Penny stocks on Reddit, typically priced at $5 or less per share, offer opportunities for traders who are building small accounts. While these stocks are affordable, they often come with higher volatility and require different strategies from those used for larger, more established stocks. Our job is to identify the stocks that have the potential to make moves and be ready to trade them if those opportunities come about.

Table of Contents

- 1 7 Reddit Penny Stocks To Watch

- 2 What Are Reddit Penny Stocks?

- 3 Most Popular Reddit Penny Stocks Worth Considering in 2024

- 3.1 Cingulate Inc (NASDAQ: CING) — The Post-Short Squeeze Reddit Penny Stock

- 3.2 Coherus Biosciences Inc (NASDAQ: CHRS) — The FDA Approval Biotech Penny Stock

- 3.3 Altimmune Inc (NASDAQ: ALT) — The Multi-Week Runner Biotech Stock

- 3.4 CleanSpark, Inc. (NASDAQ: CLSK) — The IRIS Pick Bitcoin Mining Stock

- 3.5 Cardio Diagnostics Holdings Inc (NASDAQ: CDIO) — The Biotech Stock Bounce Play

- 3.6 Uber Technologies, Inc. (NYSE: UBER) — The Self-Driving Stock Swing Play

- 3.7 Nextplay Technologies Inc (NASDAQ: NXTP) — The Low-Float Short Squeeze Penny Stock

- 4 What to Consider When Trading Penny Stocks Popular on Reddit

- 5 Managing Penny Stock Risks

- 6 Key Takeaways

- 7 Frequently Asked Questions

7 Reddit Penny Stocks To Watch

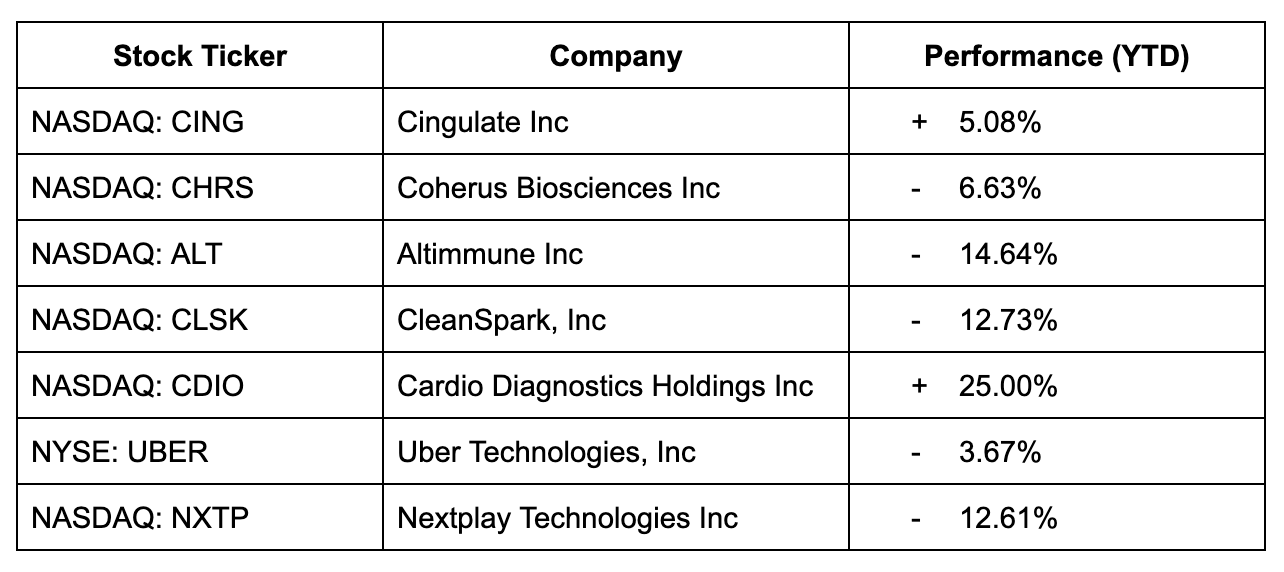

My top Reddit penny stock watchlist picks for 2024 — based on pattern, price action, and catalyst — include the following:

The top Reddit penny stocks in 2024 have the potential to do as well as the most famous Reddit penny stock of all — GameStop (NYSE: GME). In January of 2021, Reddit traders led the most famous short squeeze of all time, which resulted in at least one idiot hedge fund going bankrupt.

$GME shorts after hours…#GameStop #gamestonk #WallStreetBets pic.twitter.com/z4VWrQot2U

— StocksToTrade (@StocksToTrade) February 24, 2021

GameStop gained 1,700% in 3 weeks. In February, it ran another 550%.

This was the birth of the Reddit catalyst in penny stocks. Reddit traders figured out that they could share information just like Wall Street traders, and become a force! Sort of like the Transformers, but with more jokes.

What Are Reddit Penny Stocks?

What we call Reddit penny stocks are the stocks that are most popular on Reddit’s trading forums. Reddit has more subreddits dedicated to penny stocks than to celebrities like Iggy Azalea… The ‘r/pennystocks’ board has 1.9 million members, all discussing penny stocks.

The definition of penny stocks is any stock that trades under $5 per share — but it’s more than that. When I talk about penny stocks, I’m referring to stocks with sketchy business models and long-term projections. Penny stock can trade on major exchanges like the Nasdaq or NYSE, but the ones I really like to trade are on the over-the-counter (OTC) markets and pink sheets.

These are the penny stocks most prone to manipulation. When you’re reading about penny stocks on your Reddit social media feed — or in any internet communities — keep your guard up.

Most Popular Reddit Penny Stocks Worth Considering in 2024

My top Reddit penny stock picks for 2024 are:

- NASDAQ: CING — Cingulate Inc — The Post-Short Squeeze Reddit Penny Stock

- NASDAQ: CHRS — Coherus Biosciences Inc — The FDA Approval Biotech Penny Stock

- NASDAQ: ALT — Altimmune Inc — The Multi-Week Runner Biotech Stock

- NASDAQ: CLSK — CleanSpark, Inc. — The IRIS Pick Bitcoin Mining Stock

- NASDAQ: CDIO — Cardio Diagnostics Holdings Inc — The Biotech Stock Bounce Play

- NYSE: UBER — Uber Technologies, Inc. — The Self-Driving Stock Swing Play

- NASDAQ: NXTP — Nextplay Technologies Inc — The Low-Float Short Squeeze Penny Stock

Reddit conversations list stocks from all over the stock market — but some attract more attention than others. The following are some of the stocks that people on Reddit have been writing about the most…

There’s no guarantee I’ll trade any of these stocks. I’m watching them to see if they match my preferred setups — only then will I trade them.

The best traders watch more than they trade — that’s what I’m trying to model here.

Sign up to our NO-COST weekly watchlist here!

There’s no guarantee that any of my watchlist picks will be tradeable. But if something happens, smart traders should be ready.

Here’s some background info on Reddit penny stocks:

- What is the most promising Reddit penny stock?

A stock with a lot of volatility like Cardio Diagnostics Holdings Inc (NASDAQ: CDIO) is a promising Reddit penny stock. But remember — we’re traders, not investors. We’re watching the stocks on this list for short-term volatility that we can trade, not predicting which of these stocks will still be around in 2030.

- What are the top 3 Reddit penny stocks to buy now?

My top 3 Reddit penny stocks to buy now (as long as their price action is strong) are Coherus Biosciences Inc (NASDAQ: CHRS), Cingulate Inc (NASDAQ: CING), and Cardio Diagnostics Holdings, Inc. (NASDAQ: CDIO).

- Which Reddit penny stocks have a “Strong Buy” analyst rating?

Analysts don’t give any Reddit penny stocks “strong buy” ratings. These stocks are sketchy and unstable — you should never “invest” in them. Always trade with a plan.

Let’s get to the picks …

Cingulate Inc (NASDAQ: CING) — The Post-Short Squeeze Reddit Penny Stock

My first Reddit stock pick is Cingulate Inc (NASDAQ: CING).

All of the stocks that we trade have a reason for the price spike.

If a stock is spiking and we don’t know why, we want to stay away from it.

But there’s a catch …

To the untrained eye, some catalysts are more difficult to identify than others.

When we look at the CING chart with news notifications, it doesn’t seem there was a news catalyst to initiate the spike, now totaling more than 540%.

The spike starts before there’s any news.

From the lack of an obvious catalyst, it might look like a stock we should ignore.

However, experienced traders recognize a short squeeze when they see one.

This stock sank lower for months. That makes it a short seller’s paradise.

But there’s a problem with the short-selling thesis.

If there are too many short sellers in a stock, any bullish momentum could cause more shorts to panic. They have to buy shares to exit the position, and the result is a massive short squeeze.

It’s the worst-case scenario for short sellers. But it’s highly lucrative for long-biased traders.

The chart shows a key area of consolidation right now above $7.

There’s a chance it squeezes higher. Pay attention to key areas of support and resistance.

Coherus Biosciences Inc (NASDAQ: CHRS) — The FDA Approval Biotech Penny Stock

My second Reddit stock pick is Coherus Biosciences Inc (NASDAQ: CHRS).

After the market closed on December 26, 2023, CING announced FDA approval for its therapy to decrease the chance of infection after chemotherapy treatment.

If the stock promoters had any idea how to play the game, they would have waited until Wednesday morning.

When penny stocks announce news in premarket, the spikes have all day to run.

The price still gapped up substantially on Wednesday. The spike totals 50% right now. But I think it could push higher.

FDA news is a big deal for penny stocks. Especially if it’s related to cancer.

The chart shows a lot of support as the price consolidated near recent highs.

We don’t want to buy an overextended stock. But if the price can push off solid support, that makes for a great trade setup as prices push higher.

Altimmune Inc (NASDAQ: ALT) — The Multi-Week Runner Biotech Stock

My third Reddit stock pick is Altimmune Inc (NASDAQ: ALT).

Biotech stocks are red hot right now. 2024 looks to follow 2023 with biotechs as one of the hottest sectors.

That’s a trend we need to pay attention to as traders.

Especially when we find biotech stocks capable of spiking for days and weeks on end.

According to a JMP Securities report from December, Altimmune’s weight-loss drug performed better than competitors.

And over the month, prices spiked 290%.

Right now the chart is consolidating near the highs.

A glance at the daily chart shows us this stock has a history of running. And if the current spike is anything like the past few … We’re in for a wild ride.

The stock is attempting to bounce off $11 right now. Keep an eye on key levels.

CleanSpark, Inc. (NASDAQ: CLSK) — The IRIS Pick Bitcoin Mining Stock

My fourth Reddit stock pick is CleanSpark, Inc. (NASDAQ: CLSK).

In case you haven’t heard: Crypto is back.

In a sense …

The U.S. government is in the process of approving the first-ever Bitcoin ETF.

And as the ratification process continues, certain crypto coins are experiencing renewed spikes. We’re familiar with the volatile and speculative nature of cryptocurrencies. The right bullish news will cause a buying frenzy.

Take a look at the Bitcoin chart below …

The renewed crypto momentum is also causing certain stocks to spike.

CLSK is my #1 crypto play in the stock market.

The company works to patent and develop new and more efficient ways of creating energy.

And anyone who knows anything about crypto will remember the environmental footprint is a major talking point. To create new crypto, computers use a lot of energy to solve equations.

It takes a lot of electricity to run a technology-based financial market. And it seems CLSK is capitalizing on the renewed interest in crypto in tandem with the demand for less energy usage.

The stock spiked 290% in the last 2 months. And thankfully, prices pulled back on December 29.

We don’t want to buy an overextended stock.

Keep an eye on Bitcoin’s movements and *always* plan your trades with risk in mind.

Cardio Diagnostics Holdings Inc (NASDAQ: CDIO) — The Biotech Stock Bounce Play

My fifth Reddit stock pick is Cardio Diagnostics Holdings Inc (NASDAQ: CDIO).

It’s a textbook runner.

- Past spikers can spike again.

- In February and March, CDIO spiked 250% and 680% respectively. In December, the price launched 140%. And it’s approaching the breakout level.

- Hot sectors.

- The AI and biotech sectors are both hot right now. CDIO’s most recent spike started on October 31 after the company announced a new contract for its AI heart disease tests … It has a foot in both sectors.

- Hot catalysts.

- It keeps pushing out news. On December 19 it bragged that the Journal of the American Heart Association published its recent work.

- Low float.

- A low share supply helps the price spike higher. We aim for less than 10 million shares. CDIO has 16.6 million shares, which is close enough.

Uber Technologies, Inc. (NYSE: UBER) — The Self-Driving Stock Swing Play

My sixth Reddit stock pick is Uber Technologies, Inc. (NYSE: UBER).

When we’re trading stocks, even if it’s higher-priced and slower-moving like UBER, we have to focus on support and resistance.

Stocks like to trade between key levels. It’s kind of a self-fulfilling prophecy, caused by trader psychology.

Whole dollars and round numbers like $5 are more psychologically significant than in-between points like $5.36. Thus, we observe that prices can behave predictably around psychologically significant numbers. And knowing that, we can set our risk and goals appropriately.

That’s how we trade stocks.

UBER share prices are quickly approaching all-time highs.

The emergence of AI in 2023 boosted share prices for savvy tech companies. And Uber took advantage of the momentum.

- The company launched Uber AI to help solve scheduling difficulties.

- It’s also focused on providing more autonomous services with another initiative called Uber AV.

In 2023 share prices spiked 150%. In 2024 it’s on the brink of a breakout.

It’s slower moving than the penny stocks we usually trade.

That makes it a perfect candidate for swing-trade opportunities. But pay attention to key levels!

Nextplay Technologies Inc (NASDAQ: NXTP) — The Low-Float Short Squeeze Penny Stock

My seventh Reddit stock pick is Nextplay Technologies Inc (NASDAQ: NXTP).

The price launched 320% on December 22, 2023.

But get this: The company was notified by the SEC on December 7 that it risked delisting due to the untimely filing of its quarterly reports.

The stock is still trading because the company appealed for more time to satisfy the requirements.

This is a bearish catalyst. So why is it spiking?

It’s a short squeeze.

Degenerate short-sellers know that NXTP is a trash stock at risk of delisting. And that’s why, in their infinite “wisdom,” they short trash penny stocks that spike.

In the long term, they have the right idea. These plays will crash down eventually.

But in the short term, if there are too many short sellers in a stock, any bullish momentum could cause them to panic and get out.

They have to buy to cover to exit the position. And thus we see a domino effect of short sellers blowing up.

It’s dangerous for shorts. But It’s highly lucrative for long-biased traders.

Prices are consolidating right now. The squeeze could continue!

What to Consider When Trading Penny Stocks Popular on Reddit

When trading penny stocks popular on Reddit, you want to tread carefully. Reddit forums like r/WallStreetBets have become influential market movers, often driving sharp price increases in certain penny stocks.

Here’s the “but” — these price movements are driven by speculation and crowd mentality, not by a company’s fundamentals. That means these stocks could collapse as soon as the excitement dies down.

Do Thorough Research and Utilize Resources from the Community

In the world of penny stocks, knowledge is power. Armed with the right information, a savvy trader can spot an opportunity that others might overlook.

Reddit is a starting point, a place to find the pulse of the crowd. You’ll need to supplement the info you find there with your own detailed research.

Don’t just rely on the buzz in Reddit comments. Dig deeper. Take advantage of the wealth of data, resources, and technology available at your fingertips to unearth the facts about the company behind the stock.

For those looking to explore trading on Robinhood, understanding the nuances of Robinhood penny stocks can be a game-changer. From identifying trends to analyzing financials, the right tools can make a significant difference.

I use StocksToTrade to scan for news, tweets, earning reports, and more — all covered in its powerful news scanner.

It has the trading indicators, dynamic charts, and stock screening capabilities that traders like me look for in a platform. It also has a selection of add-on alerts services, so you can stay ahead of the curve.

Grab your 14-day StocksToTrade trial today — it’s only $7!

Monitor Market Trends and Analyze Companies’ Financials Carefully

When trading penny stocks, you’re not just investing in a company — you’re investing in the broader market too.

Keep your eyes on the NYSE, Nasdaq, and over-the-counter (OTC) markets to keep up with market sentiment.

Don’t stop at the chart. You should also check the company’s financials.

Is their balance sheet strong? Do they have positive cash flow? Do they have a viable business model? These questions help me decide whether to hold a stock overnight.

Set Your Risk Tolerance Appropriately

Trading penny stocks comes with as much downside as there is upside.

Set your risk tolerance appropriately. The true measure of a trader is how they respond to losing — so make sure any money you put into penny stocks is money you can afford to lose.

The volatility of penny stocks means they can experience significant price swings in a short period, and it’s up to you to protect your account.

Regularly Monitor Your Investments

If your trading strategy is a long-term one, make sure to regularly monitor your investments. This should be happening whether you’re trading penny stocks or blue-chip companies.

Keep a close eye on the news surrounding the companies you’re invested in. Regular monitoring allows you to react quickly to changes and make informed decisions based on the latest information.

Diversify Your Portfolio with Different Types of Assets

One investing strategy involves diversification.

You know that you don’t want to put all of your money into one stock — that’s a gambling maneuver, not a strategy. Diversification could include a mix of blue-chip stocks and hot runners, or it could include an asset mix.

If you’re interested in expanding your portfolio, consider exploring Nasdaq penny stocks to find potential hidden gems.

The only rule here is to make sure you research all your investments and build a trading plan that you stick to!

Managing Penny Stock Risks

Managing risk should be the most important part of your trading strategy.

Here’s what you should be paying attention to…

Risk Mitigation Techniques

Risk mitigation can involve strategies like diversification, hedging, and stop-loss orders. Don’t be afraid to exit a position if the chart is looking bad.

Remember: only losers hold losers!

Position Sizing

An essential part of risk management is position sizing.

New traders are usually too aggressive. They haven’t experienced the dangers of the markets.

Your number one job is to protect your account. Good position sizing insulates you from one trade hurting you too much.

When you start off, I recommend a fixed position size in dollars. For example, your position size could be $100 for each trade.

From there, you could move on to risk-based position sizing. This usually is measured in relation to the size of your overall account.

When you start day trading, stick to a small risk, like 1% or less of your account. That can potentially help you stay in the markets longer.

Position Size Calculator

Number of Shares = Account Value x Percentage Risk / (Entry Price – Stop Price)

Position Size = Number of Shares x Entry Price

Enter your stop price, entry price, percentage risk, and account value to find your risk-based position size.

Stop-Loss Orders

Stop-loss orders are a MUST for managing risk. Whether you set an automatic stop-loss or just have a clear plan in your head, cutting losses is essential.

Automatic stop-loss orders let you specify a price at which you’ll automatically sell a stock if it drops to that level. This can help you limit your losses if a stock’s price takes a dive.

Just be careful — if a stock falls through your stop AND your limit, it might not execute. This can leave you with bigger losses than you’d planned for.

Key Takeaways

Trading penny stocks, particularly for new traders, can be an effective strategy to grow your trading account. The key here is to always have a plan — and follow that plan. These penny stocks won’t make you rich, but if you trade with risk in mind they can make for some tidy day trading gains!

Here are a few key points to keep in mind:

- Be cautious with penny stocks: Many of these stocks have a questionable reputation — for a good reason! When trading penny stocks, be aware that the risk is often amplified due to the lack of extensive company information and the prevalence of questionable promotional tactics.

- Potential for significant gains: I like trading penny stocks because you can conservatively trade while still achieving substantial gains. These stocks have the potential to go supernova, and smart traders can protect themselves by focusing on “the meat of the move.”

- The companies are often in their early stages: A number of penny stocks represent relatively new companies. This means their market trajectory and valuation can change dramatically, presenting both opportunities and risks.

Although I’ve provided a list of seven penny stocks to keep an eye on within Reddit, it’s important not to blindly follow these picks. The key to successful trading is understanding the reasons behind each selection and applying that knowledge to develop your own list of stocks to watch. This approach, along with careful market observation and trading, will serve you well as you navigate the complexities of penny stock trading.

Have you traded penny stocks on Reddit? Write “I always trade with a plan” in the comments!

Frequently Asked Questions

What Are Penny Stocks?

Penny stocks are shares priced at $5 or less. They’re often in small, sketchy companies that have bad fundamentals and a lot of volatility. Many trade over-the-counter, rather than on major exchanges like the NYSE or Nasdaq.

Can You Get Rich from Penny Stocks?

While it’s possible to make big profits from penny stocks, it’s also risky. Without a conservative trading plan, you’re much more likely to blow up your account than become profitable.

Why Should I Consider Investing in Penny Stocks on Reddit?

I would never tell you to invest in any penny stock — they’re good for trading, not holding long-term. Reddit can be a good part of your research, but you should supplement it with research into a stock’s fundamentals, news, and chart.

Are Penny Stocks Riskier Than Other Investments?

Penny stocks are definitely riskier than most other investments. They’re more likely to move on speculation, not underlying value. Without a good trading plan, your investment will show just as much volatility as these stocks.