If you turn on the TV or scroll through your feed right now, you’d think the sky is falling…

Tariffs…What will be the consequences?

Fed rate Cuts…Paused for now, but when will they and how much? And will it help or hurt?

Geopolitical drama…Relations with Europe, Russia, Ukraine, and others, renewed turmoil in the Middle East…

Almost every headline sends the broad markets into a frenzy.

Here’s the S&P over the last ten days…

It’s all over the place! Talk about whiplash!

But let me remind you of something I’ve learned after decades in the market:

Fear sells.

Unlike in the past, the media’s job isn’t to keep you informed but to keep you hooked.

They want clicks. They want outrage. But just like many company-issued press releases, they rarely give you the full story.

In fact, if you’re willing to tune out the noise, there’s a lot to be optimistic about, and a lot of opportunity out there.

Table of Contents

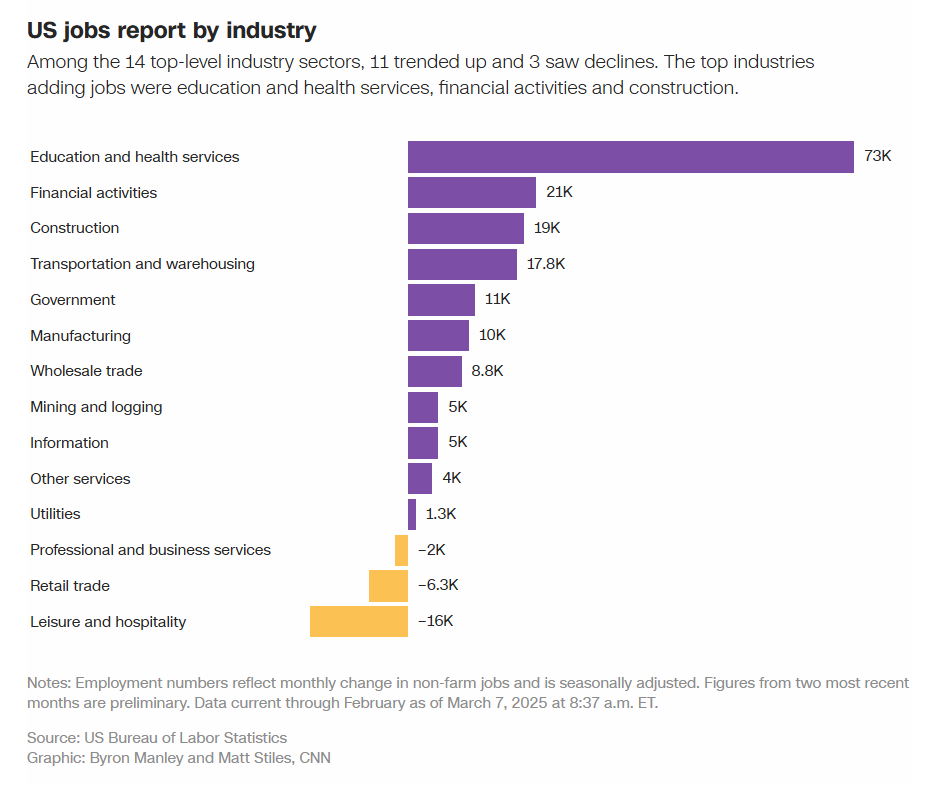

First Off, The Job Market Is Holding Up

You wouldn’t know it from the headlines, but the labor market is still strong.

- Unemployment is still near historic lows.

- Wages are still on the rise.

- Job openings are high—especially in education and healthcare.

Sure, some sectors might see layoffs, but we see that in any cycle.

But the big picture? People are working. Businesses are hiring.

Consumers Are Still Spending

Credit card usage is hitting new highs—not always great long-term, but it shows people still have confidence.

And the demand in the housing market is increasing. Home sales rose in February.

If we were staring down a true collapse, spending would dry up.

But it hasn’t. People are adapting and moving forward.

The Market Is Still Strong

Despite all the doom talk, the S&P 500 and NASDAQ are still hovering near all-time highs.

Remember that scary-looking SPY chart?

Let’s zoom out and get some perspective.

Here’s the S&P 500 over the last 5 years:

Not so terrifying anymore, is it?

And here’s the NASDAQ 100 over the same time period:

There’s still money flowing into the market every day.

And as someone who scans the market every morning, I can tell you that there are plenty of day trade setups out there.

Just tune in to Pre-Market Prep, and you’ll see it firsthand.

Innovation Is Driving Opportunity

While the media focuses on the chaos, we’re living through a massive innovation wave.

- AI is booming

- Electric Vehicles (EVs) and clean energy technology, like nuclear, are evolving fast.

- And quantum computing is moving forward by leaps and bounds.

Big companies and major investors are throwing massive amounts of cash at these endeavors, so they’re only going to advance.

This is the kind of progress that creates trading opportunities every single day.

And by the way, I have stock watchlists for all of the sectors mentioned above.

To get access to them and many others, subscribe to my StocksToTrade Advisory service today.

You’ll get a monthly newsletter with a list of my top picks, my three weekly videos, bonus reports, and more.

Sign up for StocksToTrade Advisory right here!

My Final Thoughts…

I get it…negativity always speaks the loudest.

But in this game, we don’t trade based on emotions.

We trade based on real data, price action, and proven, high-probability setups.

Right now, the U.S. economy is resilient, the markets are still offering opportunities, and if you know what to look for, you can capitalize.

To spot these opportunities and take advantage, you need a great trading platform.

It should provide real-time data, charts, technical indicators, and a financial newsfeed that filters out all the noise.

My top pick, and the one I use every single day is StocksToTrade.

It has all the features you need to stay ahead of the game.

And right now, you can get two weeks of both the STT platform and our Breaking News Chat service for $17.

Grab your 14-day StocksToTrade + Breaking News Chat trial today for only $17!

Have a great day, everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade