We had incredible runners already this week —

Then IceCure Medical Ltd (NASDAQ: ICCM) after hours on Monday.

So yesterday a lot of people were watching these stocks for follow-up moves…

After all, multi-day runners can offer the best opportunities.

But you have to know which pattern to watch for and when…

Otherwise, you get caught on the wrong end of a losing trade. And it’s completely avoidable.

So here’s a breakdown of one specific pattern you hear me talk about a lot…

But yesterday it wasn’t what I was looking for in one recent runner…

Why?

Let’s break down the pattern and I’ll explain…

Plus, don’t forget Tim Sykes’ holiday bonanza!

Click here to see what special offer is available today!

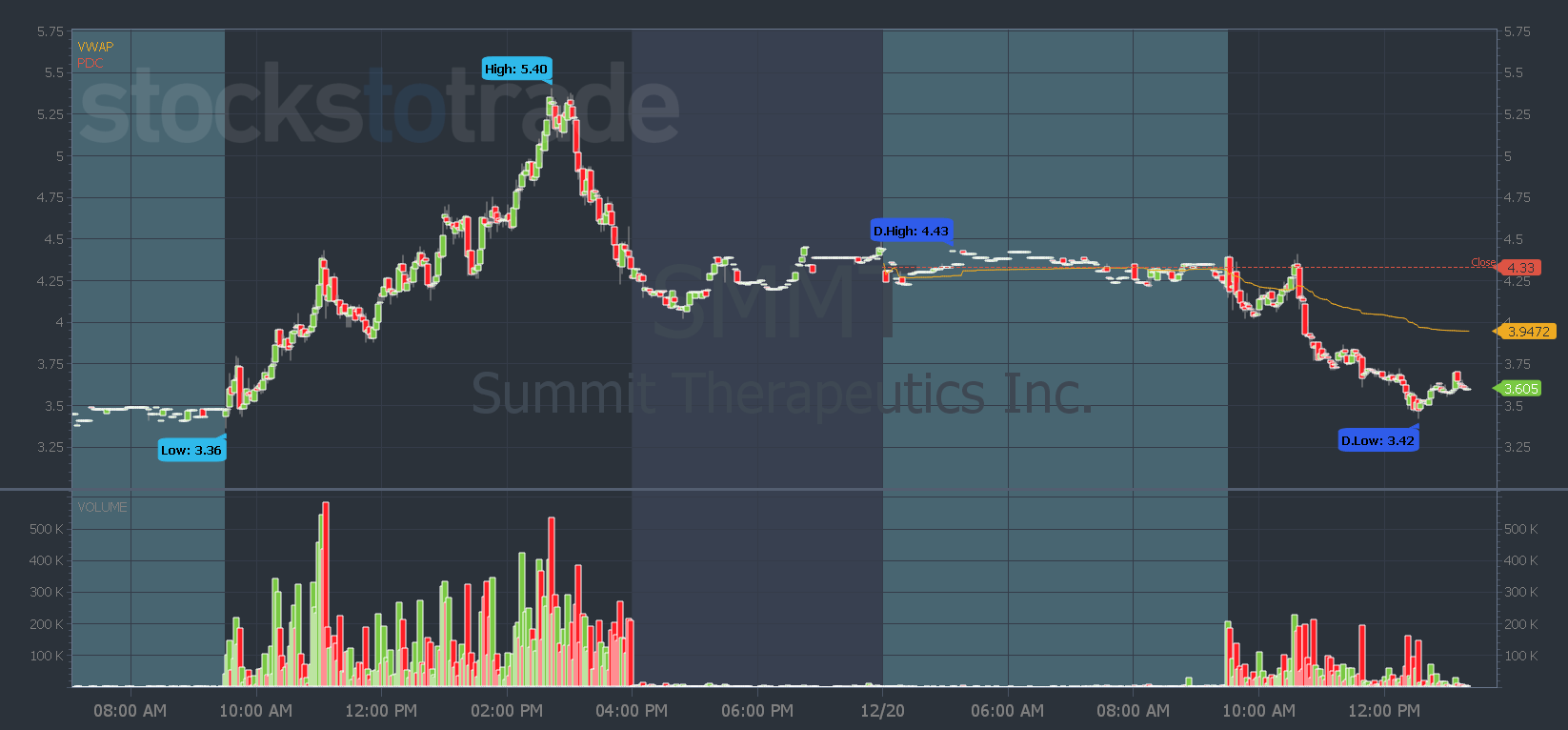

The No-Go Pattern In SMMT

Yesterday in the morning SteadyTrade Team webinar, a member asked if Summit Therapeutics Inc. (NASDAQ: SMMT) was a watch for a weak open red to green move.

Maybe you were wondering the same thing…

If you tried to trade it, you know that pattern didn’t work…

That’s why my answer right off the bat was NO to the weak open red to green.

Why?

Let’s look at a hypothetical example to help you come up with your own thesis for your trades…

Look at SMMT’s chart from Monday. The stock ramped up in the afternoon but pulled back hard into the close.

I’m talking about a $1 per share pullback.

So anyone who bought late into that ramp-up was all happy and giddy…

But if they didn’t sell and take their dollar of upside, they were left with regrets. They turned a winner into a loser.

And what’s the bagholder’s dream?

To get back to break even.

So you have all those buyers who got greedy. And what are they going to do as soon as SMMT spikes?

They’re gonna sell at breakeven or for a small loss or small gain.

So I warned SteadyTrade Team members — if you buy before the $5 level, you’re just bailing out bagholders.

So what do we look for in a potential weak open red-to-green pattern?

A Key Component For a Weak Open Red to Green Move

A key component of the weak open red-to-green move is for the stock to close at or around the high.

If SMMT had trended sideways after its big run-up, then the weak open red-to-green plan would be in effect.

Because when it closes near its highs, it doesn’t create bag holders and give traders regret.

If you want to know what patterns to look for every morning — join me in Pre-Market Prep before it’s only available to high-paying subscribers!

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade

P.S. Give yourself something you actually want for the holidays — grab our holiday sale bundle now before it’s gone!