Low-float biotechs are HOT right now — on Monday we had at least five running in premarket. Yesterday we had another five…

And they’re all gaining 50%, 100%, and even more than 200%!

Reviewing these big moves after the fact can help you recognize patterns and look for better entries and exits…

But to capitalize on the momentum while it’s here, you have to spot the big runners and make trading plans before the moves happen.

So to help you do that, I’m giving you a special mid-week biotech watchlist.

Let’s not waste any time getting ready for the potential moves we could see today…

Table of Contents

Biotech Stocks To Watch This Week

When you’re looking at recent runners and trying to determine which stocks should stay on your watchlist, look for stocks that are hanging around.

Strong stocks that have held their gains.

That can be tough with biotech stocks since they tend to be one-and-done spikers. (That’s why you need to remember this lesson.)

But these stocks can have some epic Friday squeeze potential if they hang around the rest of the week…

So I’ll show what’s been hot this week and what to potentially watch them for…

But to find your best trades each morning — use your StocksToTrade scanners to find low-float biotechs with news.

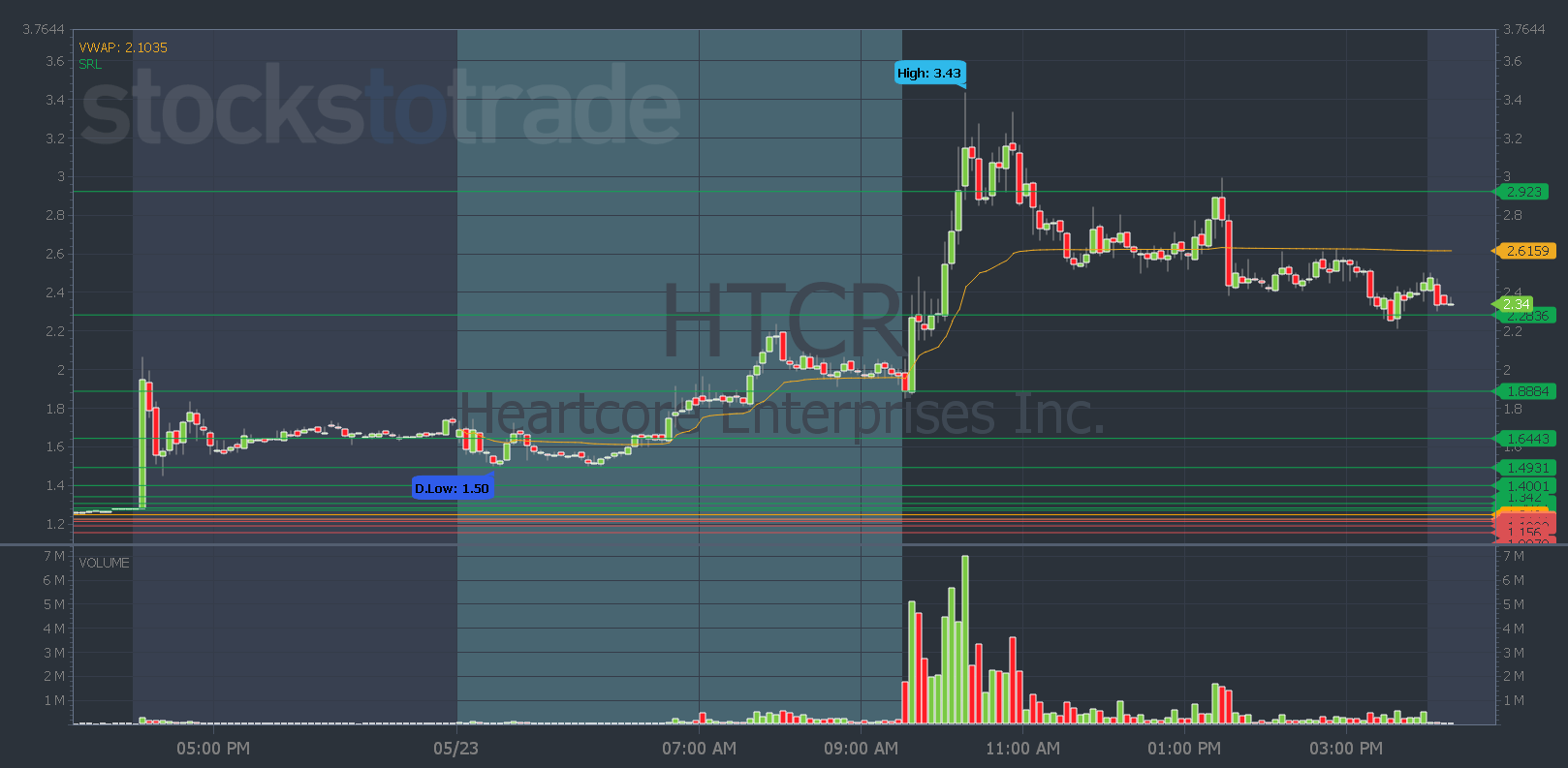

HeartCore Enterprises, Inc. (NASDAQ: HTCR)

HTCR has a low float of fewer than five million shares and it traded over 85 million shares yesterday.

The stock gained over 160% after announcing earnings.

It failed VWAP yesterday afternoon but then formed a support level. If this holds up today and consolidates, it could be a potential squeeze candidate heading into the end of the week.

I think it needs to at least be over $3 before shorts start to get nervous.

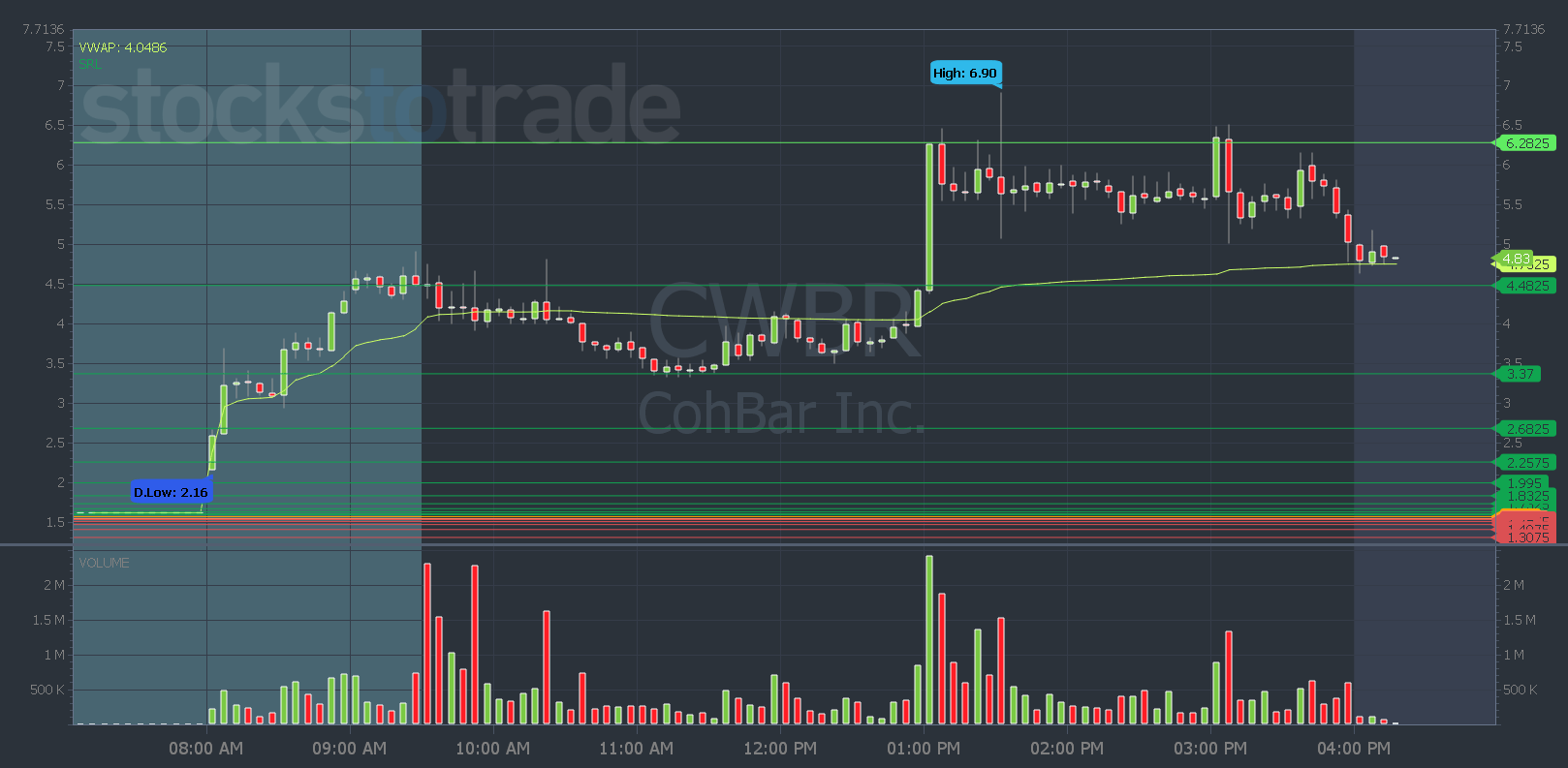

CohBar, Inc. (NASDAQ: CWBR)

CWBR was so close to becoming my number-one watch yesterday…

But I didn’t love the news. And it just kept ripping higher in premarket so I didn’t see an edge there to plan a morning trade.

I kept hoping for any kind of pullback or slowdown so it would lure in shorts and I could make a plan…

I did slow down all morning so I made it my Daily Double Down pick. It was a chat pump survivor and it was loaded up with shorts.

The stock formed a base, then reclaimed VWAP and broke the high of the day at 1 p.m. Eastern.

So again, waiting for the afternoon was the best approach.

I like that CWBR held VWAP into the close and the $4.50 level that was my long signal yesterday. Watch for a break above $6.50.

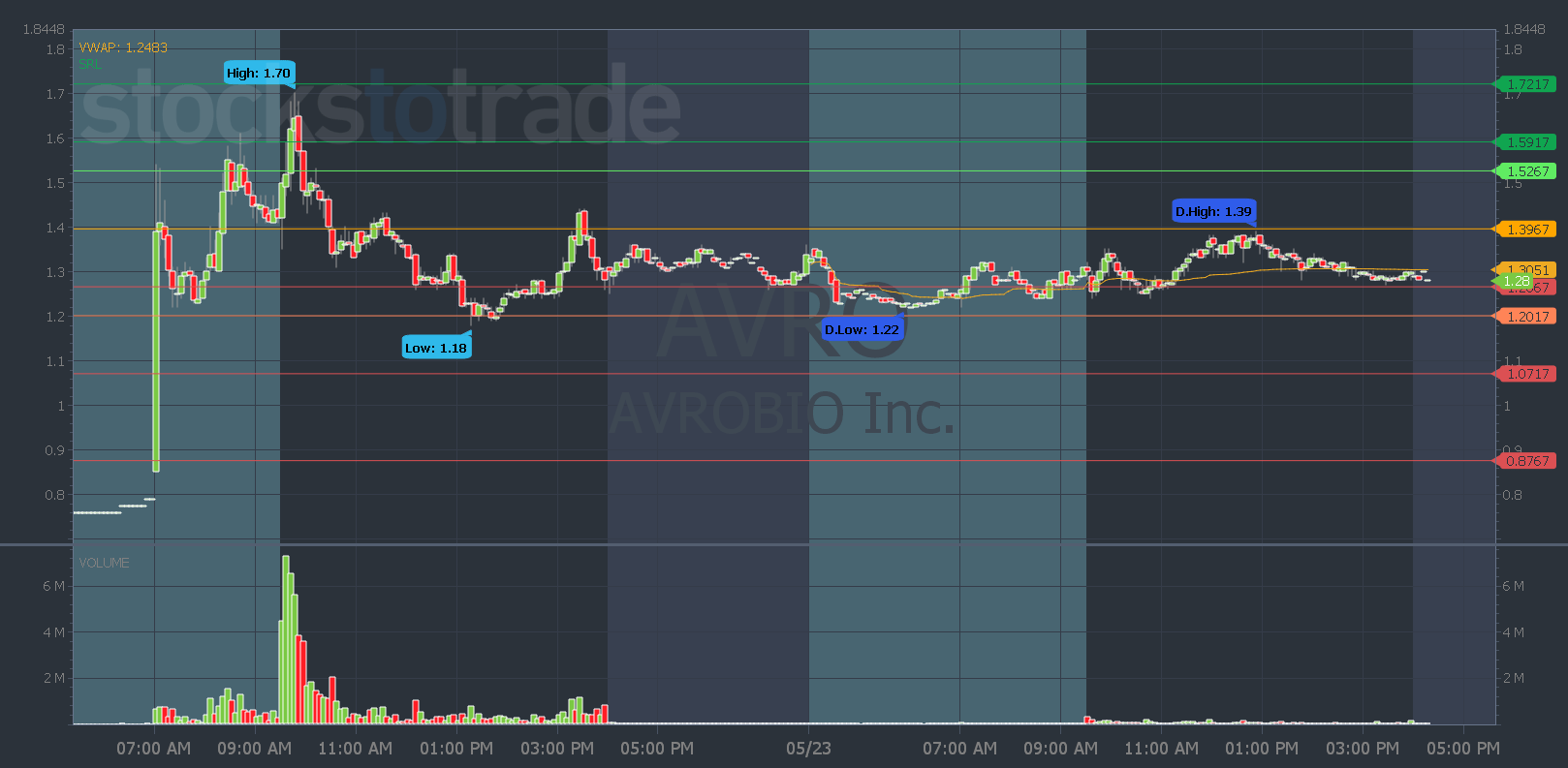

AVROBIO, Inc. (NASDAQ: AVRO)

AVRO was one of the big spikers on Monday. It’s not a low-float stock — it has roughly 40 million shares in the float…

But that could make it even more appealing to short sellers.

The stocks gained almost 120% on Monday after announcing an agreement to sell one of its gene therapies for $87.5 million cash.

The stock couldn’t hold all of its gains on Monday. But the big gap up on the daily chart and the fact that this has held up and consolidated for two days makes me think it’s full of shorts.

This could have the potential to squeeze and break out later this week. It looks like it’s setting up for a potential day-three surge. And shorts will probably get nervous around the $1.50 to $1.70 level.

But it will need volume to be able to have a big move.

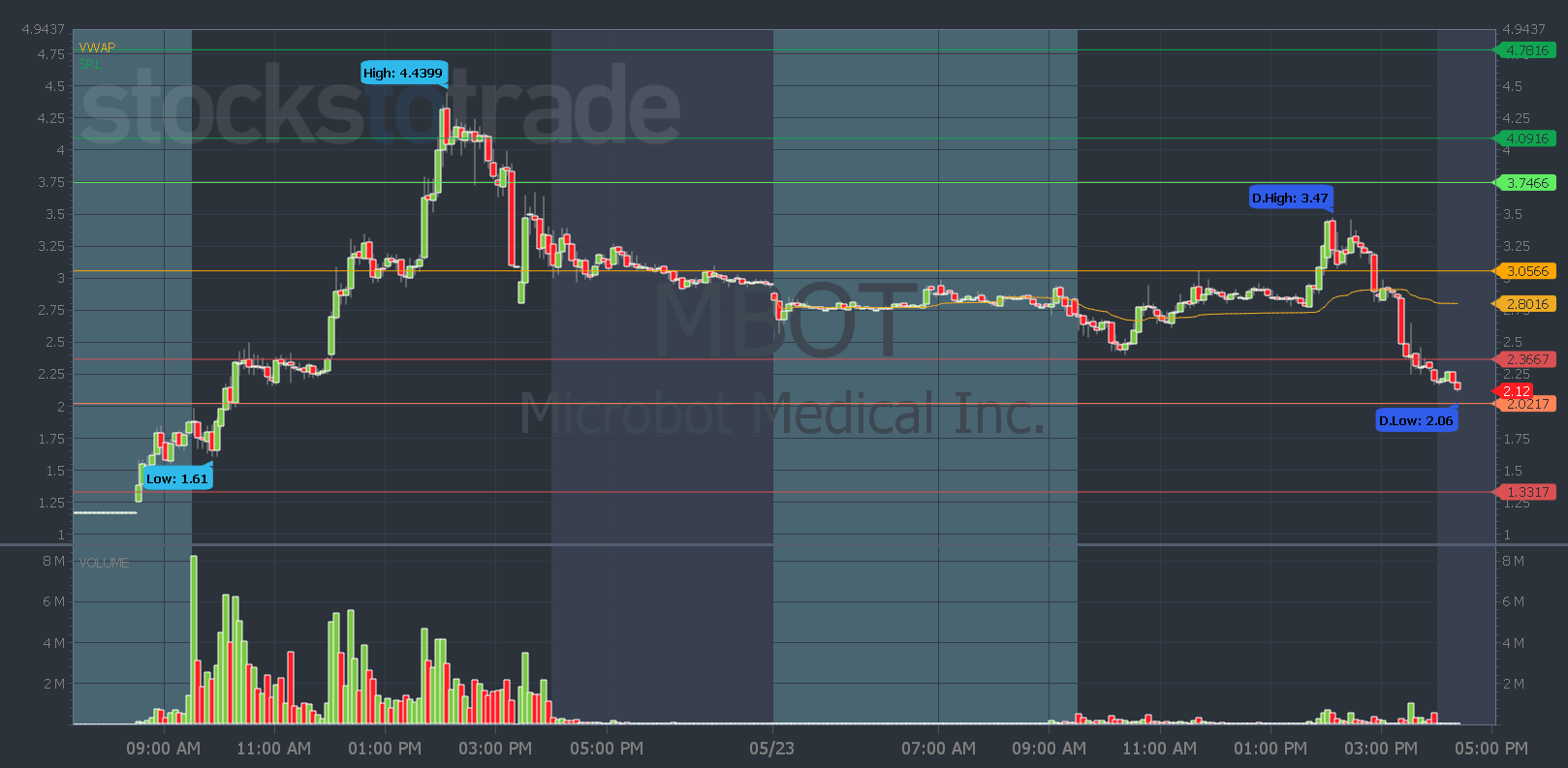

Microbot Medical Inc. (NASDAQ: MBOT)

Who could forget MBOT? This low-float biotech gained 250% on Monday after announcing a 100% success rate in its animal study.

And even after it announced nasty mid-day offering news, the stock still held up.

Yesterday it was looking good when it managed to make a brief red-to-green move. But it ended up closing weaker than I’d like.

Keep this one on watch towards the end of the week for a potential squeeze. But if it dies, it dies…

Get ready for any potential game plans with my Market Update videos three times per week.

If you want more timely trade ideas and plans — sign up for my daily morning alert and trade plan, plus, my top afternoon pick that I go over LIVE!

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade