On Wednesday AMTD Digital Inc. (NYSE: HKD) was back on traders’ radars…

The stock went parabolic from roughly $50 to nearly $300. So naturally, I received questions about it in yesterday morning’s SteadyTrade Team webinar…

How can you trade it? What’s the pattern to look for?

But honestly, to me it’s untradeable.

I get it … It’s exciting and entertaining to watch a big runner like HKD…

After all, you could buy one share and potentially make $100 or more. But there’s also a flip side to that.

And there’s one main reason I advised traders to stay away from it.

Here’s why…

The One Blaring Reason to Avoid a Stock Like HKD

When you’re trading volatile stocks like the ones we do, there’s a lot to pay attention to…

Float, volume, news, support and resistance levels…

Then you have to make a trading plan with an entry, exit, and risk level.

But there’s one thing that might not cross most traders’ minds before they execute a trade.

The stock’s spread…

What’s The Bid-Ask Spread?

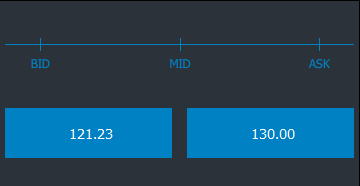

The stock market is like an auction … The bid is how much a trader is willing to pay for the stock. And the ask is how much a trader is willing to sell the stock for.

The difference between the two is the spread.

You can read more about it here.

Typically in high volume, liquid stocks the spread is only a penny.

In sub-dollar and sub-penny stocks, the spread can be fractions of a penny. And in higher-priced stocks, the spread can be pennies or up to a dollar.

Why The Spread Matters

As a trader, you want to trade stocks that have a close spread. That means you can get in and out within a penny of your stop, and it’s not a big deal.

But when you start trading stocks with a wide spread, it can significantly increase your risk.

And over the last two days, HKD had a spread of up to $10. That’s just insane…

Basically, if you bought HKD on the ask and sold it on the bid, you’re down $10 per share without the stock even moving…

I don’t even know how to trade that.

If you try to trade it like a regular stock, you could buy 100 shares, but on one downtick you’d be down $1,000 … And that’s just one tick!

Stocks move up and down all day. Nothing goes straight up or straight down…

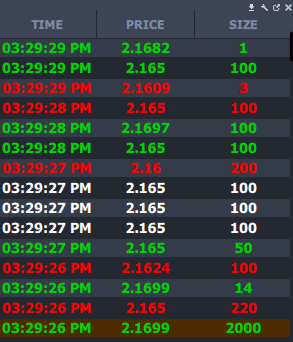

Look at a stock like HeartBeam, Inc. (NASDAQ: BEAT) yesterday. The bid and ask were a penny apart. And the time and sales show trades executed between the two at times…

Green is a sale higher than the last, red is lower, and white is unchanged.

This is how most stocks move all day. They go up, down, and in between.

If you’re in a trade in a stock like BEAT, you can easily get out at your stop, or even a cent or two below it.

But when you have a $10 per share spread, how can you plan a risk level with that kind of spread and volatility?

Once it hits your stop, it could be another $10 per share lower before you get out. And that’s if your order even gets filled.

For me, that makes it untradeable and the only reason I need to avoid the stock completely.

These insane runners are fun and entertaining to watch…

But they’re almost impossible to trade. You have to deal with halts, a huge spread, and moves from $50 to $300 and a drop back to $150.

We love crazy big moves. But there’s a limit to the crazy.

If you want the lowdown on which stocks to watch and avoid — join me every morning and afternoon in live SteadyTrade Team webinars.

I answer questions and break down tickers and trade ideas to help you get on the path to becoming a successful trader!

Tim Bohen

Lead Trainer, StocksToTrade