The coronavirus scare continued to tank the stock market and the Dow last week … We’re in a bear market.

The coronavirus wasn’t the sole cause for the drop. There was also the oil price war that broke out between Russia and Saudi Arabia. That led to the Dow dropping almost 8% last Monday.

Saudi Arabia called for oil production cuts to avoid oversupply and Russia refused to agree. Saudi Arabia answered angrily by slashing export prices. Oil prices crashed 30% overnight.

Things got worse with the global coronavirus situation when the World Health Organization (WHO) declared COVID-19 to be an official pandemic.

As I write this, there are 134,560 coronavirus cases and 4,972 deaths. Sports stars and celebrities, such as Tom Hanks, have tested positive for it.

All that led to…

Table of Contents

The Dow Drop

Flights from Europe to the U.S. are banned. The NBA season is at a halt, and theme parks are closed. That’s a few of the crazy developments to help quell the disease spread and panic.

We’re seeing huge economic impacts of the virus and the global response to it. And this is just the beginning.

All these global events created the perfect storm … The Dow plummeted 10% on Thursday, making it the worst day for the stock market since 1987’s crash.

The Federal Reserve has taken steps to try and stop the bleeding, even injecting $1.5 trillion into short-term markets. Will it be enough? Only time will tell.

All of this can be super scary. I hate the fact that people’s lives and businesses are being disrupted … But the reason you’re reading this is that you’re passionate about learning to trade the stock market.

So what do smart traders do in times like this?

The Savvy Trader’s Survival Guide

Most importantly, stay safe out there. Follow the guidelines to protect your health and your loved ones. It seems that this disease is spreading fast.

As far as the stock market … Yeah, the market’s seeing drastic effects. But this will pass in time. Just like everything else that’s been thrown at it.

The key thing for you to do in terms of trading is to adapt and adjust.

You gotta keep the big picture in perspective. Some of the characteristics in the market have shifted. And a bear market can experience large drops. But that can usually come with bigger bounce-back plays. And that means you gotta prepare and be ready.

I’ve talked about this many times before. We’ve experienced record growth. We’ve been long overdue for a correction. Even if we enter a recession, it’s just a necessary part of the economic cycle.

There are always opportunities. But you have to know what to look for. Plenty of traders in our community are still making money. The volatility we’re seeing can make for huge movements in stocks. Traders who are prepared are taking advantage.

In an earlier post, I mentioned how the coronavirus scare created a hot sector. We’re now headed into what I believe is phase 2 of the sector move.

Here’s what you need to consider now. And, of course, you have to be careful in the markets. There’s a lot of volatility out in the markets right now. Run your scans, build and track your watchlists, and remember to stick to your trading plans.

(Get my free weekly watchlist here.)

Now, let’s check out four specific ways you can trade through the insanity…

1) Start Considering Shorts

First, let’s talk about the patterns we see with crap penny stocks. It happens every time with these types of moves. Ebola, blockchain, or weed stocks … it doesn’t matter.

In the first phase, these crap penny stocks explode in the beginning. But then they exhaust themselves and fade back.

This is when you can start thinking about shorting the worst of the worst stocks. What do I mean when I say the worst? I’m talking about the companies that are hard up for cash. You can spot these companies because they start doing offerings and dilutions.

Pay attention … This is penny stocks 101. Candidates here could be sketchy biotechs.

Companies like this run up their stocks, then dilute like crazy to bring in cash. And maybe they live to operate another day.

We’ve started seeing those offerings and dilutions flow in. If you’re short biased, you can start by looking for those cash-starved companies. And you can anticipate it because these companies need the money to stay in business.

Here’s another aspect of Phase 2. I think we’ll start seeing real coronavirus sector plays … with real companies.

So what’s a real company? These are companies that create real value and solve real problems while generating substantial profits. They have solid leadership, not questionable management scrounging for the next dollar.

Take Gilead Sciences Inc. (NASDAQ: GILD) as an example. One of its existing drugs is currently being tested as a treatment for COVID-19. It’s said to have the most potential to be a solution by the World Health Organization (WHO) officials.

Take a look at the chart:

This is also what I mean by real: market cap. Where a small penny stock company might have a $100-million market cap, GILD has a $93-billion market cap … So it’s slower moving.

The great thing about these types of plays is that they can be safer. Listen, it’s great that crap penny stocks can shoot up 500% in a day … But those huge, fast moves can be risky. If you’re in a trade with one of these stocks, just taking a bathroom break can be a gamble. Walking away from the computer at all can be nerve-wracking.

These real coronavirus trades are good candidates for swing trades and longer-term holds. Especially if you don’t want to be glued to the computer nonstop.

Another part of the market to look at as the coronavirus spreads globally is disease containment. That includes stocks such as Alpha Pro Tech Ltd. (AMEX: APT) and Lakeland Industries Inc. (NASDAQ: LAKE).

Check out the charts for APT and LAKE…

These aren’t the sketchy biotech plays. Come on, we know those cheap sketchy biotech companies aren’t going to come up with the coronavirus cure. How are they gonna save the world when they’re too busy doing offerings?

APT and LAKE make real products that solve real problems dealing with the coronavirus disaster. They make the suits, masks, and tents that can help protect and keep healthcare officials safe as they work on containing the disease.

4) Remote Work

One of the big impacts we’ll see in the coming weeks is employers urging workers to work from home.

We’re all watching as the world enters panic mode. Not only are businesses deciding to switch to working remotely … Colleges are shutting down. State-wide school systems are closing for weeks.

Businesses want to keep their employees safe … But they still gotta do business or they can lose profits, fall into bankruptcy, or risk going out of business. And as we’re seeing the impact of the coronavirus spread, this could become a much bigger deal.

As things get worse, I’ll be looking for companies that enable businesses and schools to function virtually.

Plus, I already know a lot of people who work from home — I do it too.

Companies such as Slack Technologies (NYSE: WORK) allow workers to communicate, collaborate, and track projects online. Here’s the chart:

Zoom Video Communications Inc. (NASDAQ: ZM) brings remote workers together through online conferences, chats, and meetings.

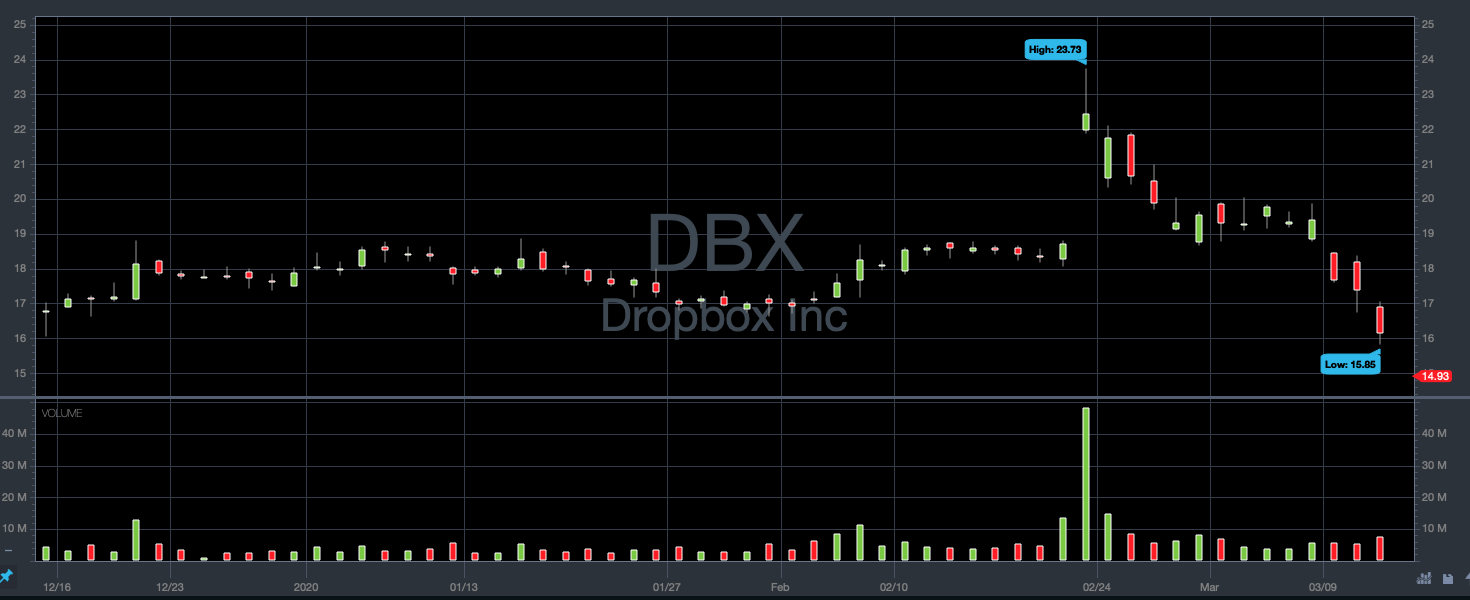

File-sharing solutions like Dropbox make it possible for organizations to share documents, files, images, and other information over the web more securely.

This is another example of how the internet is changing everything. I know I’ve seen it change trading since I started my trading career. Think about how the internet can change the way we work. Again, some of you already work from home, so you get it.

And for a lot of jobs, as long as people have a computer and internet access, it can be possible for them to continue working — if they have the right tools. I’ll be watching the companies that provide those tools.

Conclusion

That’s a wrap on coronavirus stocks, the dow drop, and the bear market. Consider this your traders’ survival guide for this crazy moment in time.

Remember, there are always opportunities in the stock market. But you gotta watch out for them and be prepared.

If the volatility is too much for you right now, that’s OK. Take this time to watch and learn, even if you don’t enter trades. See how news and world events can powerfully affect stock price movements. What you learn now can prepare you for future events.

That’s a smart way to help you stay safe and learn to take advantage of opportunities when you spot them. Check out the past and see how events like the Ebola pandemic affected the world and the markets. It’s not the same, but you can spot some key similar patterns.

And remember … a lot of people are yelling that it’s the end of the world. But it’s not really the end of the world. People have been screaming that since the dawn of time.

Markets are cyclical. We’re just in a different part of the market now due to the coronavirus and the oil price war. The stock market will survive. Smart traders learn to stay calm and prepare to take advantage. Wanna be one of those calm, cool, and collected traders?

Come join us in my StocksToTrade Pro mentorship program. Our community talks about the market every trading day. I give webinars twice a day every trading day. I tell you my take on what I see before every market open and close…

Mentorship can be a great way to learn the market essentials and help you from making big mistakes in your trading. Having the right people around you can save you months or even years of learning. Sign up for StocksToTrade Pro today!

How do you feel about this bear market? I’d love to hear from you.