How to Battle Inflation: Key Takeaways

- The problem with most trading webinars…

- Is trading part-time a potential solution for battling inflation?

- A killer pattern for part-time traders to put into action NOW

Try StocksToTrade today for only $7!

I have a big problem with most trading webinars. So many are a waste of time. They’re all about the great trades and money that some so-called guru hosting the webinar made.

Sure, they might show that it’s possible to make money in the stock market … But they fail to prove how to take action.

I try to be different and enable traders with tools and patterns so they can do something with what they learn.

In my recent webinar, “The #1 Way For Battling Inflation,” I gave traders a brief education on patterns that are currently in play. I also offered several actionable steps for the market right now.

Here, I’ll cover some of the most important lessons from the webinar…

Table of Contents

- 1 Lessons From My Inflation Webinar

- 2 1. Inflation Is the New Normal

- 3 2. Part-Time Trading: A Potential Solution for Inflation

- 4 3. You Must Be Organized

- 5 4. It’s Not Just About Penny Stocks

- 6 5. It’s All About Repeatable Patterns

- 6.1 My Grade for the AMD Trade

- 7 6. Technology Is Your Friend

- 8 Keep Learning…

Lessons From My Inflation Webinar

Here’s what I really want traders to know right now.

1. Inflation Is the New Normal

$20 for a grocery-store steak. $5 per gallon for gas.

It’s becoming more normal every day…

Prices are on the rise. You can’t change it, and inflation isn’t going anywhere.

How do you deal with it? Not by complaining.

As I see it, there are two ways to fight inflation. Either spend less or make more. If you don’t feel like becoming a homesteader, the answer is to make more money.

But how?

2. Part-Time Trading: A Potential Solution for Inflation

I think that part-time trading is the best way to fight inflation.

Why trade part time? For one, it lets you keep your day job. I’m a family man, so I’m all about stability…

Going part time lets you maintain a steady income while potentially increasing your earnings through trading. It could improve your situation…

If you ask me, it’s a lot better than just slogging away at the same old job without a raise and falling further behind because of inflation.

3. You Must Be Organized

Even if you’re trading part time, you still have to dedicate yourself fully to the process.

You’ve gotta do your research and have a trading plan for every single potential trade.

In the webinar, I shared the worksheet I use to rate potential trades. It’s the same one I featured in my Day Trading 101 series.

It’s a great tool to stay organized and help traders make a case for potential trades. For instance, if you complete this sheet and you can only give a trade a letter grade of C or worse, is it worthwhile?

Check out this post for more details on how I rate trades. Be sure to watch this video too:

4. It’s Not Just About Penny Stocks

If you tune into my daily Pre-Market Prep sessions, you might think I’m totally zeroed in on low-priced stocks and nothing else. Nope!

In fact, for part-time traders, I suggest a mix of fast-paced day trades and slightly slower-paced swing trades.

In the webinar, I mentioned a potential swing trade stock that’s over $100 per share. Yes — big stocks can have big moves, too!

They may not be as fast as penny stocks, but that’s OK — especially if you can’t be watching your monitor all day.

If a $100 stock moves $20 per share and a trader has 10 shares, that trade can help pay for grocery bills, gas … In short, it can help you fight inflation.

Of course, it’s not just about picking any stock. You’ve gotta be discerning…

5. It’s All About Repeatable Patterns

In the webinar, I walked traders through one of the most common patterns I’m seeing these days.

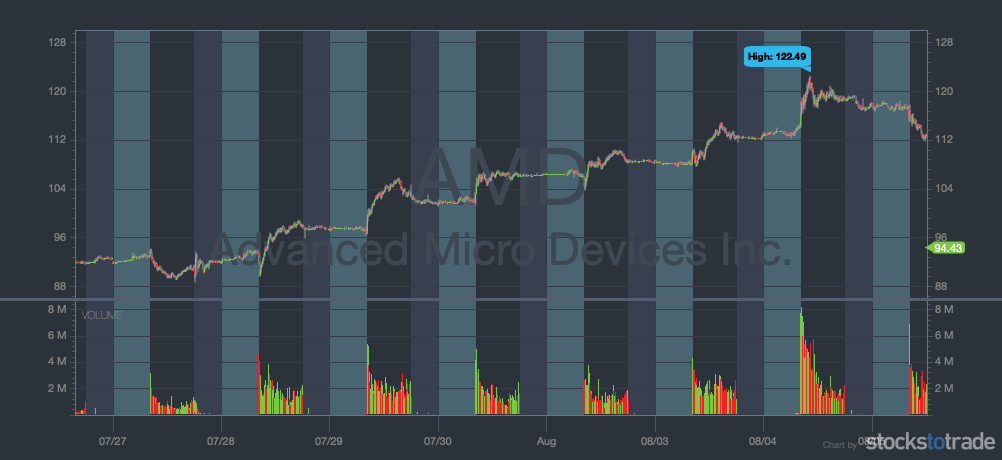

I used recent runner Advanced Micro Devices, Inc. (NASDAQ: AMD) as an example. The point isn’t just to watch this exact stock. Instead, it’s about understanding the pattern so you can spot it the next time it happens.

What makes a stock like this unique?

It checks a lot of boxes. If you haven’t checked out this foundational post, read and bookmark it now: “Does It Check All the Boxes? Bohen’s Ultimate Trading Checklist.”

In it, I explain why every potential trade should check if not all, then at least most, of the “boxes” or criteria I talk about.

In the case of AMD, it had a lot going for it:

- Earnings winner: On the week in question, AMD had announced great earnings.

- Hot sector: AMD is what I’d call a “story” stock. It’s in an interesting sector — it’s related to semiconductors, gaming, and crypto mining.

- Catalyst: For me, the combination of earnings plus having a ‘story’ is a powerful catalyst for a stock like this.

- 52-week highs: During the week in question, AMD was trading near 52-week highs. Not quite at them, but close.

- Volume: The volume went way up after earnings dropped — another sign of a lot of interest in this stock.

- Good company: AMD is a real company — not a sketchy penny stock that will probably fail by the end of the year. They’ve been crushing it for years and the sector doesn’t show any signs of a slowdown.

In fact, the only negative thing about this stock was the float. It has a very high float — about 1.2 billion.

My Grade for the AMD Trade

Overall, considering all the criteria, I rated it a 9 out of 10. Or if you prefer a letter grade, an A-minus. The float was the only sticking point.

In the webinar, I talked about watching for a $100 break and setting risk at $95. I thought it could go as high as $115.

After the webinar, what happened?

Just look at the chart. Earnings dropped on July 27. I gave my webinar on July 29. Within just a few days, it had sailed past my call of $115 and all the way to the $120s…

6. Technology Is Your Friend

If there’s one piece of advice I could pass on to new part-time traders…

Automate, automate, automate.

Don’t make your life harder than it has to be. Make use of the awesome technology out there!

In the webinar, I mentioned using specific order types to automate your executions. You can still monitor your stocks as you go, but orders can free up your time and keep you disciplined!

A stock screener like StocksToTrade can also be a huge help. It gives traders the ability to filter down the thousands of stocks out there to a manageable watchlist.

Using either built-in scans or customizable scans, it’s easy to find stocks that fit your criteria.

That’s not all … STT charts feature links to news and social media mentions. Plus, there’s an additional Breaking News Chat add-on that alerts traders to specific catalysts that could move stocks.

Talk about making your life easier! I think STT’s incredible features speak for themselves. But don’t just take my word for it. Try StocksToTrade for 14 days — it’s just $7.

Keep Learning…

By offering this webinar and these tips on battling inflation, my goal was to help give traders tools so that they can use trading to their advantage.

Trading isn’t about making bank or getting rich quick. It’s about learning the patterns and getting a little better every day.

Ready to level up? If you’re ready to advance your stock market education, consider joining my SteadyTrade Team where I give twice daily webinars every day.

What’s your biggest takeaway from battling inflation? Leave a comment … Your feedback helps me improve!