“Buy the rumor, sell the news” is a common adage in the trading world, especially in volatile markets where information and speculation drive price movements. This strategy is based on the concept of acting on market expectations and speculation rather than waiting for actual events or announcements. Traders often buy stocks or other securities based on rumors or anticipation of a positive event and sell them when the actual news breaks, regardless of its content. This approach is rooted in the idea that market expectations are often already priced into assets before the actual news is released.

Read this article because it demystifies the “Buy the rumor, sell the news” strategy, providing a clear understanding of how market expectations and speculation influence trading decisions.

I’ll answer the following questions:

- What is the “buy the rumor, sell the news” strategy?

- How does speculation impact stock prices in this strategy?

- What role do market expectations play in the “Buy the rumor, sell the news” approach?

- How can traders effectively implement this strategy in volatile markets?

- What are the risks associated with the “Buy the rumor, sell the news” strategy?

- How does this strategy differ from traditional trading approaches?

- What types of news or events are typically involved in this strategy?

- How do traders determine the right time to sell in the “Buy the rumor, sell the news” strategy?

Let’s get to the content!

Table of Contents

- 1 What Is “Buy the Rumor, Sell the News”?

- 2 Who Is a News Trader?

- 3 Mechanisms of the Buy the Rumor, Sell the News Strategy

- 4 Impact of Buy the Rumor, Sell the News on the Markets

- 5 Applying the Buy the Rumor, Sell the News Strategy

- 6 Risks and Disadvantages of Buy the Rumor, Sell the News

- 7 Key Takeaways

- 8 Frequently Asked Questions

- 8.1 How Can Traders Front-Run Earnings Reports?

- 8.2 What Is the Best GBP Pair to Trade the News?

- 8.3 Where to Find Interest Rate Expectation Pricing?

- 8.4 How Can Interest Rates and Bank Policies Impact Share Investments?

- 8.5 What Role Do Credit Cards and Derivatives Play in Financial Speculation?

- 8.6 How Does Managing Online Trading Accounts and Devices Influence Trading?

- 8.7 Why Is Understanding Previous Cases Important in This Strategy?

What Is “Buy the Rumor, Sell the News”?

To buy the rumor and sell the news is a basic stock trading strategy that plays on the market’s behavior.

The market’s a discounting machine. That means that everything that affects a stock’s value is already priced in.

But what about something that MIGHT affect a stock’s value? That’s called a rumor, and it can make for some big plays.

By the time the actual news hits, it usually doesn’t move the needle as much…

That’s why we buy the rumor and sell the news. It’s hard for the fact to live up to the possibility.

The market’s made up of people. Getting more excited by hope than reality is a very human thing.

I see this in my kids when I give them gifts. Sometimes they really want something. But sometimes by the time I get it for them, the excitement’s already worn off.

Who Is a News Trader?

A news trader is someone who bases their trading decisions primarily on news announcements and events. These traders are adept at analyzing market trends and can swiftly interpret how news events might impact stock prices and investor sentiment. They utilize a range of tools, from news feeds to economic calendars, to stay ahead of market-moving events. News traders often operate on the fringes of market speculation and information, leveraging their ability to quickly process and act on relevant news to make trading decisions.

Tools and Strategies Used by News Traders

News traders rely on a variety of tools to stay informed and react promptly. These include real-time news services, financial calendars, and advanced trading platforms that provide instant data and analysis. They employ strategies like sentiment analysis and event-driven trading, carefully timing their trades to coincide with the release of key information. By anticipating market reactions to news events, they aim to capture profits from the resulting price movements.

StocksToTrade is the platform I use to hear the most important news first. Its wide-ranging news scanner incorporates various sources — from tweets and breaking news to in-depth earnings reports — into a single, streamlined interface.

For news traders, timing is everything, and having access to breaking news can be a game-changer. Staying ahead of market-moving events and being able to react quickly to breaking news is crucial. It’s not just about having the information; it’s about understanding its potential impact and acting swiftly. For traders looking to enhance their strategy with real-time news updates and expert analysis, StocksToTrade’s guide on how to trade stocks with breaking news is an essential resource, offering tools and techniques to capitalize on news-driven market opportunities.

StocksToTrade’s Breaking News chat room gives you all of this. It’s two former Wall Street analysts constantly monitoring a wide array of news sources, including exclusive channels not readily available to the public. They distill this information and deliver the kind of news that moves stocks directly to the chat room. This service is not just about delivering news; it’s about delivering the right news at the right time, allowing traders to capitalize on opportunities as they arise.

Get a 14-day trial of Breaking News Chat here — only $17!

Mechanisms of the Buy the Rumor, Sell the News Strategy

The “buy the rumor, sell the news” strategy is a fascinating play on market psychology, where investors act on speculation rather than actual outcomes. Here’s how it works: investors buy securities based on rumors or anticipated events, hoping the eventual news will boost the stock price. Once the news is out, they sell, often regardless of the news content. It’s like betting on a horse because everyone thinks it’s going to win, not necessarily because it’s the best horse.

This approach hinges on timing and anticipation, requiring traders to have a keen sense of market sentiment and an understanding of how rumors can sway investor behavior. In my experience, this strategy requires not just following the crowd but also doing your homework, researching companies and the economy, and staying on top of articles and news that could affect market dynamics.

How Does “Buy the Rumor, Sell the News” Work?

The “buy the rumor, sell the news” strategy operates on the principle of anticipation and reaction. Traders buy assets based on rumors or expectations of a positive outcome, such as an earnings beat or favorable economic data. When the actual news is released, regardless of whether it meets, exceeds, or falls short of expectations, traders often sell, capitalizing on the price movement driven by the market’s reaction. This strategy is grounded in understanding investor psychology and market dynamics.

Understanding trading psychology is crucial here. The strategy isn’t just about market mechanics; it’s deeply rooted in human psychology. Traders must navigate their emotions and biases to make rational decisions. Fear, greed, hope, and regret can all influence trading behavior, often leading to irrational decisions. Mastering your mindset is crucial for success in this high-stakes environment. For those looking to delve deeper into the psychological aspects of trading and learn how to keep emotions in check, StocksToTrade’s guide on trading psychology offers invaluable insights.

Speed of Decision-Making in News Trading

In news trading, the speed of decision-making is crucial. Markets can react swiftly to news events, with prices adjusting in seconds. Therefore, news traders must be quick to interpret news and take positions. This requires not only fast access to information but also the ability to rapidly analyze its potential impact on markets and make informed decisions.

Examples of “Buy the Rumor, Sell the News”

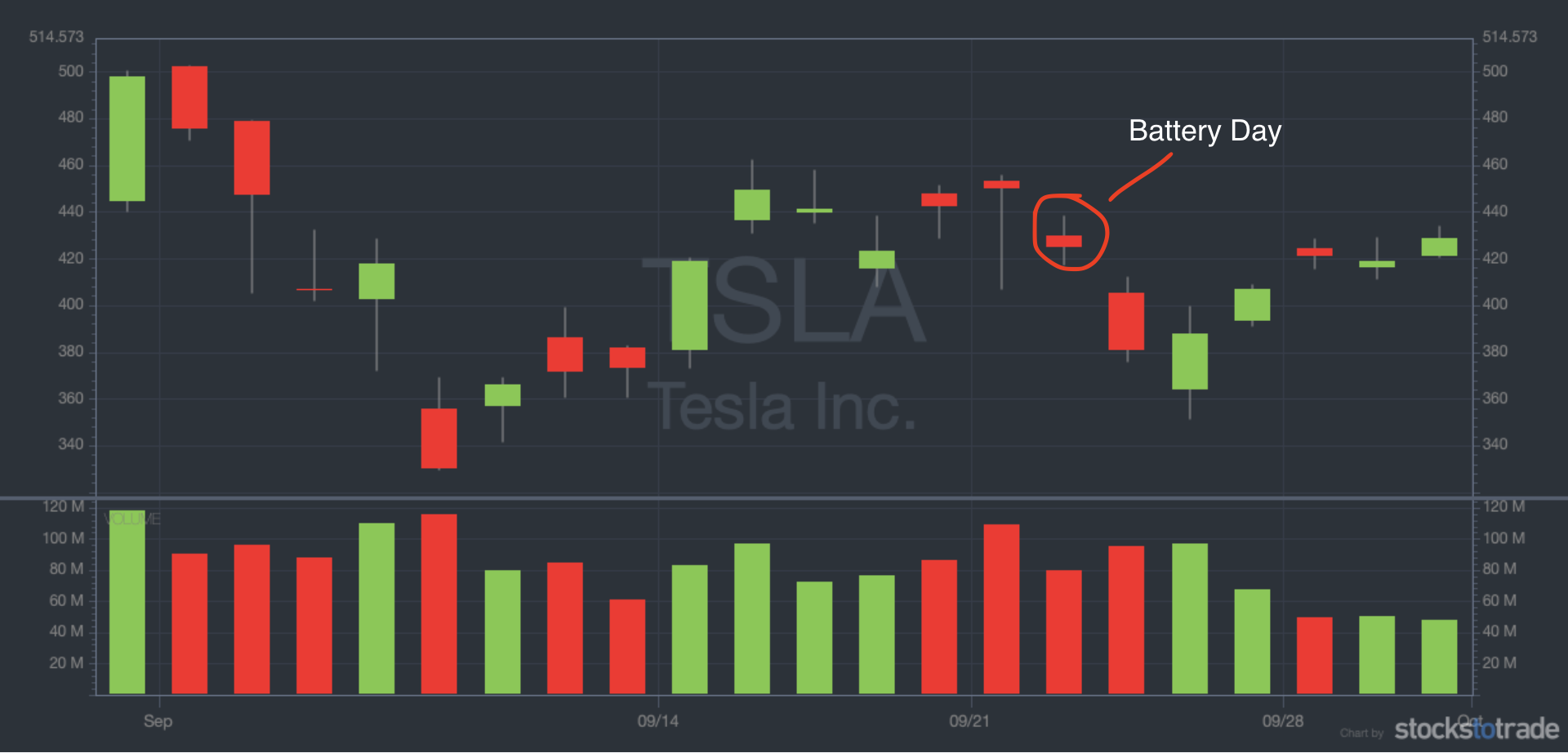

Elon Musk first announced Battery Day during a January 30, 2020 earnings call. He said, “Battery Day people. Wait until Battery Day. It’s gonna blow your mind. It blows my mind, and I know it!”

Within three trading days, the stock spiked 56%.

Closer to the event, Musk tweeted, “Many exciting things will be unveiled on Battery Day 9/22.”

Over the next two trading days, the stock spiked 27%.

We could look at these as catalysts on their own. But they weren’t news. They were promising news in the future.

That’s when the rumors got started.

The rumors took Musk’s boasts as a starting point. And they went to some wild places!

People started to wonder what would blow their minds. They came up with a list of possibilities.

Top analysts were sure Tesla was announcing a subsidiary battery business. With it, Tesla would once again assert its leadership over its growing competition.

Some thought Teslas would begin selling at the same cost as conventional cars. That’s what Musk pledged in 2018.

Others speculated on a million-mile battery. They dug into Tesla’s patent history to find that one. And they speculated some more. “The aim is to create a stigma about cars that cannot last a million miles,” wrote Steve LeVine.

Battery Day didn’t produce bad news.

At the presentation, Musk unveiled a new battery with five times the energy of today’s batteries. This would increase the car’s range by 16%. It would also help Tesla build cars at a lower cost.

Pretty impressive right? But it couldn’t compare to the expectations that had been built up.

The stock dropped 10.3% in the aftermath.

Rumors are the first hint of new value. When the news comes out and fails to match this new value, it can prompt a sell-off.

Buy the rumor, sell the news’ applies to the crypto world too…

Remember when Dogecoin was closing in on the $1 mark?

That was the day #Dogefather Elon Musk made an appearance on “Saturday Night Live”.

"Buy the Rumor, Sell the News"

— StocksToTrade (@StocksToTrade) June 21, 2021

Is it a coincidence that the all-time high of $DOGE was the day the #DogeFather appeared on Saturday Night Live?

Whether this rebounds or not, #dogecoin is still down 70%+ from highs. What do you think … can #doge recover? pic.twitter.com/fo5kiPMlnz

How could his appearance have sent Dogecoin past its record highs?

He said, “It’s an unstoppable financial vehicle that’s going to take over the world.” What more could he have possibly done?

If you’d thought ahead, you’d have known that the pre-show rally was all hype. The news didn’t have a chance to live up to it.

Impact of Buy the Rumor, Sell the News on the Markets

The impact of the “buy the rumor, sell the news” strategy on the markets can be significant. When large numbers of investors act on rumors, it can lead to inflated stock prices, creating opportunities but also risks of a decline once the news is released. This strategy can cause notable shifts in the markets, especially if the news differs substantially from expectations. For companies, particularly those in volatile sectors or undergoing significant events like interest rate changes or product launches, this strategy can lead to increased volatility in their stock prices.

Remember, while this approach can be profitable, it requires a solid understanding of market dynamics and the ability to sift through a ton of information to find those golden nuggets that signal an opportunity.

How Do Rumors Affect Markets and Stock Prices?

Rumors can have a significant impact on markets and stock prices. They can create speculation, driving prices up or down based on the perceived implications of the rumored event. When rumors circulate, they can lead to increased trading volume and volatility as traders position themselves in anticipation of the news.

The Influence of Rumors on Market Sentiment

Rumors also play a crucial role in shaping market sentiment. They can sway investor confidence and lead to herd behavior, where traders follow the perceived wisdom of the crowd. Understanding how rumors can affect market sentiment is key to successfully implementing the “buy the rumor, sell the news” strategy.

Applying the Buy the Rumor, Sell the News Strategy

Pro traders understand how to apply the “buy the rumor, sell the news” strategy very well. By following this strategy they help reinforce it.

Remember — strategies aren’t ‘systems.’ We don’t use a strategy like this because it’s foolproof. We use it because other traders use it.

Take one of our favorite Daily Income Trader patterns, the dip and rip. The dip and rip works because of traders’ psychology. When a dip occurs, there will often be a bounce.

That isn’t because of the stock’s innate value. The bounce comes from traders thinking the stock’s undervalued.

If enough traders believe something will happen, they create the conditions for it to happen. This is supply and demand 101.

The ‘buy the rumor and sell the news’ strategy has a logic to it. But it also has reinforcement from the market.

Experienced traders buy the rumor in anticipation of the news. Then they sell to newer traders who buy the press release.

This is a snapshot of how the market works. It’s why some traders come out on the winning side of trades more often than others.

Traders who use this strategy well follow rules. Here’s how they do it…

- Don’t be afraid to take the predictable move: Holding a stock through news is riskier than following the trend and taking profits beforehand.

- Think like a trader: As a trader, you don’t care about the long-term prospects of some piece of news. Follow your trading plan, and exit when you reach your goal.

- Ride the hype: In the internet age, hype has taken on a life of its own. When news drops and it’s already been predicted, it will often be viewed as a disappointment.

Trading on Stock Splits, Forex, and Earnings Announcements

This strategy can be particularly effective in specific scenarios like stock splits, forex fluctuations, and earnings announcements. Traders might buy stocks ahead of a rumored split or favorable earnings report and sell once the event occurs. In forex, traders might position themselves ahead of central bank announcements or economic data releases based on expectations.

Events Suitable for This Strategy

Not all events are suitable for the “buy the rumor, sell the news” strategy. It works best with events that have a high potential to influence market sentiment and stock prices, such as major corporate announcements or significant economic data releases.

Risks and Disadvantages of Buy the Rumor, Sell the News

While the “buy the rumor, sell the news” strategy can offer exciting opportunities for profit, it’s not without its risks and disadvantages. The main risk lies in the speculation aspect: if the news does not align with the rumor or investor expectations, it can lead to a rapid decline in stock prices, catching traders off guard. Also, this strategy often overlooks fundamental analysis of the company or security, focusing instead on investor sentiment, which can be fickle. It requires constant monitoring of market news, Reddit chatter, and being up to date with economic trends, which can be a full-time job in itself.

As an author and trader who has seen many cycles in the finance world, I advise traders to use this strategy cautiously and balance it with solid research and a disciplined trading plan to mitigate potential losses.

The “buy the rumor, sell the news” strategy often plays on the emotions of fear and greed. Fear of missing out (FOMO) can drive traders to make hasty decisions based on rumors, while greed can lead them to hold onto positions for too long, hoping for even greater gains. Understanding and managing these emotions is critical to avoid common pitfalls in trading. For traders seeking to balance these powerful emotions and make more calculated decisions, StocksToTrade’s insights on how to trade fear and greed provide practical strategies and tips.

Understanding Market Reactions and Price Patterns

While the strategy can be profitable, it also comes with risks. Market reactions to news can be unpredictable, and rumors may turn out to be unfounded. Moreover, price patterns may not always follow expected trends, leading to potential losses.

Key Takeaways

- The “buy the rumor, sell the news” strategy involves trading based on market expectations and speculation.

- Speed and accurate analysis of information are crucial for success in news trading.

- Understanding market sentiment and investor psychology is key to using this strategy effectively.

- The strategy has inherent risks, including unpredictable market reactions and the potential for misinformation.

There are a ton of ways to build day trading careers… But all of them start with the basics.

Before you even think about becoming profitable, you’ll need to build a solid foundation. That’s what I help my students do every day — scanning the market, outlining trading plans, and answering any questions that come up.

You can check out the NO-COST webinar here for a closer look at how profitable traders go about preparing for the trading day!

Have you used this strategy? Write “I won’t trade without a plan” in the comments!

Frequently Asked Questions

How Can Traders Front-Run Earnings Reports?

Front-running earnings reports involves buying or selling stocks ahead of earnings announcements based on expectations. Traders might use historical data, analyst forecasts, and market sentiment to predict the direction of the stock price post-announcement.

What Is the Best GBP Pair to Trade the News?

The best GBP pair for news trading depends on the specific news event and market conditions. GBP/USD is often a popular choice due to its liquidity and sensitivity to both UK and U.S. economic news.

Where to Find Interest Rate Expectation Pricing?

Interest rate expectation pricing can be found on financial news websites, economic calendars, and through forex trading platforms. These sources provide insights into market expectations and potential shifts in currency values.

Understanding how interest rates and central bank policies, such as those set by the Bank of England, affect the stock market is crucial in the strategy of “buy the rumor, sell the news”. Changes in interest rates can significantly impact the value of shares and derivatives, as they influence the overall economic environment. For instance, a hike in interest rates typically leads to a decrease in share prices, as borrowing becomes more expensive, reducing corporate profits and investor appetite for risk.

What Role Do Credit Cards and Derivatives Play in Financial Speculation?

Credit cards and derivatives are tools that can be used for financial speculation, aligning with the “buy the rumor, sell the news” strategy. While credit cards can provide the immediate availability of money for investment, derivatives like options and futures offer ways to speculate on the future prices of assets, including shares. Both can be employed to capitalize on rumors or news-driven market movements but require careful management to avoid significant financial risks.

How Does Managing Online Trading Accounts and Devices Influence Trading?

Effective management of online trading accounts is key in executing the “buy the rumor, sell the news” strategy. This involves not only keeping track of your account details and transactions but also ensuring the secure storing of information and appropriate cookies settings on your device. This is vital to protect against unauthorized access or data breaches. The device used for trading, whether a computer or mobile, should have secure access to trading platforms and necessary pages, ensuring timely and efficient trade execution.

Why Is Understanding Previous Cases Important in This Strategy?

Understanding historical instances of market reactions to news and rumors is invaluable for traders. These cases provide insights into how similar scenarios may unfold in the future.