Make no mistake about it.

Summer trading is slow.

But that doesn’t mean all the opportunities are gone…

It means you have to be pickier about your setups, manage risk wisely, and adjust your plan according to market volatility.

Bryce Tuohey is adapting well … while fighting off the urge to overtrade…

Read on to see how he avoided subpar trades in two stocks on Monday … And how he squeezed out a small profit taking a short trade…

Get in Bryce’s FREE SteadyTrade Team webinar this afternoon here!

How to Avoid Subpar Setups

Bryce recognizes this is a slower market. So he’s doing what he must to avoid overtrading…

On Monday, he was looking at Intelligent Living Application Group Inc. (NASDAQ: ILAG) for a potential move similar to United Maritime Corporation (NASDAQ: USEA) on Friday.

They were similar trade ideas since they’re both recent IPOs with a low float. And they both have a beaten-down chart with the stock having its first green day.

But after ILAG had a morning spike, Bryce wasn’t sure how much higher it could go.

Especially since the day after USEA’s first green day, the company did an offering and tanked it overnight…

So, Bryce adjusted his expectations based on the market.

That morning he also looked at Vertical Aerospace Ltd. (NYSE: EVTL).

But it kept dumping after the market opened so he moved on…

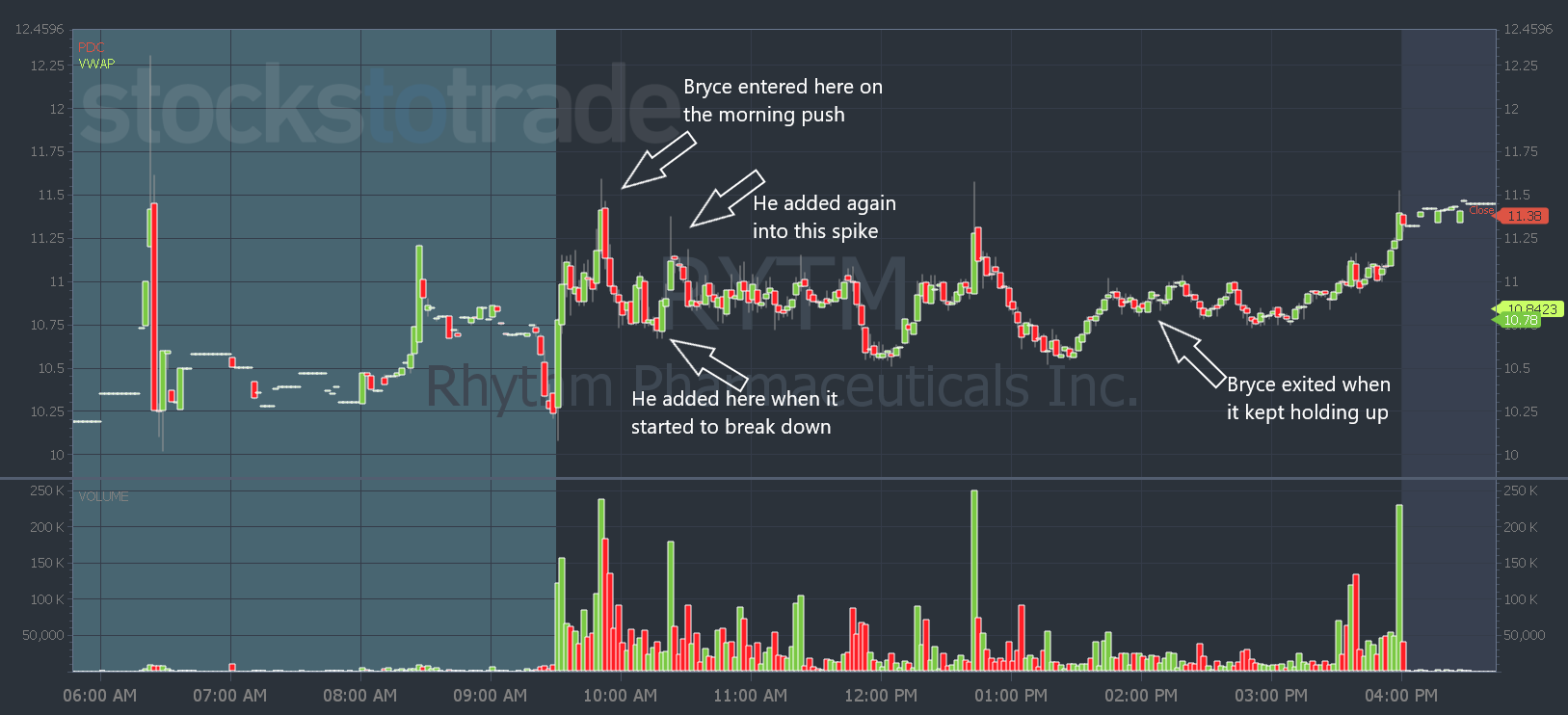

And he saw something he liked in the Rhythm Pharmaceuticals, Inc. (NASDAQ: RYTM) premarket action.

RYTM’s a multi-day runner, but it didn’t have explosive moves. It also has a higher float…

So when he saw a premarket spike and fail with low volume, he thought RYTM was ready to break down…

Are Short Trades Working In This Market?

Bryce shorted RYTM into the morning spike. He added to his position twice and used the $11.59 high of the day as his risk with a stop in place.

Then he let the trade work…

He did some house cleaning, cooking, and even took a nap. (Hey, you do what you gotta do to avoid overtrading.)

When Bryce came back to the market that afternoon, he didn’t get stopped out of his trade, but it also wasn’t breaking down…

Every time RYTM had a big dip, it recovered. That’s when Bryce knew he had to get out…

Get all the details of Bryce’s trade, plus why he didn’t like EVTL or ILAG, in his trading recap video below.

RYTM is a good example of the choppy action we’re seeing in this market.

So whether you go long or short, take your shot when you see an opportunity…

But also stick to hard stops and adjust your expectations for every trade. And if your trade isn’t working out like you thought it should, it’s okay to get out.

Take your small loss or small gain and move on.

If you want to learn more about Bryce’s strategies — join him daily in the Small Cap Rockets chat room.

Plus, he gives SteadyTrade Team webinars every Wednesday afternoon. Catch today’s afternoon webinar for FREE here.

Have a great day everyone. I’ll see you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade