IPOs are all the rage right now. They’re all anyone wanted to talk about last week…

Who can blame them though when we’ve seen such incredible gainers?

Starbox Group Holdings Ltd. (NASDAQ: STBX) had a 70%+ move on its first day…

Mobilicom Limited (NASDAQ: MOB) saw gains of 66%…

And bioAffinity Technologies, Inc. (NASDAQ: BIAF) gained 85%!

But it’s not as simple to trade these wild movers as some other stocks.

They halt like crazy which can instill panic in any trader if you get stuck in one…

Plus, it’s tough to determine a good entry and exit without a chart history.

So how can you trade these and still stay safe? And what do you do if you’re caught in a halt?

Read on to find out why these halts happen and how you can cope if you get caught in one.

Plus, I’ll share the next potential hot IPO set to debut this week…

Get all my timely trade ideas and plans every morning in Pre-Market Prep!

Volatility Halts

If you’ve never dealt with stock halts before, last week was your crash course. If you were trying to trade any of the hot IPOs, the halts were nothing less than frustrating.

So why do halts happen?

There are all kinds of market events that can trigger trading halts, pending news, an SEC investigation, or in the case of most of these IPOs — volatility.

Single-stock volatility halts follow the SEC’s limit up-limit down (LULD) rule. This rule came into effect in 2013 and affects all stocks.

It defines limits within which stocks can safely trade. When a stock trades outside of its price threshold for 15 seconds or more, that triggers a halt.

Volatility halts typically only last for five to 10 minutes. But when you’re caught in one it can feel like an eternity…

When trading opens up after a halt, the current price will become the new LULD reference point.

And if the price fluctuates above or below the threshold again, it will trigger another halt.

For a list of current Nasdaq halts, check out this page.

What to Do If You’re Caught In a Volatility Halt

My top tip if you’re caught in a volatility halt is to sell as soon as you can when it opens back up.

You never know what a stock will do when it reopens…

So the safest play is just to get out.

Stocks can halt to the upside or downside. And if you’re caught in a downside halt, it can open a lot lower than your planned risk level.

Watch the video below for more tips on how to manage a trade when you’re caught in a volatility halt…

When bioAffinity Technologies, Inc. (NASDAQ: BIAF) began trading last Thursday it halted 11 times. Most of those were in the first hour of trading.

One reason I don’t think traders should trade IPOs on the first day is that there are no levels to chart trade plans around. And trading halts make that even harder.

But on day two or three … now you have levels.

On Friday, my safe plan for SteadyTrade Team members looking to trade BIAF was to wait until the afternoon.

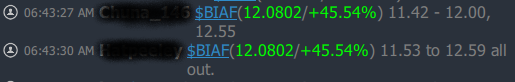

But a couple of experienced traders took their shot after the first halt and took quick profits…

There are huge opportunities in these volatile movers. But don’t make the mistake of trying to catch an entire move.

Take your shot, and when you see profits — take profits.

And if you want to avoid the frustration of trading halts, wait to get in until the stock is less volatile — typically in the afternoon.

Now, let’s see what we can look forward to this week…

This Week’s Top IPO To Watch

Jupiter Neurosciences, Inc. (JUNS) is due to start trading on the Nasdaq on September 7. Its IPO price is between $5-$7 and there are only 2.5 million shares offered.

With a low float, it could be extremely volatile. I won’t look to trade this on day one. But if it holds up and has volume, I’ll be looking at it on day two or three…

Because by then it will have chart levels I can plan a trade off of.

Be one of the first to get my game plan first in Pre-Market Prep!

Have a great day everyone.

Tim Bohen

Lead Trainer, StocksToTrade