The majority of traders lose — why is that?

The main reason I see this is that they don’t have a methodology.

Instead of approaching trading with a well-defined strategy, they chase hot stock picks or blindly jump on the bandwagon of the day’s top gainers.

They yearn for quick profits, believing that it’s the path to success…

But that’s not the reality of trading.

While they may make a few hundred dollars today — they’re bound to lose the same amount tomorrow, repeating a cycle of inconsistency and frustration.

But day trading stocks can work…

It’s been proven by experienced traders like Tim Sykes and myself, who have collectively spent decades in the market.

The key lies in having a solid process — one that is meticulously crafted and faithfully repeated over time.

So today I’ll share three steps you can take to help you identify the right stocks to trade, and how to create a process to make the most out of opportunities…

Three Steps to Include In Your Process

There are so many criteria to consider before you take any trade — it can be overwhelming.

But as you test and tinker with strategies and criteria, you’ll find what works for you.

Below are just three tips to help you — there are many more criteria to consider.

Watch this video for tips to improve your process.

And make sure the stocks you trade check the boxes.

The market can be a moving target so you have to move and evolve with it. That starts with…

Identify the Hottest Trends

It’s important to identify the hottest trends in the market to improve your odds of finding the right trade.

Recently AI stocks and biotechs have been hot. But we’re not seeing them all run at the same time…

You have to watch what’s moving in the market each morning and adapt your plan.

If AI stocks all went nuts one day, they might need to consolidate for a day. And that can mean traders shift to another hot sector or a low float stock with news.

You have to recognize what’s hot and move with the market.

Once you find the hot trend you want to focus on and have a list of stocks…

Look for Volume

Volume plays a crucial role in trading.

It’s important to look for high volume and avoid illiquid stocks. I classify Illiquid stocks as stock trading less than a million shares a day.

Trading illiquid stocks can make it difficult to enter and exit.

And you can take larger losses than you anticipate if you have to deal with slippage.

Look for stocks with volume in premarket and at the open. This can make trade execution easier and shows you that traders are at least interested in the stock.

From there you can…

Make a Solid Plan

A hot sector stock with volume and news still doesn’t guarantee a stock will go up.

That’s why making a solid plan is essential to improve your odds of finding the right trade.

Many traders make the mistake of jumping into a trade without a clear plan, driven by FOMO.

Then they get crushed when the stock tanks at the open.

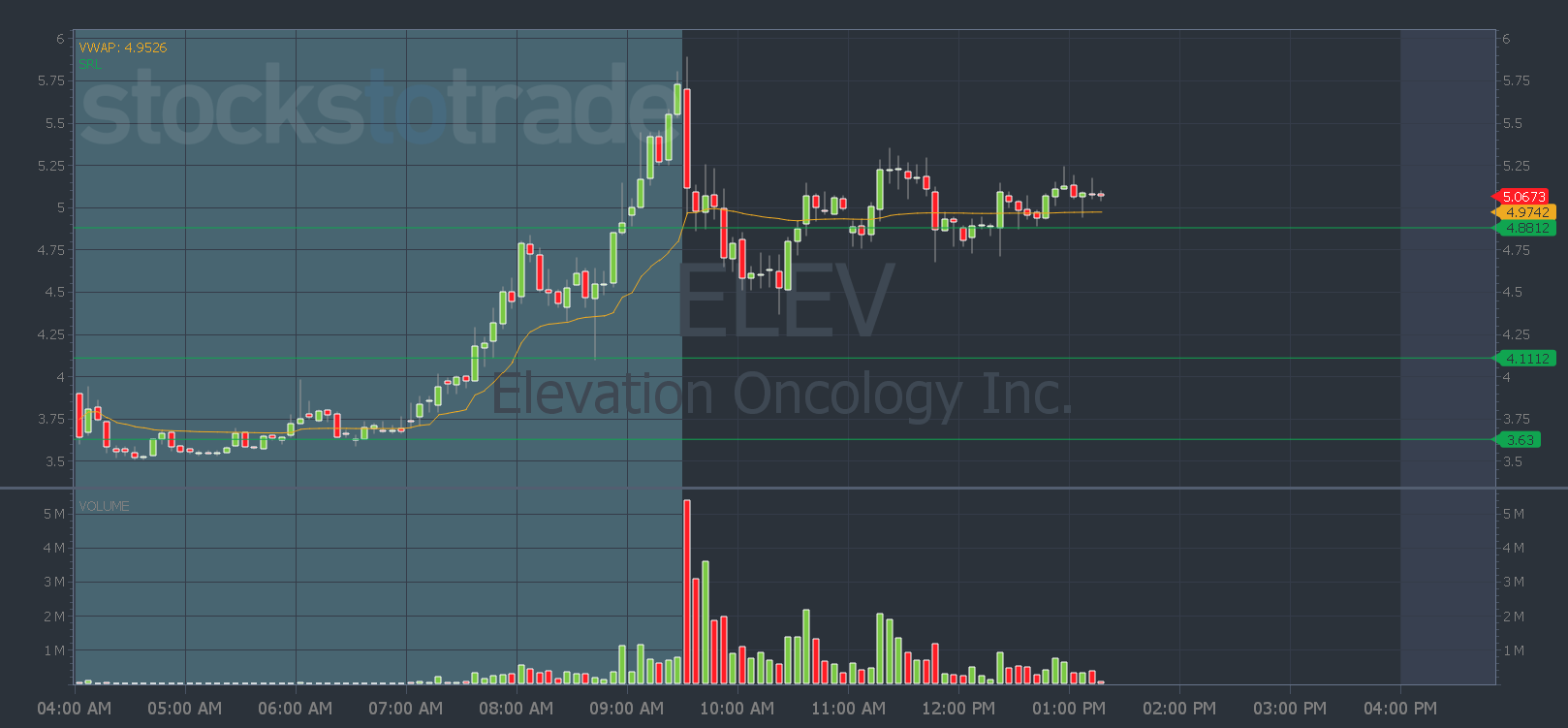

That’s what would’ve happened to anyone who bought Elevation Oncology, Inc. (NASDAQ: ELEV) at the open on Friday…

By making a plan in advance you can take time to determine your ideal position size and risk level.

This can help you avoid mismanaged trades due to too much size and a risk level that’s too tight, resulting in premature exits.

Find a balance between risk management and giving trades enough room to develop.

I use Oracle to help me make my trading plans.

My plan for ELEV included an entry signal at $4.88 (a break above the Oracle resistance level) with risk at $4.49 and a goal of $6. That plan played out in premarket.

But if you missed my daily alert, you could use your Oracle scanner in StocksToTrade to give you another plan…

Oracle had a signal for ELEV at $5.90. And waiting for that level would’ve saved you from entering a trade that didn’t work.

![]()

See how you can get Oracle working for you here!

What are you focusing on this week? Reply to this email and let me know!

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade