The Risky Business Of Buying An IPO

It seems like people always want to be first . First in line, first served, first buying an IPO — the early bird gets the worm, and so on. But buying stock for an IPO comes with risks. And when it comes to IPOs, the earlier the riskier, simply because there’s no history.

So it’s rare that we would recommend buying an IPO on day one. Sometimes it can be successful, but STT lead trainer Tim Bohen prefers a more “technical” basis, and it’s tough to chart a stock that doesn’t even have a day’s worth of data.

But before we take you through Tim’s strategy with IPOs, with examples, let’s back up and cover the basics …

An IPO (initial public offering) is the process a company undergoes when it wants to start selling shares of its stock to the public. There are a number of advantages and disadvantages to watch out for here, including the high costs associated with going public.

Download a PDF version of this post as PDF.

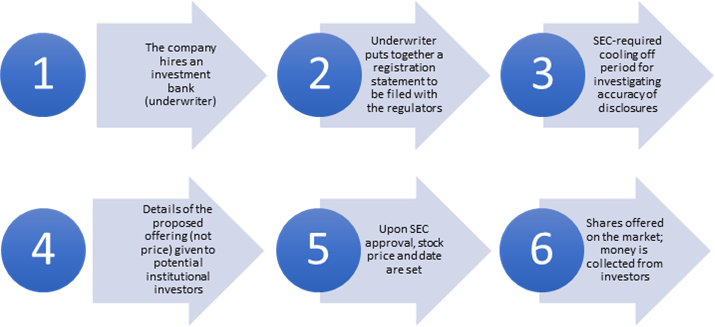

The process is a cumbersome one:

Private companies go public primarily to raise expansion capital and to monetize the investment of early private investors.

The advantages include a diverse equity base; capital for growth and debt repayment; acquisition options; financing options and—a big one: if it fails, they don’t have to return the investment.

But there are disadvantages, too: Marketing, underwriting, and accounting costs are high; information that competitors can use must be divulged; funding might not be raised as expected; they lose control to new shareholder voting rights.

Tim’s Take

Tim uses a “build-the-case” approach before determining whether he wants to enter a trade with a company that’s just gone public with an IPO. This is how he decides whether a stock in a sector is compelling enough to both investors and traders.

A great example is a unique company that issued its IPO on 27 September: $ROKU.

ROKU is a pioneer in television streaming. It launched with a $14 per share price, raising $252 million, with the IPO valuing the company at $2 billion. Already on day one it was good news, because earlier reports had suggested the company was targeting a $1-billion market cap.

This is one IPO that Tim favored—even on day one. “Web video is hot, and almost everyone agrees that it’s the future of entertainment,” says Tim.

Indeed, investors sent shares soaring on the first day—a sign that they think this brand new IPO can beat off the bigger tech rivals and even compete against giants Google, Apple or Amazon.

But that’s the fundamental side—and it’s solid—but Tim is a technical trader, too, relying about 80% on technical, supported 20% by fundamentals.

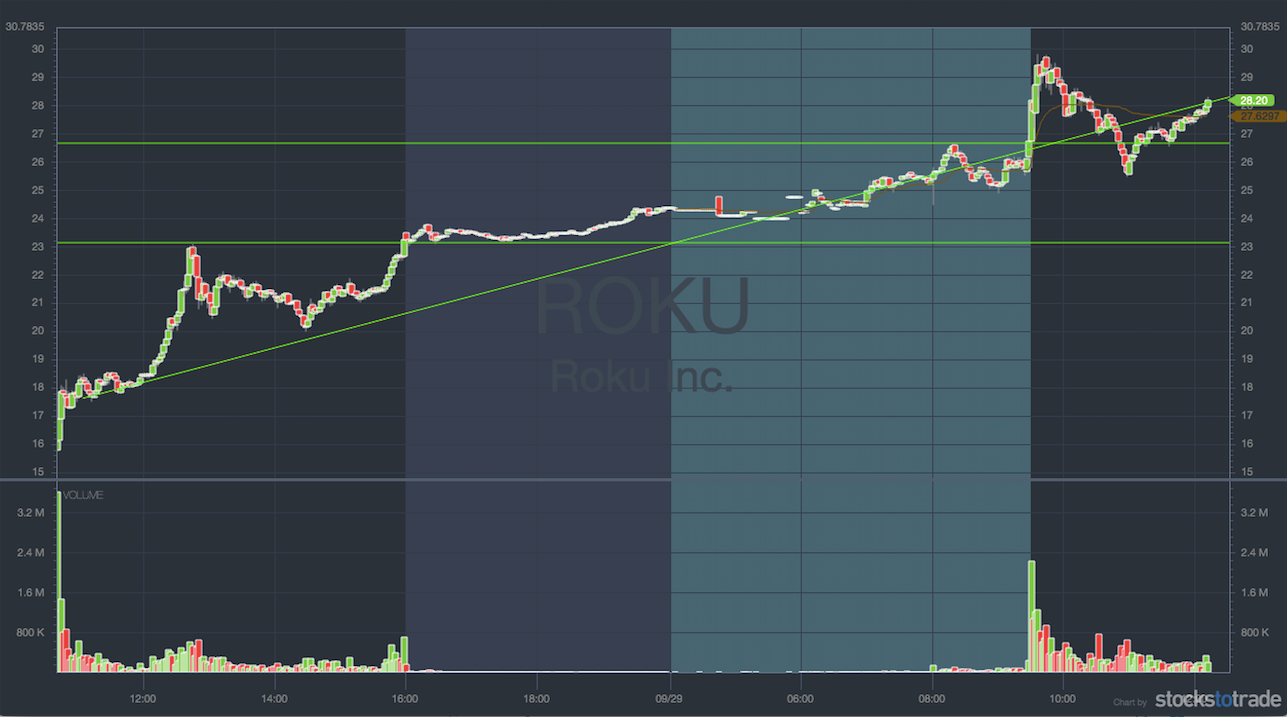

So now we have the challenge of charting ROKU, which only has two days of data to consider.

This is the point at which Tim would remind you that “only price pays”. The chart determines entries and exits, and $ROKU closed almost perfectly on day one—at the high of the day, even.

Here’s what it looks like on STT’s charting system:

This level determines the bottom end of the ascending wedge. A trend line starting at Day 1’s opening price and piercing the Day 2 open determines the overall trend on a short-term basis.

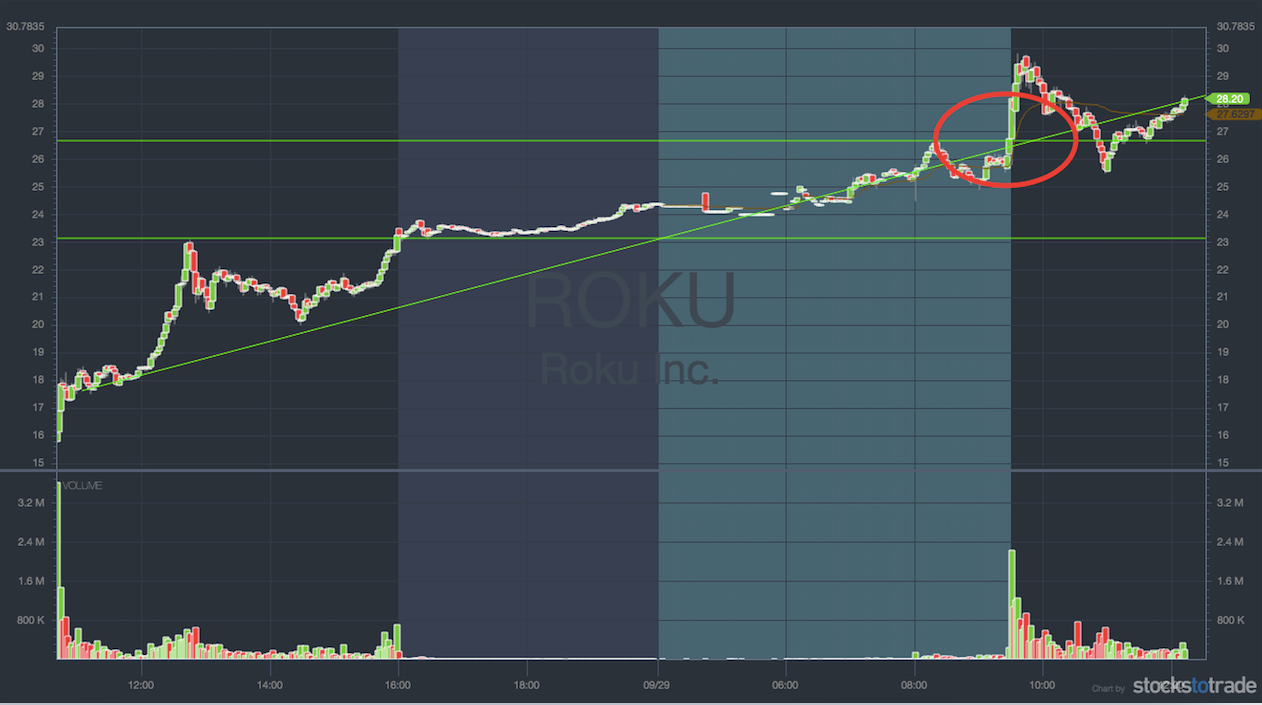

Using STT charts, this is the point Tim was looking at:

The red is showing you where the trend breaks out. It’s the point at which the price at the market open breaks the trend from the previous day.

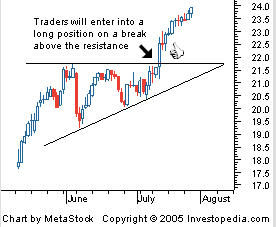

It’s also what we call an ‘ascending triangle’:

$ROKU isn’t exactly a textbook example of an ascending triangle because it’s an IPO and there isn’t enough data, but it’s the same idea.

For $ROKU, the break of the pre-market highs immediately at the open sets a logical spot for entry based on a new breakout. In this case, it’s a whole dollar/half dollar entry at $26.50.

With that in mind, a logical point of exit would be a break down of $25 dollars a share. This level would probably bring in selling and dampen any enthusiasm in the stock, short term.

Otherwise, a wise and logical exit for profits would be a breakthrough $31. This presents a solid risk to reward of 3-1. $1.50 risk to make $4.50 in reward per share.

Pretty nice on an IPO. And while there have been a ton of IPO flameouts in recent years, this year, tech IPOs have been hotter than hot, with one big exception: $SNAP. As Fortune magazine put it: “The Snap IPO was an epic fleecing, made even more glaring by the past two weeks. The one big winner is the maestro that orchestrated the entire travesty and should be no surprise to anyone: Wall Street.”

Join us on STT Pro and find out how Tim’s handles today’s IPO to avoid hitching your money wagon to a flameout.