Yesterday, a unique situation had some traders panicking at the open…

The New York Stock Exchange experienced inexplicable volatility that resulted in dozens of large-cap stocks being halted within seconds of the open.

You can imagine this volatile shake-out and halt could’ve triggered buy and sell orders along a wide range of prices…

Leaving traders to sort out the chaos of being in or out of positions that they potentially didn’t plan on executing in such a disorderly manner.

And while these kinds of random and chaotic halts are uncommon. Volatility halts happen in penny stocks all the time.

Just like traders experienced in my number one watch yesterday…

So how can you handle this kind of volatility and halts?

Especially when you’re caught in a position left wondering and stressing for minutes that feel like hours…?

Here’s my number one tip…

How to Handle Volatility Halts

During Pre-Market Prep and my morning SteadyTrade Team webinar, we had no clue what awaited traders at the opening bell…

We were making our daily trade plans like we do every day.

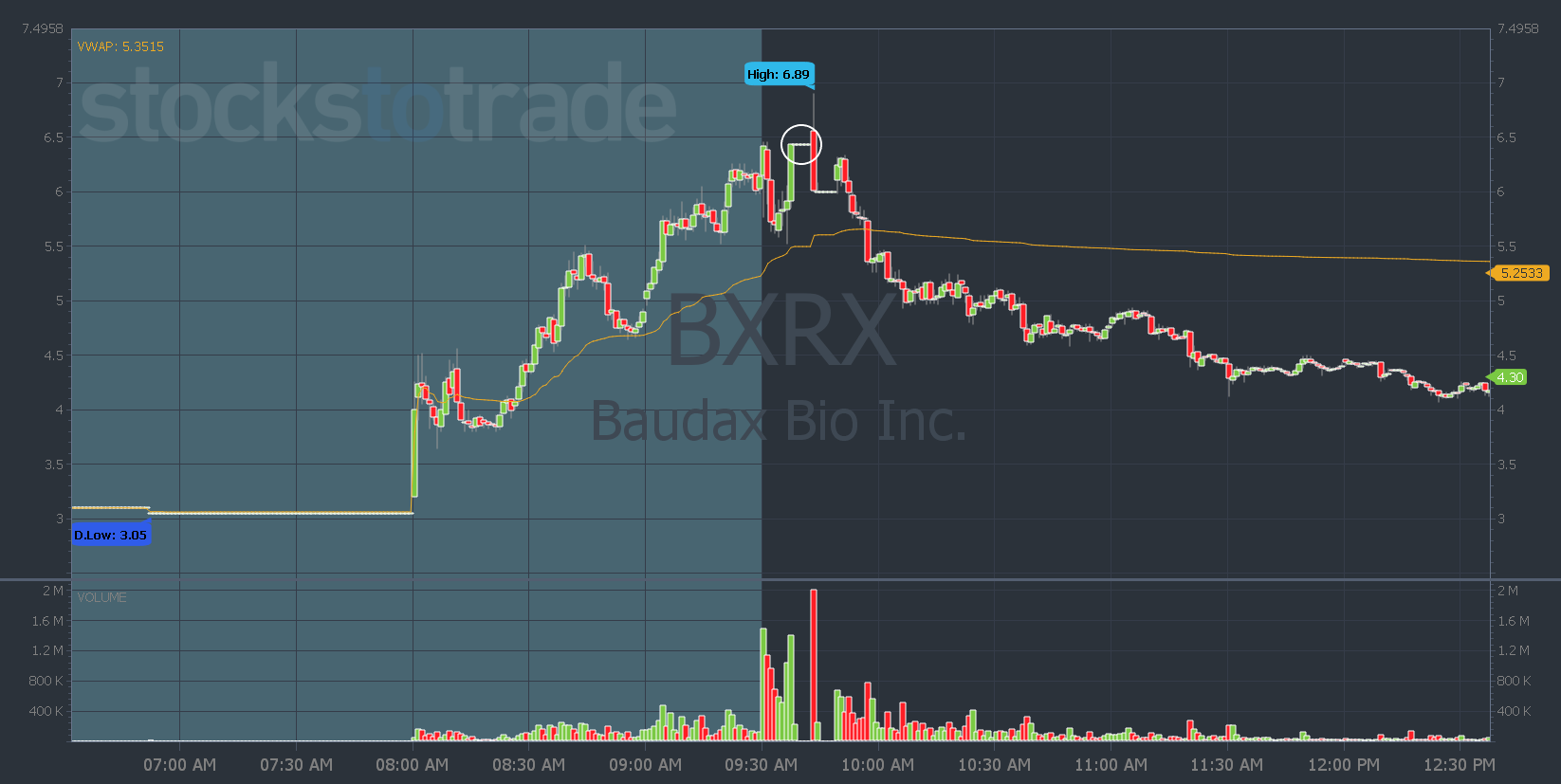

My number one watch was Baudax Bio, Inc. (NASDAQ: BXRX)…

I said multiple times it’s just another Intelligent Bio Solutions Inc. (NASDAQ: INBS) from Monday, just with different letters. It checked a lot of the boxes.

But in the end, all we care about is price action…

My plan was to enter at breaks of $6 with risk at $5.50 and a goal of $7+.

And while at the open it didn’t halt with the NYSE large cap stocks, it did halt a few minutes into the trading day — right in the middle of my trade plan!

Once BXRX was through $6, it halted the next minute at $6.43…

That left a lot of SteadyTrade Team members in limbo. They were caught in a volatility halt with no way of knowing where the stock would open.

The stock can gap up and open higher. Or gap down and open significantly lower than your entry.

So here’s how I always approach trading halts…

I’ve found this to be the safest and surest way to get out of a trade with minimal damage and not have to worry about a ton of unknowns…

My #1 Tip For Trading Volatility Halts

We love these volatile penny stocks — the large swings are how we’re able to grow small accounts without waiting years holding large-cap stocks.

But volatility halts are one of the drawbacks of that.

They can make traders feel scared and frustrated, which usually results in bad decision-making.

My trick to managing all of those emotions and your trades is simple…

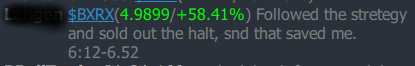

Exit the trade as soon as the stock reopens for trading.

Just like this SteadyTrade Team member did…

Because once a stock starts halting it can start halting multiple times. And it can halt to the upside and the downside…

Before you get caught in some ugly downside halt that leaves you with a big loss, just exit your trade and ignore the stock until it calms down.

Once the volatility subsides, you can look to trade the stock in the afternoon or the next day.

Staying disciplined and following the rules and process is how you build the foundation of success…

Not by swinging for home runs and holding unpredictable stocks.

Learn these lessons daily with me and build your discipline in the SteadyTrade Team.

Have a great day everyone! See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade

P.S. Tesla’s due to announce potentially groundbreaking news after the bell. And today’s your last day to make your move. Watch this to see why I think this could be HUGE!