When you start learning how to trade, you are learning a new skill — and a new language…

And just when you think you know it all, something new comes up.

That might’ve happened for some of you yesterday…

In Pre-Market Prep, there was a distinct play that some of you may have never heard of before.

So today, I’ll break it all down and explain why this strategy can be a self-fulfilling prophecy…

I’ll even give you another potential play just like it to watch for today!

You have 46 days to grow your account by 10X. After that, time starts to run out…

Click here NOW!

Yesterday was another great day with lots of opportunities…

But one of the best morning plays was from Pre-Market Prep. A member asked about Addex Therapeutics Ltd (NASDAQ: ADXN). I liked it…

It’s a low float stock and it had news…

After hours on Wednesday, the company announced a corporate update and financial outlook. The company also announced a reduction in the nominal value of shares.

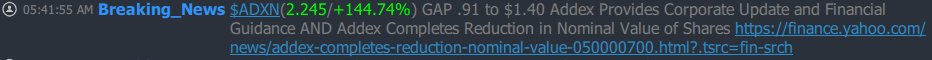

And the Breaking News Chat team alerted it in premarket yesterday…

In Pre-Market Prep, I said it’s a watch for a dip and rip with the gap to fill overhead.

If you’ve been following me for a while, you know a dip and rip is a pattern we look for often in the morning…

We want to see a premarket spiker dip at the market open, then come back and breakout above the premarket highs and continue higher.

That’s precisely what ADXN did yesterday … But what does “gap to fill” mean?

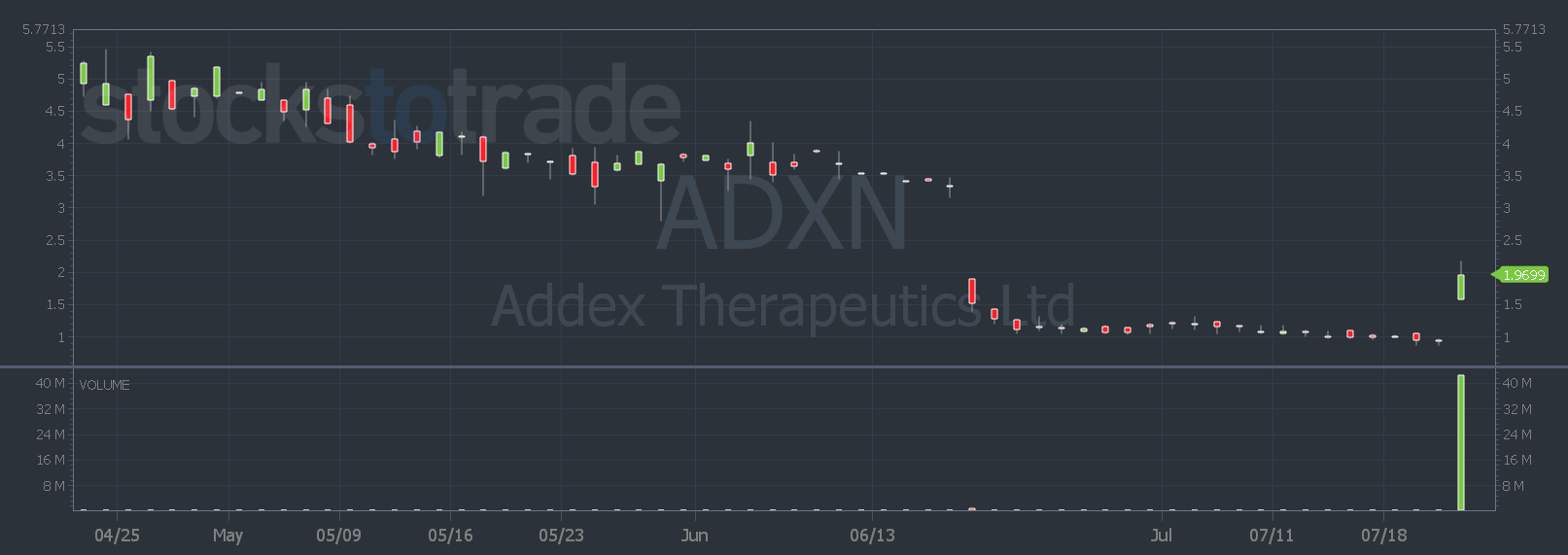

A gap to fill means there’s a gap in the daily chart. Here’s what ADXN’s daily chart looks like…

You can see in June ADXN gapped down from roughly $3.50 to around $2. That leaves a gap on the chart. Now, normally a big gap down is bad news … Especially for traders who buy and hold…

But for day traders, gaps can create opportunities.

After a stock gaps down, if it consolidates and grinds back up to the gap level, it can often mean the gap will fill. Meaning the stock will climb to the lows set before the gap.

And when a stock has news, that’s added fuel that can help it break out of consolidation and fill the gap.

So why is a gap fill a strategy some traders use?

Think about this…

What’s the bagholders dream?

To get back to breakeven. So the holders from above the gap won’t sell in the gap. They want to break even.

And the people who bought below the gap won’t sell, because they’re all green.

So a gap fill chart is similar to a stock breaking out to new highs…

There’s no resistance overhead in the gap.

And like a lot of trading patterns, they become self-fulfilling prophecies because traders believe in them.

But nothing in trading is guaranteed…

And the gap won’t necessarily fill in one day — as ADXN showed us yesterday. So keep your expectations in check.

If you like this strategy and are looking for another potential gap-fill play, look at my Amazon.com, Inc. (NASDAQ: AMZN) trade idea from the weekly watchlist. I think if it breaks $125, it could close the gap to $135 and potentially go even higher.

For higher-priced stocks like AMZN, remember the ‘rule of 10.’

Have a great day growing your accounts everyone. I’ll see you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade