Is the next economic recession just around the corner?

There’s plenty of speculation in the news and on social media about it, and it’s safe to say that fear levels are running on high.

Honestly? We can’t really know when a recession will hit for certain.

But whether a recession is actually on the horizon at this precise moment, we’re bound to experience one sooner or later … so as a trader, it’s smart to be prepared.

If you’re biting your nails over the possibility of an economic recession, this post is for you. Here, we’ll offer an education on economic recessions, including plenty of smart survival tips to help you continue trading intelligently. No matter what happens in the markets.

Table of Contents

What Is an Economic Recession?

You’ve definitely heard the term economic recession. But do you actually understand what it means? Let’s take a moment to clear it up.

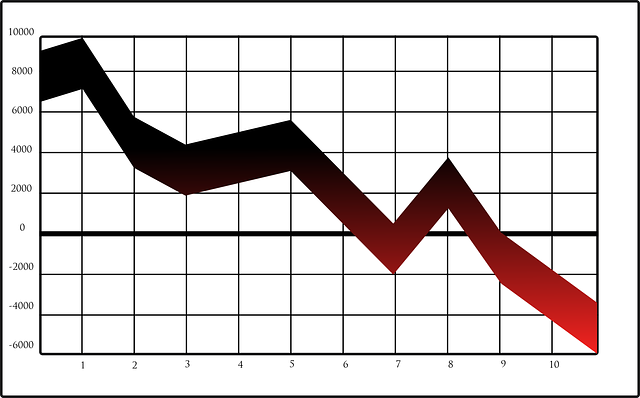

A recession is a significant decline in a particular area’s economy. Typically, the criteria that separates a recession from a brief market downturn is at least two back-to-back quarters of decline.

“Recession” isn’t just a label that’s applied willy-nilly. It’s a real thing as determined by the National Bureau of Economic Research (NBER). They take into account things like the GDP and other indicators like employment to make the call about whether or not the economy is in a state of recession.

Worth noting: since before the stock market was even established, the long-term trend in the U.S. has been economic growth. But things can’t always be on the up and up. With sustained growth comes inevitable short-term downward fluctuations.

The good news? In the scheme of things, periods of recession, as painful as they can be, have been far fewer than periods of growth.

Economic Recession of 2008

History repeats itself … Maybe not to the letter, but it’s often close enough to take note. Looking back at past events can help us understand how things might unfold in the future.

So right now, it might be helpful to reflect on the last recession. It could help you consider trading approaches for the next time a recession occurs.

While the last recession officially kicked off in late 2007, the conditions that led to it began a few years before: namely, the subprime mortgage crisis.

Things got out of hand with lenders doling out mortgages left and right — they were a little too easy to come by. And when housing prices fell, the mortgage defaults started flooding in … and they just didn’t seem to stop.

The fed funds rate and the primary credit rate were lowered, but it wasn’t enough. Banks were afraid to lend to each other. And in spite of efforts on the part of the Federal Reserve, the decline continued.

Then, Lehman Brothers filed for bankruptcy … and all hell broke loose. Suddenly, the impossible seemed possible, and people feared the worst.

But the economy did recover. The last recession actually only lasted for about 18 months. So no matter how bad things might seem … and they genuinely were bad in 2008 … the economy usually bounces back.

Fear of Recession in 2019

If you’ve tuned in to the news anytime recently, you’ve seen the headlines about an imminent market crash. It’s not hard to see why plenty of traders feel so fearful these days.

And it’s true that some signs have been are pointing in that direction. For example, the Dow and S&P are down, and the fed funds rate has been lowered. But these things don’t necessarily mean that an economic recession is just around the corner.

Right now, there are some unusual forces at work that could be affecting the economy … You know, like that little ol’ U.S.-China trade war that’s lurking in the background.

It’s impossible to accurately predict the timing of a recession. So why waste your time when you could be taking advantage of opportunities in the market right now?

Check out this recent SteadyTrade video for a closer look at the potential of a market crash and economic recession. And while there’s value in watching indicators and anticipating these conditions, you should trade based on the chart action you see here and now.

5 Ways to Survive an Economic Recession

Whether it’s within months or still years off, you’ll most likely experience a recession at some point if you stick with trading in the long term. So it’s always wise to be prepared! Here are 5 ways to survive an economic recession.

Try Different Styles of Trading

When the market changes, it’s usually a great time to change with it.

An economic recession can make seem like the market has turned on its head. So don’t fight it: it can be helpful to shift your trading strategies, too.

Now, it’s impossible to know how long a recession will last. So don’t think you should load up on shares of certain stocks with the hope you’ll clean up when the trend reverses.

That downward trend could continue for a while. You just don’t know where the bottom is. So instead of investing in what could still be a sinking ship, consider focusing on trading strategies that can take advantage of downtrending markets.

For example, some traders may find that when stocks aren’t performing well, it’s a good time to explore short-term bonds, which can be more stable than stocks.

Alternatively, trading options could be … you know … an option. Buying short-term puts on major indices is a strategy that some traders find successful during a recession.

Consider Short Selling

Short selling relies on falling prices, so it’s only natural that it becomes a favored method of trading during a recession or bear market.

In case you’re not familiar, short selling is a method of trading where you seek out and borrow shares from a broker. Then, you sell them in hopes that they’ll decline in price.

Then, once the share price falls, you buy them back at a lower price and profit based on the price difference. Then, you return the shares to your broker. And that’s that…

Well, that’s the scenario in an ideal world.

If that stock price doesn’t go down, you’re still responsible for buying back those shares to return them to your broker. So if the price skyrockets unexpectedly, you could be left with some serious debts.

It’s not necessarily the safest style of trading — even during a recession. It’s important to conduct really thorough technical analysis and fundamental research and to formulate a rock-solid trading plan before you dive into short selling.

Think About Different Sectors

A recession can feel like a tide change that’s bringing all boats down. But actually, there are some stocks and sectors that can hold steady and maybe even perform well during a recession.

Yes, it’s easy to start panic when you look at a trending sector that suddenly plummets in a recession. However, when you take a step back, you might see that it’s not without rhyme or reason.

Here’s a trend that you might see in a recession: luxury products may decline while necessities generally hold steady or may even go up.

This trend occurs pretty much for the reasons you’d think. During a recession, people are less likely to go out and buy fancy jewelry or products or services. These non-essentials are the first thing that people ditch when the belt-tightening begins.

However, even during recessions, people need basics like food, heating, and health care. So these sectors could be places to look for more solid investments.

Do Lots of Research

Stock research is always important, no matter what stock you’re trading. But in a recession, it’s extra important to be thorough about your research.

Why? Because a recession is kind of a curveball. It can throw off otherwise recognizable trends in both technical analysis and fundamental research.

Look for ways that the stock price might have moved in the past or see if certain catalysts have affected it. If it’s a company that’s been around for a long time, consider looking at how it performed during and after the 2008 recession.

Keep a Level Head

Traders tend to panic during a recession. Separate yourself from the pack by staying calm. Here are a few ways to keep your cool during a recession…

Always Have a Trading Plan

It can be a challenge to stick to a trading plan during the best of times, but it’s imperative during the worst of economic times.

To set yourself up for the highest likelihood of success, it’s important that you have a strong thesis behind your trade, and that you carefully plot out your entry and exit points. Having an actual written trading plan can prevent you from doing anything stupid in the heat of the moment.

Take Smaller Positions

You don’t need to go all in all the time, and quite honestly it’s a big risk during times of economic uncertainty. Small profits can add up over time. They don’t all have to be home runs!

Cut Losses Quickly

Remember: there are absolutely no guarantees in trading. Even if a strategy has worked 200 times in a row, you have zero guarantees that it will continue working in the future.

So it’s important to be ready and willing to cut your losses quickly. Don’t be a bag holder — don’t sit around and hope that things will turn around. Not only could it lose you big bucks, but it will make you insane. Cutting losses quickly can help preserve your sanity!

Keep a Trading Journal

A trading journal is a log where you track your trades, making note of things like the size of your position, your thesis, and how the trade worked out.

Then you can review the trading journal and gain a lot of great insight into your personal habits and leanings as a trader. When you have this self-awareness, it’s much easier to focus on what you’re doing right. But it can also help you spot what’s not quite working.

Conclusion

It’s not possible to predict if or when a recession will hit. But chances are pretty good that whether it’s this year or sometime in the next decade, a recession will hit at some point. As a trader, it’s always a good idea to be prepared.

By learning from the past and focusing on responsible trading practices, you can protect yourself during times of economic uncertainty. Being able to weather storms like this is key to long-term survival and success as a trader.

StocksToTrade

Navigating the stock market during a recession isn’t for the faint of heart. A powerful stock screener can help.

StocksToTrade is a trader-designed platform that can help you identify promising stocks to trade. Among its many features:

- Stock screener. STT is equipped with a powerful stock screener that lets you set criteria and run scans based on your preferences. This lets you filter stocks by your favorite chart patterns or other indicators that suit your style.

- Charts galore. The awesome charting software lets you look at technical indicators, price action, and alerts … all at once. It’s never been easier to manage your watchlist!

- News. STT also has a news scanner that gives you easy access to the latest headlines. Browse through SEC filings and check out social media buzz, too!

These are just a few of StocksToTrade’s many features. Wanna see for yourself? Try a 14-day trial of StocksToTrade for just $7! Check out the platform that so many top traders choose to use — StocksToTrade.

Did you trade during the last economic recession? Have any survival tips of your own to share? Leave a comment!