What can cause a stock to drop 50% in a matter of minutes?

Leaving anyone holding stuck like a deer in the headlights just hoping for a bounce to sell into…

But the bounce doesn’t come. The stock just keeps going lower…

It’s a common phenomenon for penny stocks. So if you don’t know what it is, I’m going to explain it to you today…

It’s part of the penny stock lifecycle and how they stay in business.

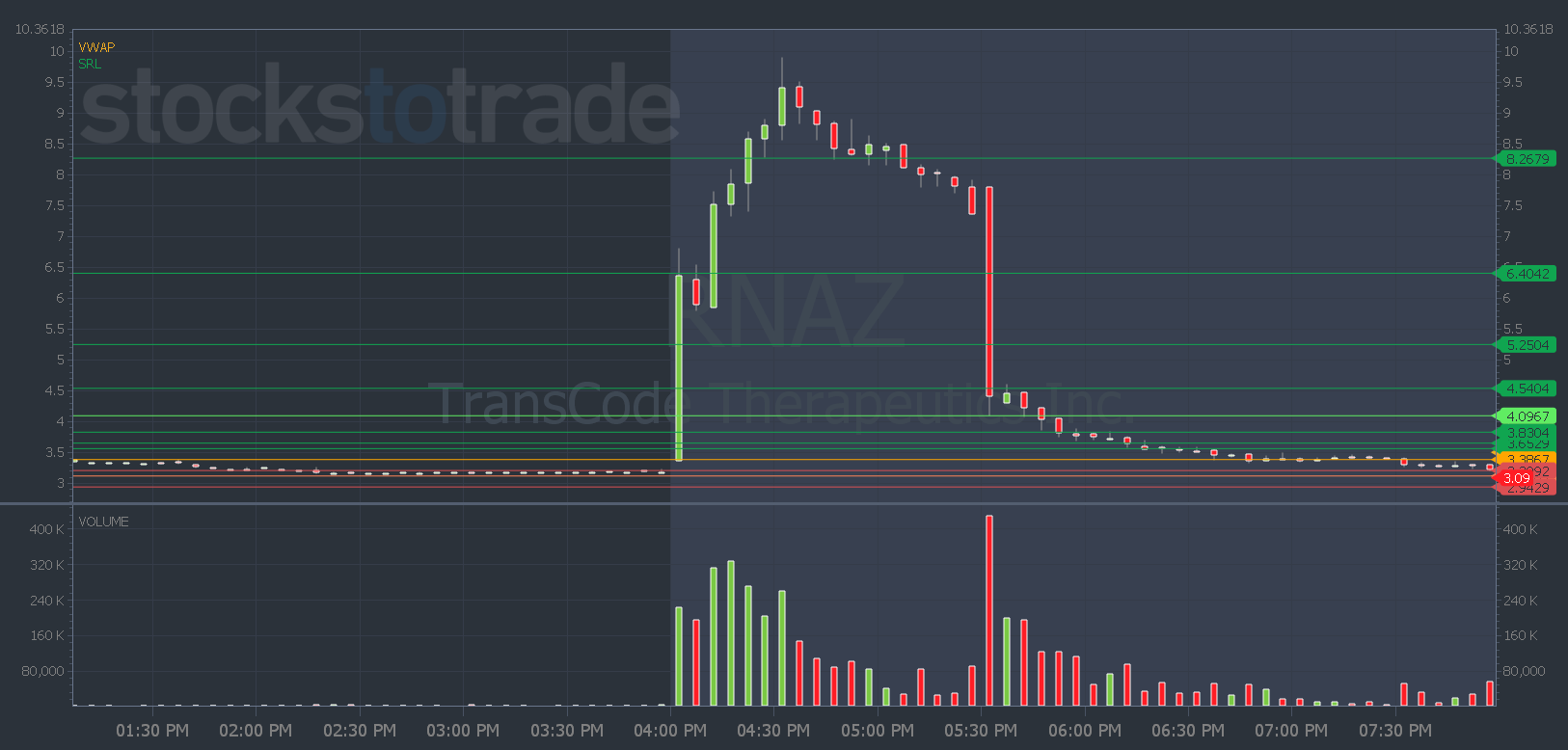

And TransCode Therapeutics, Inc. (NASDAQ: RNAZ) gave us a perfect example of it after hours on Tuesday…

These news announcements can have a big impact on a stock’s price and how it will move in the near future…

If you’re a bag holder in Mullen Automotive, Inc. (NASDAQ: MULN), you know what I mean.

So let’s break down dilution, how it affects stocks, your trading, and how you can reduce your risks…

What Is Dilution In Penny Stocks?

When a company issues new shares, it dilutes the existing stock. Think of it like watering down your black coffee — each sip now has less flavor.

Similarly, when a company dilutes shares, each share has less value.

The company’s market cap remains the same, but there are more shares trading, which lowers the value of existing shareholders’ positions.

There are several ways shares can become diluted. Warrants can be exchanged for stock, convertible bonds can be converted into stock, and there are dilutive stock offerings.

A dilutive stock offering happens when a company introduces new shares into the market.

Money-losing companies do this to raise money, which is common in the world of penny stocks.

Is Stock Dilution Good or Bad?

In the case of penny stocks, dilutive stock offerings are usually bad news. However, there are exceptions…

Say a stock has a low float of around three million shares … And the stock rips higher on some kind of positive news.

Then the company announces an offering the next day for another one million shares at a price close to the current market price.

Well, it’s still a low-float stock. The company didn’t sell stocks at much of a discount, and it means the company now has some money.

And if the stock’s still trading high volume from the positive catalyst, it might continue to run…

And shorts who thought the offering was bad news will get squeezed.

But the worst kind of dilution is what I call toxic financing…

That happens when a company does an offering of a large number of shares at a way lower price than what it’s currently trading at.

Let’s look at RNAZ as an example…

Examples of Diluted Shares

RNAZ is the example I mentioned earlier.

The company announced positive preclinical trial results after hours on Tuesday.

Then, not even an hour and a half later, the company announced an offering.

You can’t make this stuff up. Click the links and look at the times of the press releases.

And this chart says it all…

The stock was trading around $8 when the company offered two million shares at $3.50 and warrants for more at $3.25.

Who wouldn’t cash those in at $8, $7, or even $5?

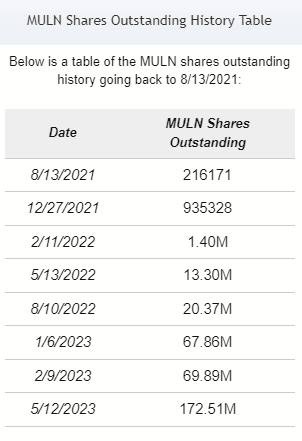

The conversation about RNAZ in my morning webinar yesterday reminded me of Mullen Automotive, Inc. (NASDAQ: MULN)…

The stock was great to day trade when EV stocks were the hot sector in 2021. I loved it for a while because it had a low float and the potential for explosive moves.

The stock’s float was only around 213,000 shares in August 2021.

But then the company started doing offerings…

And as of May 2023, it has 172 million shares in the float. I’ve been warning traders to sell and get away from this stock as fast as possible for months!

Source: www.sharesoutstandinghistory.com

Now the stock is trading at around 50 cents per share. And that’s after the company did reverse splits to try to lift its stock price…

Only to dilute them again.

This is the penny stock lifecycle — reverse splits and dilution. And you need to know it.

Or you could become one of the bagholders stuck in these stocks with your account down over 90%.

Stay on top of breaking news, read SEC filings, and set tight stops to help you reduce the risk of being hit with toxic dilution.

If you want help navigating the crazy world of penny stocks — get my insights and lessons three times a week here.

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade