Most of the meme stocks failed yesterday as the overall markets opened red…

Some more experienced traders might’ve been looking to short these stocks after their big runs this week.

Like I said yesterday, shorts are trying to guess the top…

But that’s how they’ve gotten blown up trying to short these the last few days. It’s not a viable strategy…

Now, I’m not against shorting. But there’s a right way to do it.

So today I’ll show you three chart examples that show you where to focus when sector hype slows down…

Should You Short Hot Sectors?

As long traders, we want to ride the momentum to the upside…

We want to see a stock show strength, trade high volume, and break key levels.

With shorting it’s the opposite…

You want to see a stock look weak…

A stock that’s trading low volume that takes out support levels as it goes lower.

So if you short sell — ignore hot sectors altogether when they have upside momentum.

But eventually, the hype will fade and almost every penny stock will fail.

That’s when the shorts can take over…

Is It Time to Short Meme Stonks?

When a sector is hot, there’s typically a sector leader…

One stock that trades ridiculously high volume, takes out resistance levels, has massive percent gains, and looks super strong.

Once we get that, usually the other sector stocks start to pop in sympathy…

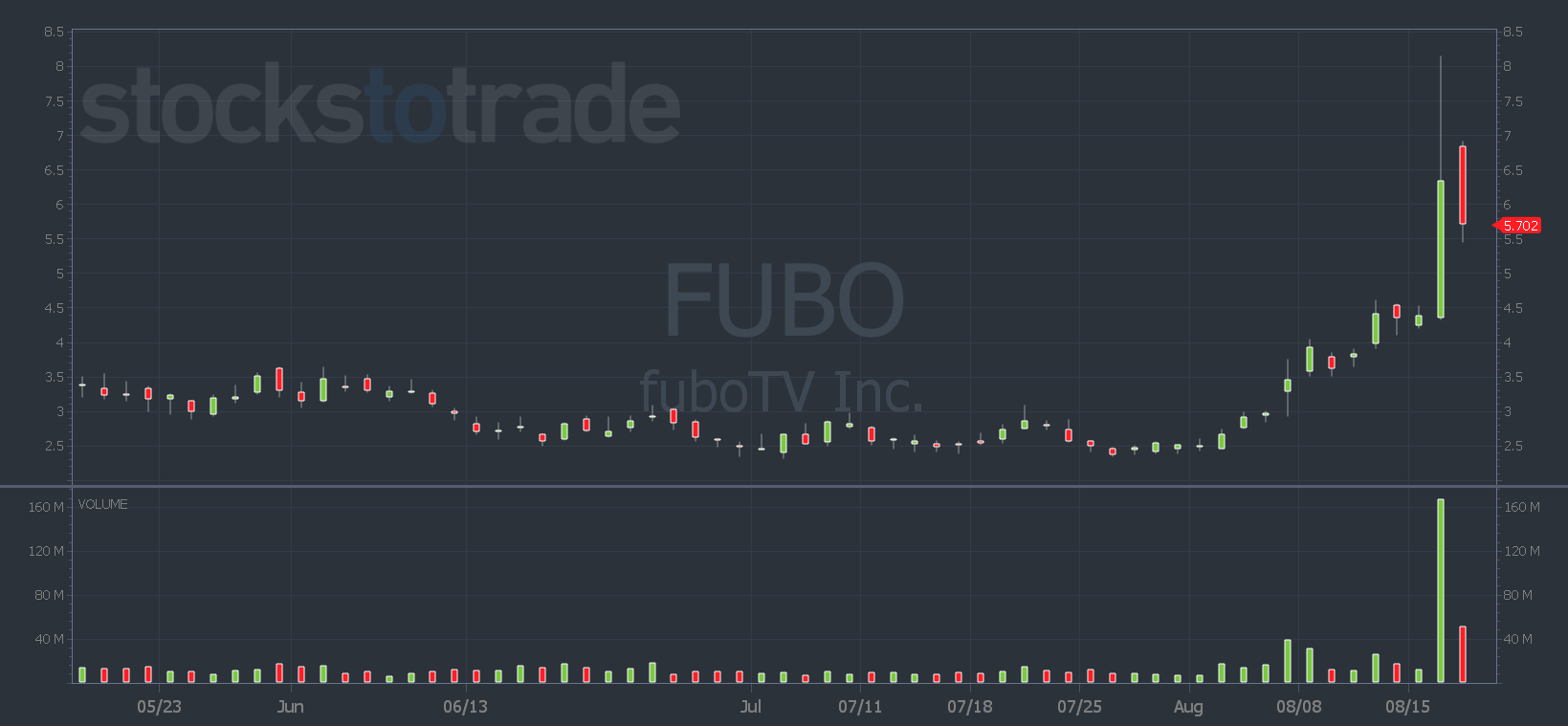

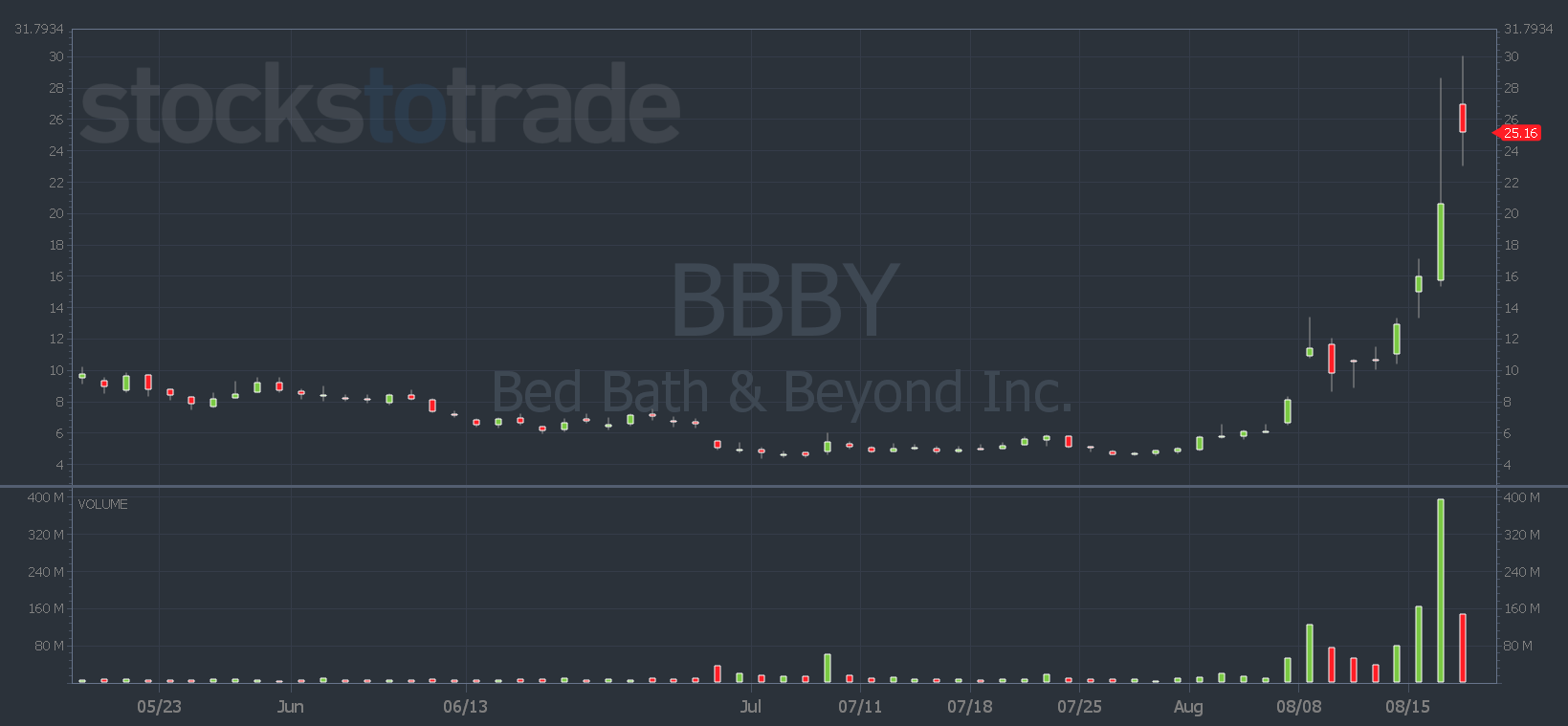

You can see below that Bed Bath & Beyond Inc. (NASDAQ: BBBY) is the meme stock sector leader…

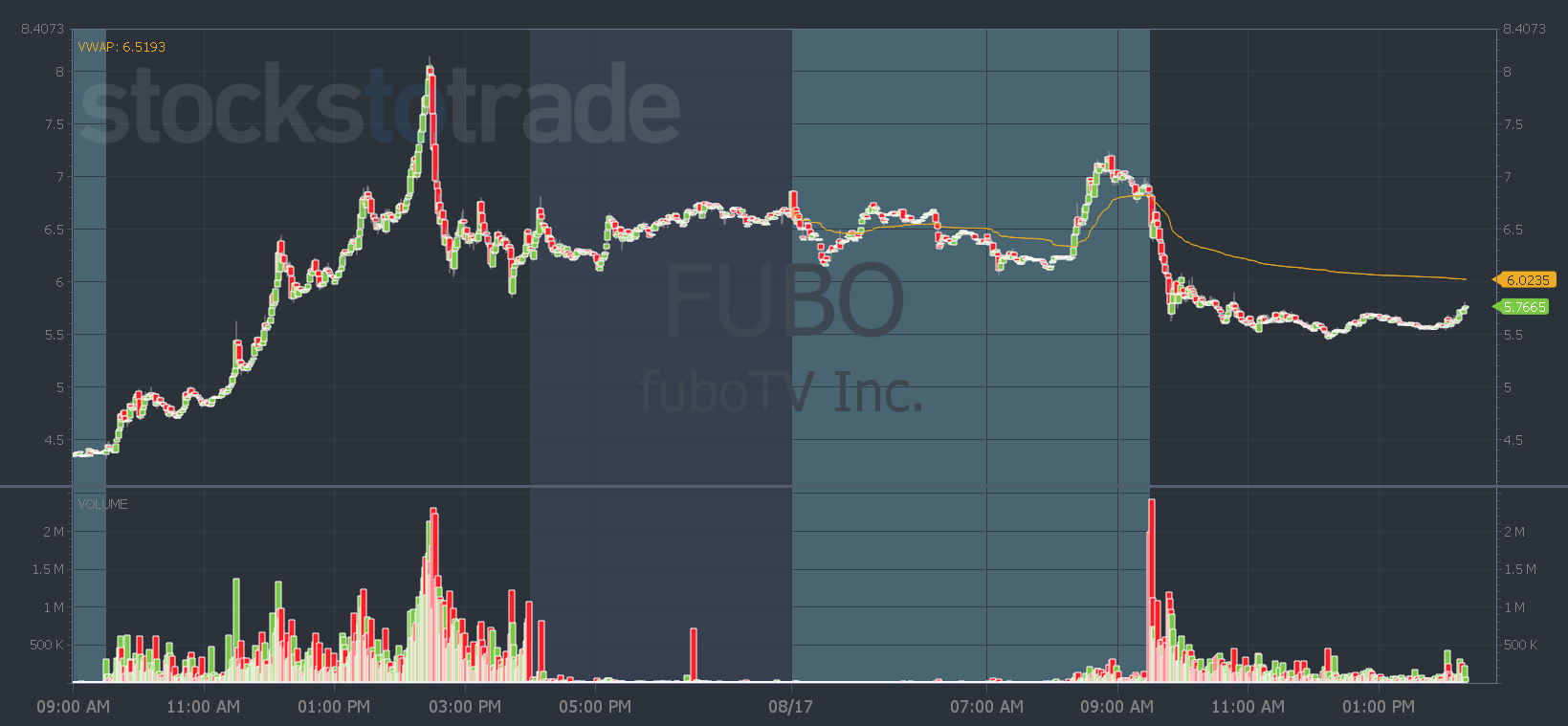

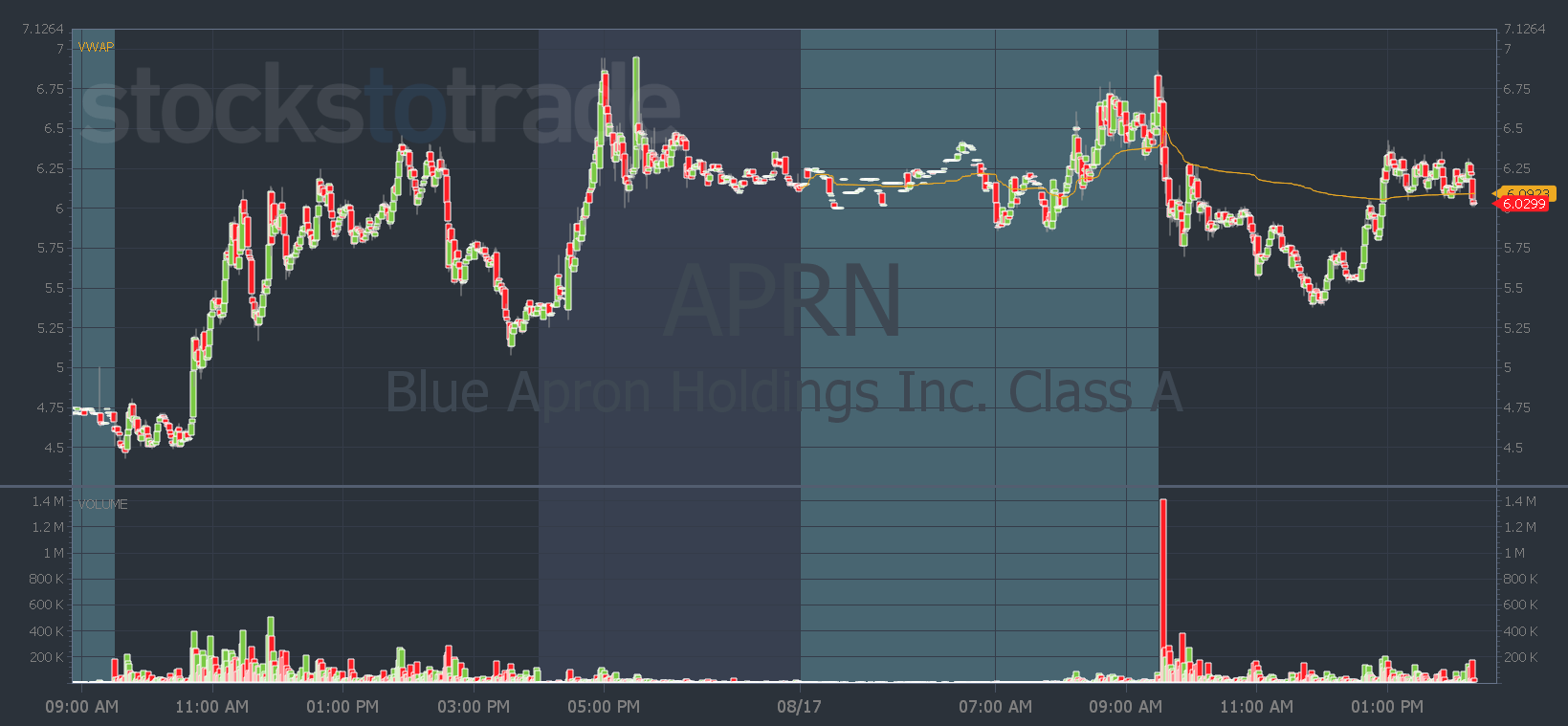

Compared to fuboTV Inc. (NYSE: FUBO) and Blue Apron Holdings, Inc. (NYSE: APRN), it traded the highest volume. It also ran for multiple days before the sympathy plays started moving, and it had the biggest gains…

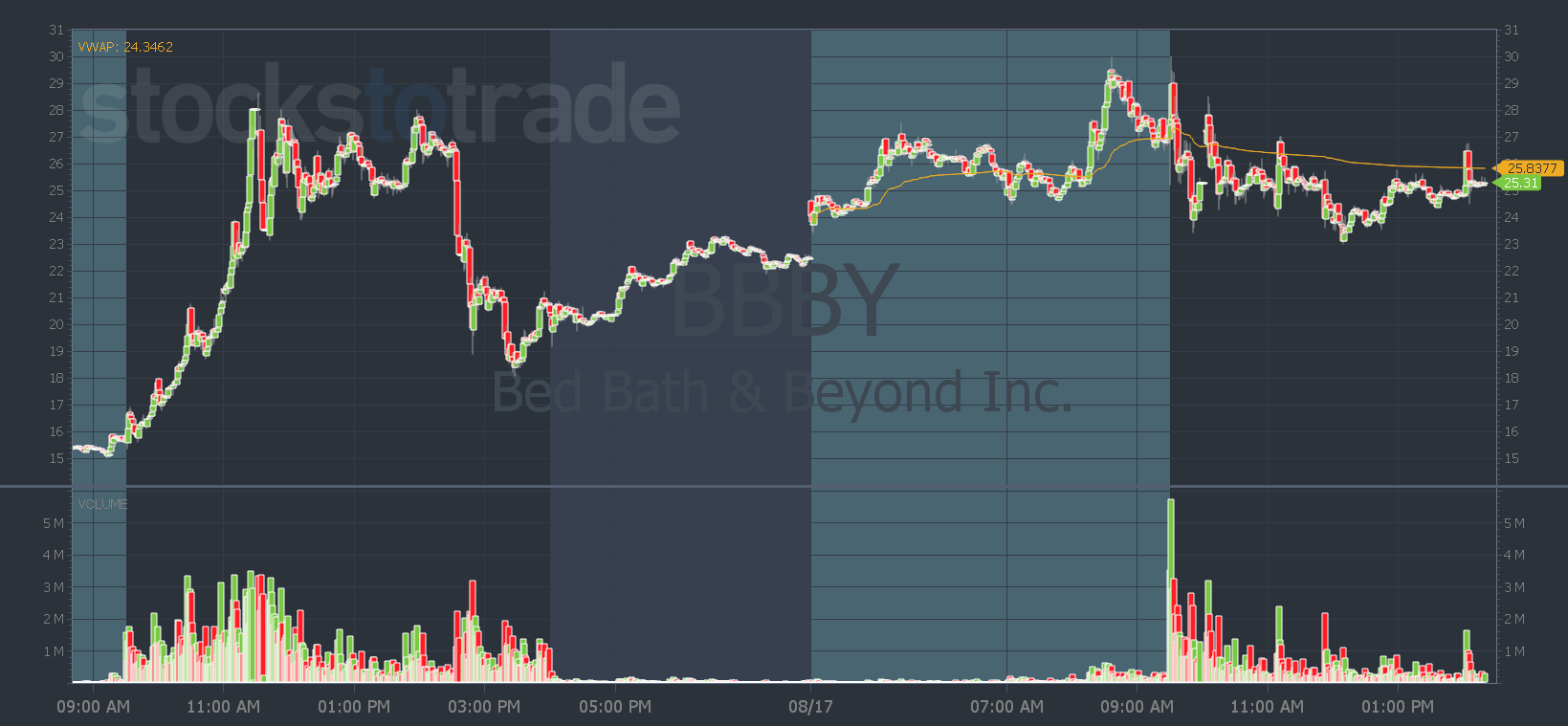

But when they all started fading on Tuesday afternoon, look which ones died first…

BBBY was able to bounce back on Wednesday morning and hold some of its gains after the sell off…

The sympathy plays weren’t as lucky. Once the market opened they fell off a cliff…

So if you want to try your hand at shorting, or maybe looking to add a new strategy to your shorting playbook, consider approaching sector stocks this way…

Don’t try to guess the top when they still have lots of momentum. And watch the sector leader as the guide.

Once it looks like weakness is hitting a sector, look for the sympathy plays to die first.

And always take profits…

As you can see on the APDN chart, hot sector stocks can bounce back, so don’t get caught being stubborn.

And the meme stocks might not be dead yet…

Watch Pre-Market Prep to find out if meme stocks are a top watch for me today, or if the sector’s dead.

Have a great day everyone. I’ll see you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade