If you’re relying on Moving Average Convergence Divergence (MACD) crossovers for your trade entries and exits, timing is crucial. This timing affects not only the profitability of trades but also their risk exposure.

Read this article to learn how to effectively use MACD crossovers for timing your trade entries and exits! Here’s what I’ll cover:

- What is the Moving Average Convergence Divergence (MACD)?

- What are MACD crossovers?

- How can MACD crossovers indicate a change in price trend?

- What are the types of MACD crossovers?

- How do MACD crossovers assist in market analysis?

- How can you time your entry and exit points with MACD crossovers?

- How can integrating MACD crossovers into your trading strategy improve decision-making?

Let’s get to the content!

Table of Contents

- 1 What Is Moving Average Convergence Divergence (MACD)?

- 2 What Are MACD Crossovers?

- 3 Types of MACD Crossovers

- 4 The Role of MACD Crossovers in Market Analysis

- 5 How to Time Your Entry and Exit Points with MACD Crossovers

- 6 Integrating MACD Crossovers into Your Trading Strategy

- 7 Key Takeaways

- 8 Frequently Asked Questions

- 8.1 How Reliable Are MACD Crossovers for Predicting Market Movements?

- 8.2 Is It Necessary to Use MACD Crossovers With Other Technical Analysis Tools?

- 8.3 Can I Use MACD Crossovers for Both Short-Term and Long-Term Trading?

- 8.4 How Does a MACD Crossover Indicate Trading Opportunities?

- 8.5 What Chart Features Assist in Identifying Divergences?

- 8.6 Why Should Traders Combine MACD with Other Analysis Tools?

- 8.7 How Can LinkedIn and Learning Resources Improve Trading Success?

- 8.8 What Role Do Company Rates and Securities Play in Technical Analysis?

- 8.9 How Can Traders Use Distance and Series Analysis in Technical Case Studies?

What Is Moving Average Convergence Divergence (MACD)?

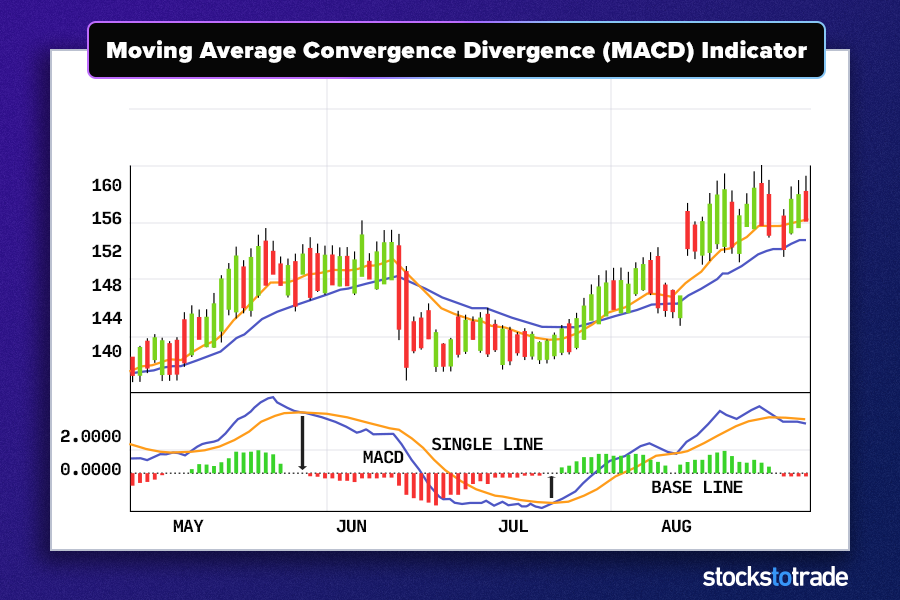

The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. The result of this calculation is the MACD line. A nine-day EMA of the MACD, called the “signal line,” is then plotted on top of the MACD line, which can function as a trigger for buy and sell signals. Traders also watch the histogram, which represents the difference between the MACD line and the signal line, to gauge momentum.

The MACD was developed by Gerald Appel in the late 1970s. It has become one of the most popular and widely used indicators in technical analysis due to its simplicity and flexibility. It can be applied to stocks, ETFs, forex, and even crypto markets, making it a versatile tool for various types of traders. Understanding the MACD’s components and their interaction helps traders predict price movement direction, speed, and duration, offering a valuable advantage in navigating diverse market conditions.

What Are MACD Crossovers?

A MACD crossover occurs when the MACD line crosses above or below the signal line. This event is viewed as a potential sign that a change in the direction of the price trend may be imminent, making it a critical moment for traders.

Traders interpret these signals to make educated decisions about opening or closing positions, often confirming these signals with other indicators or forms of analysis to increase the accuracy of their trades.

Types of MACD Crossovers

There are two basic types of MACD crossover — bullish and bearish crossovers.

Bullish Crossover

A bullish MACD crossover occurs when the MACD line moves above the signal line, typically indicating that upward momentum is increasing and the price might start to climb. This is a sign for traders to consider entering long positions.

- Recognize the crossover early by observing the MACD line’s upward movement toward the signal line.

- Confirm the trend by looking for increased volume or related bullish signals from other indicators.

Bearish Crossover

Conversely, a bearish crossover—where the MACD line falls below the signal line—suggests that downward momentum is building, and prices may begin to fall. This scenario often prompts traders to sell off holdings or enter short positions.

- Spot the bearish crossover as the MACD line begins to dip toward the signal line.

- Use additional verification like a volume spike or supporting signals from other technical analyses to confirm the bearish outlook.

The Role of MACD Crossovers in Market Analysis

MACD crossovers are integral to market analysis as they provide insights into potential price movements before they occur. The predictive value of these crossovers helps traders anticipate market shifts, allowing for proactive rather than reactive trading strategies. Whether identifying the start of a new trend or potential reversals, MACD crossovers give a quantifiable measure of momentum that can be a standalone tool or part of a broader analytical framework.

Understanding the broader implications of these signals within the context of market conditions and economic events can enhance their effectiveness. As a seasoned trader, I’ve learned the importance of integrating the nuanced signals from MACD with comprehensive market analysis, ensuring that every decision is supported by robust data and a clear understanding of market dynamics.

For traders aiming to deepen their technical analysis skills and leverage MACD effectively, it’s essential to explore comprehensive resources that explain the MACD’s complexities in detail. Here’s our in-depth guide on how to use the MACD indicator.

How to Time Your Entry and Exit Points with MACD Crossovers

Timing entry and exit points using MACD crossovers is both an art and a science, requiring a nuanced understanding of market signals and a disciplined trading approach.

Entry Points

When it comes to determining the optimal entry points using MACD, the focus should be on recognizing bullish or bearish crossovers as they align with other market indicators. This multi-faceted approach helps confirm the validity of the signal and reduces the likelihood of false positives.

- Identify a Bullish Crossover: Look for the MACD line to cross above the signal line, ideally accompanied by an increase in trading volume.

- Confirm with Additional Indicators: Use other technical tools, such as RSI or Stochastic oscillators, to confirm that the momentum truly supports a bullish entry.

- Watch for Market Context: Align your entry with broader market trends and economic indicators to ensure that external factors support the move.

From personal experience, integrating these steps helps in creating a more reliable entry strategy that leverages MACD effectiveness while minimizing risk.

Exit Points

Just as critical as knowing when to enter a trade is knowing when to exit. MACD crossovers can also guide this decision, ensuring that gains are preserved and losses are cut swiftly.

- Bearish Crossover as an Exit Signal: Initiate an exit when the MACD line crosses below the signal line, suggesting that the upward momentum is waning.

- Set Stop-Loss Orders: Always have a stop-loss in place to limit potential losses, adjusted according to the volatility and the specific risk tolerance.

- Monitor the Strength of the Trend: Keep an eye on the histogram; diminishing bars might indicate that the trend is losing strength, reinforcing the decision to exit.

Implementing these exit strategies has proven essential in my trading, ensuring that profitable trades are not left to turn into losses and that risk is systematically managed.

Integrating MACD Crossovers into Your Trading Strategy

Blending MACD crossover signals with other technical analysis tools creates a robust trading strategy that can enhance predictive accuracy and improve decision-making. By combining MACD with tools like Bollinger Bands for volatility, Fibonacci retracement levels for price points, and moving averages for trend confirmation, traders can build a comprehensive view of the market.

- Use Multiple Indicators for Confirmation: Combining MACD with other indicators can help filter out noise and refine trading signals.

- Backtesting Is Crucial: Before fully integrating MACD into your trading strategy, backtest it against historical data to understand how well it performs under different market conditions. This practice, which I regularly follow, not only builds confidence in the strategies but also helps identify potential adjustments for improved performance.

To do effective technical analysis, you’ll need a powerful trading platform.

StocksToTrade has the trading indicators, dynamic charts, and stock screening capabilities that traders like me look for in a platform. It also has a selection of add-on alerts services, so you can stay ahead of the curve.

Grab your 14-day StocksToTrade trial today — it’s only $7!

Key Takeaways

- MACD Crossovers Provide Essential Market Insights: They are crucial for identifying potential trend reversals and momentum shifts in the market.

- Timely Entries and Exits Are Key: The effective use of MACD can help time these crucial decisions, enhancing the potential for profit and reducing risk.

- Integrate for Comprehensive Analysis: MACD crossovers should be used as part of a broader set of analytical tools to ensure well-rounded trading decisions.

There are a ton of ways to build day trading careers… But all of them start with the basics.

Before you even think about becoming profitable, you’ll need to build a solid foundation. That’s what I help my students do every day — scanning the market, outlining trading plans, and answering any questions that come up.

You can check out the NO-COST webinar here for a closer look at how profitable traders go about preparing for the trading day!

How do YOU use the MACD indicator? Let me know in the comments!

Frequently Asked Questions

How Reliable Are MACD Crossovers for Predicting Market Movements?

MACD crossovers are generally reliable indicators of changes in momentum and can signal potential price movements. However, their predictive accuracy can be affected by market volatility and should ideally be used in conjunction with other indicators for best results.

Is It Necessary to Use MACD Crossovers With Other Technical Analysis Tools?

Yes, integrating MACD crossovers with other technical analysis tools can provide a more thorough understanding of market conditions, leading to more informed trading decisions. This combination allows traders to confirm signals and minimize the risk of false positives.

Can I Use MACD Crossovers for Both Short-Term and Long-Term Trading?

MACD crossovers are versatile and can be adapted for both short-term and long-term trading strategies. For short-term traders, they offer quick insights into market momentum, while long-term traders can use them to gauge the strength of ongoing trends.

How Does a MACD Crossover Indicate Trading Opportunities?

The MACD crossover is a crucial event in technical analysis indicating potential buying or selling opportunities. It occurs when the MACD line (the difference between two EMAs) crosses above or below the signal line, which is a smoother version of the MACD line. This crossover can signal the start of an uptrend or downtrend. Traders use this indication alongside other tools such as trendlines and divergences to confirm the strength and potential duration of the trend.

What Chart Features Assist in Identifying Divergences?

Identifying divergences in trading involves observing discrepancies between price action and indicators on a chart. When the price chart shows new highs or lows that are not mirrored by the MACD, this divergence can indicate a weakening trend and potential price reversal. Effective use of charts to spot these divergences includes tracking the movements of EMAs and signal lines, which provide a visual representation of market momentum and shifts.

Why Should Traders Combine MACD with Other Analysis Tools?

Combining MACD with other analysis tools enhances trading strategy effectiveness. For example, using trendlines with MACD can help confirm trend reversals or continuations signaled by MACD crossovers. Additionally, observing pullbacks and overall price action in relation to these tools can provide a more robust understanding of market conditions, helping traders decide when to enter or exit trades.

How Can LinkedIn and Learning Resources Improve Trading Success?

LinkedIn and other learning resources can significantly enhance a trader’s success by providing educational content, real-life trading examples, and professional advice. Engaging with trading communities on LinkedIn allows traders to exchange insights, discuss strategies, and keep up with market trends. Learning from the successes and failures of others through detailed examples helps traders refine their techniques and avoid common pitfalls.

What Role Do Company Rates and Securities Play in Technical Analysis?

In technical analysis, the performance of company securities is closely monitored to make informed trading decisions. Analyzing how securities react to changes in interest rates, for instance, can offer insights into potential market movements. Additionally, observing the trading patterns of various companies helps investors identify which stocks might be poised for a sell or buy, based on technical signals like the MACD crossover.

How Can Traders Use Distance and Series Analysis in Technical Case Studies?

In technical case studies, analyzing the distance between price points and moving averages helps traders gauge market momentum and potential reversal zones. By studying a series of price actions, traders can identify patterns and trends that may not be evident from a single data point. Effective site navigation on trading platforms also plays a crucial role, allowing traders to access historical data and various analytical tools efficiently. This holistic approach helps in developing well-rounded trading strategies based on comprehensive market analysis.