High volume stocks deserve a spot on your watchlist … So how can you find them?

These days, it can take a lot more volume for a stock to be considered a high volume stock today than it did in the past. In my 15 years of trading, I’ve never seen so much volume in the markets.

When I first started trading, high volume meant a stock traded 10 million shares in a day…

Now, a stock can trade 10 million shares or more before 10 a.m. The volume, volatility, and action in today’s markets — it’s all wild.

You’re here to learn all about it and how to find and trade the top high volume stocks. Let’s do this!

Table of Contents

- 1 High Volume Stocks: What Are They, and How Do They Work?

- 2 High Volume Stocks: Why Are They Important?

- 3 What Causes a High Volume Stock?

- 4 What’s Considered a High Volume Stock?

- 5 Is High Volume Good for Stocks?

- 6 How Does Volume Affect a Stock Price?

- 7 Buying High Volume Stocks

- 8 Selling High Volume Stocks

- 9 6 Top High Volume Stocks to Watch in 2021

- 10 How To Analyze a Stock’s Price Movement and Volume

- 11 How To Find High Volume Stocks To Trade

- 12 Conclusion

High Volume Stocks: What Are They, and How Do They Work?

A stock’s volume is the number of shares bought or sold in a specific period — for instance, a trading day. Volume is an important indicator for traders, perhaps the most important. It can tell you so much.

Volume can help determine a stock’s momentum, trend, price action, volatility, and more. Generally, the more volume a stock has coming in within a trading day, the more volatile its price will be.

High Volume Stocks: Why Are They Important?

Why is high volume so important?

Because it can mean great trading opportunities…

The more volume a stock has, the more momentum it’s likely to get as more traders jump in and add to the trading volume.

That’s why traders want to look at stocks with high volume, especially with lower-priced stocks. Ideally, in any trade, the idea is to buy low and sell high. So traders seek out high volume.

What Causes a High Volume Stock?

Any number of things could cause a stock’s volume to spike. Especially in 2021…

Any kind of catalyst — news of a merger, new product, or big contract, for example — could spike a stock’s volume as traders pour in. That’s why it’s important to keep up with the news.

Our Breaking News Chat add-on feature for StocksToTrade subscribers is one of the best ways to keep up with market-moving news. It’s run by two trading pros who scan market news all day to alert members of the most noteworthy items that can move stocks big. It’s changing the game. Check it out for yourself and get your 14-day trial here.

What’s Considered a High Volume Stock?

As I said, the definition of high volume has changed.

In 2020, a wave of new traders flooded the markets and shook things up drastically. More traders, more volume.

Based on the action we see today, high volume means a stock trades close to or over the 100 million mark in a single trading day. Sounds crazy — but it’s happening every day.

We see multiple stocks almost every day trading 50 million, 100 million, sometimes even a billion shares in a single day … It’s unbelievable! Will it last? Only time will tell.

Is High Volume Good for Stocks?

Absolutely.

Stocks with high volume are more likely to have better price action and be better trade candidates over time than those with low volume.

Low volume stocks have wider bid-ask spreads. The spread is the difference between the bid and ask prices. It’s based on supply and demand.

I’m not saying traders should avoid trading stocks with low volume. A low volume stock could still be a good trade. But it’s important to do research, study the patterns, and see if it fits your setups.

How Does Volume Affect a Stock Price?

More volume often equals more volatility.

The more volume a stock has in a trading day, the more likely its price is to fluctuate. There’s a greater chance the stock price could spike.

When you have a lot of traders trading a stock, any number of things could happen involving catalysts, short sellers, chat rooms, and more. (Check out this GameStop squeeze recap for a great example.)

If a stock’s volume begins to drop, it may be a sign the stock’s headed down and not a great trade.

Buying High Volume Stocks

When trading high volume stocks, it’s important to have a trading plan ready before you do anything.

A trading plan is essential. Do your research, learn the patterns, study the charts, and prepare a plan that best suits you.

Getting in any stock at the right time is important. Scooping it up when the stock dips a bit — buying the dip — is one strategy.

But you need to be careful and make sure you recognize a dip buy opportunity. Remember, stocks with high volume can be volatile.

Selling High Volume Stocks

You know the saying … buy low, sell high. This goes for high volume stocks as well.

A good exit strategy should be part of every trader’s trading plan. Just like you need a plan for when to buy, you need to have a plan to sell for every trade.

High volume stocks are highly volatile, so don’t get greedy. It’s important to have realistic trading goals.

Remember, high volume stocks can tank just as easily and quickly as they shoot up…

6 Top High Volume Stocks to Watch in 2021

Bionano Genomics Inc. (NASDAQ: BNGO)

BNGO is a biotech company that always seems to have news.

It’s my #1 short squeeze play going into February. The volume on this stock is insane — almost every day, it trades 100 million shares or more.

This stock gapped up in December, rising from 50 cents to from $0.50 to almost $14 today.

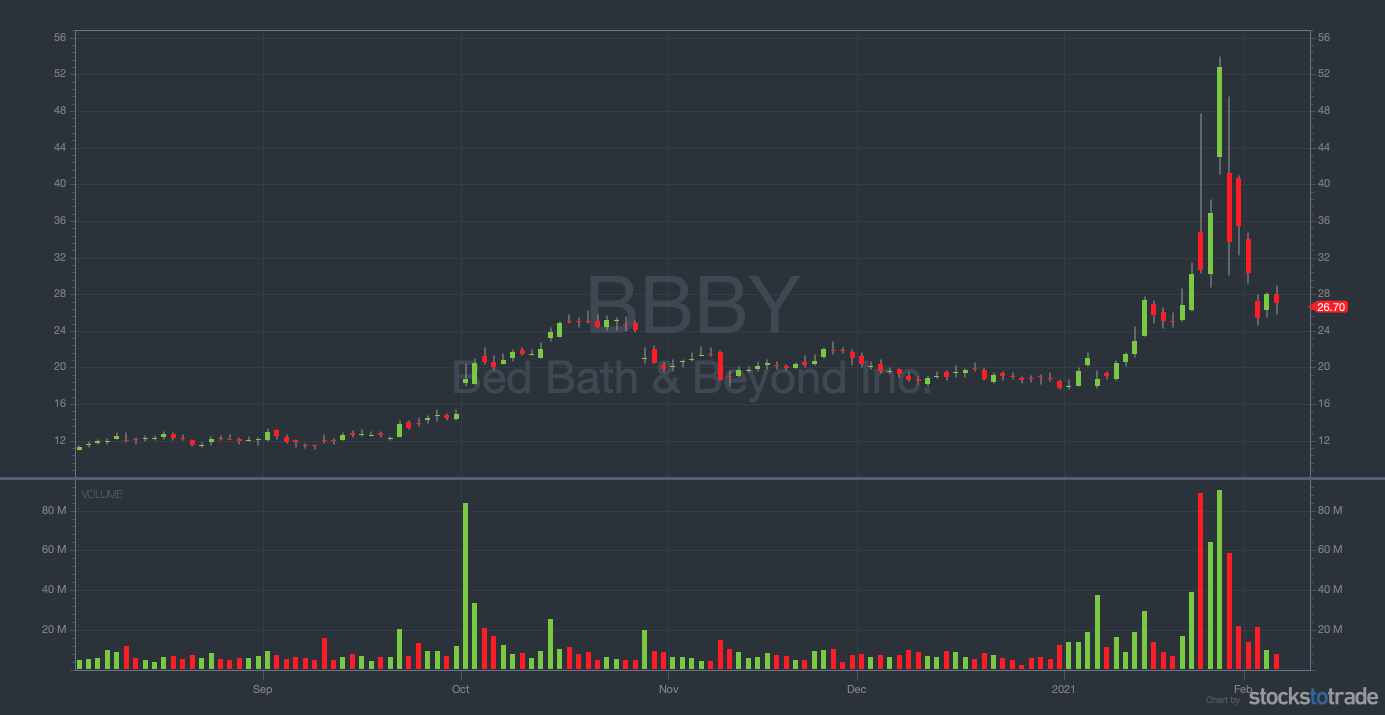

Bed Bath & Beyond Inc. (NASDAQ: BBBY)

Bed Bath & Beyond Inc. is a dying retailer, but it’s also an example of a classic short squeeze play like GameStop (NYSE: GME).

This is another Reddit trader favorite. If GME is a sign of things to come, it’s a good idea to watch BBBY as it hits 52-week highs in the $40 range.

Not to mention it averaged around 60 million shares recently.

Gevo Inc. (NASDAQ: GEVO)

GEVO is an alternative energy company that’s had some big volume recently.

If you’ve been listening to the Pre-market Prep sessions every day at 8:30 a.m. Eastern on Instagram, you know I talk about this stock a lot…

I’ve called GEVO “the worst stock in the world” many times … But lately, there’s been huge momentum, and it’s on quite the run.

On average, this stock is trading close to 100 million shares a day. Currently sitting at around $12 per share, it’s definitely a high volume stock to watch.

Nano Dimension Ltd. (NASDAQ: NNDM)

NNDM is a 3D printing company based in Israel. This stock is in one of my favorite sectors for 2021 … I think 3D printing has potential this year. It could be the next hot sector.

NNDM went on a wild run to close out 2020. It went from under $3 a share to just over $15, where it sits now — averaging close to 40 million shares per day!

Sunworks Inc. (NASDAQ: SUNW)

SUNW is a solar energy company and one of my favorite swing trade ideas to start off 2021.

When it first ran in the fall of 2020, it traded 300 million shares in one day…

Solar energy is a sector to watch right now. With the new administration settling in and talk of the Green New Deal ramping up, it could be another sector on the rise.

This is definitely one of my top stocks to watch right now. It’s currently trading in the range of $20 to $23 per share…

Clean Energy Fuels Corp. (NASDAQ: CLNE)

CLNE is another green energy company to watch.

Like SUNW, it’s a high volume stock to watch in 2021 as the sector continues to soar.

When CLNE first started gapping up in December 2020, it went from around $6 per share to just over $11 on 50 million shares traded in a single day. It’s now at around $12.

How To Analyze a Stock’s Price Movement and Volume

Most traders use technical analysis to study stock price action and distinguish good trading setups from bad.

Indicators like price trends and support and resistance levels can help find good potential trading opportunities.

That’s why studying patterns is so important. The tickers may change, but the patterns remain the same.

Technical analysis can also help you build trading plans, entry and exit strategies, and more.

How To Find High Volume Stocks To Trade

What’s the best way to find the top high volume stocks to trade?

Simple — You need a great scanner.

A stock scanner is a piece of software that can help you search for stocks using the exact criteria you’d like to find to fit your strategy. A really great scanning tool, like the one built into the StocksToTrade platform, can help you find the top high volume stocks to trade during any given trading day.

StocksToTrade gives you one place, one program to scan for stocks using almost any criteria — whatever indicates a great trade for you. A 14-day trial of StocksToTrade is now just $7 — try it today! Or get it with the game-changing Breaking News Chat add-on for $17.

Conclusion

That’s a wrap on my top six high volume stocks to watch, along with some ways to look for more.

2020 trends are continuing into 2021, and there are plenty of opportunities for traders.

But you need to be prepared. Create your trading plan, stick to it, and keep an eye open.

Think you’re ready to step up your trading game to the next level? Consider joining the SteadyTrade Team. It’s where you can be part of a community of like-minded traders working to better navigate the market together. See which stocks other traders are watching.

Plus, every trading day, you can access twice-daily webinars and get hands-on guidance, and so much more. Learn more and sign up here.

What do you think about these stocks? Leave a comment below!