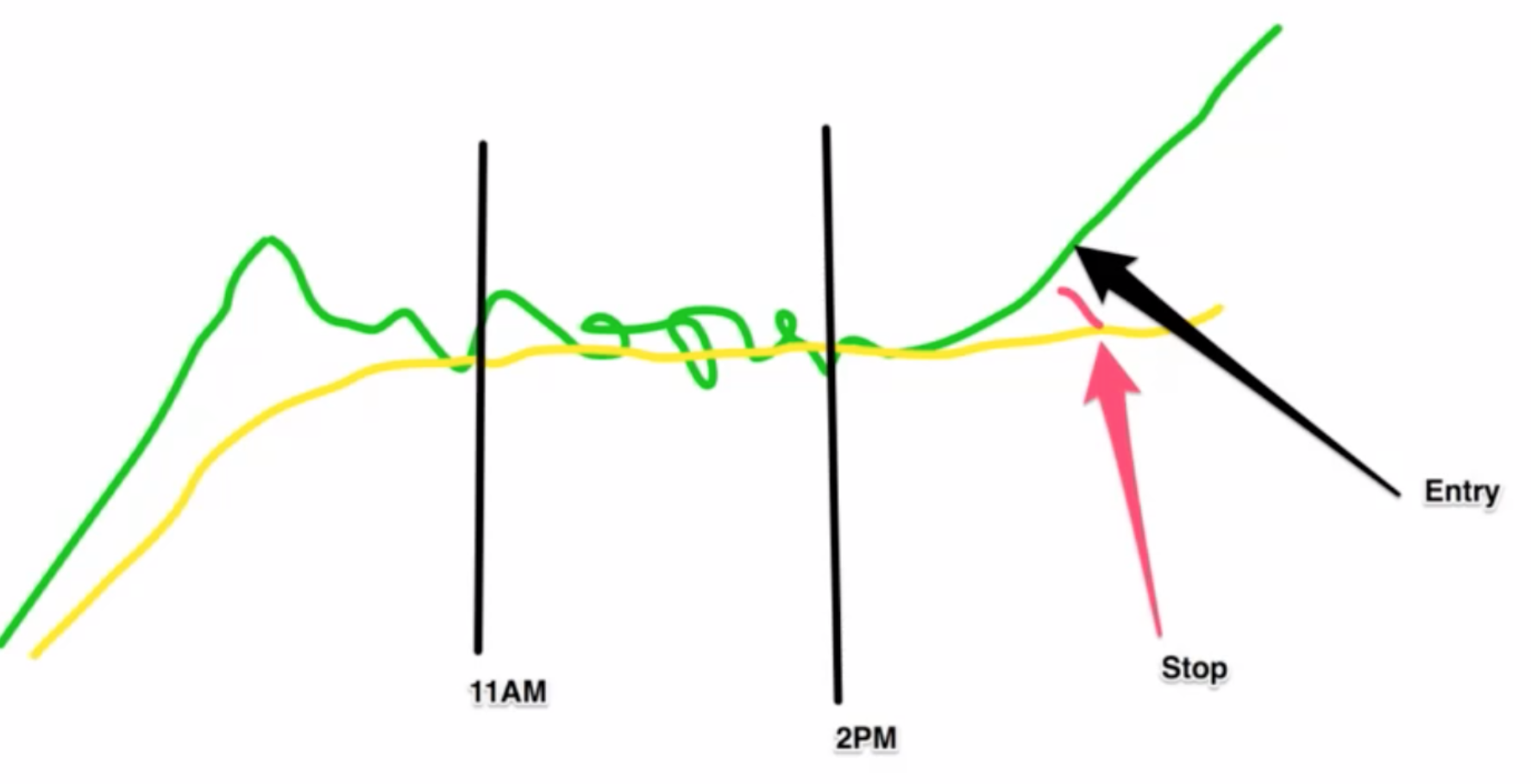

Afternoon HOD Break and VWAP Hold

Then, around 2 p.m. Eastern or later, the stock breaks to the high of the day. Once you see this, you want to look for one more thing. You want to make sure it’s holding VWAP (volume-weighted average price — more on that in a minute.)

Personally, once I see that HOD break and VWAP hold, I set my stop-loss in case of failure.

Here’s a little dramatization of the pattern:

© StocksToTrade.com 2020

Love lessons about patterns like this? Check out this video for more:

Pattern Example: GrowGeneration Corp (NASDAQ: GRWG)

As intimidating as my artistic skills are, let’s take a look at how this pattern actually looks on an intraday chart.

GRWG checked a lot of the boxes in terms of illustrating this pattern — strong market, earnings winner, great volume, nice chart, and an all-day VWAP hold.

Check out the arrow to see the timestamp from my afternoon webinar when I talked about it…

My Top Two Afternoon Scans

How do you find these afternoon plays? I use a combination of two scans: the 52-week break scan and the VWAP break scan.

StocksToTrade

Finding the right stocks is a matter of having the right tools. I run these scans on StocksToTrade. Obviously I’m biased, but I think that it’s the best way to filter down the thousands of stocks out there to find plays like this.

What’s awesome about STT is that you get nearly everything you need in one trading platform. You can analyze charts, figure out entry and exit points, and take advantage of features like the Breaking News chat tool or Oracle Daily Direction Alerts.

But it also has built-in tools to scan for stocks based on the specific criteria that you set.

You can create your own scans or use pre-designed scans and customize them to suit your preferences.

If you don’t have charting set up with VWAP capabilities, you can check it out on StocksToTrade — a 14-day trial is just $7!

52-Week Break Scan

52-Week Break Scan

In trading, when we’re talking about the 52-week range, we’re talking about a stock’s highest and lowest prices for the year.

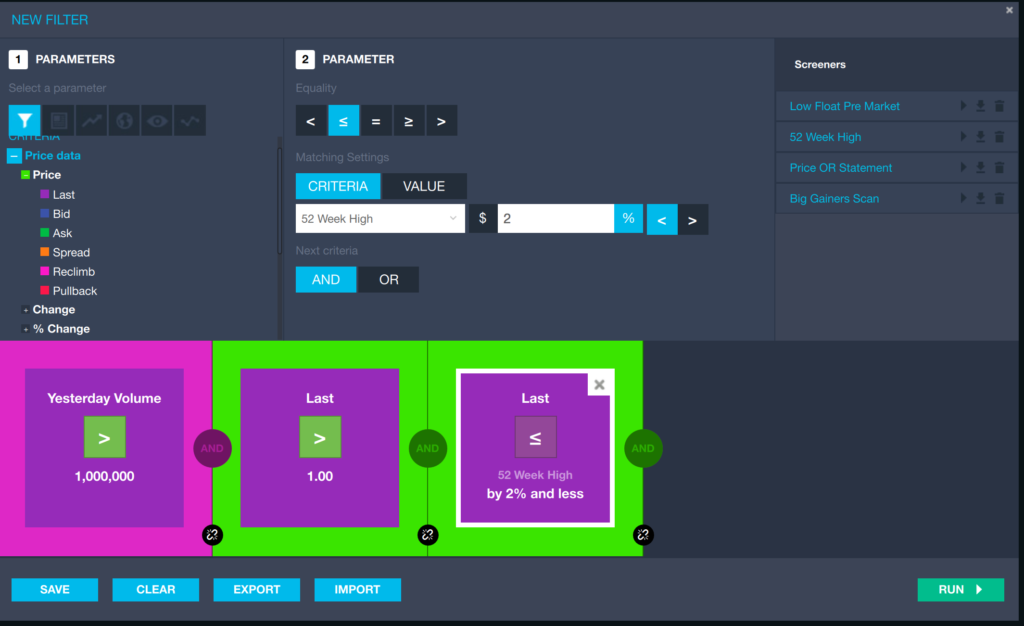

On StocksToTrade, there’s a 52-week high scanner that can help you find stocks that could be contenders for this afternoon trading pattern.

I even wrote a little tutorial on it. As you can see here, it locates stocks that fit this criteria:

- Trading volume of one million or more the day before

- Stocks trading at $1 or more

- Stocks at or around the 52-week high (with a 2% variance built in — you can cast a wider net by increasing the percentage.)

You can make tweaks based on your personal criteria or preferences, but this scan is a great starting point for finding these afternoon plays.

@ StocksToTrade.com 2020

Of course, it’s only a piece of the puzzle. I wouldn’t trade based on this scan alone. I combine my findings with the VWAP scan to find the strongest potential trades.

VWAP Break Scan

Another thing to look for? Potential VWAP bounces.

Not sure what VWAP is? Let’s take a minute to talk about why it’s so important with this pattern.

What’s VWAP?

VWAP is short for volume-weighted average price. It’s a technical indicator that shows you where the majority of the volume is trading price-wise with a stock.

It’s shown as a line on the chart. When the price is above the line, it’s above VWAP. And as you probably guessed, below the line is below VWAP.

A lot of day traders love looking at VWAP. It can help you get an idea of whether traders who recently entered trades are making or losing money.

I personally love VWAP for a variety of reasons:

- It’s simple. The price is either above or below VWAP — no ambiguity here.

- It makes it easy to see whether a stock is ‘cheap’ or ‘expensive’ on a given day.

- You can use it to figure out smart entry and exit points for your trade.

- And you can look at potential trends and determine any changes — sometimes even quicker than using moving averages!

Again, VWAP alone isn’t a deal-breaker for whether a trade is a good idea. That’s why I combine it with the 52-week break scan and wait to see the price action.

Wanna get up close and personal with VWAP? Check out this post and then watch this…

What If Afternoon Trading Doesn’t Fit Your Schedule?

Lately, we’ve started having a few slower trading days in late August of 2020.

Could it be that the market insanity is slowing down?

Or is it just a blip in the radar as people get into back-to-school mode (whether they’re actually going back)? Either way, the mornings haven’t been as crazy.

And recently, a student asked a perfectly valid question: what if you can’t trade in the afternoon?

A lot of traders might have limited schedules due to work. Or maybe, like my SteadyTrade podcast co-host Stephen Johnson, they’re in Dubai and don’t want to be up all night to wait for trades. He talks about his time constraints in the latest episode:

If you can’t trade in the morning, you might not like my suggestion. But here it is anyway…

Wait.

Keep showing up and making plans. But accept that you might not be trading as much.

Sometimes, the best trade is no trade.

You’ve gotta remember — I come from the ‘dark days’ of trading. From 2010 to 2014, just about every day was like it is in these slow late summer days of 2020. Don’t worry — opportunities will come along. You just have to be patient.

Regardless of what happens, it’s never a bad idea to be prepared for market volatility. It’ll be back sooner or later.

Get up to speed! I collaborated on “The Volatility Survival Guide” with my friend and trading teacher Tim Sykes. This no-cost resource is a must-watch for traders who want to understand the state of the market and how trading has changed in recent months.

Always Have a Plan — and a Scan

Always Have a Plan — and a Scan

Good trading is all about planning … and scanning. Are you making time to do both? If not, your results might not be as consistent as they could be.

It’s worth taking the time to be prepared.

Everyone loves a good dip and rip in the morning. But on the days when you miss it, or it’s just not there, there’s always the afternoon to try again.

Wanna be prepared for the ‘Late-Day, VWAP-Hold, HOD-Break With News at or Around 52-Week Highs’ pattern? It’s all about having a strong watchlist, watching and waiting, and not getting angry or hate-trading if nothing happens.

Have you ever traded this afternoon trading pattern? How’d it work out? I love hearing what you have to say … leave me a comment!