On Friday we had multiple biotech penny stock runners…

I hated all of them except one.

And that brings me to an important lesson I have to share with you…

Because too many new traders don’t understand why one stock is a potential trade, while a similar stock isn’t.

So today I’ll share what the difference was between multiple stocks for me on Friday.

Pay attention, this might save you from crashing and burning this week…

Table of Contents

Try StockToTrade with all the features YOU want!

Get special pricing and offers with our Fourth of July sale today!

The Best Stocks Vs. The Worst

Recently we’ve seen a lot of true penny stock biotechs spiking. Some traders think that’s a great thing, but let me explain why they’re not my favorite…

First, I don’t like true penny stocks. (Stocks that trade under $1.)

Second, I don’t love sketchy biotechs, especially on their first green day.

These sketchy companies are known to drop offerings to take advantage of their increased stock price. And that usually sends the stock off a cliff. No thanks.

To me, it’s not worth the risk.

So let’s look at a few of the recent spikers and I’ll share why I don’t love them. Then I’ll show you why I liked one more than the others…

The Worst

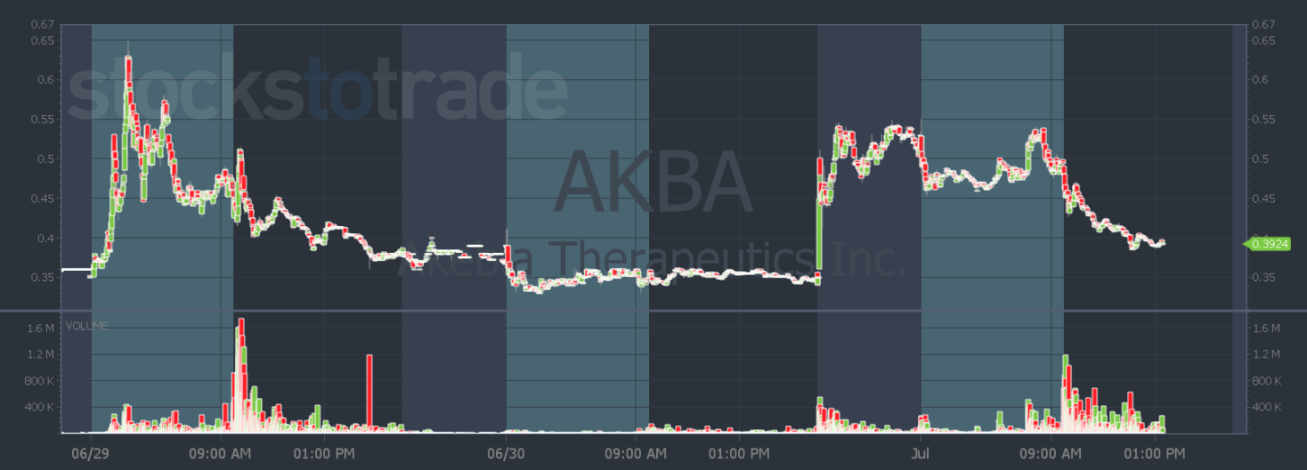

Akebia Therapeutics, Inc. (NASDAQ: AKBA) gapped up in premarket on June 28 with no news.

And on June 30 it spiked after hours when the company announced it terminated a collaboration and license agreement with another company.

But both days it couldn’t hold its gains…

Allena Pharmaceuticals, Inc. (NASDAQ: ALNA) was another failed spiker. It spiked after hours on June 28.

But it was another stock with no news.

No wonder it couldn’t hold its gains…

It was spiking again in premarket on Friday. But here’s why I didn’t like it…

I just can’t get excited about these true biotech penny stocks.

Most traders won’t short true penny stocks because of the $2.50 rule. And while there are opportunities to catch good percent gains on low-priced stocks, they just don’t have the same range as low-float stocks.

That limits their ability to squeeze and get parabolic moves.

If you just can’t resist these sketchy biotech trades — all I can say is wait until the afternoon.

The Best

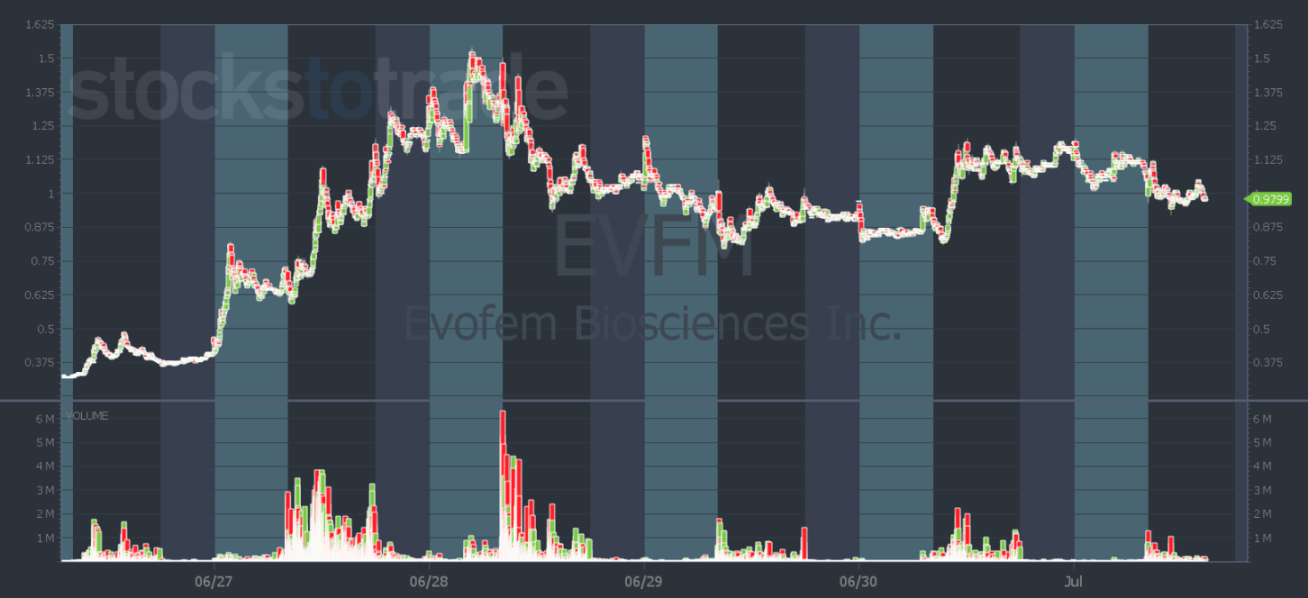

Now, with hindsight, I can’t really say Evofem Biosciences, Inc. (NASDAQ: EVFM) is the best. Ultimately, I didn’t get the move I was hoping for. But it was one of my top watches on Friday…

I thought it could break $1.20 on Thursday afternoon. It tried multiple times but it couldn’t break out. So I wanted that move on Friday.

Why did I like EVFM more than the other two true biotech penny stocks?

You could argue that EVFM is also a true penny stock. But here’s my counterargument to that…

EVFM has traded 1.2 billion shares since its big spike following the supreme court news headlines on June 24. After the initial news, it had two days of consecutive gap-ups. And it’s still hanging around…

This week it’s heading into day seven of its run on dubious news. (It reminds me of AeroClean Technologies, Inc.’s (NASDAQ: AERC) early days.)

It’s traded insane volume and it has hot sector news.

That’s why it was my top short-squeeze trade idea.

AKBA and ALNA didn’t have hot sector news or insane volume.

And at the end of the day, high volume changes everything.

I’ll finish off with an analogy I’m pretty proud of…

Picture biotech penny stocks like this…

You’re all alone sailing across the ocean. For years you’ve been alone…

All of a sudden you see an island and sail towards it…

It looks like an oasis after being at sea for so long … Like the one biotech you think will survive…

Then you crash into the rocks and die!

I hope that mental picture keeps you safe from the wreckage that is true biotech penny stocks this week…

Join me for more trading analogies in Pre-Market Prep every morning here.

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade