A big part of trading is pattern recognition. It’s one of the reasons I tell traders to study charts until their eyes bleed…

Anyone can recognize a pattern after the fact … But the real money is made when you can spot them while they’re unfolding.

But where do you start? And how does it all work?

Today I’m going to show you two charts with a similar pattern. One of them is in the middle stages of pattern progression…

Study these and keep your eye on this stock — we’ll see if the finishing move plays out today…

If you missed last night’s big crypto announcement — catch the replay here!

Day Three Surge Pattern

The reason patterns work is because traders believe they work. They become self-fulfilling prophecies. And that’s why it’s such a critical part of learning to trade…

I previously broke down the day three surge in another big runner here.

But let’s break down two more charts and see if you can see the similarities. That way you can prepare to strike if the pattern fully plays out today…

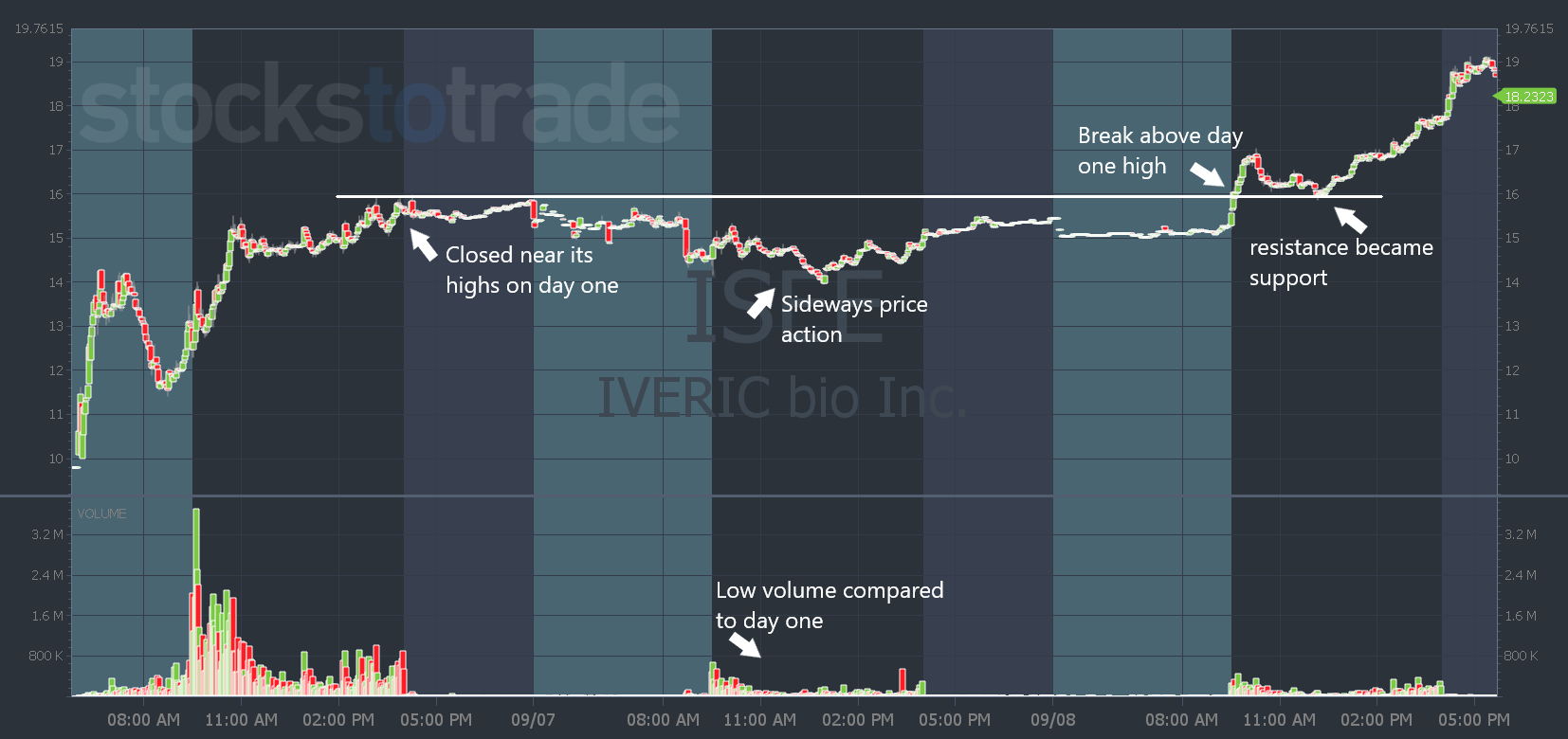

Last week IVERIC bio, Inc. (NASDAQ: ISEE) had a beautiful day three surge.

First, it had a massive day one move on Phase 3 clinical trial news and closed near its daily high.

Then, on day two it traded sideways on lower volume. On day three it broke the high from day one.

Study this chart!

Because now, I see a similar setup in another recent runner …

My number one watch on Tuesday was Akero Therapeutics, Inc. (NASDAQ: AKRO). It had a big day one move in premarket. And it closed right near its highs.

And in the morning SteadyTrade Team webinar yesterday, my day two squeeze idea was to watch it for a break above $30 at any time of the day.

That move didn’t happen…

But it did trend sideways on lower volume than its first day. And as you saw in my example above — it’s exactly what we look for before a potential day three surge…

While it trades low volume as it goes sideways, high volume can come in when it breaks above that key level and buyers come in.

As I started off saying, patterns work because traders believe they work. Then they become self-fulfilling prophecies…

When a trashy lowish float stock closes near the high of the day — everyone knows to watch it.

We don’t try to trade obscure proprietary patterns that nobody knows about…

And we’re not the only traders watching $30 as a key level.

That’s why the best trades are the obvious ones. And when one pattern doesn’t play out, it can often set the stage for another one to take the spotlight.

So today, focus on quality over quantity when picking which stocks and patterns to focus on.

AKRO has the potential to squeeze over $30. But also watch the premarket high of $32 from Tuesday as possible resistance.

Make a plan with a risk level and position size you’re comfortable with. And try to aim for a 3:1 risk/reward when planning a goal for your trade.

Have a great day everyone. See you all back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade