When markets have a big red day as they did on Friday, it leaves a lot of people wondering where to put their money…

In times like that, it makes sense to follow the ‘smart money.’

And if you’ve been following along, you know I shared how following the smart money could’ve landed you nice gains in Bed Bath & Beyond Inc. (NASDAQ: BBBY) and Minerva Neurosciences Inc. (NASDAQ: NERV) if you traded them right last week.

(You also could’ve caught NERV’s incredible move yesterday if you opened my watchlist.)

But now it’s time to follow the ultimate smart money…

The government.

It’s betting big on clean energy.

And while some traders think the path to profits is to buy EV stocks, I’m looking at a different sector…

Because in order for EVs to rev up, they all need one thing…

Batteries.

That requires one critical component … And the stocks are already reacting. Check this out…

What’s Driving The Clean Energy Revolution?

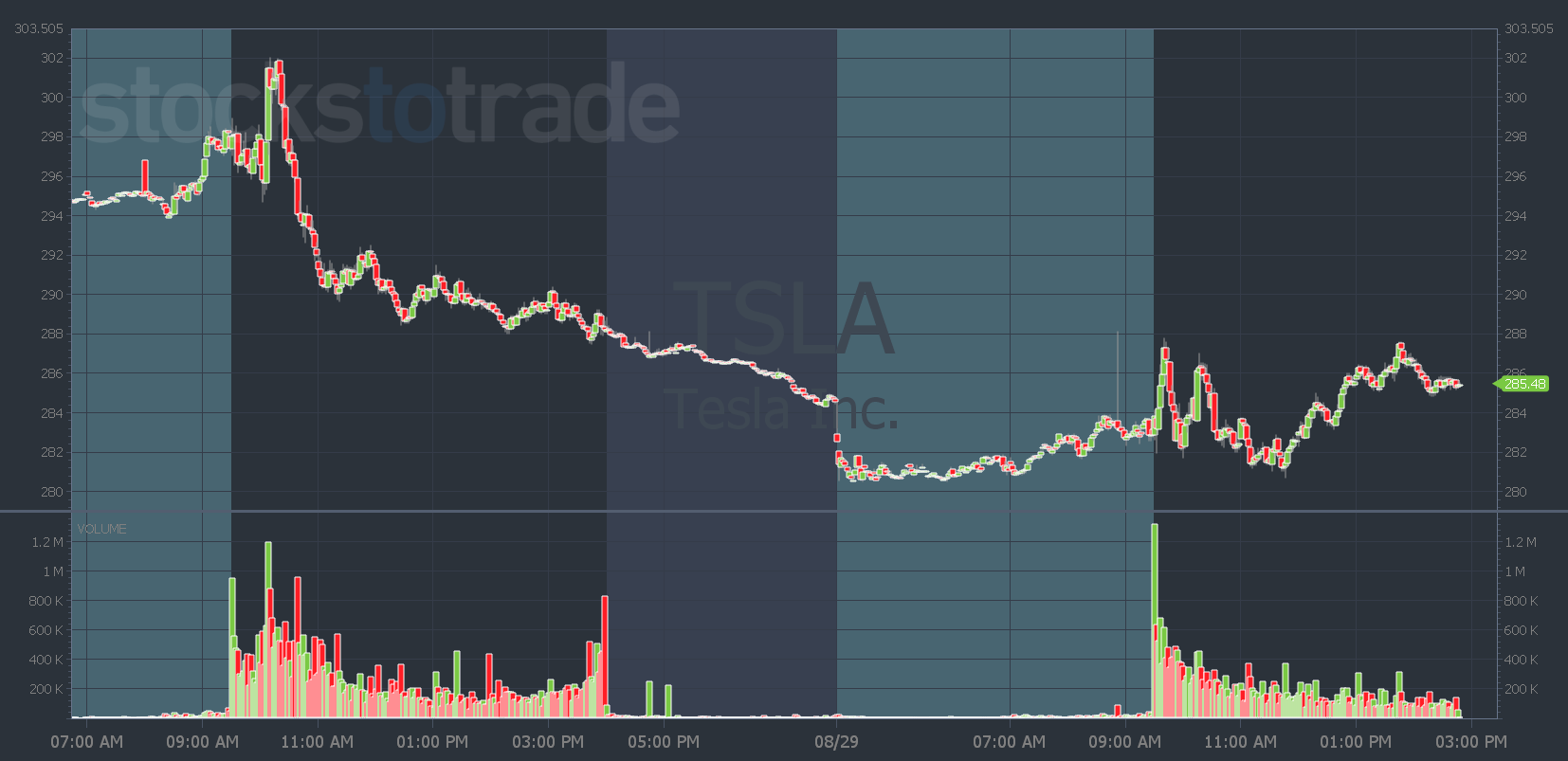

Before Tesla, Inc. (NASDAQ: TSLA) or other EV manufacturers can drive off into the sunset with big profit margins…

They all need a constant supply of lithium to power their batteries.

Right now, China dominates the battery market share…

China manufactures nearly 80% of all EV batteries.

But that could change with Biden’s Inflation Reduction Act, which he signed into law two weeks ago…

It doesn’t just give consumers tax credits to buy EVs. It also dumps billions worth of incentives for manufacturers to build batteries here in the U.S.

The infusion of cash has already had an effect…

Just yesterday, Honda announced it will build a $4.4 million EV battery plant in the U.S.

Construction on the plant is slated to start next year. With batteries getting pumped out of the plant by 2025.

And the more batteries that are built, the more lithium is needed…

How to Get In On The EV Battery Boom

Check out Livent Corporation (NYSE: LTHM)…

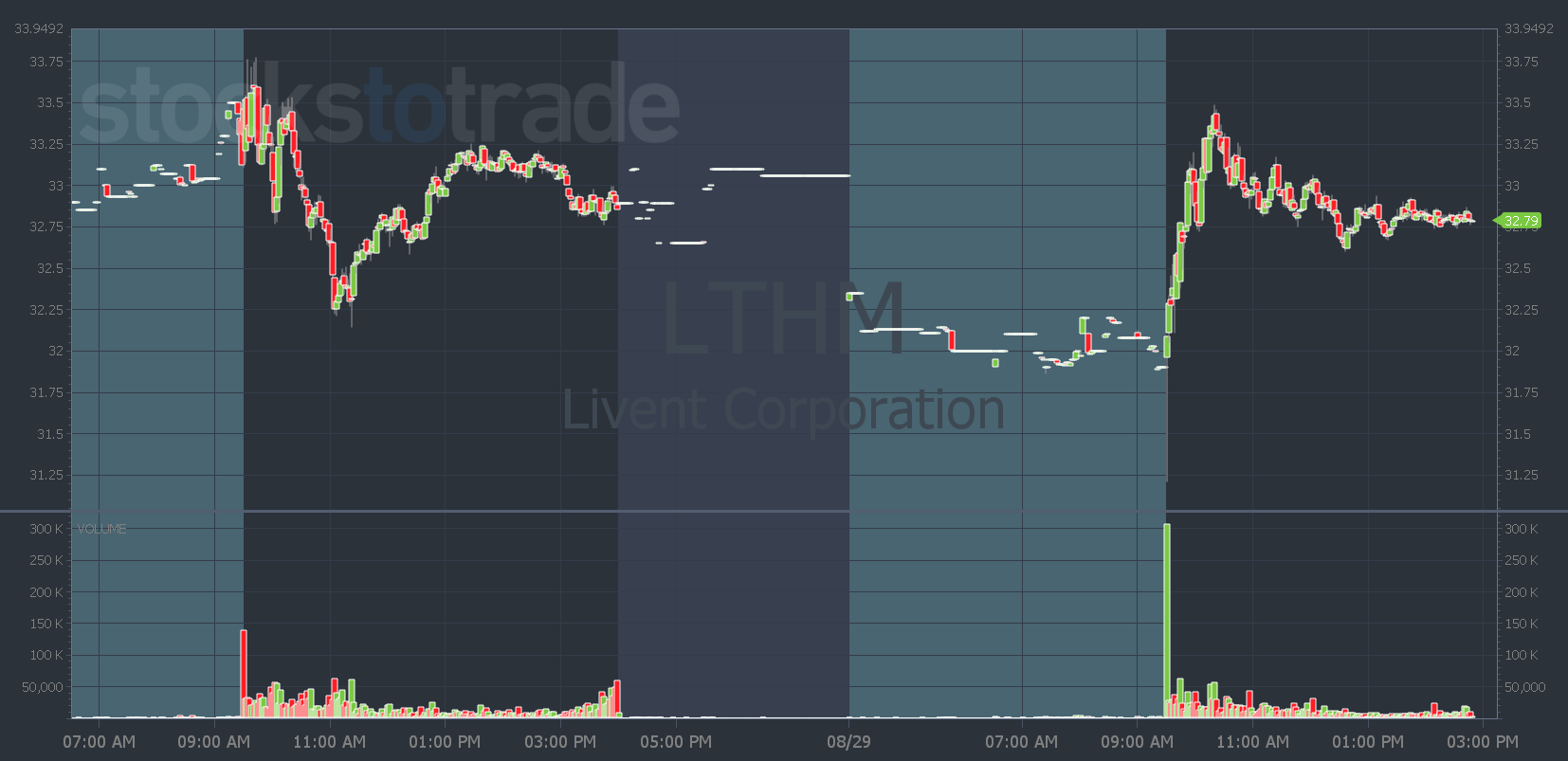

While the overall markets dumped 3% on Friday and had another big gap down yesterday, LTHM barely budged…

Compare LTHM’s two-day chart to TSLA’s below…

Even a 3% drop in the market couldn’t bring LTHM down.

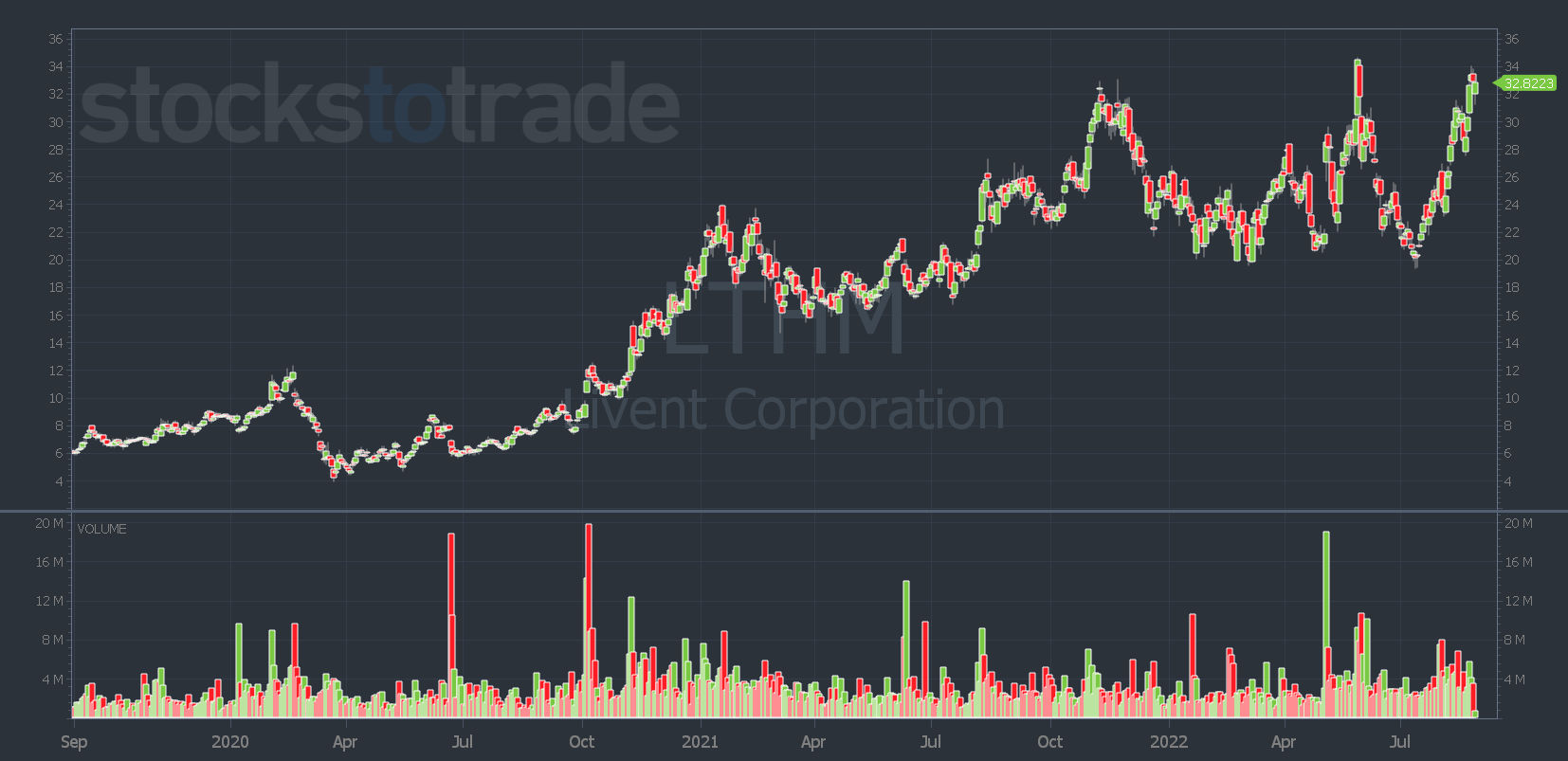

In fact, it’s trading near its all-time highs…

It’s made a 70% move in just the last six weeks! Not bad for a target=”_blank” rel=”noopener”large-cap stock.

That’s why I think trading lithium stocks is the best way to play the upcoming EV boom.

Plus, LTHM isn’t the only lithium stock near all-time highs…

Click here to get a complete list of lithium stocks ready to take off.

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade