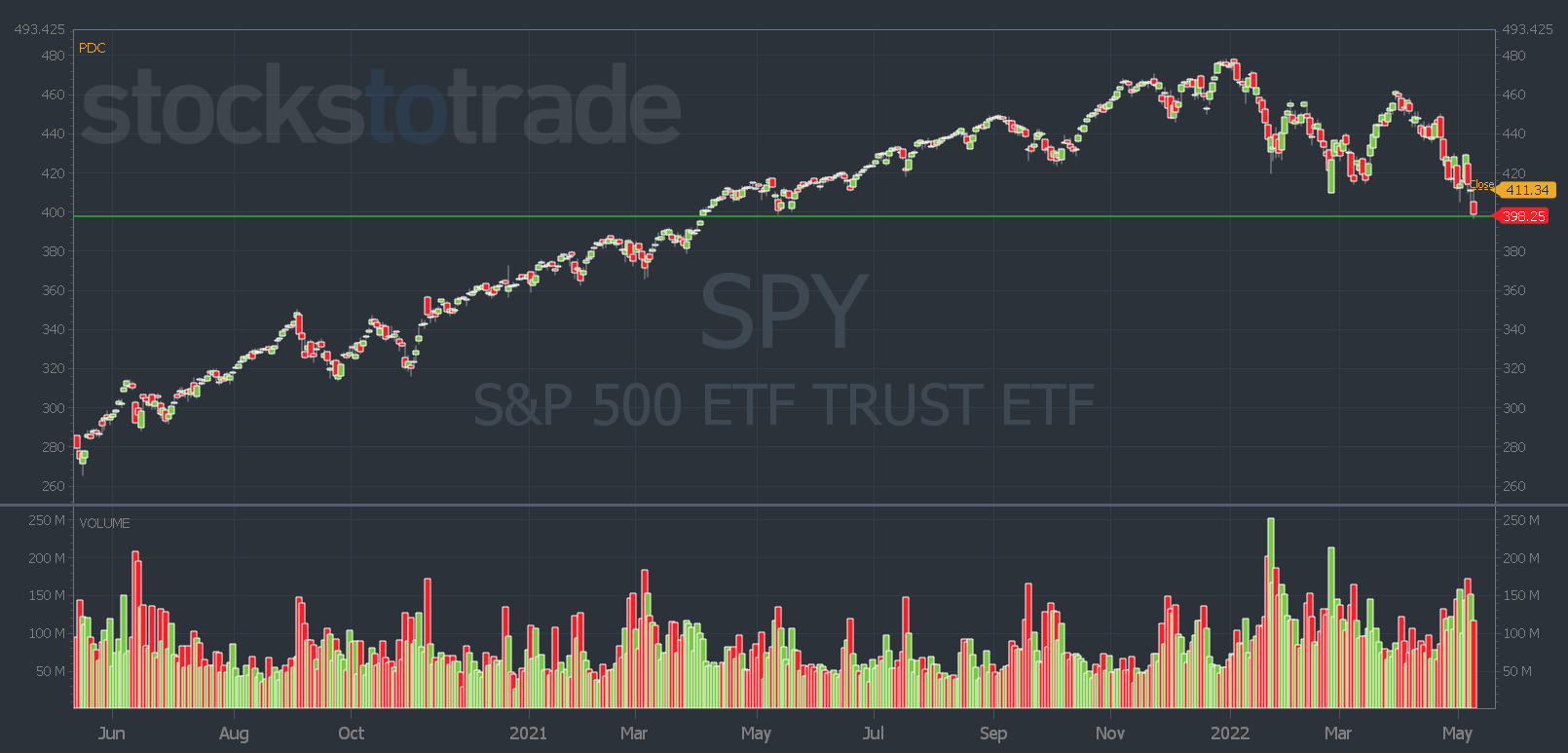

The market continues to sink lower this week. But unlike penny stocks that panic and crash when the buying stops, the market is experiencing a slow and orderly bleed out…

Traders trying to pick bottoms in tech have gotten smoked.

Meanwhile, pro traders are waiting for capitulation to happen.

Which begs the question…

How do you know when the bottom’s in and momentum will shift?

We could still be a ways off from the market finding a bottom…

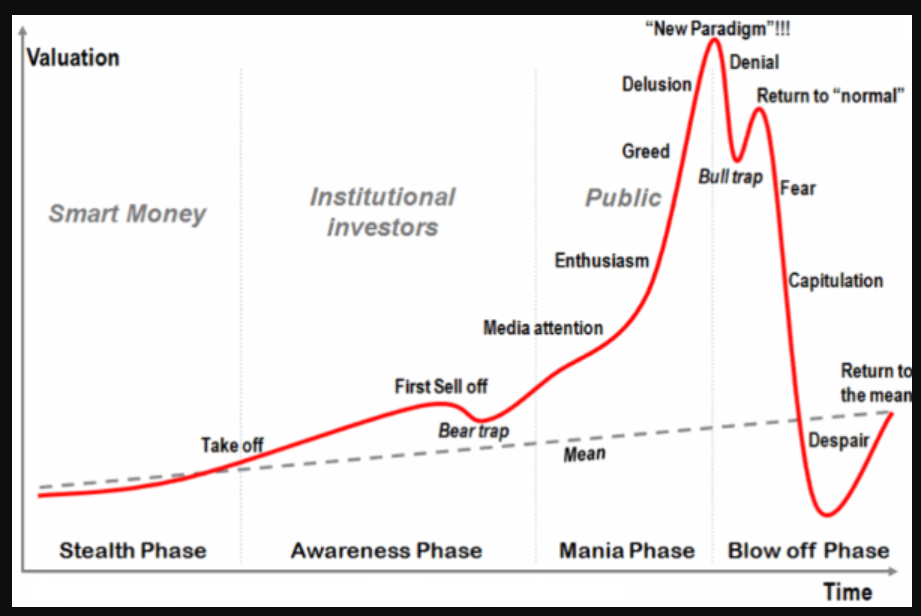

So let’s look at some charts to get familiar with the market cycle and how you can use this knowledge in your trading. These charts might even look familiar…

What is Capitulation?

Capitulation basically means ‘to surrender.’ In the market, it’s the point of max selling.

It’s when even the strongest bag holder gives up and finally takes a loss. Then, they cry and moan that you can’t make money in the markets…

Because shortly after, the market usually reverses. The ‘smart money’ comes in and we start the cycle all over again.

Take a look at the typical market life cycle chart below…

Right now, I don’t think we’re even close to capitulation. But we’re near a key level in the SPDR S&P 500 ETF Trust (NYSE: SPY).

If recent support in the major indexes fails, we could enter the ‘fear’ stage. And continued selling could lead to capitulation…

Why should you care?

Because penny stocks follow a similar pattern.

But there are a few differences…

First, the mania and blow-off top phase happen much quicker. Remember one of the best Twitter pumps of all time?

Last October, Camber Energy, Inc. (NYSE: CEI) climbed from roughly 50 cents to $4.85 within a month. That’s an 870% increase!

But when the pump was over, CEI went back below $1 per share within five trading days…

The second difference is that when the penny stock cycle is over, the stock doesn’t come back to life.

There are millions of penny stock charts that look just like CEI and the exaggerated market cycle…

So what can you learn from the market and penny stock cycle?

Don’t hold a loser.

As long as you bag-hold, you’ll always be part of the 90% of traders who fail.

The reason most day traders fail is that they don’t take profits on the way up.

Instead of going down with the ship, it’s much better to stick to your stop, take a small loss, and live to trade another day.

Even if the market does fall further, there’s always a trading opportunity in penny stocks. And no one trade is worth losing your account over.

If you want to learn the tools, rules, and knowledge to trade these big penny stock gainers in any market environment — join the SteadyTrade Team.

I’ll give you the tools you need — then it’s up to you to use them. And that can be easier with the right team and mentor behind you.

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade