During shaky times, the worst thing you can do is struggle alone.

Having a community behind you to cheer on your wins and pick you up after losses can greatly improve your performance.

And the more traders you can learn from, the better…

You may not know this, but in the SteadyTrade Team, it’s not just the Tim Bohen show…

Yes, I’m there for the market open and close in my live webinars … and I’m in chat alerting potential trades as they come up…

But there are also a ton of experienced traders in there alerting trades, encouraging others, and sharing their wins and losses.

So today I’m sharing two members’ trades from yesterday. Because they’re both great examples of how focusing on high-probability setups can be the difference between a winning trade and a losing trade.

When to Trade in Premarket

Yesterday in my premarket SteadyTrade Team webinar, there were a lot of stocks to like…

We were watching multiple stocks for potential dip and rips, weak open red-to-green moves, and breaks above the previous day’s high.

There were also three stocks that were chat pumps…

Mobile Global Esports Inc. (NASDAQ: MGAM) and Bed Bath & Beyond Inc. (NASDAQ: BBBY) were top watches.

But since they were both chat pumps, the safe play was to wait until 9:45 a.m. or later…

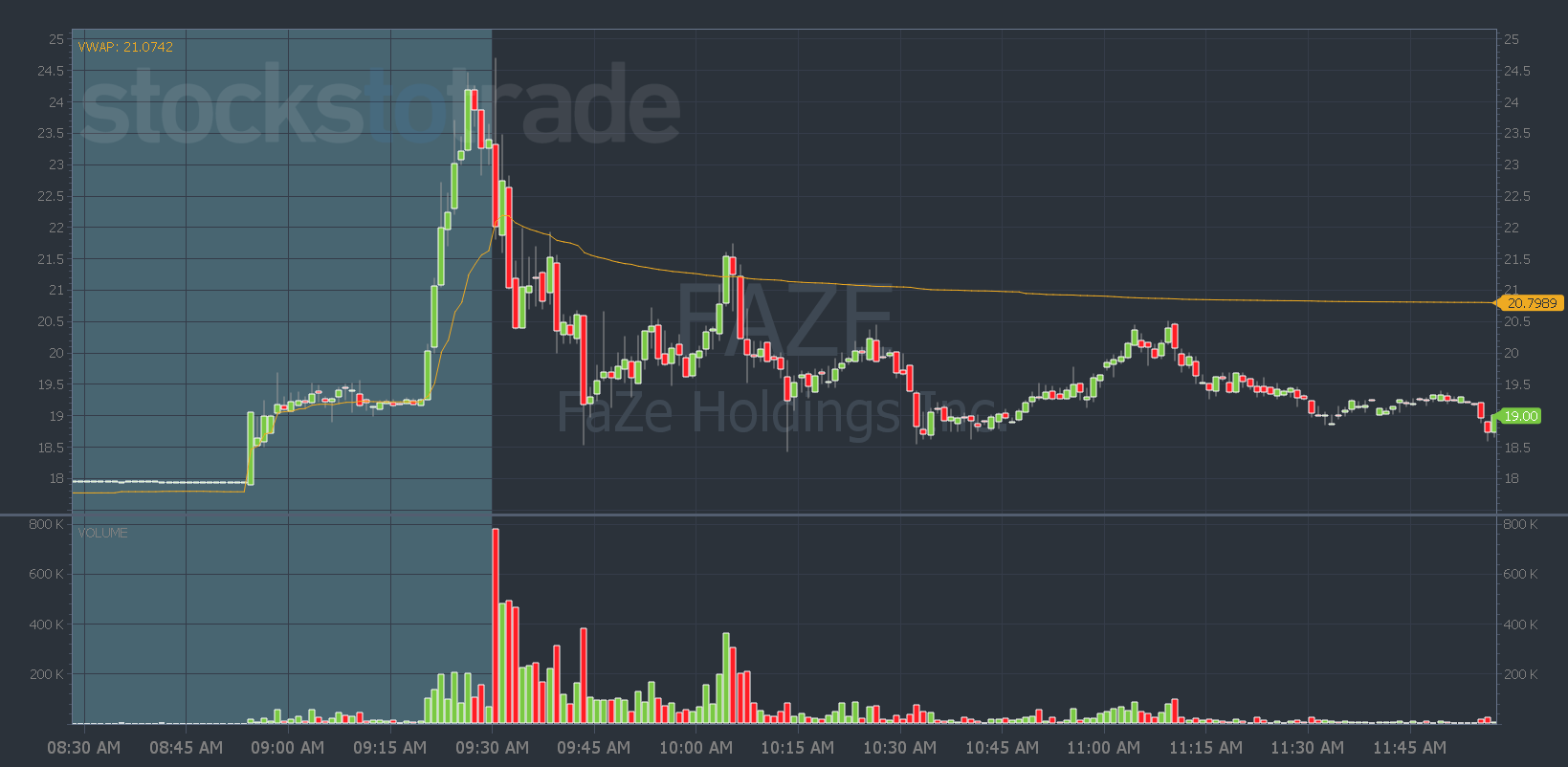

FaZe Holdings Inc. (NASDAQ: FAZE) was another chat pump.

And when it started spiking in premarket, I reminded everyone to think about what they’re trading…

Because nine out of ten chat pumps fail at the open.

But if you’re a more experienced and disciplined trader, you don’t always have to wait until after 9:45 a.m. to trade chat pumps…

Buy in Pre, Sell in Pre

You can use the Breaking News Chat alerts to get in and ride the momentum in premarket.

That’s what two traders did in the SteadyTrade Team yesterday. And they shared their trade details in chat…

![]()

This trader got in a little late so I think the entry was aggressive. But I love their exit.

Anytime you trade a chat pump in premarket and you get a $1 to $2 rip before the open and you take profits…

That’s how you trade a chat pump.

Another trader was in earlier and held right up until three minutes before the open…

![]()

Both traders made the smart decision to buy in pre and sell in pre.

I don’t care if FAZE would’ve gone to $30 after they sold. It’s not worth the risk to hold a chat pump through the market open…

Because nine out of 10 times they fail.

Then chances are you end up with a loser. I was there in the beginning…

I would have nice gains in premarket … Then I’d overstay and wouldn’t take my $1 or $2 dollars per share of gains. Then I’d watch the stock sink like a stone at the market open turning my winner into a loser…

It sucked.

And I don’t want you to go through those kinds of losses. That’s why we stick to high-probability trade setups in the SteadyTrade Team.

There was no guarantee that FAZE would fail at the open. But the odds were that it would.

And in this case, the odds were right…

And the one time out of ten that a chat pump doesn’t fail at the open — you can always get back in.

If you want to learn more about how to grow your small account, I’m giving a free live webinar to an exclusive group of traders who sign up here.

You also get a ton of tools to help you find the hottest stocks to trade, my top ten patterns to trade, plus education on how to make the best trade plans.

Have a great day, everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade