Imagine having a stock crash 30% in a few minutes…

This is a real risk when trading penny stocks. Yet most traders aren’t aware of diluted shares and what they can do.

Printing money devalues existing currency — and companies creating new shares devalues existing shares.

Share dilution is common in the penny stock world. If you love trading the volatile momentum you can find in low-priced stocks, you need to understand what diluted shares are.

Read on to learn the ins and outs of this weird market mechanism.

Table of Contents

- 1 What Are Diluted Shares?

- 2 How Do Shares Get Diluted?

- 3 Dilutive Stock Offerings

- 4 Why Do Companies Dilute Shares?

- 5 Is Stock Dilution Good or Bad?

- 6 How Do You Protect Yourself Against Stock Dilution?

- 7 Diluted Shares: Examples

- 8 What’s the Difference Between Basic and Diluted Shares?

- 9 Theoretical Diluted Price Calculator

- 10 Fully Diluted Shares

- 11 Fully Diluted Shares Calculator

- 12 Conclusion

When companies issue new shares, these new shares dilute the existing stock.

Imagine adding water to black coffee — each sip now has less oomph behind it. And after a company creates diluted shares, each share has less value behind it.

That’s because the company’s market cap stays the same, but there are more shares trading. The new shares lower the value of existing shareholders’ positions.

There are lots of ways shares can become diluted. It can happen when warrants are exchanged for stock or when convertible bonds are converted into stock. But the biggest risk to penny stock traders is dilutive stock offerings.

Dilutive Stock Offerings

A dilutive stock offering is when a company introduces new shares into the market. I’m going to be talking about secondary offerings here … Those are offerings that happen after an IPO, when the stock is actually trading on the market.

A company will do a secondary offering when it needs to raise capital. In penny stock land, these companies are almost always low on money. So they sometimes raise capital by offering new shares.

These dilutive stock offerings can cause headaches for penny stock traders and investors. They tend to stop momentum and usually cause prices to fall.

Dilutive stock offerings can happen without warning, at any time of day.

Offerings may be made during regular trading hours, premarket, after hours, or even overnight. Sometimes companies offer dilutive shares when shareholders least expect it.

I’m still bullish as ever, but you gotta be super careful trading these low-priced, junk stocks!

Dilutive stock offerings are always a risk. After a big rally, companies love to cash in. And they raise capital for themselves with a stock offering.

A struggling company may use a dilutive stock offering to raise cash when there aren’t many other options.

This sneaky but legal tactic is a common way junk companies keep themselves afloat. Most of them desperately need capital to keep running. They aren’t profitable, so this is one way they generate money.

Is Stock Dilution Good or Bad?

With penny stocks, these offerings are usually a negative catalyst. That doesn’t mean a stock is guaranteed to fall after a dilutive stock offering. Again, nothing in trading is guaranteed…

After stock offerings, we’ve seen aggressive shorts get overwhelmed by dip buyers. These shorts quickly cover their positions… and cause massive short squeezes. A stock can sometimes shake off dilutions like they’re nothing, especially in a hot sector.

Sometimes an offering will be at a higher price than where a stock is trading, leading to a rally.

When bigger companies dilute their shares, it can be a positive catalyst … That’s because traders assume the company is raising capital for a big venture, like an acquisition or research into a new product. They’re not struggling to keep the lights on. The bigger company usually has a proven track record and doesn’t need quick cash.

So, a stock dilution will usually tank a penny stock. But be aware of potential squeezes. Even when they squeeze, I love the incredible volatility these junk stocks provide. I break down setups like these live every day on Instagram for premarket and noon sessions. Tune in to learn what I look for after 10 years of experience day trading stocks!

How Do You Protect Yourself Against Stock Dilution?

One way to protect against dilution is to read the Securities and Exchange Commission (SEC) filings. Looking for companies with warrants or registered offerings that can be exercised can help you avoid the worst dilutive stocks.

Another way to protect yourself against a stock dilution is to have a hard stop in place. Sudden unexpected price swings are common in penny stocks … whether they’re squeezes or panics.

Remember, a stock can go against you further than you think!

Whenever an offering is placed, it pops up immediately in your StocksToTrade news feed.

That’s one reason StocksToTrade is an invaluable resource for traders. You don’t have to dig through multiple websites. Your news comes up right below whichever chart you’re viewing. For even more in-depth news, check out the Breaking News chat room. We work with two former Wall Street pros to filter out the fluff and deliver you the news that moves markets!

It’s simple, professional, and all-in-one. Try StocksToTrade today with a 14-day trial for just $7 — or add a trial of the chat room as well for $17!

Seeing the effect diluted shares can have on a stock’s price is critical, so let’s see some charts!

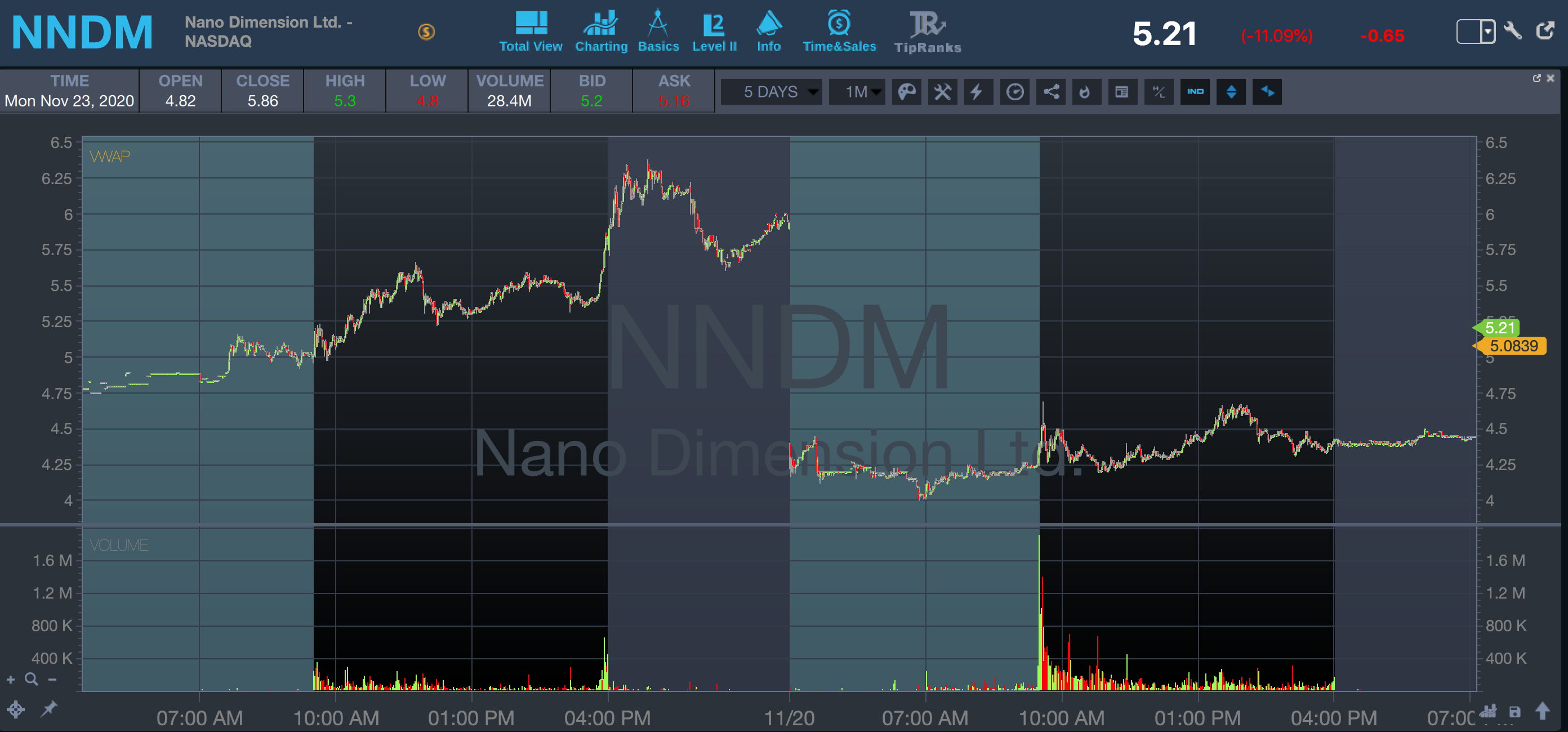

Nano Dimension Ltd. (NASDAQ: NNDM)

After a substantial multi-day rally, NNDM announced a dilutive offering overnight. This company announced 25 million diluted shares to be sold at $4 each.

The stock gapped down 25% without allowing any traders and investors a chance to get out, not even during after-hours or premarket.

Kandi Technologies Group Inc. (NASDAQ: KNDI)

KNDI, another multi-day runner, announced a dilutive offering premarket. The company announced over 8.8 million diluted shares would be sold at $11.30 per share. This caused the stock to drop over 15% into the open.

You can see this on the chart as the big, red candle right at 9:15. Shorts cleaned up big time. But because the stock was in the hot EV sector, it had a substantial bounce during regular trading hours.

AYRO Inc. (NASDAQ: AYRO)

AYRO was another hot EV stock. And the company announced a dilutive offering after a solid multi-day run. It offered 1.6 million shares at $6.06, along with a similar number of warrants. You can see this on the chart as the big red candle right at 9:00.

However, this was a short trap. The stock barely cracked $8.50 before ripping to new highs. The sector was so unbelievably hot this day, even diluted shares couldn’t bring it down. That’s the power of hot sectors.

This is why we love to focus on hot sectors in the SteadyTrade Team. Sure, there are plays in other sectors … but you’re missing out if you don’t zone in on the hottest movers!

In the SteadyTrade Team, you’ll get guidance from veteran trading coach Kim Ann Curtin and rising-star Huddie. Plus, I’ll tell you in my twice-daily webinars where to focus your watchlist so you don’t miss these hot runners. Join us today!

Basic shares are the shares that are already issued. They are a part of the stock’s outstanding shares.

Diluted shares are the shares that would be added if warrants, convertible bonds, and new shares issued through stock offerings were exercised.

Theoretical Diluted Price Calculator

Sometimes we want to see where the stock price might go right after an offering. The theoretical diluted share price is simply a rough estimate of where the price should go. It doesn’t account for the typical market volatility we see with penny stocks … So expect the price to quickly change or not even reach this value.

Here’s the formula:

Theoretical Diluted Price = (Original Shares Outstanding x Current Share Price + Diluted Shares Issued x Diluted Shares Issue Price) / (Original Shares Outstanding x Diluted Shares Issued).

Fully diluted shares include current shares AND all the dilutive securities that aren’t exercised yet. This includes:

- Options

- Warrants

- Convertible Debt

- Other convertible derivatives

The number of fully diluted shares is what the number of shares outstanding would be if all these securities were turned into stock at the same time.

Fully Diluted Shares = Basic Shares + Options + Warrants + Convertible Debt + Other Convertible Derivatives

The greater the number of fully diluted shares is over the basic shares outstanding, the riskier the stock. More dilution tends to keep the price down.

Conclusion

Every trader will experience the effects of diluted shares. No matter whether you’re long or short, it’s important to be aware of this volatility-inducing trading phenomenon. Stocks can fall fast after diluted shares are created. So it’s crucial to limit your downside!

Trading knowledge and education can help avoid unexpected losses. That’s what we prioritize in the SteadyTrade Team. We aim to teach you about all the hidden traps of trading. With the right coaching, you’ll have tools to help you trade safely and effectively.

Diluted shares can be a sneaky way for companies to raise capital in the market. So pay attention to your news scan, read SEC filings, and keep your stops tight. All these will help you reduce the risk of getting hit with diluted shares.

Do you consider diluted shares in your trading? Leave a comment below and tell me what you think!