Yesterday, a little unknown penny stock soared 320%!

How did that happen while the markets gave back its morning gains into the afternoon?

Because penny stocks don’t care about the overall market.

They don’t move on macro trends or Fed announcements … they move on specific news, high volume, FOMO, greed, hopes, and dreams…

In the case of this massive penny stock gainer, a knight in shining armor came to save it. And that sparked the hopes and dreams of many traders looking to cash in on the news.

All while squashing the dreams of short sellers. Check it out…

Click here for help finding the hottest penny stocks every morning.

Where the Opportunities Are in This Market

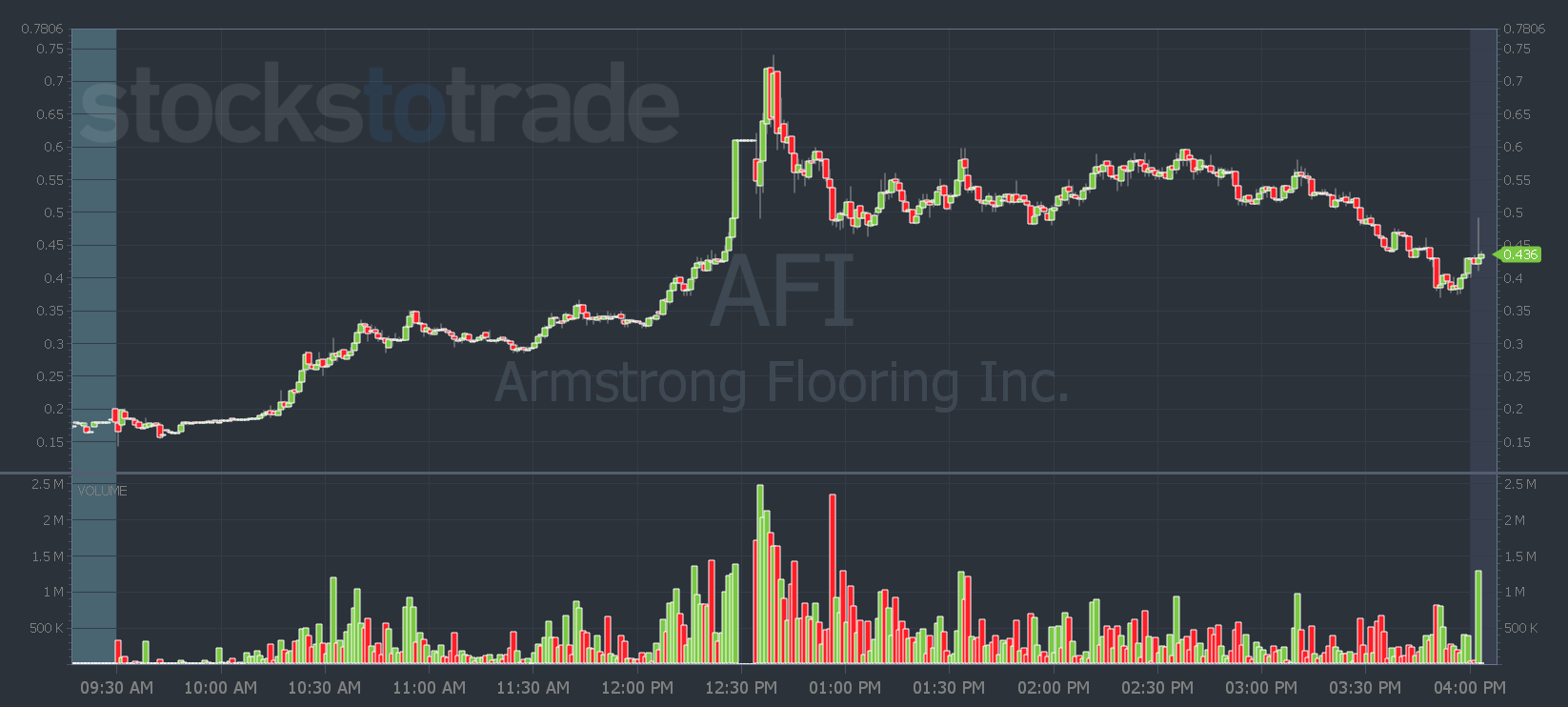

Yesterday, Armstrong Flooring, Inc. (NYSE: AFI) gapped up and skyrocketed from roughly 20 cents to over 70 cents. That means if you had put $2,000 into AFI when it had a post 9:45 a.m. EST dip and rip, you could’ve profited $1,000 within half an hour.

If you held longer, you could’ve doubled your money by lunchtime!

Meanwhile, most of Wall Street was concerned about inflation numbers, wondering when this sell-off is ending…

But as you can from the chart, the opportunities in this market are in penny stocks…

So what made AFI have such an absurd move while the markets headed lower?

Yesterday morning, AFI filed a 13D, which showed that Esopus Creek Value Series Fund LP bought a 5% stake in the company.

And when an investment fund acquires a stake in a small company, that’s bullish news. After all, investment firms have access to more resources and information than the average trader.

So, as the saying goes … ‘follow the smart money’…

That’s exactly what traders did to send the stock soaring…

And what’s even more interesting?

AFI filed for Chapter 11 bankruptcy only three days ago, looking for a buyout.

That’s right, the company was going under…

And after the news on May 9, AFI lost roughly 50% of its value over two days. I can almost guarantee that short sellers were licking their chops waiting for this thing to go to $0.

But instead, a big institutional investor came in. And shorts got blown out of the water!

At its highest point, AFI was up over 320%.

All while traditional large-cap traders got smoked in a bear market rally.

So, if you’re still looking at the overall markets to guide your trades — it’s time to think differently. Like I say everyday in the SteadyTrade Team — there’s always one runner.

And when you can catch 100%+ gains in penny stocks, why would you look anywhere else?

Like I’ve been telling traders recently — focus on afternoon trades. Stick with high volume, catalysts, and the best setups. AFI checked all of the boxes…

Find out what will be the next hot runner with me today!

I’ll see you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade