Have you ever seen a big premarket runner with all the makeup to be a monster? … Positive news, low float, and crazy volume…

It looks juicy and ripe for a squeeze higher…

But instead, it falls flat after the market opens. And you feel like you did something wrong…

Maybe you got in early anticipating a spike and took a loss.

Or maybe you were just watching and waiting for an entry. And when it goes lower you think you wasted your time.

Some traders don’t have to think too hard to remember that feeling…

Yesterday Merrimack Pharmaceuticals, Inc. (NASDAQ: MACK) checked a lot of boxes but failed to rip higher at the open.

So what happened?

Let me break it down for you…

Then I’ll share what to look for next in premarket spikers fail at the open.

What Went Wrong With MACK?

First of all, nothing went wrong with MACK…

Some trade ideas work, and some don’t.

That’s why we look for patterns, then make a trading plan with an entry, a risk level, and a goal for the trade.

If the pattern doesn’t present itself — we don’t touch it and we stay safe.

And if you waited for the right confirmation before entering, you didn’t waste your time. Waiting for a setup is 90% of what trading is.

It’s what I like to call waiting for a go or no-go setup. Typically I look for these in the afternoon after consolidation, but it worked in the morning for MACK.

Let me explain…

How to Avoid Unnecessary Losses

MACK did check a lot of boxes yesterday morning…

It had great volume, it has around 10 million shares in the float, and it rotated the float. Plus, it had cancer news that the Breaking News Chat team absolutely nailed the alert on…

But what we didn’t get is a pattern.

And if you enter without a pattern presenting itself, you’re just guessing.

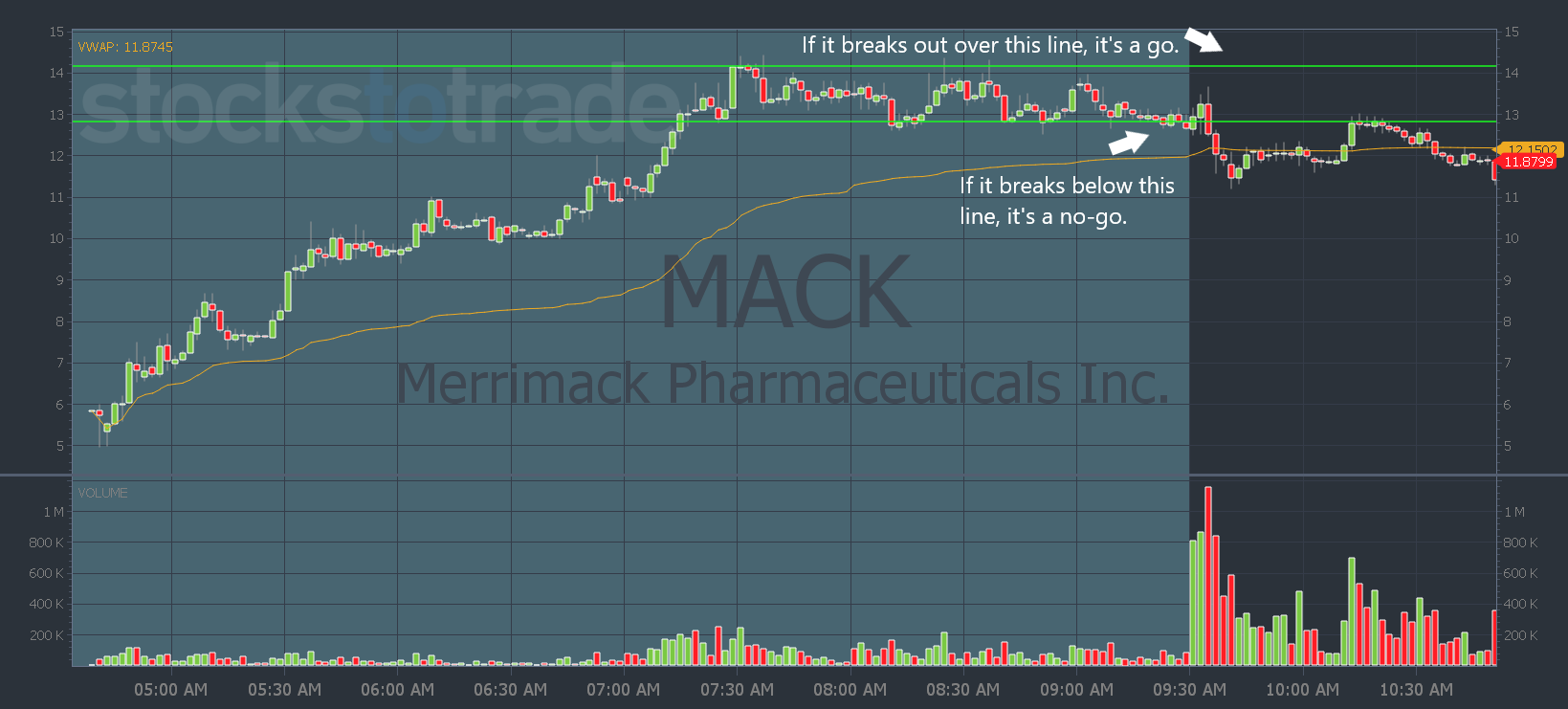

In Pre-Market Prep I drew two lines on the MACK chart. I was looking for a dip and rip over the $14.30 area. With risk on the lower support formed during premarket. If we got the rip over the premarket consolidation highs, it would make it a go setup.

But we didn’t get that move.

Instead, MACK broke the support level and it became a no-go…

But that doesn’t mean it’s over … MACK didn’t completely fail. It just consolidated.

This is understandable since it had a 200%+ move in the morning…

Shorts want to pressure it.

But there are also buyers and/or trapped shorts holding it up. So it’s still a watch to see which way it breaks out of consolidation.

If it breaks to the upside above key levels — watch for more squeeze!

Get all the details on what I’m watching this morning — join StocksToTrade Advisory to get in my live Pre-Market Prep webinars!

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade