Oracle picked Genius Group Limited (NYSE: GNS) as one of its top stocks for a potential explosive move on Thursday — and that’s exactly what it did…

The stock hit gains of over 250% at its peak.

But unlike the Oracle algorithm that has no biases or emotions — I do.

I make mistakes. (Just ask Mrs. Bohen, she’ll gladly agree.)

And I made a big mistake when it came to GNS…

It was one of those instances SteadyTrade Team members like to call “Tim bashes, we cashes.”

Because I bashed it all morning but it ended up being the strongest and biggest runner of the day.

But losses or mistakes can be our biggest lessons…

And you don’t have to make the mistakes yourself to learn. You can learn from others and save yourself some heartache and trading capital.

So whether you traded GNS or not, had a win or a loss, here’s what you can learn from my mistake to build your own plans…

Learn From Mistakes and Biases

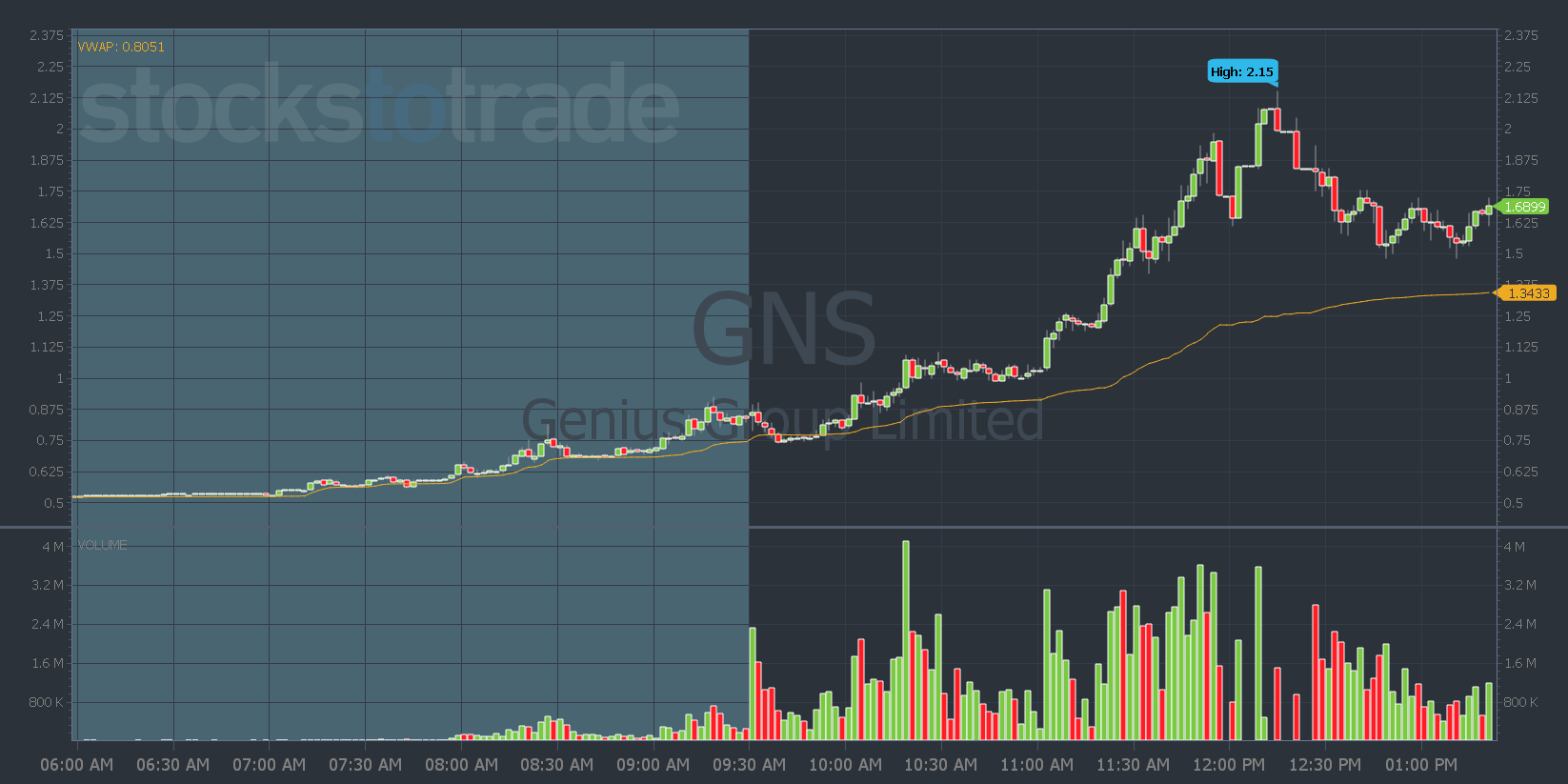

Yesterday in premarket, Oracle showed Genius Group Limited (NYSE: GNS) with a buy signal at 91 cents.

![]()

The Breaking News Chat team also alerted the stocks gap up on news in premarket before it had a 186% gain.

So it had news, a lowish float, and it was on Oracle.

But I still didn’t like it … Because the news seemed so ridiculous!

I laughed out loud for a good 30 seconds when I read the press release…

The headline read, “Genius Group Appoints Timothy Murphy To Lead Illegal Trading Task Force.”

Here’s a quote from the press release:

“The Board of Directors (the “Board”) of Genius Group Limited (NYSE American: GNS) (“Genius Group” or the “Company”), a leading entrepreneur edtech and education group, approved at a meeting of the Board held on Wednesday 18th January 2023, an action plan to address alleged illegal short selling of its stock.”

And there was another red flag about the stock and press release.

if (window.convertflow == undefined) { var script = document.createElement(‘script’); script.async = true; script.src = “https://js.convertflow.co/production/websites/8742.js”; document.body.appendChild(script); };The investor relations company for GNS was RedChip — the only investor relations company sketchier than H.C. Wainwright.

So my advice in Pre-Market Prep was to wait for the afternoon to go long. Or even to short it if you could find shares.

It’s not very often I give traders advice to short sell. Especially a stock with a lowish float like GNS.

And I admit I was wrong.

But GNS’s big move proves that I wasn’t the only one that had a short bias…

The stock wouldn’t have had such an incredible move without all the shorts getting squeezed and having to buy to cover. So in a way, I was right…

But either way, here’s the lesson…

Even though I thought the news GNS put out was totally bogus — price action always wins in the end.

I was biased against the news in the morning. But as a human, I can change my opinions when presented with new information.

So after my morning SteadyTrade Team webinar, I laid out a plan for trading GNS live as it was breaking out to new daily highs in my Daily Income Trader webinar.

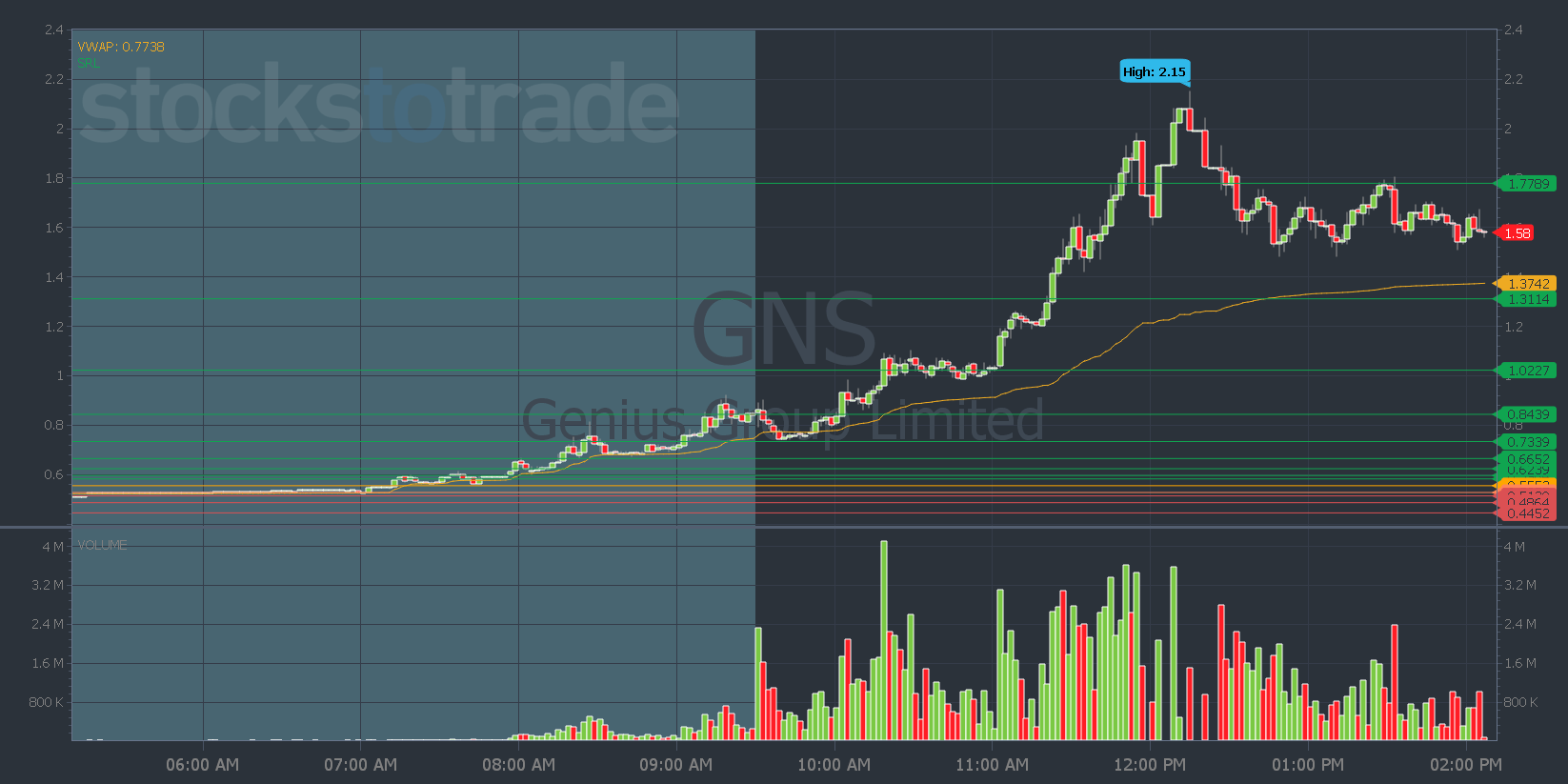

Oracle gave traders the support and resistance levels they can use to trade between the lines…

The algo laid out a beautiful trade plan.

And one of the best things about Oracle is — it doesn’t have biases.

It picks the top stocks to watch and gives you the levels to trade off of. Then you can trade between the lines, and the plan either works or doesn’t. If it doesn’t, you cut losses and move on.

I’ll show you how it works in my next webinar tomorrow morning at 10 a.m. Eastern…

Have a great day everyone! See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade