Trading options can be a complex strategy, so today we’ll hone our focus take a close look at call options.

Trading options can be attractive to a lot of traders … They can require a smaller initial investment than buying stocks outright.

But that doesn’t mean they don’t come with risk. And that risk can vary depending on which trading strategy you use.

In StocksToTrade Pro, we devote most of our time to buying and selling penny stocks. It’s the niche of the market where a lot of us thrive and find opportunities for big gains.

But even if you only trade low-priced stocks, it’s still important to have a well-rounded market education. That includes call options. It’s just smart to know how the overall market works and how other traders can influence price action.

Let’s take a closer look at options trading — today, we’ll focus on call options.

Table of Contents

What Is a Call Option in Stocks?

A call option is basically a contract that gives the owner the right — but not the obligation — to purchase a stock at a particular price within a specified time frame.

Think of it like a coupon … You may use it before the expiration date or just let it expire. Or you might it resell to other buyers.

Each purchased call option gives the holder the right to buy 100 shares of a stock at an agreed-upon price — that’s the strike price.

The right to buy these shares ends at a specific time … that’s the expiration date.

Buying a Call Option

Buying a call option is similar to buying or investing in stocks — you want the stock’s value to go up. The big lure of buying call options is that you don’t pay full price for the stock. Instead, you pay what’s known as the option’s premium.

Once you pay the premium, you own the call option. Your position is ‘being long a call option.’ You buy the call option because you believe the underlying stock value will go up. In turn, the contract value will increase, and that means you can profit from your investment.

Remember, you’re not actually buying the stock. With call options, you have no ownership in the company. You’re only buying the right to purchase the stock at the agreed-upon price.

Selling a Call Option

Traders can sell call options before buying them, kinda like short selling a stock. Traders who use this strategy attempt to gain profits when they believe the option contract’s value will decline.

Just like short selling, selling a call option can come with big risks.

Call vs. Put Options

Call and put options are opposite from one another…

Call options are contracts that give owners the right to buy a stock at a set price for a particular time frame. Put options are contracts that grant the owners the right to sell a stock at a precise price within a set time frame.

Profit and Loss of a Call Option

Let’s talk about intrinsic value and how you can look at a call option’s potential profit before you enter a trade. Take a look at following call option formulas:

Current Stock Price – Strike Price = Intrinsic Value

Market Price – (Strike Price + Premium) = Profit

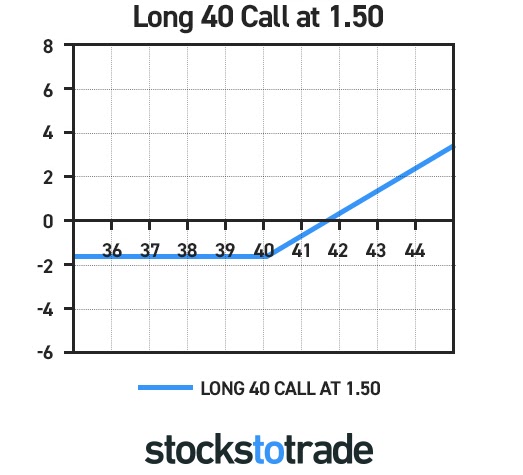

So, for example, say a call option has a strike price of $40 per share with a $1.50 per share premium. You purchase the option when the market price is also at $40. Your investment would be $1.50 per share to pay the premium.

If the stock rises to $44 per share and you exercise the option, you pay the agreed-upon strike price of $40 per share, then sell the stocks for $44 per share.

In this case, the call option’s intrinsic value is $4 per share ($44 current stock price – $40 strike price = intrinsic value)…

… and your profit would be $2.50 per share ($44 current stock price – [$40 Strike Price + 1.5 premium] = $2.50 profit).

Here’s a call option graph showing the potential of profit and loss for the above scenario. Notice how the maximum loss of the call option is limited to the original premium you paid.

How Do Call Options Work?

A call option is what’s called a derivative instrument, because its price is derived from an underlying security — in this case, a stock. If the price of the underlying stock increases significantly, the option value increases. And if the stock price declines, the call option price will follow suit.

Time is another factor in valuing a call option — it loses value with each passing day. The less time the contract has until the expiry date, the less value the call option will have. That’s because there are fewer opportunities for the underlying stock to have significant price moves.

The stock’s volatility will affect the call option’s value. The higher the volatility, the larger the call premiums will be because there are more chances for big moves.

Call options are tradable securities. Few of them actually expire and see shares change hands. Most are traded before expiration, and a good number of call options expire worthless.

How to Sell a Call Option After Purchasing

To sell a call option, a trader has to put in what’s called a ‘sell to close’ (STC) order.

STC is one of the most basic orders in options trading. It means “closing a position by selling.” It’s used to exit a trade in which the trader already owns the options contract and no longer wants to hold a long bullish position on the underlying asset.

When to Sell a Call Option

You can use STC orders to close open call-option positions any time before the contract expires. It’s similar to selling a stock. There are three possibilities…

Sell to Close for Profit

If the stock price increases enough to increase the call option’s value, the option holder can sell to close for a profit.

For example, let’s say an option’s underlying stock increases from $200 to $215 by expiration, increasing the call option’s value from $15 to $18. The trader can now sell to close the call option for a profit of $3 per share ($18 current value – $15 purchase price).

Sell to Close Breaking Even

If the stock price doesn’t increase significantly, the call option’s value can remain the same. In this case, the option holder can sell to close to break even.

For example, say the underlying asset rose from $200 to $203.25 by expiration and the call option value remained at $15. The trader can sell to close the position at break-even ($15 current value – $15 purchase price = no profit).

Sell to Close for Loss

If the stock price increases minimally, the call option can decline in value. That can be because a stock price increase isn’t enough to offset the time decay that affects all options. Remember, as a call option gets to its expiry date, its value diminishes.

So, let’s say a trader paid $15 for a call option and the underlying asset only increased from $200 to $201 by expiration. That drops the call option value to $13.50. The trader can only sell to close the option at a loss of $1.50 ($13.50 – $15 = $1.50 loss).

What Happens When a Call Option Expires?

If the stock price is above the option strike price at the expiration date, it’s ‘in the money’ (ITM). The trader can do one of two things … The first is to sell to close the option for profit. The second is to exercise the option to buy the stock shares for the lower price, then sell at the higher price for a profit.

If the stock price is below the strike price at expiration, it’s ‘out of the money’ (OTM). In this case, it expires worthless. There’s no reason to exercise the option when you can buy the shares cheaper on the open market.

Call Option Strategies

Covered Call Option

Covered calls involve selling call options on underlying stocks that someone already owns. In this case, sellers intend to use their stocks to generate income through premiums. These sellers don’t expect the stock value to rise significantly before the expiry date.

Best case here? The call option contracts expire worthless, and the sellers can collect the premium while keeping their stock shares.

Collecting premiums on owned stock can be a way to hedge — or reduce risk — should the stock experience a large price decline.

This is the least risky way to sell call options. Say the stock value rises and the option buyer exercises the option to buy the stock. If you’re the seller, you’re covered from losses since you can supply the buyer with shares you already own.

In this case, although your profit is limited to the agreed-upon strike price, you’re also protected from actual loss.

Long Call Option

This is the most basic call option strategy. A trader buys the call option, believing the underlying stock’s value will increase significantly before the expiration date. The trader can either sell the call option for a profit or buy the stock at a lower price and sell it for a profit.

Short Call Option

Short call options are also called uncovered call options. In this case, sellers sell call options on stocks that they don’t own.

This is an extremely risky method. There’s no limit to how high the underlying stock can go, and the seller isn’t covered by a supply of shares.

What if the stock price goes up significantly and the contract holder exercises the option to buy? The uncovered seller must purchase the stock at the current market price to provide the shares to the call-option holder.

Conclusion

That’s a wrap call options for now. As you can see, there can some upsides to this trading style, but it can come with plenty of risk, too.

There’s a lot to learn about options overall — don’t think this is a strategy you can just jump into. If you think it’s something you want to try, build your knowledge base first.

But why even do we cover topics like options, puts, and calls?

Here at StocksToTrade, we think a thorough understanding of the market and all the different players in it just makes for smarter trading. And in the StocksToTrade community, we strive to be smarter, better traders every single day.

We also want to help you learn more about the market. So check out our resources, like this blog, our YouTube videos, and our SteadyTrade podcast. No matter what level of trader you are, there’s always something new to learn.

And if you’re really ready to step up your trading game, come join us at StocksToTrade Pro. That’s our hands-on mentorship program designed to help you learn to navigate the markets with like-minded traders, webinars, cutting-edge strategies, and so much more. Join us today!

What do you think of trading options? Leave a comment!