The Bitcoin and crypto market sentiment, in general, is decidedly fearful; so, is it time to become greedy and buy?

Bitcoin has failed to go past 10k since March 7 and has been facing severe resistance around the 9k level. Bitcoin bulls have been warned as the digital currency approaches the dreaded ”death cross”– the chartist’s lingo for a situation where the short-term average crosses below the long-term average, portending a further downward movement.

On the other hand, Warren Buffett has advised investors to be fearful when the markets are greedy and greedy when the markets are fearful.

The answer to that question is ‘yes’–at least according to one sentiment indicator–the Bitcoin Misery Index (BMI).

BMI and, more recently, the Thompson Reuters MarketPsyche Indices version 3, are the first sentiment indicators that track market sentiment for bitcoin and other cryptocurrency markets.

Puckish Wisdom

Unlike technical charts which strictly rely on a set of rules and hard numbers, sentiment indicators are a group of graphical or numerical indicators that operate more loosely because they are designed to show how the market feels about a particular asset (positive or negative sentiment) by quantifying several different factors.

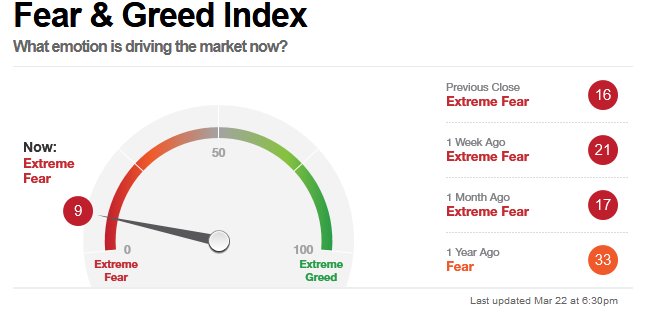

A well-known sentiment indicator in the world of stocks trading is CNN’s Fear and Greed Index (FGI).

FGI looks at seven different factors and uses them to score, on a range of 0-100, to what degree the market is being driven by fear or greed. FGI reading on March 22 at market close was a paltry 9, indicating extreme fear in the market.

One of the indicators that go into the FGI mix is market volatility, a metric that most day traders are already accustomed to.

Sharply higher volatility in the market tends to coincide with bearish sentiment and heavy selloffs.

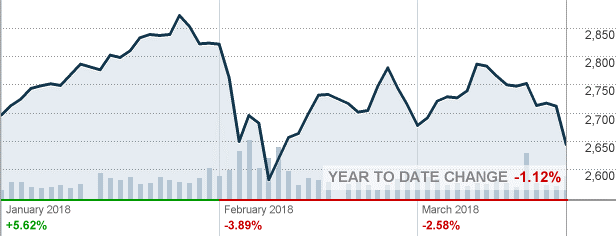

For instance, the low FGI reading coupled with a large 45% increase in VIX reading over the past 5 days has coincided with a nearly 4% drop in the broad S&P 500 Index over a similar timeframe.

CBOE Market Volatility Index (VIX)

S&P 500 Index (SPX)

Source: CNN Money

Despite divided opinion on its usefulness, it’s hard to ignore the puckish wisdom by the FGI.

FGI has been fairly accurate at tracking short-term market sentiment probably because its powered not only by VIX but also six other equally-weighted market-related factors. A more detailed study though is required to determine whether FGI has been leading or lagging the market (hint: the former is more beneficial to traders).

In the cryptocurrency space, sentiment indicators like BMI and Thompson Reuters MarketPsyche Indices version 3 have come up. BMI was founded by Tom Lee, a name that probably needs no introduction because he is the only Wall Street analyst who not only takes a keen interest in crypto markets but also releases regular bitcoin price targets.

The Bitcoin Misery Index is essentially a contrarian indicator (most indicators are contrarian anyway), meaning it prompts investors to act contrary to the prevailing market sentiment.

Just like FGI, BMI is based on a 0-100 scale that measures how happy or sad bitcoin owners are at any moment. A value below 27 signifies “misery” and a good time to buy bitcoin.

Lee says BMI uses a variety of factors, including volatility and percentage of winning trades, to determine bitcoin sentiment. The reading at the time of publication on March 10 was 18.8, thus indicating a good time to buy and HODL for at least 12 months (HOLD in crypto slang).

Lee says that buying bitcoin at the misery level has always generated good returns in the past–but that’s only when looking at a one-year timeframe.

Looking at the chart above you will notice than BMI has been generating a good buy signal about once every 12 months or so. BMI has thus been good at predicting 12-month bitcoin performance but does not say much about the intervening period.

For short-term traders looking for more than a single good buy signal every 12 months, Thomson Reuters’ new MarketPsyche Index v3.0 will probably do the trick.

Initially launched in 2012, MarketPsyche uses data and real-time social media feeds from 2,000 news sites and 800 social media networks to generate actionable information flows. The latest version is geared towards cryptocurrency trading by filtering through more than 400 news and social media sites that are mostly dedicated to cryptocurrencies to generate useful investing decisions. TRMI v3.0 also features a dedicated bitcoin sentiment data feed as well as MVIS indices that have been contributed by Cryptocompare, CBOE and CME Group’s bitcoin futures.

Why it might work…

Bitcoin has been around for nearly a decade now, and analysts have figured out several ways to predict future long-term prices. Among the leading methods include:

- Using the law of supply and demand

- Metcalfe’s law (the value of a network is proportional to the square of the number of users on the network)

- Using Google Trends

Let’s zero in on the last one–Google Trends.

Analysts have discovered that indeed there’s a correlation between bitcoin prices and how frequently people search the term “bitcoin” on Google. Further, sentiment analysis, the science of analyzing data from social media feeds from Twitter, Facebook and other social networks, has been shown to work to a fairly reliable degree.

Data mining tools such as DataMinr, Social Media Analytics, Ticker Tags and Knowsis employ artificial intelligence, advanced machine learning and NLP (Natural Language Processing) to quickly and efficiently analyze millions of mostly social media messages every day and generate actionable investment tips.

Going by its description, TRMI v3.0 appears to be a tool that largely analyzes sentiment from social media feeds, and that’s something that’s backed by science.

…and why it might not

On the flipside, social media trends have been known to be imperfect indicators because they can sometimes lag behind bitcoin prices. Thus, by the time a trader learns about an impending bull run or a selloff, it will probably have run a good part of its course.

The other reason why sentiment indicators like TRMI are risky is simply because the cryptocurrency space remains poorly regulated. Many people will probably think twice before engaging in the blatant pump-and-dump scheme for a particular stock because they know the SEC is watching. The same can hardly be said about crypto markets where many stories are designed to invoke FUD (Fear, Uncertainty, and Doubt) or its cousin, FOMO (Fear Of Missing Out).

For instance, Japanese news outlet Nikkei recently ran a story that claimed that one of the world’s largest bitcoin exchange, Binance, had received mandates from the Financial Services Agency following a hack on the accounts of people who had used API keys. Binance CEO, however, later denied that the exchange had received any mandates from the FSA, but not before bitcoin prices were sent plunging. Whether the Nikkei story was a deliberate ploy to drive prices down is yet to be established.

The FOMO effect can be particularly pronounced when inventors of new cryptos use social media to hype up their coins, such as when IOTA surged 90% after its founders claimed it had partnered with tech giants such as Microsoft on a blockchain marketplace. Turns out the scope of the partnerships was greatly exaggerated, and IOTA was sent tanking.