A lot of people are getting burned trading sketchy penny stock IPOs…

They jump in on day one thinking they’ll ‘make bank bro,’ just because it’s a hot sector.

But trading a hot sector stock doesn’t mean you don’t need a plan…

If you jump in one of these IPOs on day one, you’re playing a guessing game.

That’s not what I teach.

And if you learn how to trade these opportunities safely, you can capitalize on these extremely volatile moves…

So allow me to explain the difference between trading these the right way and the wrong way…

The Latest Hot Sector

AMTD Digital Inc.’s (NASDAQ: HKD) crazy 12,900% gain sparked a hot market theme in recent IPOs.

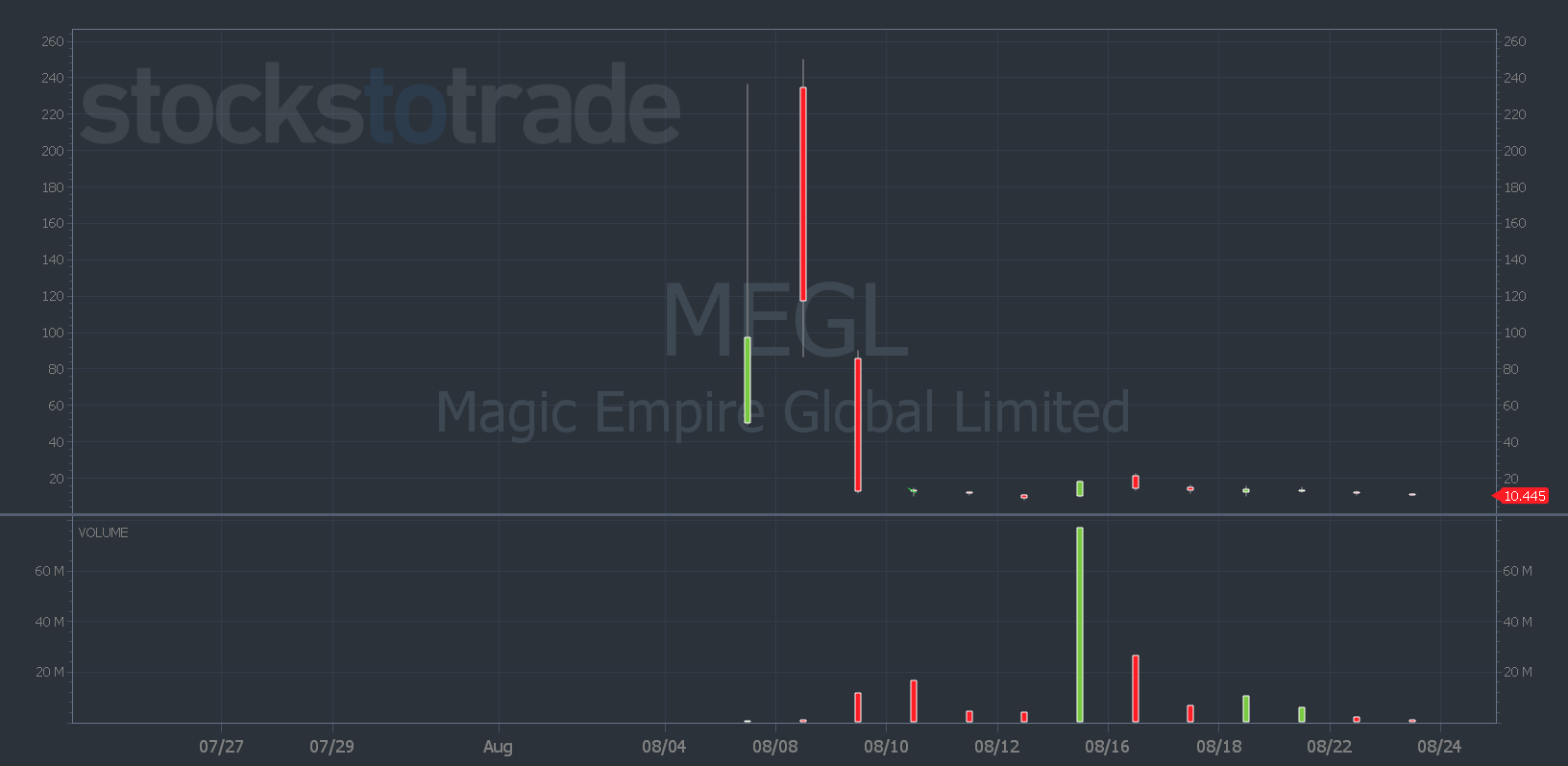

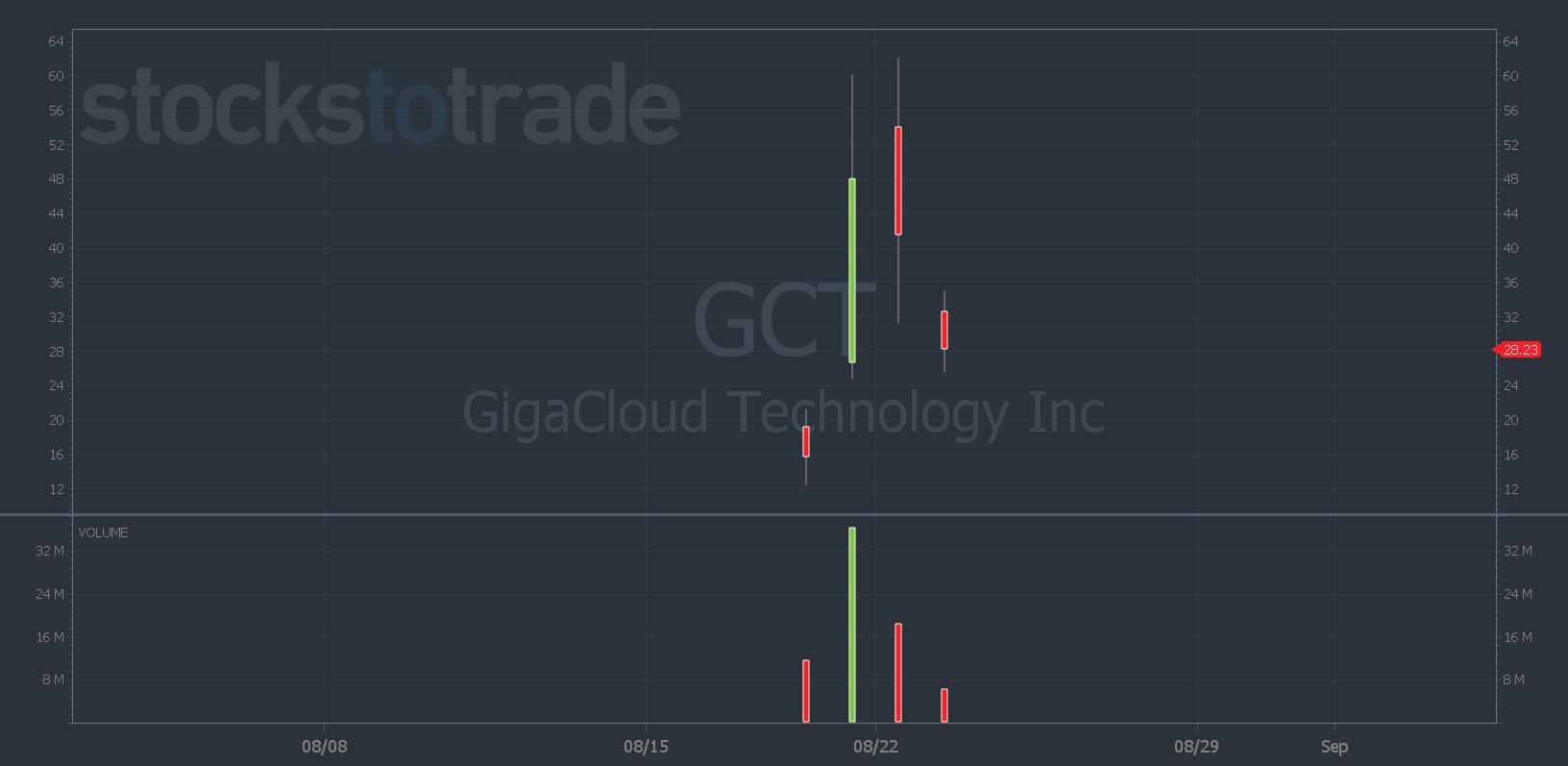

Specifically sketchy Chinese or Hong Kong-based penny stock IPOs. Just look at a few recent examples of these insanely volatile stocks…

But the hot sector and volatile moves don’t change my opinion about trading these on day one…

It’s not an ideal strategy.

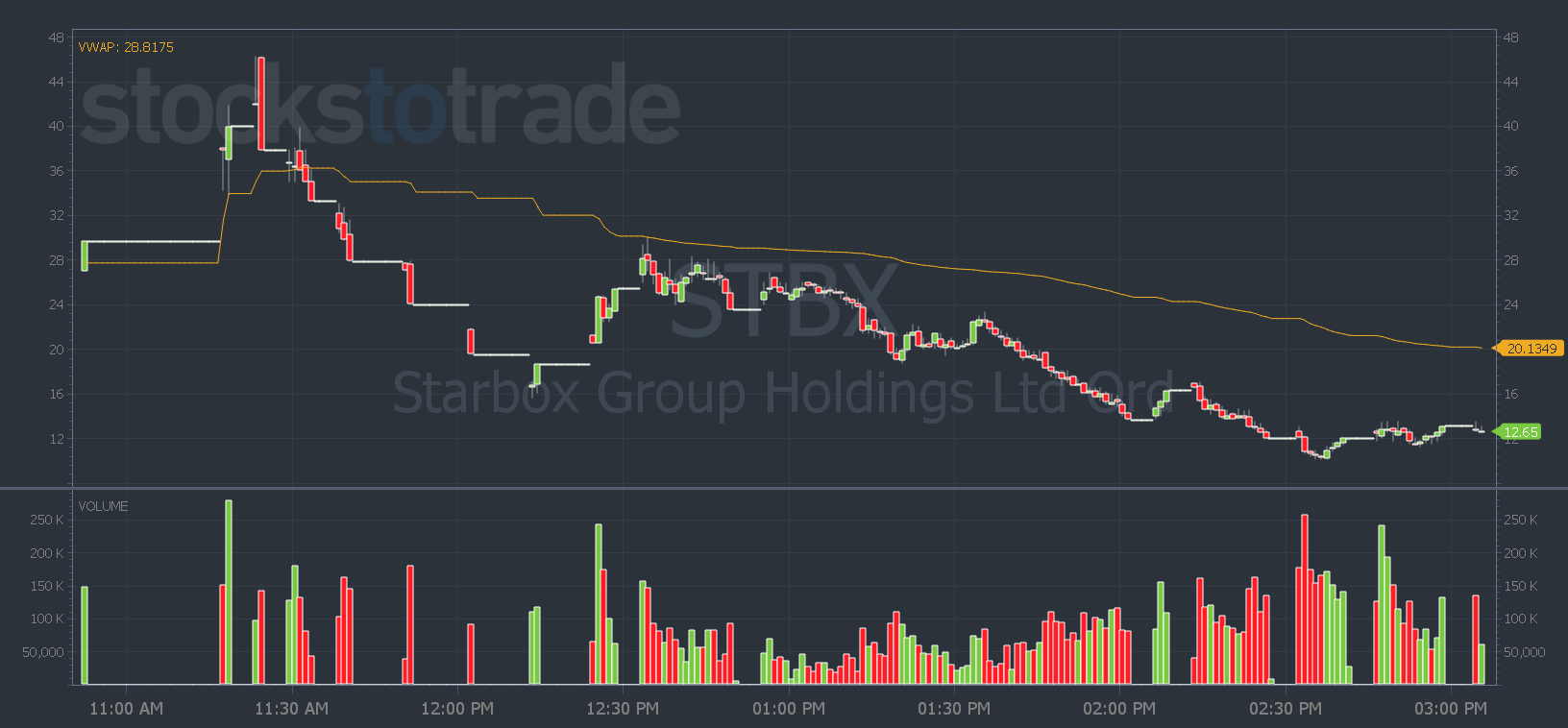

And yesterday’s IPO, Starbox Group Holdings Ltd. Ordinary Shares (NASDAQ: STBX), was a great example of why…

The stock opened at $27, spiked to $46.21, then slammed down to a low of $15.60. It sold off even more into the afternoon

How can you trade a stock like this?

I don’t see an edge there…

Not to mention the 10+ volatility halts you’d get caught in if you blindly bought in hoping for a profit…

I don’t play those guessing games.

How to Trade Recent IPOs

My style of trading is mostly based on technical analysis.

I like to look at key levels of support and resistance when planning my trades. But when a stock opens on its first trading day, there are no chart levels to base a plan on.

How can you make decisions on where to enter and exit without a chart history?

You can’t.

Now, usually, I’d say day one IPOs are an ignore.

But since this is a hot sector, I don’t think you should ignore these sketchy Chinese IPOs completely.

But don’t jump into a trade when it starts trading.

At least wait until the afternoon or the next day. That’s when you have some chart levels to make a plan.

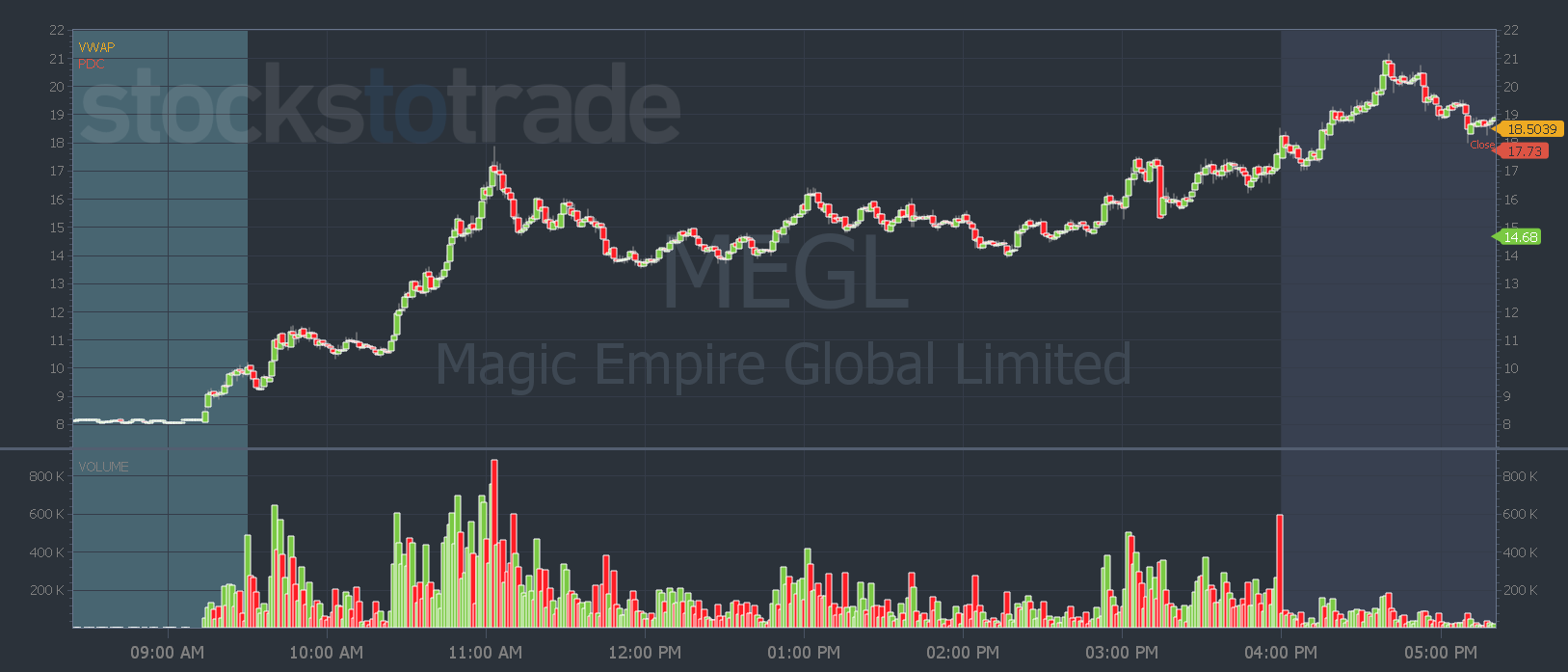

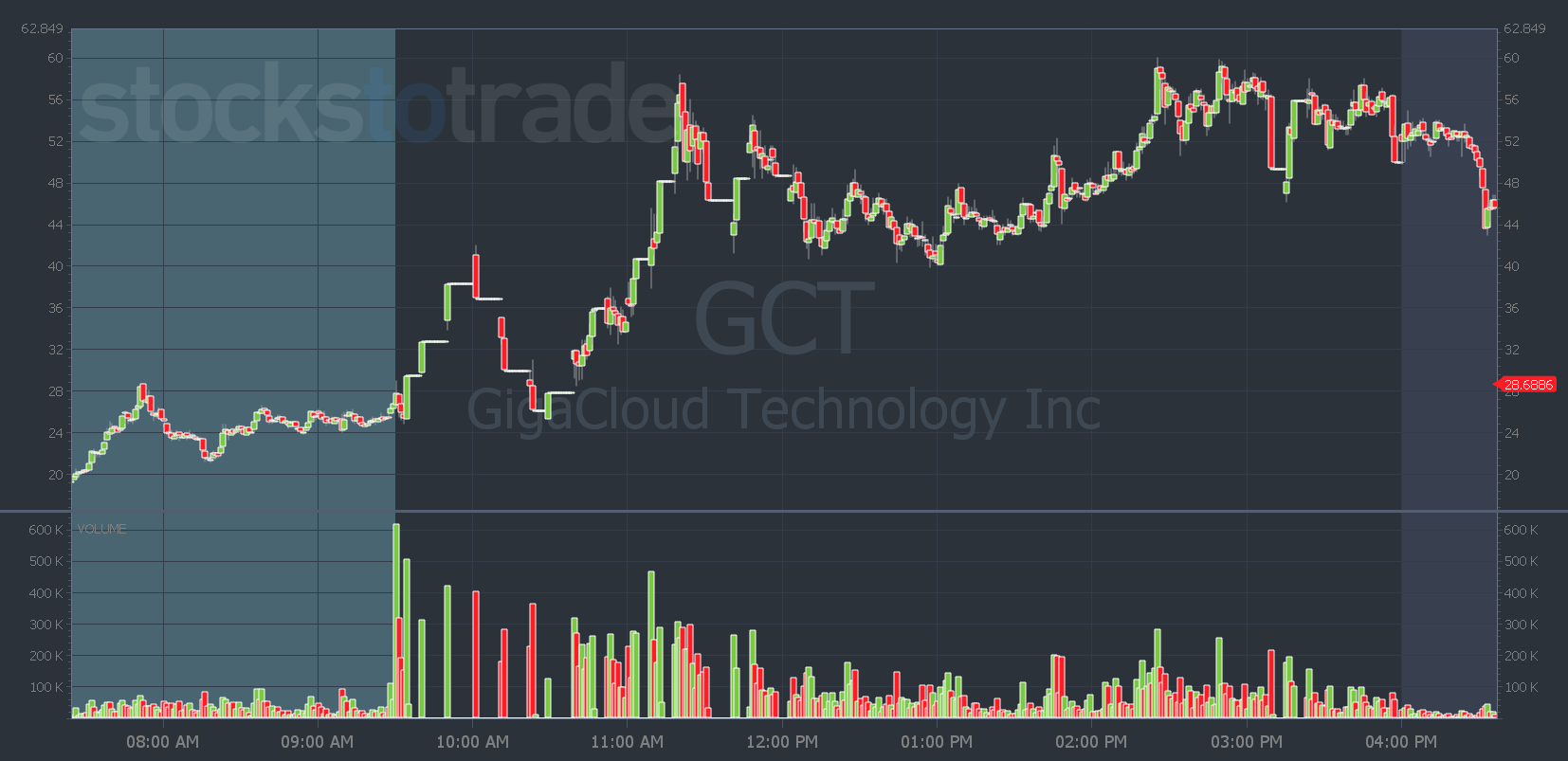

Both Magic Empire Global Limited (NASDAQ: MEGL) and GigaCloud Technology Inc. (NASDAQ: GCT) offered their best trading opportunities days after the IPO…

MEGL offered a dip and rip and afternoon VWAP hold into after hours on its seventh trading day…

And GCT had a beautiful dip and rip on its second trading day. But you had to deal with multiple volatility halts…

Those are just two examples of how waiting until a stock sets chart levels can help you make better plans rather than just chasing an entry on day one.

If you did that in STBX yesterday, you most likely ended up with a loss…

The stock faded all afternoon. But as we saw with the last two examples, it doesn’t mean it’s dead yet…

It could be a watch today for a potential red-to-green move. Since that’s where shorts should exit if they use any kind of risk management strategy.

You can learn more about how to trade this hot sector here.

And join me on Pre-Market Prep to see if STBX makes my daily watchlist.

Have a great day everyone. I’ll see you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade